Summary:

- The stock is currently in a bullish trend, with a 2024 price target of $6.70, driven by favorable RSI and VPT signals.

- Vehicle deliveries surged to 57,373 units, a 143.9% YoY increase, boosting vehicle sales revenue by 118.2% from Q2 2023.

- NIO’s vehicle margin improved to 12.2% from 6.2% in Q2 2023, driven by lower material costs and production efficiencies.

- Despite rising SG&A expenses and potential share dilution, NIO remains well-positioned for future growth with a robust infrastructure strategy.

Robert Way

Investment Thesis

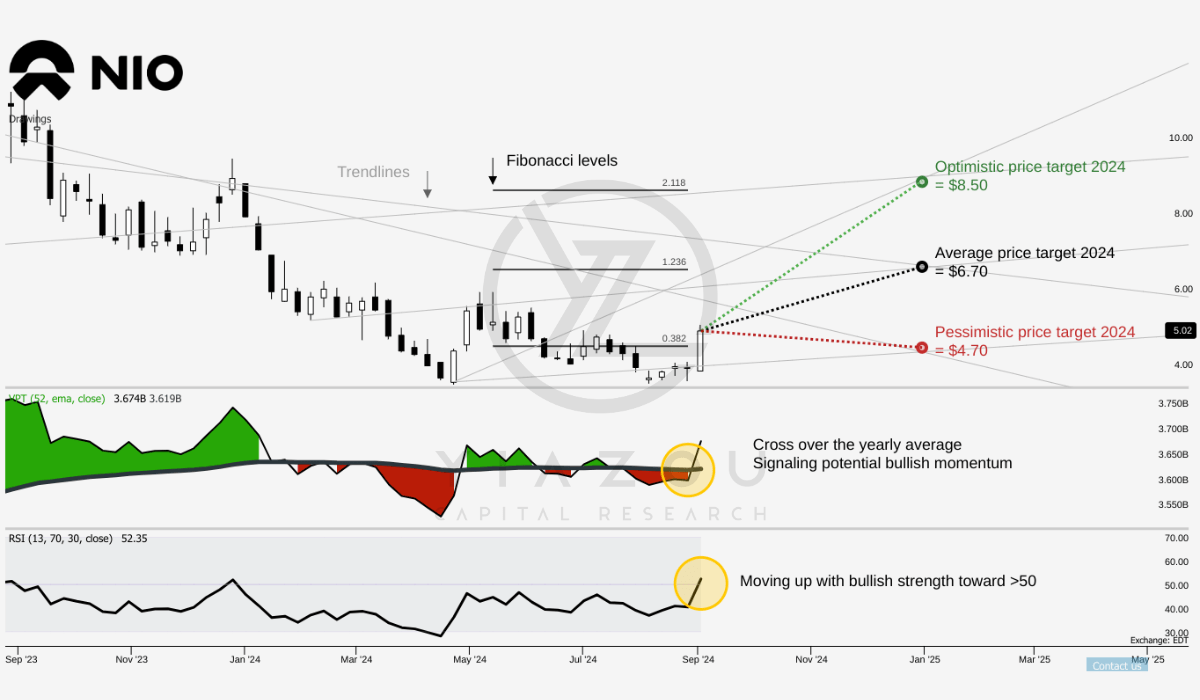

NIO (NYSE:NIO) has surged by more than 25% since our last coverage in July, entering a clear bullish trend and validating our previous technical analysis. The upward momentum is supported by strong technical indicators, such as the RSI moving into a bullish zone and the Volume Price Trend (VPT) showing accumulation, both signaling continued positive movement.

NIO’s robust Q2 results, driven by significant revenue growth and record vehicle deliveries, further strengthen the company’s outlook. With improving margins and expanding infrastructure, NIO is well-positioned to capitalize on the growing demand for premium EVs.

While risks like share dilution and rising operational costs remain, the overall technical and fundamental picture points to further upside potential. Investors can expect continued growth if market conditions remain favorable, with NIO on track to reach higher price targets based on the ongoing bullish momentum.

