Summary:

- Nio’s Q2 2024 results show strong vehicle deliveries and margin expansion but still report significant operating losses, making it less attractive for long-term investment.

- The EV market is overcrowded, and Nio faces intense competition from peers like Li Auto and ZEEKR, which offer better value and performance metrics.

- Nio has a strong cash buffer but higher debt and ongoing cash burn compared to peers, necessitating significant fundamental improvements before being considered a core portfolio stock.

- Despite positive short-term prospects, I recommend staying on the sidelines or investing in better-positioned EV companies with stronger track records and financial health.

Andy Feng

Investment Overview

With NIO (NYSE:NIO) reporting Q2 2024 numbers, there has finally been some positive price-action. In the near term, Nio stock touched lows of $3.7 on August 28. The EV stock is already higher by 31% at $4.85. This does not come as a surprise. Nio stock was oversold and my view is evident from the fact that the stock is still down by 46% for year-to-date.

I would also agree that Nio’s Q2 2024 results have been encouraging on several fronts. With a positive guidance, it’s likely that Nio can witness further upside. However, investors need to clearly differentiate between a trading opportunity and a long-term investment.

In my opinion, Nio is still not attractive as a portfolio stock. This coverage discusses the reasons for this view. The first point to note is that the EV space is overcrowded. If we scan through the listed space, there will be at least a dozen opportunities among EV stocks that look interesting.

As an investor, I would therefore dig deeper before selecting a few portfolio stocks from the EV space. If this analysis is done for Nio as compared to Chinese peers, it’s clear that there are relatively better ideas for value creation.

A Quick Look At Q2 2024 Numbers

Before getting into the main thesis, let me quickly discuss Nio’s Q2 numbers and the key positives. First, Nio reported robust growth in vehicle deliveries by 143.9% on a year-on-year basis to 57,373.

Strong deliveries growth was associated with margin expansion. For Q2, vehicle margin was 12.2%, which was higher by 600 basis points on a year-on-year basis. Nio however reported operating loss of $717 million.

With guidance for healthy growth and further expansion in margins, it’s likely that operating level losses will narrow in the next quarter. Nio also has a healthy cash buffer of $5.7 billion that will support investments in R&D.

Another important point to note is that the company’s mass-market brand ONVO, will launch its first model L60 on September 19. The car is expected to be priced around $34,600. A low pricing is likely to have a positive impact on deliveries. It, however, remains to be seen if margins are significantly impacted once L60 deliveries are significant.

Overall, Q2 results provide hope from the perspective of vehicle delivery growth and margin expansion. However, in an intensely competitive market, it’s too early to believe that Nio is out of the woods.

Nio Compared to Chinese EV Peers

Thus far, I have looked at Nio on a standalone basis. It’s important to talk about the EV company as compared to peers. This will support my view that it’s too early to consider Nio as a portfolio stock.

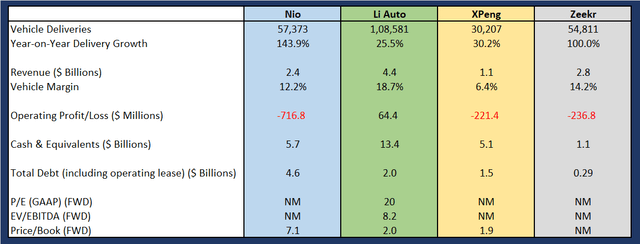

The table below gives some of the important metrics for Nio and peers as of Q2 2024.

Company Q2 Results, Seeking Alpha Valuation Metrics

I have the following conclusions to make.

First, Nio reported robust deliveries’ growth on a year-on-year basis. However, this is partially due to low deliveries in the base year. If we look at vehicle margins, Li Auto (LI) and ZEEKR (ZK) are better than Nio. It’s worth noting that Nio has indicated that its “long-term operational target is to realize a monthly volume of 40,000 units and a vehicle margin of 25%.” It would, however, be fair to assume that with operating leverage and technological advancement, peers would also be looking at a higher vehicle margin.

