Summary:

- NIO Inc. stock’s April rally has fizzled out, disappointing its investors again.

- The company’s June deliveries helped it surpass the Q2 outlook, suggesting an improvement.

- NIO Inc. still faces significant challenges in reaching profitability, which is worsened by intense competition.

- In the second half, the company aims to scale its sub-brands to lift optimism, but execution risks could persist.

- I argue why staying out of this troubled EV maker is a reasonable conclusion. Read on.

Getty Images/Getty Images News

Nio Stock: April’s Rally Has Fizzled Out

NIO Inc. (NYSE:NIO) (“Nio”) investors attempted to help NIO stock bottom in April 2024, but the rally has since fizzled out. While NIO still hovers above its those lows, it has given up much of its April gains. Consequently, investors who didn’t manage to get out of NIO at its April spike have missed a fantastic opportunity to cut exposure.

I reiterated my cautious NIO update in my previous April article. I had also anticipated a “near-term bullish mean reversion setup,” which played out accordingly. However, I also reminded NIO investors that Nio’s weak execution and intense EV competition could still hurt its thesis moving forward.

Nio Q2 Deliveries: Strong, But From A Low Base

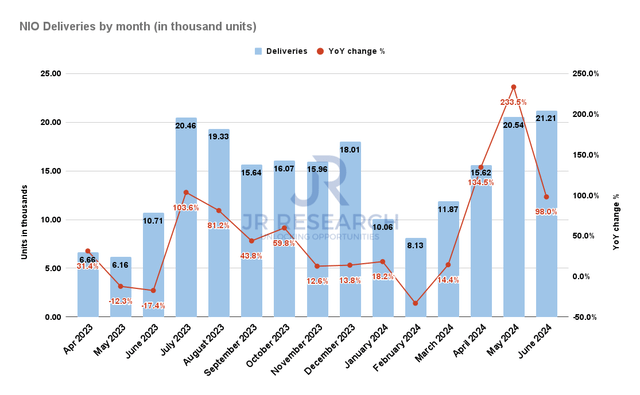

Nio monthly deliveries (Nio filings)

Nio’s recent June deliveries helped Nio surpass its Q2 deliveries outlook. As a reminder, Nio telegraphed a Q2 deliveries guidance range of 54K and 56K units. It represents significant growth from the previous year’s quarterly deliveries. However, investors must be cautious about being overly optimistic about the YoY growth, as the comps were against a significantly lower base in 2023, as seen above.

Despite this, Nio’s improved June performance should bolster investor confidence about its demand challenges, helping it potentially scale faster. Improved buying momentum in China’s EV market could also bolster Nio’s efforts to lift its performance. In addition, the enhancements in the go-to-market strategy for Nio’s BaaS service have likely contributed to Nio’s more robust execution in Q2. China EV leader BYD Company (OTCPK:BYDDF, OTCPK:BYDDY) also experienced a significant improvement as BYD’s car sales reached a record in Q1, corroborating the industry’s recovery.

Nio: Sub-Brand Scaling Introduces Higher Execution Risks

Nio’s sub-brands are expected to help lift deliveries in the second half, although execution risks could remain relatively high. Nio and its loss-making EV peers face challenges against BYD’s highly competitive EV offerings as the EV leader continues to scale. Therefore, Nio’s attempt to penetrate the lower-end segment could introduce more challenges toward achieving free cash flow profitability.

Nio is expected to begin deliveries for its Onvo brand in September. Nio anticipates the need to scale between 20K and 30K units to reach breakeven. As a result, the need to lift its production quickly in the second half across its main and sub-brands will likely require solid execution, which could remain complicated.

China’s economic recovery and the optimism in China’s consumer spending sentiments have remained mixed. With Nio facing more significant challenges in the EU due to the recent tariffs, China is expected to stay as Nio’s single most important market for some time. While Nio has expressed interest in expanding to the Middle East, its lack of profitability could hamper a more aggressive expansion. Furthermore, BYD’s much more robust profitability has afforded China’s EV leader substantial leverage in navigating the EU’s tariffs on automakers importing from China.

NIO: “F” Profitability Grade Justifies Caution

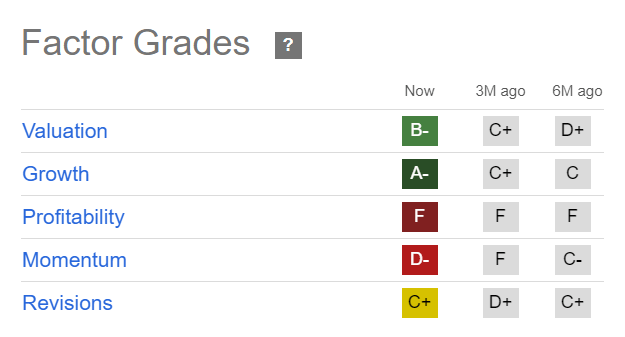

NIO Quant Grades (Seeking Alpha)

NIO’s “F” profitability grade corroborates the need to be cautious. While it boasts a net cash balance sheet with cash and equivalents of $5.3B as of Q1, Nio is not expected to attain free cash flow profitability through the FY2026 forecast period.

In addition, based on current Wall Street estimates in 2024 and 2025, Nio is expected to burn through more than $3.5B in cash. Therefore, worse-than-expected execution could necessitate another potentially significant dilution event as Nio raises more funds. Given the abovementioned challenges, investors must closely monitor Nio’s second-half undertaking.

Is NIO Stock A Buy, Sell, Or Hold?

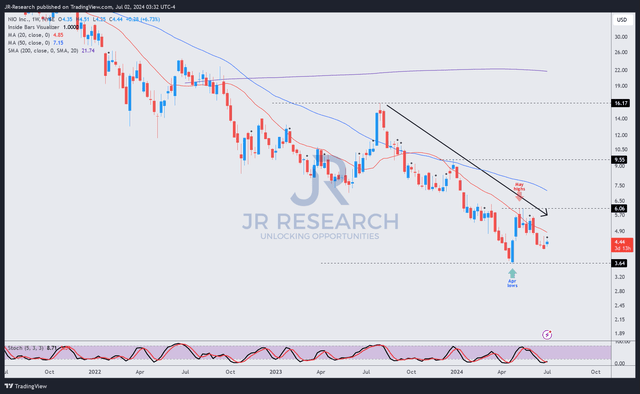

NIO price chart (weekly, medium-term) (TradingView)

NIO’s price chart indicates a clear downtrend bias, benefiting bearish investors. However, NIO’s short-interest ratio of less than 10% suggests it isn’t assessed as a heavily shorted stock. Therefore, bullish NIO investors anticipating short-covering opportunities from bearish investors could be massively disappointed.

Notwithstanding Nio’s better-than-anticipated Q2 deliveries update, the market has not reacted with significant optimism. NIO has also lost much of its gains from its May highs. Therefore, NIO Inc. stock has again failed to break out of its downtrend bias, suggesting the need to remain cautious.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!