Summary:

- NIO’s mass market model launches have been extremely timely, attributed to the recent introduction of government subsidies/ tax breaks for EV purchases.

- It is unsurprising then that the automaker has reported robust deliveries along with expanding profit margins, with it potentially signaling the second round of EV boom.

- Combined with the healthy balance sheet and potential moderation in cash burn, NIO’s reversal is likely to come sooner than later.

- Even so, the recent rally has been overly fast and furious, especially since it is uncertain when the exuberant market sentiments surrounding Chinese ADRs may moderate.

- With the US election campaigns still ongoing and trade war likely to continue, we believe that a near-term pullback may be inevitable. Patience may be more prudent.

Klaus Vedfelt

NIO’s High Growth Investment Thesis Remains Robust After A Moderate Pullback

We previously covered NIO Inc. (NYSE:NIO) in July 2024, discussing why we had maintained our Buy rating then, attributed to its attractively valued EV stock position with double-digit growth prospects, thanks to its upcoming mass market models.

Combined with the robust financial metrics in FQ1’24 and promising deliveries in H1’24, we had remained optimistic surrounding its long-term prospects, significantly aided by the oversold position then.

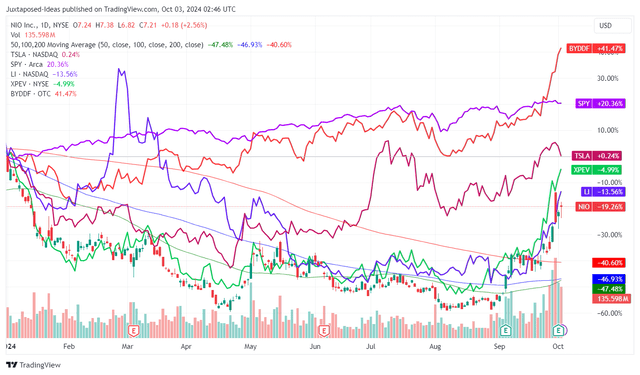

NIO YTD Stock Price

Since then, NIO has continued to lose -19% of its value through the end of August 2024, worsened by the painful market rotation then, with the recent vertical recovery attributed to the Chinese government’s numerous stimulus measures “aimed at supporting the economy’s” recovery.

Part of the optimism is probably attributed the potential uplift in consumer spending, with it already triggering a sharp recovery in the Yuan currency against the US dollar.

Readers must also note that this round of stimulus builds upon other government efforts to boost consumer spending, including the automotive sector.

For reference, China’s Ministry of Commerce doubled its subsidies for consumers whom scrap old cars and buy new EVs from the previous announced levels of 10K Yuan in April 2024 to 20K Yuan by August 2024.

This is a material development indeed, since it allows EVs to be a lot more affordable for Chinese consumers, since China’s Ministry of Finance has also “extended the purchase tax breaks for NEVs until 2027” at 30K yuan per passenger vehicle.

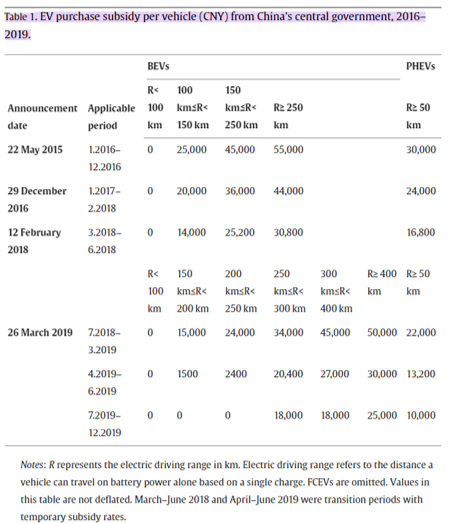

Historical EV Subsidies In China

Science Direct

Given that the Chinese government has been gradually phasing out its generous EV subsidies since May 2015, it is unsurprising that the stock market has gotten exuberant surrounding Chinese automaker stocks again, since we are likely to see a second round of EV boom in the country over the next two years.

If anything, readers must note that this round of subsidy is capped for EVs priced below 300K Yuan, with it implying robust prospects for NIO, since the automaker aimed to release new mass-market models, Firefly at an estimated price range of between RMB 100K to 200K in China from Q4’24 onwards.

This also builds upon NIO’s recent launch of Onvo, aimed at the RMB 200K to 300K Yuan end-market, with it effectively demonstrating the automaker’s robust near-term prospects across the budget conscious consumer groups.

These developments may also be why NIO has reported an excellent overall deliveries of 21.18K vehicles in September 2023 (+5% MoM/ +35.4% YoY), in particular, 832 deliveries through Onvo – despite the latter only being launched in late September 2024.

