Summary:

- NIO’s Q2 2024 results are crucial as the stock is trading at multi-year lows. But whether they offer any support to the stock remains to be seen.

- While robust revenue growth is expected, substantial operating losses are likely to continue, too. The outlook for Q3 2024 can be subdued as well.

- Even longer-term promise, in the likes of battery swaps, can take time to impact profitability. With softer growth going forward along with continued losses, NIO isn’t a Buy.

Andy Feng

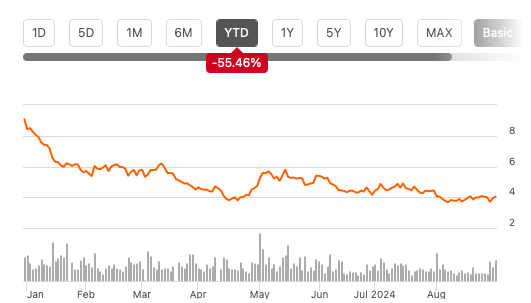

Chinese electric vehicle manufacturer and brand NIO’s (NYSE:NIO) (OTCPK:NIOIF) upcoming second quarter (Q2 2024) results are critical at a time when the stock lags behind both its long-term and nearer-term levels.

Not only is it trading at levels 94% lower than its all-time highs seen in May 2021, its current price is weak even compared to its performance over the past 52-weeks. It’s at 64% lower than the 52-week high and even 34% lower than the average during this period. Even year to date [YTD] it’s down significantly (see chart below).

Price Chart (Source: Seeking Alpha)

What to expect from Q2 2024 results

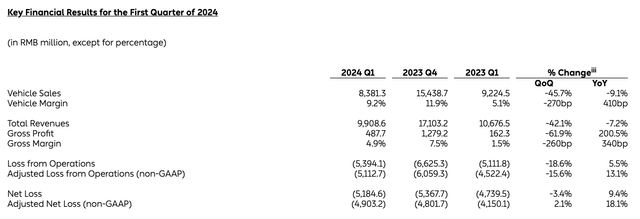

The company’s outlook for Q1 2024 released in early March, followed by worse than expected actual sales figures (see table below) dragged the stock down, and it hasn’t recovered since. The results due on September 5 can, however, offer some support to the sagging price and might even throw light on what to expect over the longer-term regarding NIO’s innovations with regard to batteries.

Expect roaring revenue growth…

There’s good news to be expected on the financials’ front, with the company seeing revenue growth between 89.1% and 95.3% YoY. A part of the reason for this is a weak base period, as Q2 2023 saw a 14.8% YoY fall in revenues.

But it’s also due to a robust trend in deliveries in Q2 2024, which saw a 144% YoY increase. This increase was notable as it was around 10 percentage points higher than the midpoint of NIO’s guidance range. It’s also especially encouraging after a 3% YoY contraction in Q1 2024.

… but big operating losses can continue

Despite robust expected revenue growth, however, NIO’s operating losses will continue. Not even with an improved gross margin in Q1 2024 to 4.9% from Q1 2023, when it was at 1.5%. And this is because of NIO’s big operating at 59.4% of revenues in Q1 2024. This alone reflects that the gross margin is no match for the expenses.

In numerical term, to estimate the operating loss for Q2 2024, two assumptions were made. One that revenues come in at the midpoint of the guidance range at 92.2% and two, both the gross margin and operating expenses ratios remain constant in Q1 2024 levels.

This results in an operating loss to revenues ratio of 54.5%, almost the same as in Q1 2024. But in absolute terms, it’s a significant increase of 51.1%., compared to a 5.5% YoY loss increase in Q1 2024.

Q3 outlook to be muted

Further, even the big revenue gains can be overshadowed by the company’s outlook for Q3 2024, which will be part of the upcoming results. As it happens, NIO’s vehicle sales momentum has not carried forward from Q2 2024. Growth reversed in July, contracting by 3.4% YoY. It picked up in August, with a 4.4% YoY increase, but even this isn’t like the rise seen in Q2 2024.

Positive battery related developments

However, the release might still offer some insight into the company’s progress on battery innovations and services, which appear promising from the longer-term perspective. Here’s how.

- Long-endurance battery: The company’s founder and CEO, William Li, drew interest when he live-streamed his road trip across China for 14 years earlier this year. The idea was to demonstrate the long-lasting battery.

- Battery swap: The company’s disruptive battery swap technology that allows for an exchange in less than three minutes is another of the innovations. It has also found its takers, not just among users but also other EV companies that have collaborated to make this technology work, with 2,480 swap stations installed to date.

- Battery as a Service [Baas]: With 70% of NIO’s users choosing Baas, the service looks like a success since its release in March. Not only does it allow for lower upfront costs, but the company has also recently lowered the monthly rental, which explains its popularity.

With this as the background, Li ascribed these to the company’s increased vehicle deliveries in April and May, among others, saying:

Despite the intensifying market competition, NIO’s premium brand positioning, industry-leading technologies, and innovative ‘chargeable, swappable, upgradeable’ power experience have been recognized for their exceptional competitiveness, leading to solid sequential growth in vehicle deliveries in recent months.”

Future is still uncertain

Despite both the expected short-term sales upswing and the long-term potential in NIO’s battery developments, the future is still uncertain. For one, as discussed above, even in Q3 2024, the company can see a reversal of the buoyant revenue growth expected for Q2 2024. With much competition in the EV market, it remains to be seen whether NIO can show consistent growth.

Next, the company’s massive operating losses are a challenge too. Even taking into account that price cuts in the EV market have made profit making difficult in the recent past, the fact is NIO has never made an operating profit. By comparison, its competitor Li Auto (LI) clocked one in its most recent quarters and also through 2023. The size of NIO’s operating loss, its small gross margin and growing operating expenses also don’t indicate that it can turn profitable anytime soon.

Also, the battery innovations can take their time to generate profits too. For instance, the numbers for battery swaps available so far indicate that the average number of daily swaps is at 27.4 per station, while it needs 60 to become profitable.

Investor takeaways

The challenges NIO continues to face make it a no-go stock, even as it trades at multi-year lows and its trailing twelve months [TTM] price-to-sales ratio at sub-1x is lower than both for LI at 1.05x and XPeng (XPEV) at 1.47x.

This doesn’t mean it’s without potential. In fact, it has truckloads of it on the battery front. From innovations like the long-range battery to battery swapping, it’s pushing the EV industry forward. But when that translates into consistent revenue growth and profitability remains to be seen.

The Q2 2024 results release might offer insight into these developments. But unless there’s something exceptional about them, even with its upcoming robust revenue numbers, it’s hard to see any sustained upswing in the stock. This is particularly as the numbers are likely to be overshadowed by a subdued guidance for the next quarter. And a big operating loss is likely too. I’m going with a Hold rating for now on NIO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this analysis, head over to Green Growth Giants for much more on the decarbonisation economy.