Technically, NIO Is Set To Hit $6.7 In 2024

Currently priced near $5.3, NIO’s average price target for 2024 is set at $6.70, which aligns with the 1.236 level of the Fibonacci extension sequence. This level suggests moderate optimism about the stock’s recovery. A reasonable increase is possible if market conditions remain favorable (as they are now).

The optimistic price target of $8.50 is in line with the 2.118 Fibonacci level, which implies a higher upside potential if NIO stock experiences significant positive momentum or market sentiment shifts. Conversely, the pessimistic target of $4.70 (marking the 0.382 Fibonacci retracement level) points to minimal growth or slight declines based on a cautious outlook under less favorable conditions (following historical view on the street).

The RSI indications for NIO stock stand (at 52.35) at a neutral position, indicating neither overbought nor oversold conditions. The RSI trend upwards, with a noted bullish divergence (no bearish divergence), generally signals strengthening momentum. The crossover by the RSI line over the level of 50 further supports a potential long setup for investors.

This bullish trend is complemented by the VPT line, which moves sharply upward over the yearly moving average. The VPT line stands at 3.67 billion, above its moving average of 3.62 billion. It indicates a considerable accumulation trend and supports a potential long position after stabilizing or progressing over the moving average.

Yiazou (trendspider.com)

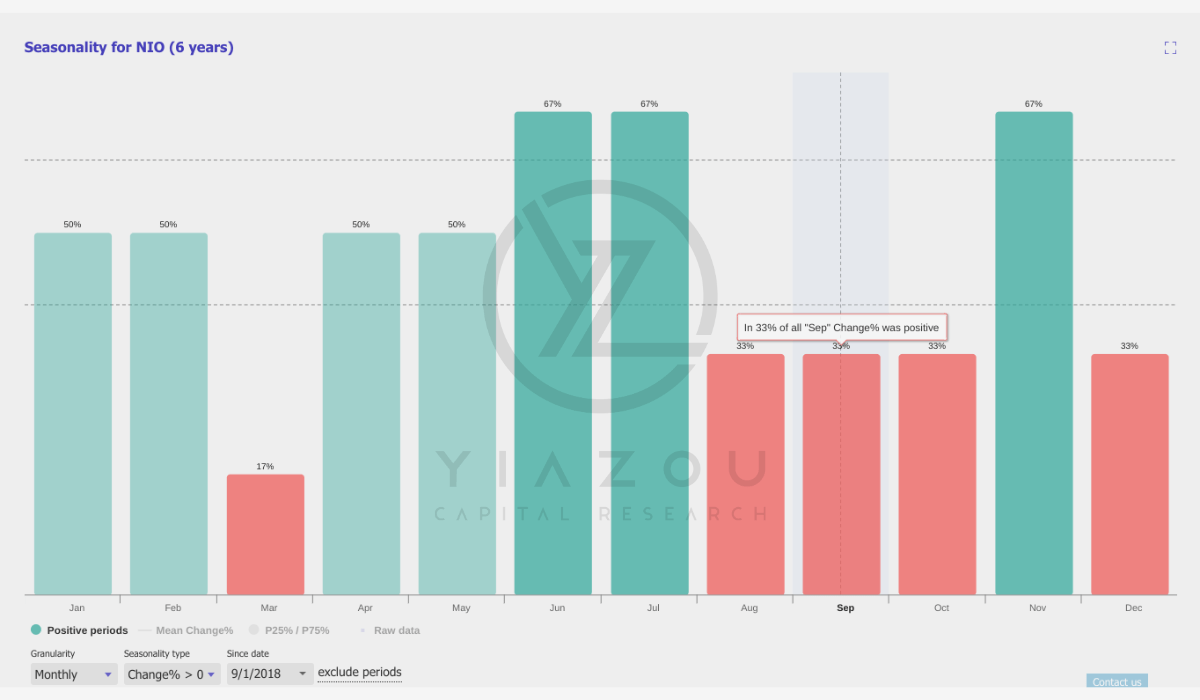

NIO’s seasonality analysis for September to November shows mixed performance. September and October have a 33% probability of positive returns, indicating weak performance during these months, with only one out of three years yielding gains. This suggests early fall is typically challenging for NIO. However, November marks a turnaround, with a 67% probability of positive returns, making it one of the strongest months for the stock. Historically, two-thirds of Novembers have been positive, possibly driven by year-end market optimism or company-specific catalysts.

