Summary:

- NIO Inc. reported mixed annual earnings results, with increased vehicle sales but decreased profitability.

- The company’s financial fundamentals are weak, with a low current ratio and high debt/equity ratio.

- NIO’s stock is not undervalued and faces downside risks, but also has potential for growth in the EV industry.

Andy Feng

NIO Inc. (NYSE:NIO) reported a mixed set of annual earnings results. The company has been loss-making for a while. Although this is my first article on this EV maker, I have covered its rivals before, including Tesla (TSLA) and Lucid (LCID). Overall, the sector has growth potential, but most of the companies operating in this industry are either highly expensive or loss-making. NIO is loss-making and not very cheap if we look at its valuation ratios. But let me dive into more details about the company’s last set of results as well as its other fundamentals.

NIO 2023 earnings results

NIO reported its 4Q 2023 and full-year 2023 results.

Here is a summary of the company’s quarterly results:

- Vehicle sales totaled RMB 15,438.7 million, or $2,174.5 million, in the fourth quarter of 2023. This was an increase of 4.6% compared to the fourth quarter of 2022 and a decrease of 11.3% compared to the third quarter of 2023.

- Total revenues were RMB 17,103.2 million, or $2,408.9 million, in the fourth quarter of 2023. This was a rise of 6.5% compared to the fourth quarter of 2022 and a fall of 10.3% compared to the third quarter of 2023.

- Gross profit totaled RMB 1,279.2 million, or $180.2 million, in the fourth quarter of 2023. This was a rise of 105.7% compared to the fourth quarter of 2022 and a fall of 16.0% compared to the third quarter of 2023.

- Net loss totaled RMB 5,367.7 million, or $756.0 million, in the fourth quarter of 2023. This was a reduction of 7.2% compared to the fourth quarter of 2022 and a rise of 17.8% compared to the third quarter of 2023.

I would say that the 4Q 2023 results were better than the 4Q 2022 earnings. But the last set of results was worse than that published for Q3 2023. However, we can attribute these differences to seasonal fluctuations. So, it would make sense to see the annual results.

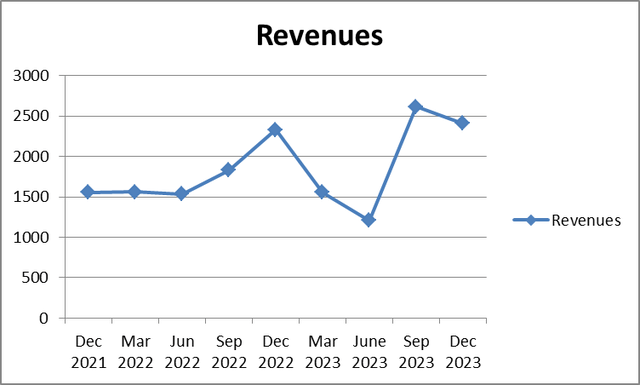

I have prepared tables and graphs showing NIO’s quarterly revenues and profits.

NIO’s quarterly revenues (in dollars, rounded to the nearest million)

|

Dec 2021 |

Mar 2022 |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

June 2023 |

Sep 2023 |

Dec 2023 |

|

|

Revenues |

1558 |

1563 |

1536 |

1828 |

2329 |

1555 |

1209 |

2612 |

2409 |

Source: Seeking Alpha

NIO’s quarterly revenues (in $million, rounded to the nearest million)

Prepared by the author based on Seeking Alpha’s data

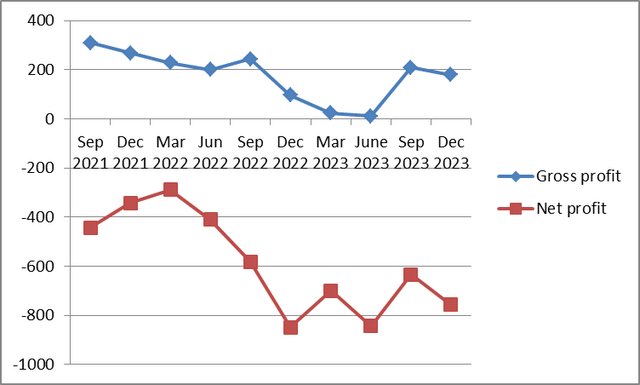

NIO’s quarterly profit (in $million, rounded to the nearest million)

|

Sep 2021 |

Dec 2021 |

Mar 2022 |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

June 2023 |

Sep 2023 |

Dec 2023 |

|

|

Gross profit |

309 |

267 |

228 |

200 |

244 |

97 |

24 |

12 |

209 |

180 |

|

Net profit |

(443) |

(343) |

(288) |

(410) |

(582) |

(848) |

(700) |

(844) |

(634) |

(756) |

Source: Seeking Alpha

NIO’s quarterly profit (in $million, rounded to the nearest million)

Prepared by the author based on Seeking Alpha’s data

Here is a summary of the company’s annual results:

- Vehicle sales totaled RMB 49,257.3 million, or $6,937.7 million, for the full year 2023, a rise of 8.2% vs. the previous year.

