Summary:

- NIO shares are up 12.4% since my last thesis update, slightly outperforming the market. I don’t think we’ve seen anything yet in terms of a potential uptrend.

- Despite Q1 2024 challenges, NIO’s improved margins and liquidity position suggest potential for growth and resilience in the EV market.

- I believe the internal improvements position NIO for potential growth and resilience in the competitive EV market.

- The cash-to-market cap ratio is >57%, suggesting NIO may be undervalued.

- I see a possible reversal to the 200-day moving average in the $6.2-6.3 range, implying a price target of 30-35%. For all these reasons, I have decided to reiterate my previous “Buy” rating.

Robert Way

My Thesis Update

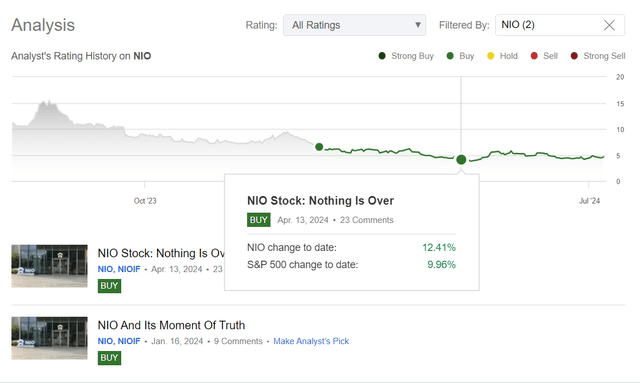

I wrote my first article about NIO Inc. (NYSE:NIO) stock in mid-January 2024 and updated my bullish rating in mid-April. Since my last thesis update, the stock has risen by about 12.4%, compared to the market’s increase of approximately 10%:

Seeking Alpha, Oakoff’s coverage of NIO stock

I can’t say that I’m completely satisfied with how my thesis has played out over the past 3 months. However, based on current market conditions and my updated analysis of the company’s financials and corporate developments as of late, I believe that the 12.4% increase is not the full potential – I see much higher price targets for NIO in the medium term. So I think I should leave my”Buy” rating unchanged today.

My Reasoning

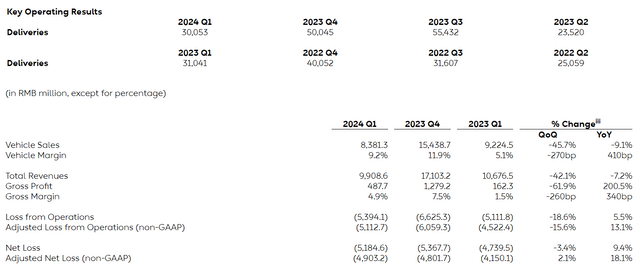

NIO managed to report for Q1 2024 financials in early June. Having delivered 30,053 vehicles (17,809 premium smart electric SUVs and 12,244 premium smart electric sedans) and marking a 3.2% YoY decrease in this figure, NIO reported its vehicle sales at ~$1,160.8 million, which was a 9.1% YoY decline (-45.7% QoQ dip). The total Q1 2024 revenue amounted to ~$1,372.3 million – that’s also a major decrease on both YoY and QoQ basis (-7.2% and -42.1%, respectively). As the management commented during the latest earnings call, the primary reasons for these declines are “lower average selling prices, resulting from adjustments to user rights since June 2023, and a decrease in delivery volume.” Additionally, they noted seasonal factors, which contributed to the 40% decrease in delivery volume on a QoQ basis. Nevertheless, what we found is that NIO’s margins recently experienced a great increase: The vehicle margin stood at 9.2%, up from 5.1% in Q1 2023, although it decreased from 11.9% in Q4 2023. The same was carried over to the company’s gross profit margin which improved to 4.9% from as low as 1.5% in the same quarter of last year (although it was down from 7.5% in the previous quarter).

As a result, NIO’s operating losses for Q1 2024 were -$747.1 million, a 5.5% YoY increase and an 18.6% decline from Q4 2023 – I think this could be considered a success as it means that the company has managed to cut its quarterly loss by almost $140 million or over 15% on an adjusted basis, even though its revenue was hurt considerably, as we saw above.