Yiazou (trendspider.com)

NIO’s Revenue And Deliveries Surge: Scaling Up With 99% YoY Growth In Q2 2024

To begin with, NIO’s Q2 2024 total revenues of RMB17.45 billion ($2.4 billion) are nearly doubled from Q2 2023, which is a 98.9% year-over-year (YoY) growth and a 76.1% quarter-over-quarter (QoQ) increase from Q1 2024. This significant acceleration in NIO’s top line suggests that the company is rapidly scaling up operations based on its core business growth, vehicle deliveries sales revenue, and other sources of income.

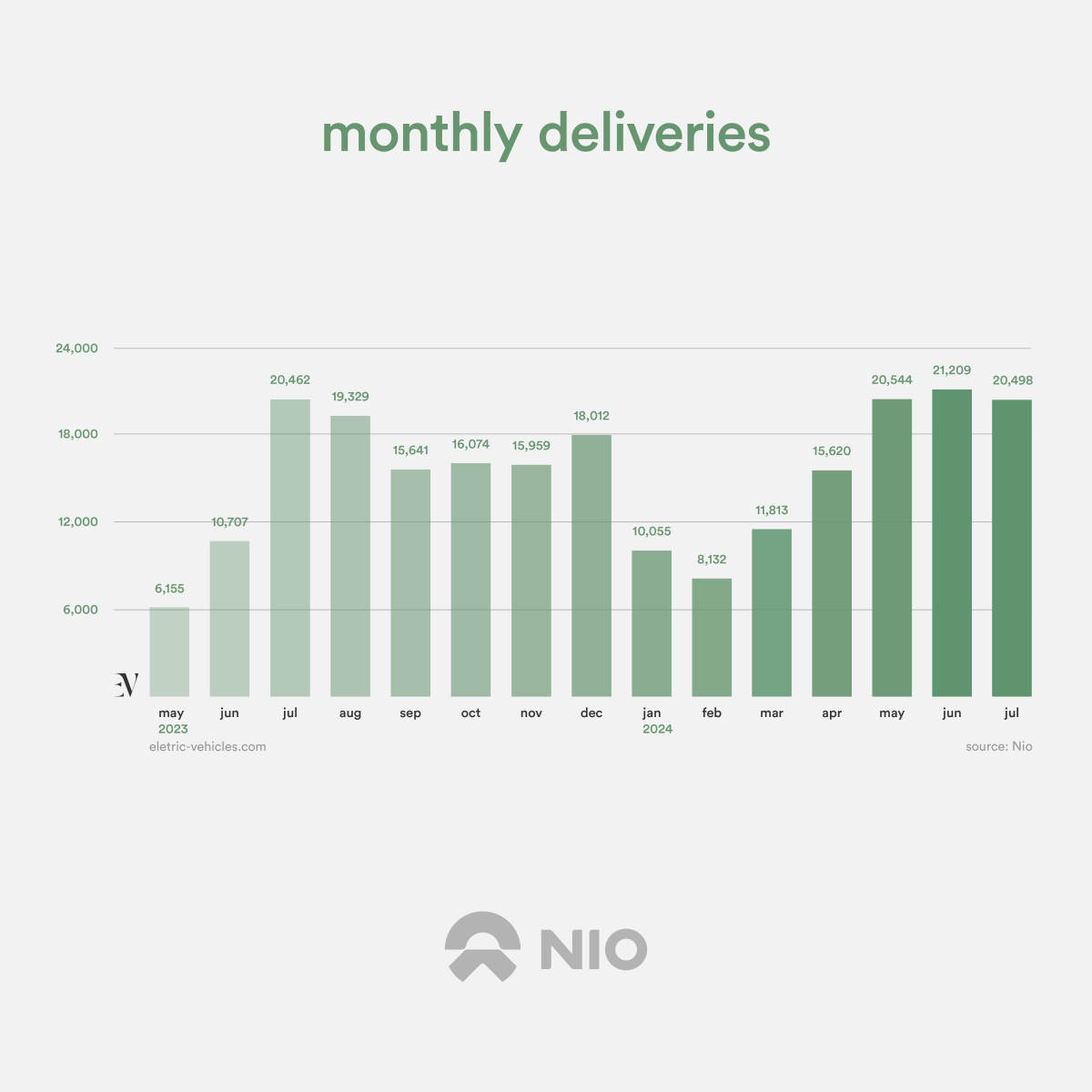

A sharp increase in vehicle deliveries led NIO to hit 57,373 units in Q2 2024 with a massive 143.9% YoY increase and a 90.9% sequential boost. The surge in deliveries directly correlates with NIO’s vehicle sales revenue, which has a 118.2% growth from Q2 2023 and 87.1% growth QoQ. For a premium brand like NIO, such a dramatic uptick in deliveries of SUVs and sedans points to the brand’s appeal. The 32,562 premium smart electric SUVs and 24,811 premium smart electric sedans were sold during the quarter.

In July 2024, NIO delivered 20,498 vehicles, followed by 20,176 in August. By August 31, 2024, the ability to maintain delivery levels above 20K units per month is a clear signal of stable demand for NIO’s EVs. Considering the adversities in EV production at a high volume with supply chain disruptions seen in recent years, the deliveries’ consistency may continue to lead to a stable revenue base and NIO’s market share in China’s increasingly competitive EV market.

eletric-vehicles.com

Back to the top line, the rise in vehicle sales revenue is based on increasing unit sales. NIO’s can hold a significant portion of the premium battery electric vehicle (BEV) market, priced above RMB300K. The market share was 40% in Q2 2024 against 59% last year. Logically, this is not a red flag, considering the growing number of vehicle sales units as the BEV market expands.

