Summary:

- NIO is navigating a challenging market with a 45% drop in stock value YTD, amid concerns about slowed growth in vehicle deliveries and increasing competition.

- NIO plans a third factory in China to produce budget-friendly Onvo brand EVs, aiming to compete with Tesla and capture the mass market.

- Despite facing import tariffs in Europe and the US, NIO’s battery-swapping technology and improving profit margins signal potential for resilience and growth.

- Key indicators like the RSI and PVT suggest a possible bullish momentum. The stock may reach an average price target of $10.15 by the end of the year, indicating significant upside potential.

Robert Way

Investment Thesis

NIO (NYSE:NIO) continues its downward trajectory, causing frustration among investors and perpetuating a negative spiral. Our previous coverage emphasized the importance of using a dollar-cost averaging (DCA) strategy during this expected downturn to maximize long-term gains or expedite exit upon recovery.

Despite the bearish sentiment, the DCA approach remains crucial for existing investors. By continuing to invest gradually at lower prices, investors can reduce their average cost basis, positioning themselves for substantial gains when the market rebounds. This strategy is supported by historical trends and Fibonacci extensions, which indicate significant upside potential.

Fast-forward, Nio is under immense pressure more than ever. The stock is down by 45% as investors questioned the company’s growth metrics. One of the biggest concerns is that the company’s growth in electric vehicle delivery has slowed in recent years. Unlike in previous years, when it posted an over 100% increase in vehicle deliveries, the growth rates were less than 50% for the better part of 2023.

In conclusion, while NIO’s current performance may seem discouraging, combining a DCA strategy and positive technical indicators offers a viable path for investors to navigate the downturn and capitalize on future recovery. Maintaining a buy rating for long-term investors remains a sound approach, given the anticipated upside potential and the strategic advantages of reducing the average cost basis during periods of volatility.

Is NIO Ready to Surge? Mid-Term Projections Suggest Potential Gains Despite Sideways Trading

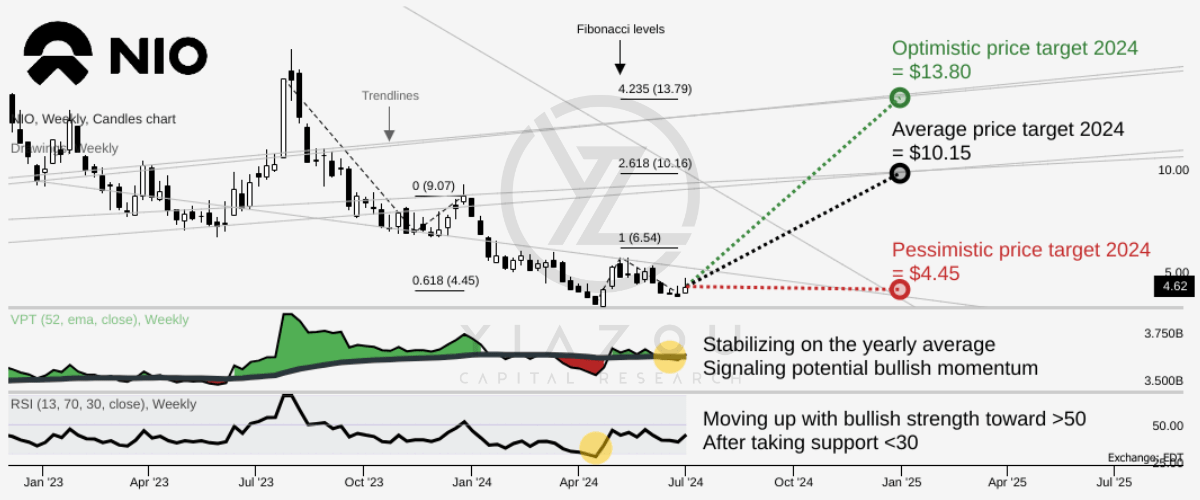

NIO is currently trading at $4.62, following a sideways price trend. Considering the mid-term price swings and related trendlines, the stock price may hit $4.45 by the end of 2024, pessimistically. On the upside, if recent price swings are considered along with the trendlines, the stock may reach $10.15 by the end of the year on average.

Optimistically, the price may reach $13.80 by the end of the year. These price targets are projected to be above Fibonacci levels. Specifically, the pessimistic price target is based on the 0.618 retracement level derived from the mid-term downtrend. Similarly, optimistic and average price targets align with 2.618 and 4.235 Fibonacci extensions derived from recent weekly price swings.