NIO’s press release, Oakoff’s compilation

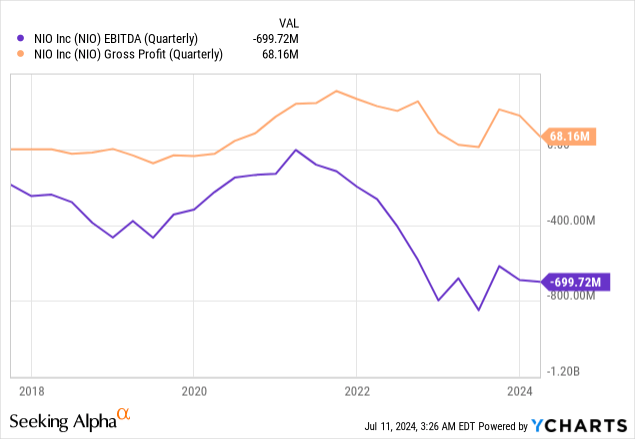

I think it’s worth noting a positive aspect: despite a slight decrease in gross profit over the last couple of quarters, EBITDA has stabilized in dollar terms.

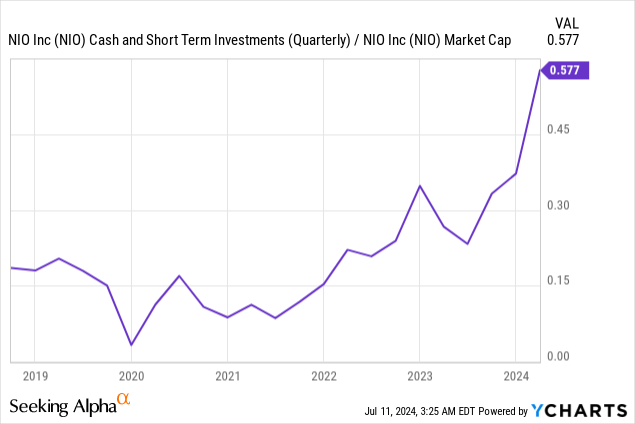

This is particularly encouraging given the increased liquidity on the balance sheet. Having received a strategic investment of RMB1.5 billion “to further develop its core technologies and expand its charging and swapping network”, as of March 2024 NIO had RMB45.3 billion (~$6.3 billion) in cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits. Thus, the ratio of all liquid funds and short-term investments on the balance sheet to market capitalization is now above 57% (YCharts data), which is unprecedented in the company’s public history.

Given that losses have stabilized at the EBITDA level and are no longer widening, I believe that the improved liquidity also indicates that NIO’s outlook has brightened, as the market should now expect that the company can stay afloat without additional cash injections (and consequently without diluting existing shareholders) for much longer than we could have expected 2-3 quarters ago.

Meanwhile, NIO’s business continues to grow and develop. The company saw a gradual improvement in vehicle deliveries month by month due to the launch of all model-year products and a more flexible sales policy. NIO delivered 15,620 vehicles in April and 20,544 vehicles in May. It is gaining market share rapidly and momentum in the premium BEV. Just a few days ago, they announced their delivery figures for Q2, reaching a new record-high level:

NIO’s latest deliveries update [July 1, 2024]![NIO's latest deliveries update [July 1, 2024]](https://static.seekingalpha.com/uploads/2024/7/11/53838465-17206844235965014.png)

In April 2024, NIO took a significant step forward by launching the ET7 at the Beijing Auto Show aimed at satisfying business community expectations and market competition; BMW 5 series, Audi A6, and Mercedes E-Class are some of its high-end counterparts. Meanwhile, NIO expanded its NOP Plus urban driving feature that crosses more than 1.4 million kilometers of Chinese highways and city streets in 726 cities which has been used by over 260,000 users.

Another milestone made by NIO towards capturing the mainstream family car market was through the establishment of ONVO – a new brand whose initial product, L60, will be delivered in September this year. In order to facilitate this development, it continued to expand its sales network and service capacity presently having 154 NIO houses, 388 NIO bases, 344 service centers, and others. Additionally, the charging and swapping network grew to include 2,472 power swap stations worldwide that have carried out over 45 million swaps; besides housing more than 22k power chargers plus destination chargers among others. Moreover, battery-swapping network enhancements have been achieved through partnerships with such companies as Changan, Geely, JAC, Chery, Lotus, GAC, and FAW, thereby summing up other ways through which this venture has proven itself committed to infrastructure development for customer convenience.