- Total revenues were RMB 55,617.9 million, or $7,833.6 million for the full year 2023, a rise of 12.9% compared to the previous year.

- Gross profit totaled RMB 3,051.8 million, or $429.8 million, for the full year 2023, a fall of 40.7% compared to the previous year.

- Net loss totaled RMB 20,719.8 million, or $2,918.3 million, for the full year 2023, a rise of 43.5% compared to the previous year.

Overall, we can say that the company’s sales increased while its profitability decreased.

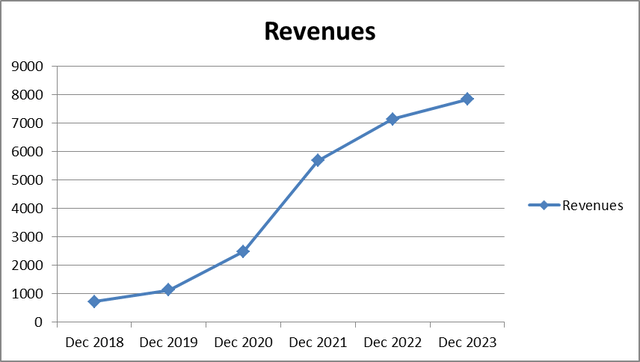

Below, you can see that the company’s revenues have been rising very fast. At the same time, the company cannot convert its sales into profits.

Nio’s annual revenues (in dollars, rounded to the nearest million)

|

Dec 2018 |

Dec 2019 |

Dec 2020 |

Dec 2021 |

Dec 2022 |

Dec 2023 |

|

|

Revenues |

720 |

1124 |

2491 |

5686 |

7144 |

7834 |

Source: Seeking Alpha

Nio’s annual revenues (in $million, rounded to the nearest million)

Prepared by the author based on Seeking Alpha’s data

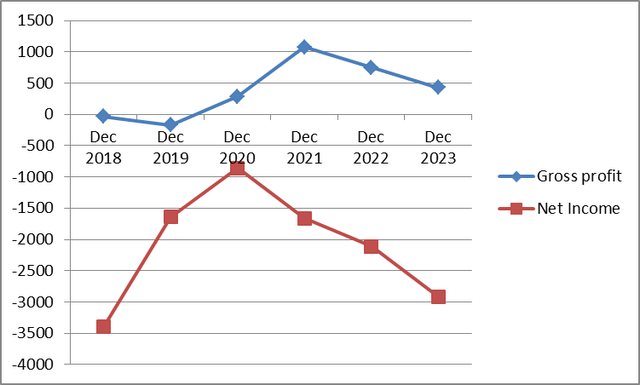

NIO’s annual profits (in $million, rounded to the nearest million)

|

Dec 2018 |

Dec 2019 |

Dec 2020 |

Dec 2021 |

Dec 2022 |

Dec 2023 |

|

|

Gross profit |

(37) |

(172) |

287 |

1073 |

752 |

430 |

|

Net Income |

(3391) |

(1639) |

(860) |

(1664) |

(2111) |

(2918) |

Source: Seeking Alpha

NIO’s annual profits (in $million, rounded to the nearest million)

Prepared by the author based on Seeking Alpha’s data

As you can see from the diagram above, the gross profit has hardly risen over the past six years. The net loss is similar to the 2018 period, when the company was a new EV player. In fact, NIO has never managed to record a positive net profit. This is mostly due to high and rising operating expenses.

In 2023, research and development expenses were RMB 13,431.4 million, or $1,891.8 million. This was an increase of 23.9% compared to the previous year. In 2023, general and administrative expenses totaled RMB 12,884.6 million, or $1,814.8 million, a rise of 22.3% compared to the previous year.

So, we can say that NIO is not particularly efficient right now. But let me dive into NIO’s financial position.

NIO’s financial fundamentals

In my view, NIO’s financial fundamentals are not particularly strong right now.

NIO’s current ratio history

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

1.20 |

5.14 |

1.42 |

0.52 |

3.31 |

2.18 |

1.29 |

1.09 |

Source: Prepared by the author based on Seeking Alpha’s data

We all know that a good current ratio should be above 1.5. This is not the case with NIO right now. The ratio used to be 1.29 in 2022 and 1.09 in 2023.

NIO’s debt/equity ratio

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

0.87 |

0.30 |

1.31 |

(4.02) |

0.71 |

1.18 |

2.48 |

4.20 |

Source: Prepared by the author based on Seeking Alpha’s data

As concerns the company’s debt/equity ratio, it should not be above a level of 2.0. NIO’s D/E is 4.20, substantially higher than 2.0.