Looking at the relative strength index (RSI), the RSI line is moving upwards to enter a bullish trajectory above 50. The indicator has taken support below 30, oversold levels, during April 2024. Finally, the volume price trend (PVT) line stabilizes at its annual moving average towards the bullish momentum zone. These indicators signify potential upside embedded in the stock price.

Author (trendspider.com)

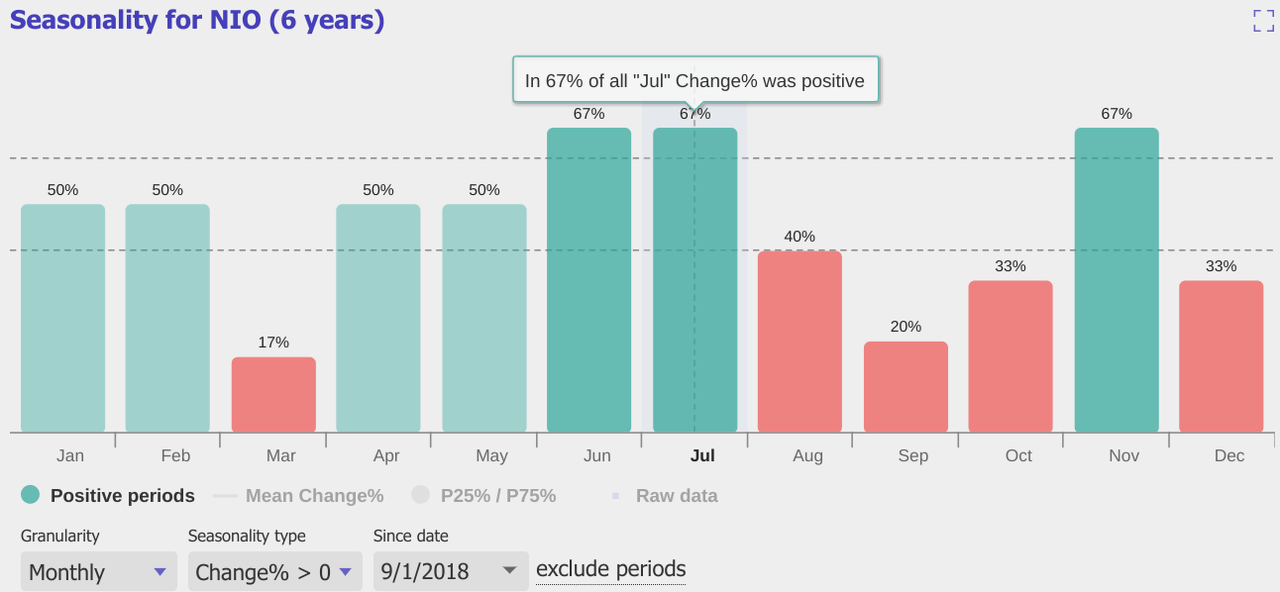

The seasonality chart for NIO stock over the past six years reveals critical insights for potential investors. June and July stand out with a 67% chance of positive performance, making them the most opportune months to buy. November also shows strong potential with a 67% positive rate. Conversely, March and September are notably weaker, with only 17% and 20% chances of positive returns, respectively. The remaining months display moderate trends, with January, February, April, and May at 50% and August, October, and December showing less favorable outcomes. Timing investments around these stronger months could maximize potential gains.

A Quality EV Stock Trading at a Discount

When it went public in 2018, Nio was one of the hottest electric vehicle stocks seen as an alternative to Tesla (TSLA), sending shockwaves. It rose to prominence with an array of electric sedans and SUVs backed by a broad Chinese market needing EVs to accelerate the transition from fossil fuel-powered cars. The stock is under immense pressure, going by the 45% slide year to date.

As early as 2019, Nio was billed as the fastest-growing luxury EV maker, delivering 20.5K cars, marking an 81% year-over-year (YoY) increase. The automaker delivered 43.7K EVs the following year, marking a 113% YoY increase, as deliveries rose 109% in 2021.

