Summary:

- NIO Inc. stock is in a downward spiral, with recent earnings worse than expected and the potential for more dilution.

- NIO’s financial challenges are exacerbated by missed revenue estimates and increasing losses.

- The Grizzly Research report alleges NIO may be using questionable accounting practices, adding to concerns about the company’s financial health.

- There are much better stocks than NIO, and the company may not be worth the risk now.

Robert Way

While I’ve been bullish or neutral on NIO Inc. (NYSE:NIO) stock, I recently unloaded the remainder of my position. NIO’s stock remains in a downward spiral, and the company continues struggling. Recent earnings were worse than expected, and there is little inclination that NIO’s turnaround will occur soon. On the contrary, NIO continues losing money hand over fist ($2.9B loss in 2023), and new capital raises and dilution could be approaching. Moreover, NIO’s stock could continue trending lower, and it may be best to stay away from NIO unless significant improvements materialize soon.

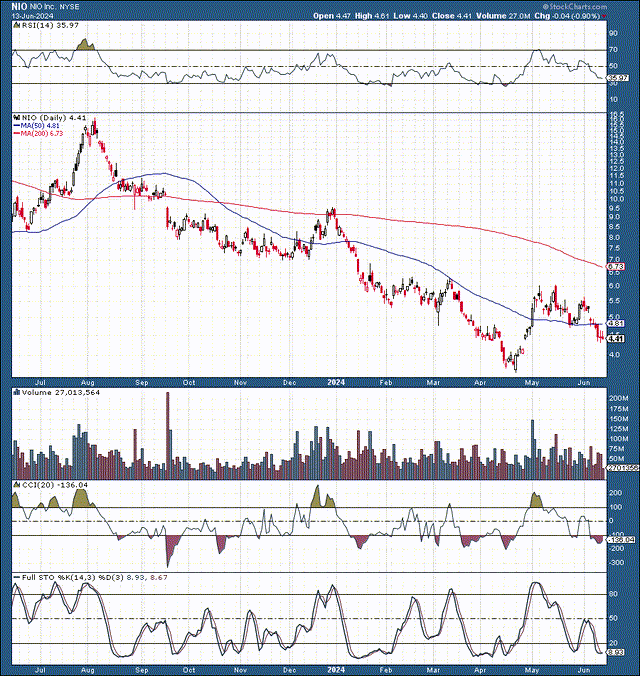

NIO’s Technical Whirlwind Continues

NIO (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools)

NIO’s stock continues to melt, and considerable downsides may be ahead even at $4-5. The company continues to lose money, and more dilution opens the door to a lower stock price. While the stock may appear oversold and undervalued now, there is no guarantee that shares won’t continue moving lower from here.

NIO’s Capital Raises

NIO now has more than 2 billion shares. At the end of last year, it had around 1.7 billion shares and only 1 billion shares around the end of 2019. This dynamic illustrates considerable dilution and implies that NIO’s stock could see more dilation as the company remains unprofitable for longer. We’ve seen margins falter and profitability slip more recently as competition and price wars among EV manufacturers heat up.

NIO faces substantial challenges as it attempts to compete with more profitable and established EV manufacturers like Tesla (TSLA), BYD Company (OTCPK:BYDDF), other EV startups, and legacy automakers. The company’s sales aren’t increasing as expected, and demand appears lackluster, especially considering Tesla’s price chops in China.

NIO’s Earnings Are Not Improving

While NIO’s loss was slightly narrower than expected, revenue estimates were missed by $70M. Sales of $1.37B were down 7.2% year over year. Deliveries were also down 3.2% year over year and 39.9% quarter over quarter.

NIO’s net loss was about $718M, roughly a 9% increase over the same quarter in the previous year. Also, despite selling more cars in Q4, NIO managed to rack up a loss of roughly $744M. So, we’re looking at a loss run rate of around $2.7B annually, illustrating significant problems for NIO.

This dynamic also underscores the urgent need for NIO to become profitable. The fact that NIO continuously raises capital and its share count continues increasing clearly indicates the company’s financial challenges. However, the mounting losses make it difficult to imagine substantial improvements soon.

Is NIO Playing Philidor-esque Accounting Games?

While Grizzly Research’s allegations about NIO’s accounting practices may be baseless, it’s crucial not to dismiss the report. Being aware of its existence and conducting a thorough analysis is a responsible approach that we should adopt.

Valeant was a high-profile pharmaceutical company that crashed and never recovered because of its alleged greed, mismanagement, and accounting issues. The Grizzly Research report alleges that NIO uses Weineng (a Philidor-like entity) to boost sales and profitability metrics.

The Grizzly report has been out for over two years, and while NIO has refuted it, the report has not been proven wrong. On the contrary, the report mentions likely dilution, and the stock has declined by about 80% since the report was released.

NIO’s Continuous Underperformance

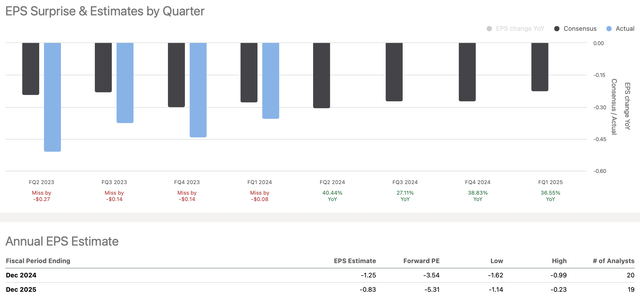

Earnings vs. estimates (Stock Market Analysis & Tools for Investors)

The consensus estimate was for an EPS loss of $1.05 over the previous TTM. Yet, NIO’s loss stacked up to $1.67 instead, roughly 60% higher than expected. While the consensus estimate is for a loss of $1.25 this year, NIO’s poor track record suggests it can continue underperforming estimates.

By poor track record, I mean that NIO has missed EPS estimates in each of its last ten quarters, illustrating a concise pattern. If NIO misses its 2024 EPS estimates by 30% (half of what it missed in its TTM), it will deliver a loss of around $1.62 per share.

NIO has over 2 billion shares; thus, a $1.62 EPS loss would equate to a loss of around $3.25B. Even a $1.25 per share loss would equal a net loss of around $2.5B, suggesting a high probability of more dilution.

Also, where is the end game here? When will NIO become profitable? Tesla, other more efficient EV manufacturers, and legacy automakers can remain profitable despite adjusting vehicle prices lower if needed. How will NIO compete when it’s continuously losing billions of dollars?

Risks To NIO’s Bearish Thesis

Of course, there are risks to NIO’s bearish thesis. NIO could become profitable sooner than expected. Improving deliveries and other constructive factors could also favorably impact NIO’s stock price. Additionally, we could see unexpected news materialize that may improve sentiment for NIO, leading to improved price action and a higher stock price as we advance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!