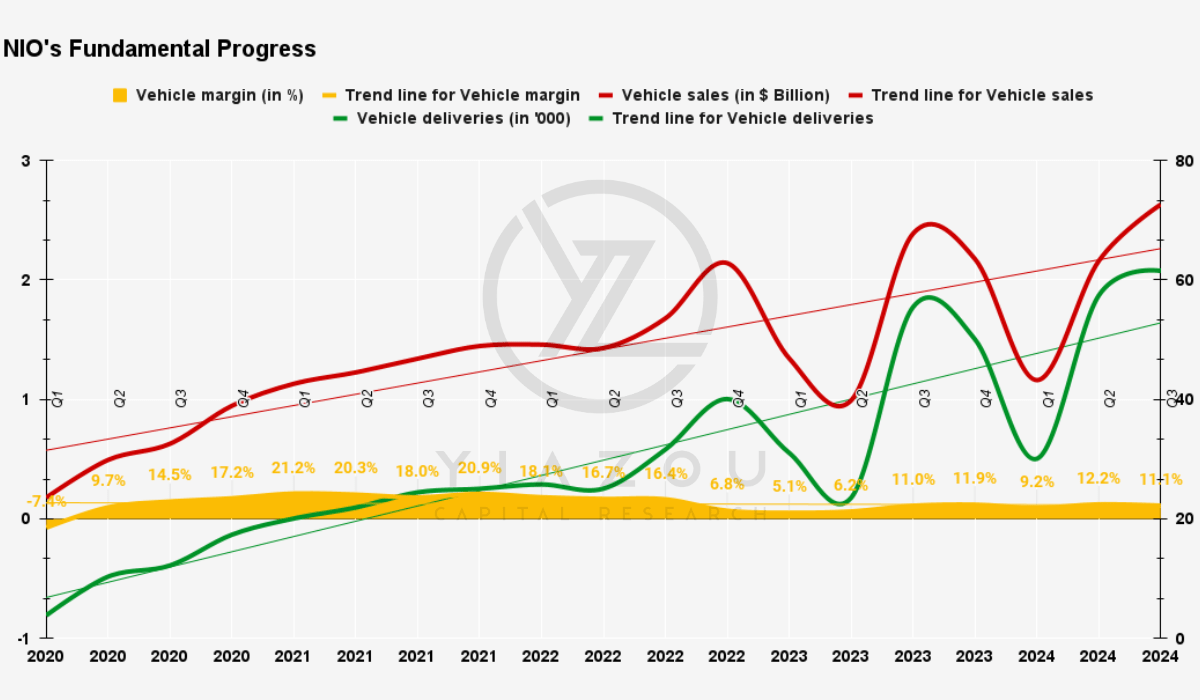

However, NIO’s competitive lead in the high-end market requires an increasing capacity to attract new consumers based on improved tech, an infrastructure to save charging time (time is money here), and service offerings. Looking forward, in Q3 2024, vehicle deliveries may hit 61.5K, with vehicle sales to be $2.63 billion (internal estimates), and an 11.1% vehicle margin is possible based on the last 12-month average.

For NIO, another core fundamental is improved vehicle margin, now at 12.2% from 6.2% in Q2 2023 and 9.2% in Q1 2024. This margin expansion is primarily attributed to decreased per-unit material costs, even though the average selling price slightly decreased due to product mix changes. This progress in margin points to NIO’s emerging ability to manage production costs with operational efficiencies as the company scales.

As a result, the quarter’s gross profit reached RMB1.688 billion ($232.4 million), an increase of 1,841% year over year and a 246.3% sequential rise. Therefore, this significant jump in gross profit indicates improving operational leverage, with revenue growth outpacing the increase in production costs.

yiazou.com

Progress In Operational Edge And Reduced Losses Amidst Growth Investments

NIO’s operating loss decreased by 14.2% compared to Q2 2023 and a 3.4% decrease in Q1 2024. As a result, the company’s net loss in Q2 2024 holds a 16.7% decrease from Q2 2023 and a 2.7% reduction from Q1 2024. This reduction in operating loss suggests a growing capability to manage costs with significant ongoing growth initiatives through gross margin and vehicle margin enhancements. One such growth initiative is the “Power Up Counties” plan (August 20, 2024). This program may expand NIO’s charging and battery-swapping network across all county-level administrative divisions in China.

By the end of 2025, NIO plans to extend its charging network to over 2.3K counties (in China). The strategic deployment of this infrastructure may further encourage EV adoption in less-penetrated regions. Moreover, the SkyOS operating system launch, the Shenji NX9031 intelligent driving chip, and the Banyan 3 smart system may enhance vehicle intelligence and autonomous driving features. These factors may also support NIO’s top-line growth.