Battery Swaps Boosted NIO’s Rise, but Slowing Growth Sends Stock Tumbling Amid Supply Chain Woes

The growth came as the automaker differentiated itself from other automakers by producing EVs that had removable batteries. Given that the batteries could be swapped out at battery stations, it has always been a hit as they address the lengthy charging times synonymous with other EVS. By paying a subscription fee, EV owners can easily swap their depleted batteries in charging stations with fully charged ones, saving significant time.

However, the growth appears to have stagnated since 2022, when they only rose by 34% yearly to 122,486. The growth in deliveries hit a new low of 31% to 160,038 in 2023, raising concerns in the investment community about the slowing pace of development.

The decelerating growth of EV deliveries has been the catalyst behind the plunge of Nio stock. Supply chain constraints of key parts needed to produce the EVs have been cited as one reason why the Chinese EV giant has struggled to achieve the growth rates it achieved between 2019 and 2021. Likewise, macroeconomic challenges amid the slowdown in the Chinese economy following the COVID-19 pandemic have also hurt the company’s prospects.

cnevpost

Surging Deliveries Signal Turnaround for NIO

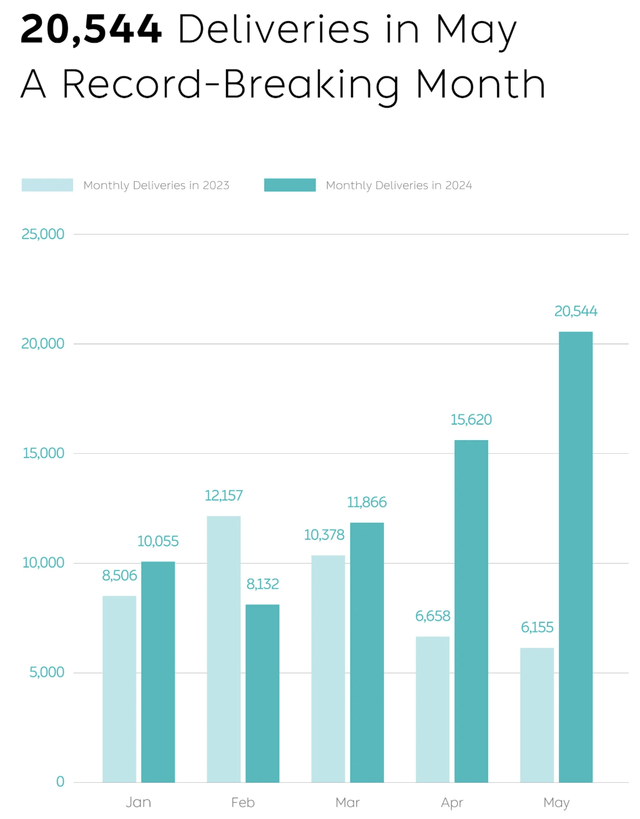

Even though car delivery growth appears to have stagnated in recent years, Nio has moved to address the issue. The Chinese automaker delivered a 234% YoY increase in car deliveries in May, reaching 20,544 vehicles, and a 98.1% YoY increase in June, with 21,209 vehicles. This follows a 135% increase in April, with 15,620 EVs delivered, indicating that 2024 could be a game changer.

Car deliveries in the past three months are already signaling resilience and growth momentum as the automaker continues to shrug off stiff competition. Likewise, Nio deliveries for the year are already up by more than 50% compared to last year. Amid the robust vehicle deliveries in the second quarter, the automaker expects revenues to rise between 89% and 95%, propelling it to profitability.

Affordable EVs for the Mass Market

The robust growth in EV deliveries is due to the company launching a series of low-cost brands as it looks to undercut the likes of Tesla. Onvo is one of the new EV brands slated for release in September that Nio hopes to use to target the mass market as the transition from fossil fuel cars to EV cars heats up, especially in China.

The new Onvo L60 model will go on sale for $30,000, well positioned to compete against Tesla’s cheaper version, the Model Y. Additionally, it intends to drive deliveries later in the year and heading into 2025 with the launch of Firefly. This model will cost between $13,800 and $27,600. While the affordable model will first be available in China, there are plans to make it available in Europe in the first half of next year.

NIO Targets Mass Market with New Factory for Budget EVs to Challenge Tesla’s Dominance

To take advantage of the growing demand for affordable electric vehicles in China and abroad, Nio has secured approval to construct its third factory in China. The new factory will have a capacity of producing 1 million cars a year, setting it in a position to compete better against its fiercest rival, Tesla, which shipped 1.8 million cars last year.