Second, from the perspective of operating level losses, Nio is the worst. Li Auto has been exceptional on that front and continues to deliver healthy margin and cash flows. However, even if we compare ZEEKR with Nio (almost similar deliveries), the former has better numbers to show. If I had to choose one stock, I would prefer to invest in Li Auto than Nio.

Third, Nio has a strong cash buffer, but Li Auto is way ahead on that front. Further, with positive operating cash flows, Li Auto is well positioned as compared to Nio that’s still experiencing cash burn. At the same time, Nio has significantly higher debt as compared to peers. Fundamentals need to improve significantly before Nio can be considered for the core portfolio.

Fourth, most of the valuation metrics remain unavailable on account of EBITDA and net profit level losses. However, from a price-to-book perspective, Nio stock seems stretched as compared to peers. Even on this front, Li Auto is ahead.

Therefore, on a standalone basis, Nio seems to be on a recovery path. However, when compared to peers, there are better options.

There is another business aspect that sets Li Auto apart from Nio. To elaborate, BYD (OTCPK:BYDDF) reported 340,799 passenger car sales in July 2024. Of this, 60% were plug-in hybrids. In general, Chinese EV consumers are preferring hybrid options as compared to battery-only cars. This implies that Li Auto has an advantageous position as compared to Nio.

I mentioned earlier that ZEEKR reported better vehicle margin and operating level performance as compared to Nio. This is another reason why ZEEKR holds an edge. The company is backed by Geely Automobile (OTCPK:GELYY). If we look at July 2024 data, Geely was in the second place in terms of NEV sales in China. With the company having a strong market position, ZEEKR is positioned to benefit. These are just indicators of the point that there can be better investment options.

It’s worth mentioning here that Nio and XPeng have expanded into the European markets. However, considering the tariffs factor, growth is likely to be impacted. Nio has already indicated that prices are likely to be increased to mitigate the impact of tariffs. The long-term impact still needs to be ascertained.

On the other hand, Li Auto is exclusively focused on China. This has helped in curbing cost and maintaining operational efficiency. With a strong cash buffer, I expect Li to pursue international expansion in the next 12 to 24 months. However, the focus is likely to be on regions where the regulatory environment is friendly. This includes the Middle-East and Southeast Asia.

Let me again emphasize that a standalone analysis might paint a different story. JPMorgan (JPM) believes that Nio will turn operating cash flow positive in the second half of 2024. Further, the price target for the stock has been revised to $8. In my personal view, a rally in Nio stock would be a good time to sell and shift to relatively better EV companies.

I must mention that I am not talking about the industry leaders like Tesla (TSLA) or BYD. If these names are included in the basket of EV stocks, it makes sense to remain invested in industry leaders. The focus, however, is on emerging EV companies from China.

Concluding Views

I believe that the electric vehicle industry is at a point where the winners will be separated from the laggards. There is likely to be industry consolidation and the Chinese EV market is positioned for “brutal elimination.” According to Wang Chuanfu, Chairman of BYD, “China’s EV industry has entered a stage of cyclical adjustment after two decades of growth.”

I am not suggesting that Nio is unlikely to survive. However, in the current industry scenario, I would prefer to remain invested in companies with a relatively better track record and deep pockets. If the industry scenario worsens, Nio might be forced to pursue further dilution of equity.

I also expect high R&D investments to sustain for all major EV companies. It’s technological advancement that’s likely to set companies apart from peers. In a recent news, BMW (OTCPK:BMWYY) announced that it will be working with Toyota (TM) to advance “hydrogen fuel cell technology and expand fuel cell electric vehicle options available to drivers.”

The company plans to launch its first-ever fuel cell series production vehicle in 2028. The point I want to make is that the horizon for new energy vehicles is expanding. This will further contribute to the competitive landscape.

My key conclusion is that Nio has reported encouraging numbers. However, it’s still too early to conclude on sustained growth and recovery. I would stay in the sidelines or look at relatively better investment options in the EV industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.