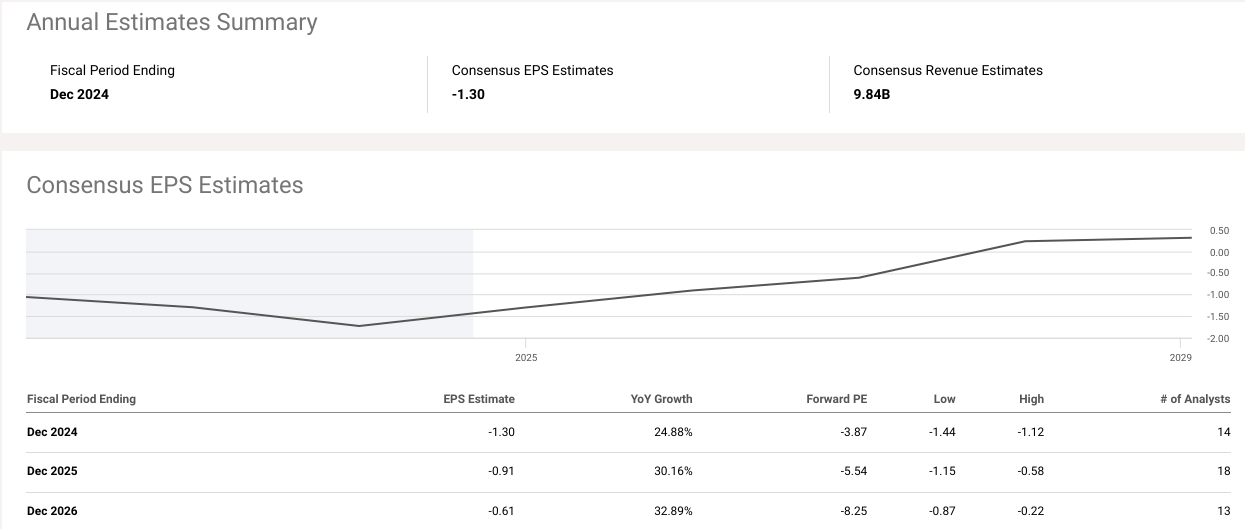

Looking ahead, NIO’s revenue consensus estimates solidify the growth assumption. The street estimates forecast $9.84 billion in revenue for 2024 to $15.9 billion in 2026. Similarly, the emerging operational edge will support the bottom line’s YoY growth, hitting +33% YoY in 2026.

seekingalpha.com

Downsides: Large Share Issuance And Jump In SG&A expenses

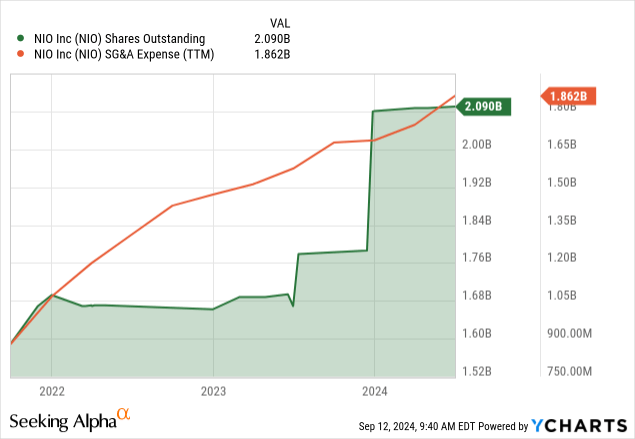

On July 12, NIO issued 30 million Class A ordinary shares to Deutsche Bank Trust Company Americas to facilitate its employee share incentives. This issuance aligns employee motivation with company performance, often boosting retention and productivity. However, the issuance will lead to dilution among existing shareholders, reducing their ownership fraction. This is not just one instance of NIO’s growing number of diluted outstanding shares, following a long-term trend. This is a fundamental issue that is adversely impacting NIO’s market valuations.

Moreover, NIO’s Q2 2024 marked a high increase in SG&A expenses (+31.5% YoY and +25.4% QoQ) from Q1 2024. This cost surge was driven primarily by expanding personnel in sales roles and increased marketing activities, indicating NIO’s aggressive push for market expansion. However, these jumps in SG&A expenses may slow down NIO’s projected EPS recovery. The expected EPS loss of -RMB1.35 in December 2024 is forecasted to improve to -RMB0.61 by December 2026. Although this suggests narrowing losses, the company must hit a positive bottom line to attach the stock with progressive valuations.

Takeaway

NIO’s substantial Q2 2024 revenue and vehicle delivery growth highlights its ability to scale operations efficiently. Improved margins and infrastructure investments position the company for continued growth. Technical indicators suggest further upside, but concerns over share dilution and rising expenses could impact market valuations and earnings recovery. Despite challenges, NIO remains well-positioned for future success.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.