Summary:

- NIO’s stock rallied significantly yesterday after inspiring Q2 delivery numbers, which more than doubled.

- The company’s financial performance suggests that management prioritizes growth at all costs, which is unsustainable and harmful to shareholders in the long term.

- Valuation analysis suggests NIO’s stock is overvalued, fair share price estimated at $1.36.

travelview/iStock Editorial via Getty Images

Introduction

I remain bearish about NIO (NYSE:NIO) and want to reiterate my ‘Strong Sell’ rating for the stock. The stock declined by 2.4% since my previous thesis. My previous thesis could have looked even better, but the stock gained more than 6% yesterday after positive Q2 deliveries data. NIO’s latest deliveries report is really impressive with sales more than doubling in Q2. On the other hand, this growth might be unsustainable because it looks like a ‘growth at all costs’. I think so because Q1 financial performance was quite disappointing with soaring cash burn. NIO’s profitability metrics are way behind its closest rivals, which also underscores prioritizing ‘growth at all costs’. I expect more dilution soon, which will probably make NIO’s unattractive valuation look even worse. Considering all these factors, I believe that NIO’s yesterday rally was more a ‘dead cat bounce’ rather than a sustainable rebound.

Fundamental analysis

The most fresh fundamental information about NIO is its Q2 2024 deliveries. The quarter’s deliveries totaled 57,373 vehicles, increasing by 144% YoY. The increase is impressive, the market reacted by showing a big intraday rally. NIO’s Q2 deliveries growth outperformed its closest rivals like Li Auto (LI) and XPeng (XPEV). On the other hand, Li Auto’s deliveries are twice as high as NIO’s. Growing against larger numbers is usually more difficult.

NIO delivered a total of 87,426 during the first half of 2024, compared to 54,561 units in H1 2023. The increase is 60%. According to the last November’s information, NIO’s target for the full year is 230,000 units. With that being said, NIO needs to deliver 142,574 cars in H2 2024. Thus, NIO should demonstrate a 35% increase in deliveries during the second half of the year. This looks doable considering strong growth momentum of the Q2.

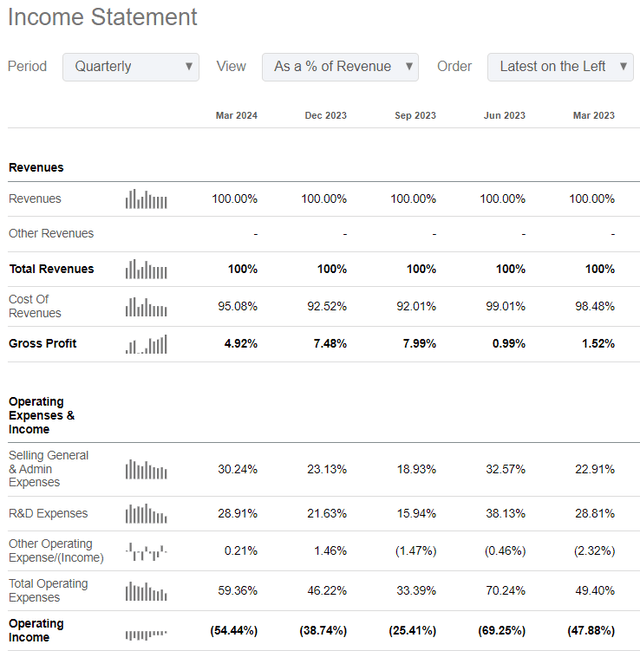

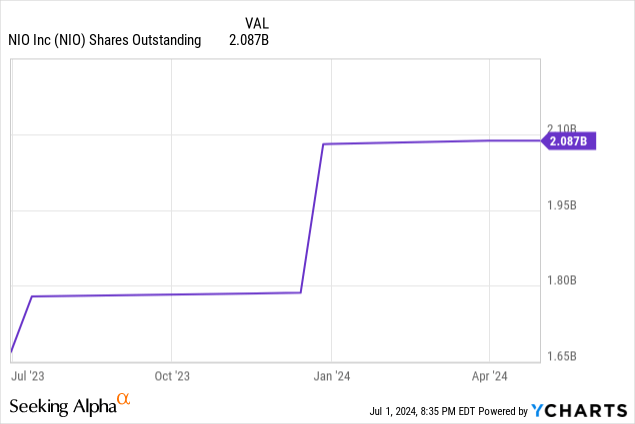

Despite the impressive growth in the volume of cars sold, NIO’s financial performance is not improving. Of course, we do not have Q2 earnings yet, but financial metrics of Q1 were disappointing. The operating margin dipped below -50% and it was much weaker both compared YoY and QoQ. As a result, NIO’s outstanding cash balance decreased by around $1.7 billion sequentially. The company’s balance sheet continues shrinking at a notable speed. This will likely lead to the issuing of new shares, and the recent stability in the number of shares outstanding will be disrupted.