Nio’s new factory in Huainan City is being tailored to manufacture budget-friendly vehicles based on the Onvo brand. By focusing on budget-friendly cars, Nio hopes to take on Tesla as demand for affordable EVs heats up. The factory will strengthen the company’s competitive edge to take on Tesla’s Model Y and the Toyota Rav4.

In the most recent quarter, Nio posted a 7.2% revenue decline to $1.37 billion. While it is one of the reasons why the stock has been battered in the market, the decline is attributed to lower average sales prices for the company’s cars in the first quarter. The Chinese automaker reportedly slashed the prices of its vehicles as it looks to get rid of the 2023 models in preparation for the new affordable models, including the Onvo L60, that it plans to use to target the mass market.

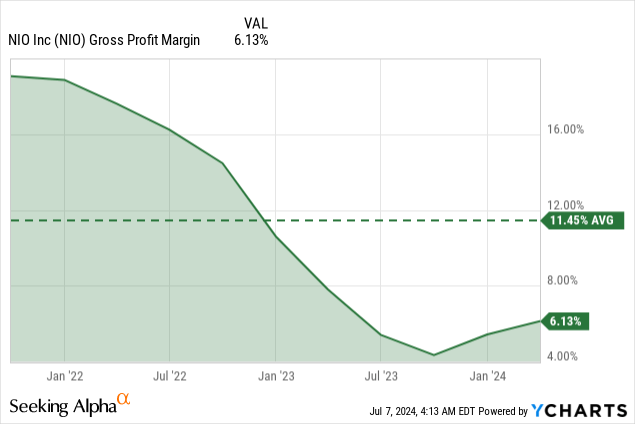

Despite the significant revenue drop due to lower selling prices, Nio’s gross profit margins also show signs of considerable improvement. For instance, gross profit margin more than tripled to 4.9% in Q1 compared to 1.5% a year ago, suggesting that the company is generating more profits even by slashing prices.

EV Showdown: Can NIO’s Affordable Onvo Brand Challenge Tesla’s Market Dominance?

The battle for supremacy in EV sales is no better than between Tesla and Nio. Tesla has an edge in EV sales, having delivered 443,956 cars from April through June. In contrast, Nio delivered about 57,373 vehicles.

Tesla’s delivery edge stems from the fact that it enjoys a first-mover advantage and can sell its cars in various markets without facing stringent importation tariffs. As it stands, Nio can be compared to Tesla back in 2017, when it only delivered about 101,312 cars. However, in the following years, Tesla’s sales grew at a compound annual growth rate of 61% to highs of 1.81 million as of the end of last year.

Nio has what it takes to take on Tesla, especially on the unveiling of a lower-priced brand, Onvo. With prices starting from as low as $30,000, it remains a worthy competitor to Tesla’s Model Y—the new car positions Nio to target the mass market needing affordable EVs.

However, unlike Tesla, Nio faces significant risks in its bid to ramp up sales globally. Import tariffs in Europe and the US present a significant challenge for NIO in reaching more than 1 million annual sales.

Rising Import Tariffs Threaten NIO’s Expansion Plans in Europe and the US

The European Union is pushing importation tariffs to protect European automotive from the influx of cheaper models abroad. Even as the trading block pushes on with the tariffs, not everyone is against the idea, given the prospect of a similar retaliation from Beijing.

Import tariffs of up to 38% on Chinese EVs will essentially make Nio’s affordable EVs more expensive and thus uncompetitive in attracting European sales. Therefore, the importation risk poses the biggest challenge for Nio as it looks to diversify its revenue streams away from China by selling its cars in Europe. The US is another important market that has already increased tariffs from 25% to 100%, making it challenging for Chinese EV makers to pursue sales opportunities in the country.

Bottom Line

Thanks to the robust growth in EV deliveries, Nio’s business is slowly stabilizing. The company’s model of differentiating itself from the competition through swappable batteries that address the lengthy charge times of traditional EVs continues to strengthen its competitive edge in the EV space. The fact that Nio revenues are expected to increase by up to 20% in 2024 on the back of solid deliveries supports growing expectations that the company will return to profitability.

As the company continues to overcome the challenges that have destroyed it in the past and accelerate vehicle deliveries, the stock’s sentiments should receive a boost. Given that the stock is down by about 45% for the year, it looks dirt cheap amid growing demand for EVs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.