As a result of the promising market trends, we believe that the automaker is likely to report an excellent Q4’24 delivery number while building upon the impressive YTD delivery sum of 149.27K (+35.7% YoY), with it naturally explaining the stock’s recent surge by +94.8% since the August 2024 bottom.

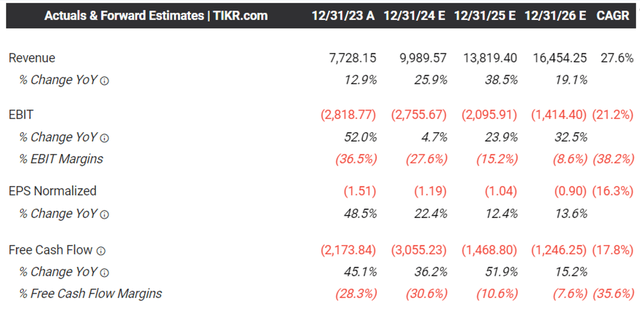

The Consensus Forward Estimates

These developments may also explain why the consensus forward estimates remain promising, with NIO expected to generate a robust top-line growth at a CAGR of +27.6% through FY2026.

While bottom-line break even seems still far away, the automaker’s losses are expected to narrow over the next few years, with profitability likely by the second half of the decade.

These numbers do not appear to be overly aggressive as well, based on NIO’s growing vehicle margins to 12.2% in FQ2’24 (+3 points QoQ/ +6 YoY), expanding overall gross margins of 9.7% (+4.8 points QoQ/ +8.7 YoY), and narrowing adj net losses margins of -25.9% (+23.5 points QoQ/ +36.1 YoY).

With the mass market models likely to trigger higher volume sales along with improved profit margins, we believe that the automaker remains well positioned for its slow but sure reversal, significantly aided by the $5.7B of net cash on its balance sheet (-9.5% QoQ/ +32.5% YoY).

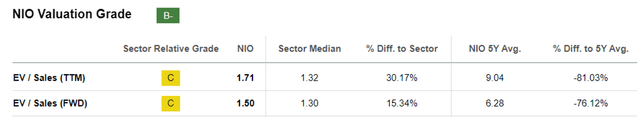

NIO Valuations

And this is also why we believe that NIO at FWD EV/ Sales valuation of 1.50x remains attractive, attributed to the moderation from the its 5Y mean of 6.28x.

If anything, based on the consensus FY2026 revenue estimates of $16.45B and the resultant FY2026 EV/ Sales valuations of 0.91x, its high growth investment thesis remains compelling.

While NIO may appear to be trading at a premium compared to its Chinese automotive peers, such as XPeng (XPEV) at FWD EV/ Sales valuation of 1.76x, BYD Company (OTCPK:BYDDF) at 1.11x, Li Auto (LI) at 0.84x, and the sector median of 1.30x, we believe that the former remains attractive upon a moderate retracement.

So, Is NIO Stock A Buy, Sell, or Hold?

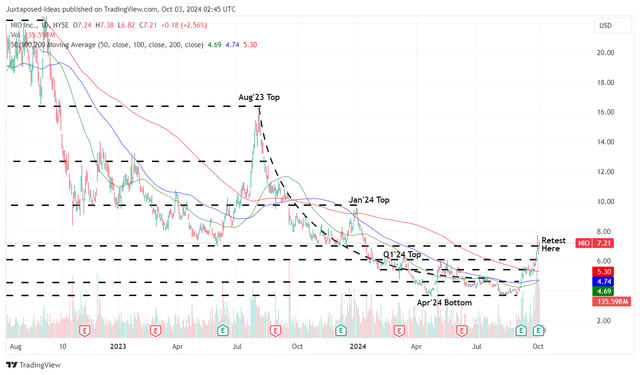

NIO 2Y Stock Price

For now, NIO’s rapid recovery has seemingly hit a ceiling at $7s as it fails to break out of the $7.40s in September 30, 2024, after rapidly breaking out of its 50/ 100/ 200 day moving averages.

At the same time, the stock remains highly shorted at 9.53% with it implying moderate volatility in the near-term, worsened by the potential profit taking at these inflated levels.

While we remain optimistic about NIO’s long-term prospects, we believe that the recent rally has been overly fast and furious with it offering interested investors a minimal margin of safety, especially since it is uncertain when the exuberant market sentiments surrounding Chinese ADRs may moderate.

With the US election campaigns still ongoing and trade war likely to continue, we believe that a near-term pullback may be inevitable, especially given the automaker’s ongoing cash burn and higher initial operating/ marketing expenses from the Q4’24 mass market launches.

As a result, while we may continue to rate the NIO stock as a Buy, we urge interested investors to wait for a moderate retracement to its previous trading ranges at $5s for an opportunity to lower their dollar cost averages.

Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.