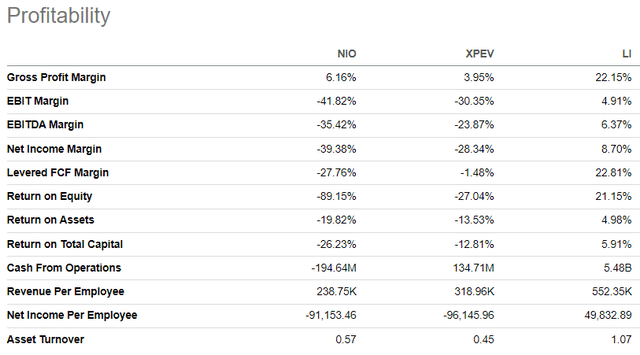

NIO’s impressive H1 deliveries growth was likely achieved with a ‘growth at all costs’ strategy. I made this conclusion by comparing the company’s profitability metrics with rivals. NIO’s profitability still looks poor compared to LI and XPEV. Comparing with Li might be unfair due to the big gap in scales of these two companies. However, XPEV delivers less cars than NIO and its profitability metrics look better.

NIO’s revenue per employee is two times lower than Li’s and 25% lower compared to XPEV. This indicates that NIO does not prioritize efficient and profitable growth, which is not a sustainable approach to building value for shareholders.

The management did not announce exact global expansion plans, but opening ‘NIO houses’ across Europe suggests that they had ambitious plans in this direction. The recent introduction of additional tariffs on Chinese EVs by the EU is a serious fundamental headwind for NIO’s plans to expand internationally. Expansion to the U.S. market already looks impossible for Chinese EVs after Joe Biden introduced a 100% tariff.

Valuation analysis

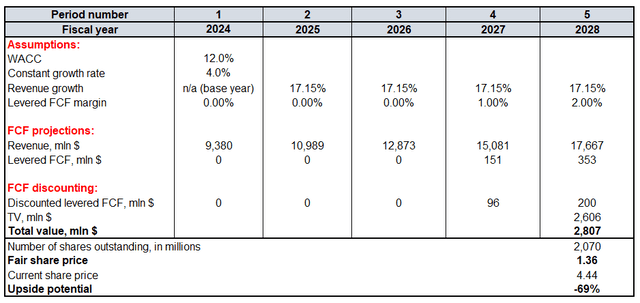

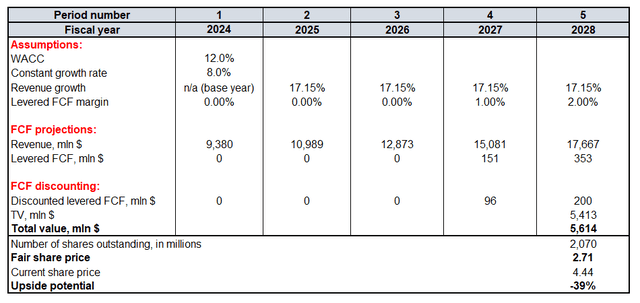

I use the discounted cash flow (‘DCF’) approach to update my valuation analysis for NIO. I use a 12% WACC, as recommended by Finbox. I rely on the FY 2024 revenue consensus forecast of $9.38 billion and use a linear 17.15% CAGR for 2025-2028.

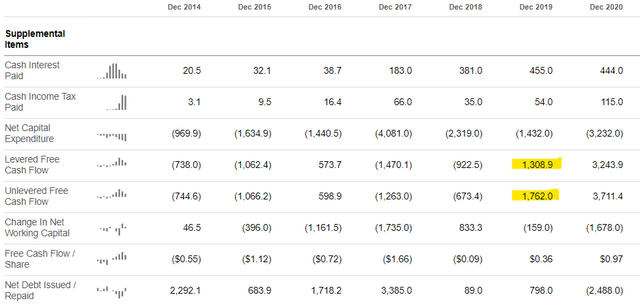

NIO is still not profitable and the level of uncertainty regarding the free cash flow margin is very high. However, Tesla (TSLA) first achieved sustainable positive FCF starting in FY 2019 (please see above) when it had already surpassed $20 billion in revenue. Therefore, I assume that to generate at least 1% in FCF, the company must surpass $15 billion in revenue. Therefore, I expect NIO to start generating positive FCF no earlier than FY 2027, with a slow expansion. According to Seeking Alpha, there are 2.07 billion outstanding NIO shares at the moment. I project a 4% constant growth rate because NIO operates in an industry that enjoys solid positive secular transitions.

The fair share price is $1.36, three times lower than yesterday’s closing price. This financial model is very sensitive to changes in constant growth rate. However, even upgrading the rate to unrealistic 8% does not make NIO’s stock attractively valued. Therefore, I do not find NIO’s valuation attractive at all.

Mitigating factors

NIO’s current ‘growth at all costs’ approach might be temporary. The management might prioritize this method for a limited time period just to gain momentum and gain popularity. This will help in expanding the company’s market share and building brand loyalty. Once these goals are achieved, NIO might start aggressive cost-cutting to improve its profitability profile. However, it is quite a risky strategy because the competition is intensifying as more legacy automakers introduce plans to expand their all-electric models. Therefore, the possibility of such a scenario is quite low.

Conclusion

I do not believe in the sustainability of NIO’s yesterday rally. The Q2 deliveries look impressive without looking at financial performance. However, peer analysis of profitability metrics together with recent historical trends suggest that NIO switched its approach to ‘growth at all costs’ which is unsustainable. The cash burn problem cannot be over-estimated and there will highly likely be more dilution soon. My fair share price estimate is much lower than the last close. All these factors make me reiterate a ‘Strong sell’ rating for NIO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.