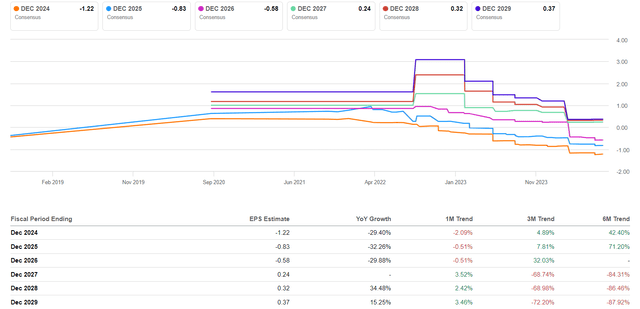

Based on the above, I believe that NIO stock is, so to speak, unfairly lagging behind the new bullish sentiment in the EV space, which was recently triggered by Tesla, Inc. (TSLA), as the positives in this growth story outweigh the negatives. In any case, the company’s risk profile seems to me to have improved, but Wall Street seems to ignore it, keeping downgrading the EPS improvement prospects:

Seeking Alpha, NIO’s EPS revisions

I believe that with the end market and TAM expansion initiatives outlined above, as well as increased liquidity, NIO stock should go much higher from current levels. It is difficult to value a company solely on sales-related valuation metrics, which are inflated in some places but seem acceptable to me overall. More important, in my opinion, is the ratio of cash on balance to market capitalization – as I wrote above, this metric has never been as high as it is now. For this reason, I think NIO is an undervalued company with a lagging market sentiment – once the positive sentiment returns, the stock price should rise significantly. I don’t have a specific target in mind, but looking at the technical analysis, I see a clear and logical level in the $6.2-6.3 range, which coincides with the potential reversal to the moving average (200-day). If the local price low from late June turns out to be a “higher low” in this price action structure, my thesis has a high chance of being realized. The target potential for a mean reversion to the next strong level is 30-35%:

TrendSpider Software, NIO daily, Oakoff’s notes

Hence my “Buy” rating reiteration today.

Risks To My Thesis

A significant risk factor for NIO that I see today is that the European Union has recently put very high tariffs on all battery EVs that have been imported from China. As Seeking Alpha News team reported, this move, which was after a nine-month study by the European Commission, showed that Chinese EV manufacturers benefited from non-competitive government grants which made them underprice EU-produced vehicles and raise their market share from 3.9% in 2020 to 25% by end-of 2023. So as a result, the EU has imposed countervailing duties of up to 37.6% on vehicles exported from China, with NIO and other Chinese producers facing a 20.8% weighted average duty if they cooperated in the investigation and 37.6% if they did not. In addition, this action could last until the final vote in November and may have implications on NIO’s profits and market penetration in Europe but also cause retaliation whereby China may introduce taxes against European goods resulting in further complicating global operations for NIO (and others as well).

It is also important to understand that the company is still in its active growth stage, and while the number of deliveries is growing at a phenomenal pace, revenue is stagnating due to pressure on average selling prices and other factors. This stagnation may indicate that it will be challenging for NIO to achieve profitability in the next few years (or ever).

Due to its lack of profitability, NIO stock can only be valued based on its price-to-sales ratio, which appears slightly elevated for the Consumer Discretionary sector. This is a risk factor, similar to the conclusions I reached based on my technical analysis described above.

Your Takeaway

NIO’s financial results for Q1 2024 revealed a difficult quarter with a decline in vehicle deliveries and revenue, largely due to lower ASP and seasonal factors. Nevertheless, NIO’s vehicle margin improved significantly compared to the previous year and the company was able to reduce its operating losses amid a strengthened liquidity position. Together with the continued expansion of the company’s product range and infrastructure, I believe the internal improvements position NIO for potential growth and resilience in the competitive EV market. The cash-to-market cap ratio is >57%, suggesting that NIO may be undervalued, although there will be no P/E ratios in the next 2-3 years. I see a possible reversal to the 200-day moving average in the $6.2-6.3 range, implying a price target of 30-35%. For all these reasons, I have decided to reiterate my previous “Buy” rating.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.