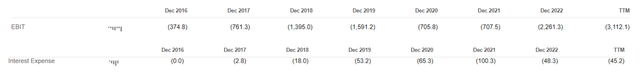

NIO’s interest coverage ratio

Interest coverage ratio is calculated by dividing the EBIT by the interest expense. However, as you can see from the excerpt below, NIO’s EBIT has been negative since 2016. In fact, this indicator has been worsening for a while.

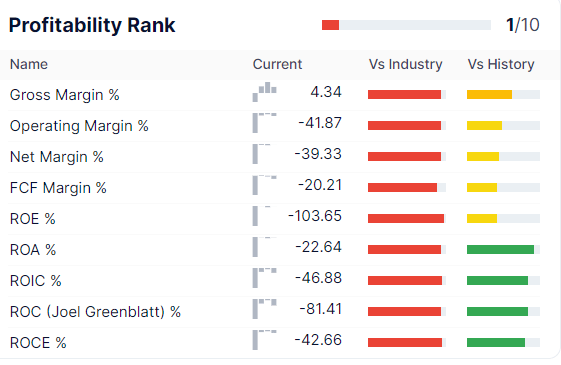

As I have mentioned in the previous section, the company’s profitability is quite poor. According to GuruFocus, even the company’s gross profit margin is substantially below the industry’s average. The other margins below are negative because the operating and net profits, as well as the free cash flow, have been negative for a while.

GuruFocus

Although the EV industry is not particularly profitable, NIO’s profitability indicators are even worse.

Valuations

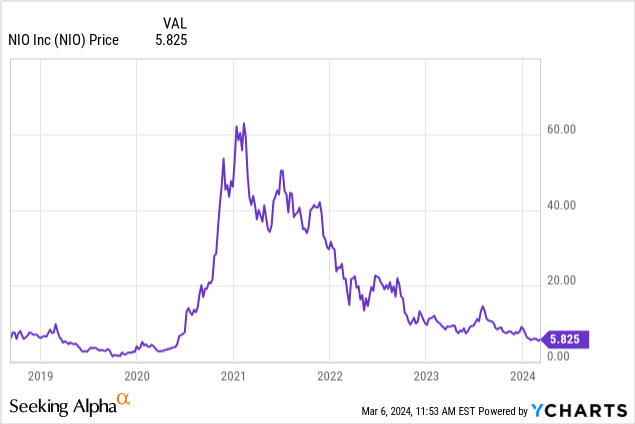

In my view, NIO is not too undervalued, even though its stock is trading at multi-year lows. I will explain why.

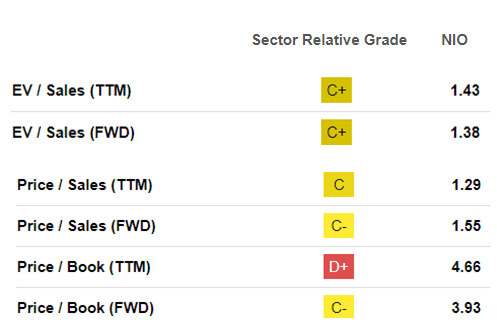

As I have mentioned above, NIO is not profitable right now. So, it is impossible to use the P/E ratio to value the company.

But NIO’s EV/Sales and P/S are quite average. Both of these indicators should be between 1 and 3. NIO’s are 1.43 and 1.38, respectively. You might say that it is good. Maybe, but not for a loss-making company. Also, a normal P/B ratio should be between 1 and 3. NIO’s is 4.66. Given its weak financials, the company is not cheap, according to this indicator.

Seeking Alpha

Overall, I would say that NIO is not very cheap, according to its valuation ratios.

Upside risks

NIO faces a number of upside risks in spite of the fact that its financials are not brilliant.

- First, the industry it operates in has been growing quite well for a while. Although the growth rate has slowed down somewhat, EV demand in 2024 is still forecast to rise by 36%. So, NIO can turn profitable thanks to the general demand increase.

- The company might raise its market share in China. In 2023, it was very small, just over 2%. That might mean the company has plenty of growth potential.

- There could be a soft landing for the global economy if the Fed and other central banks decrease interest rates on time.

- NIO’s shares are trading at multi-year lows. So, there is a risk they might bounce back.

Downside risks

The downside risks are more obvious.

- First, there is a recession risk. If there is a full-scale economic downturn, then the company might obviously face lower demand for its products.

- The company has quite poor financials and is not profitable. But if there is an economic crisis, things might get even worse.

- NIO’s stock is not too cheap, according to the valuation multiples.

Conclusion

NIO reported a mixed bag of results. It has not managed to reach profitability. In fact, its expenses are rising higher than its sales. The company’s stock is trading at multi-year lows even though its valuation ratios do not suggest undervaluation. My rating on the stock is “hold” due to the fact that NIO operates in a fast-growing industry and its stock price touched multi-year lows.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.