Summary:

- My article examines China’s macro environment, highlighting its impact on the financial performance and future prospects of the stock market in general.

- NIO’s financial updates in particular reveal strong revenue growth and solid balance sheets, supporting a positive outlook for the stock.

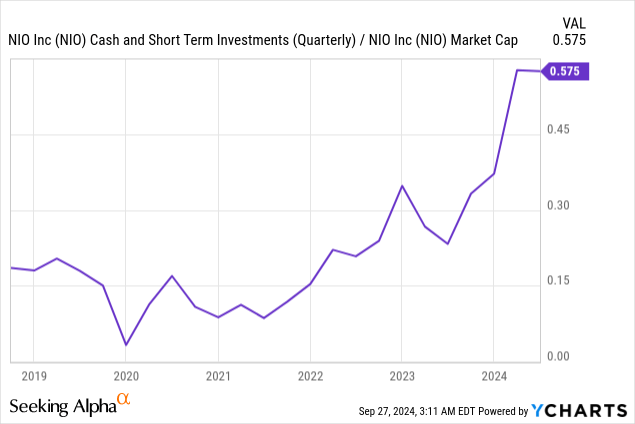

- Valuation analysis suggests the stock may have an upside indeed, with NIO having a cash-to-market-cap ratio of 57.5% to date.

- Although the long term outlook remains highly uncertain, I continue to look at NIO today as pure speculation for bulls.

primeimages

My Coverage History & Thesis Update

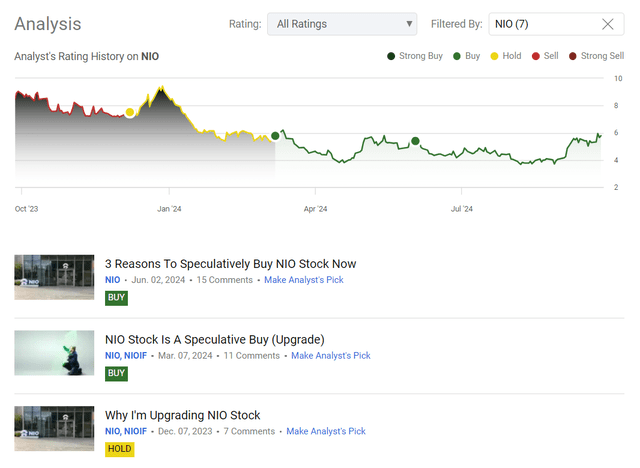

I’ve been covering NIO Inc. (NYSE:NIO) stock for quite a long time here on Seeking Alpha. Since November 2022, I’ve been bearish, but then I changed my stance to “Neutral” at the beginning of December 2023 and then finally issued a “Buy” rating, noting that NIO was looking interesting as a speculative “Buy” (that call was made in early March 2024). In early June 2024, I reiterated my “Buy” rating, still seeing a few reasons to stay bullish on NIO in the short-to-medium term.

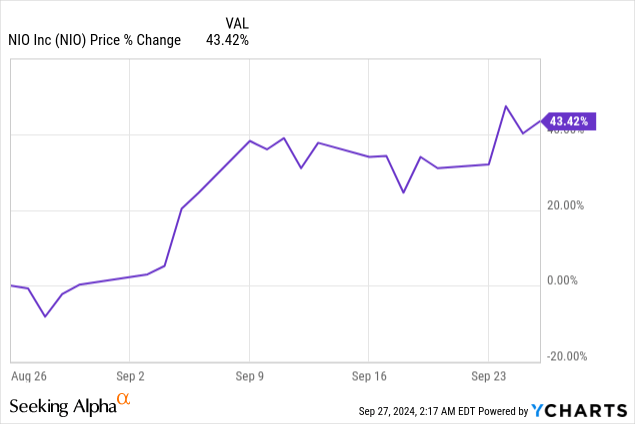

I think my bullish thesis hasn’t played out yet, but I see it started to go in the right direction recently:

Seeking Alpha, my coverage of NIO stock

To date, I still believe I was close to marking the local bottom in NIO’s price. I think NIO still has significant growth potential in the medium term, especially as interest from retail and international investors returns to China.

Why Do I Think So?

Let me first tell you a bit about the macro setup in China the way I see it.

China has rolled out a sizeable monetary policy easing package a few days ago. The measures include a cut of 50 b.p. on the reserve requirement ratio (RRR) and a 20 b.p. cut on the 7-day reverse REPO rate, thereby releasing bank liquidity for credit creation and asset purchase. Moreover, preexisting mortgage interest rates have been cut to improve consumer confidence. It would have been a hit to the banking sector, but the negative effect on margins should be theoretically offset by lower rates on deposits. Net-net, it’s going to stimulate the economy, in my view.

At the same time, new special credit lines from the People’s Bank of China (aka PBoC) are now available for funds, investment banks, and insurance companies at low interest rates for share buybacks (~1.75% annually) and for major shareholders to increase their stakes (~2.25%). The CCP tried to encourage a stock market rally, hoping to lift sentiment and trigger a consumer confidence revival that would turn into real money.

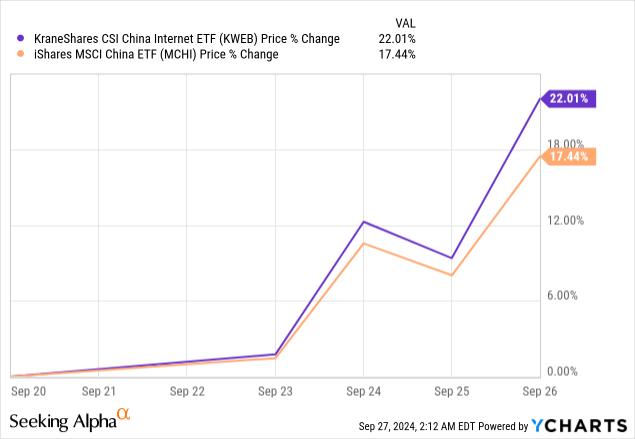

The regulatory changes in August not only made it easier for the PBoC to trade bonds to raise the yield curve and support the banks, but they also removed interest-rate caps on inter-bank lending. So the response of the markets to this announcement last 7 calendar days has been encouraging: the MSCI China ETF (MCHI) is up 17.44%, while the tech sector – China Internet ETF (KWEB) – is up over 22%. The price action looks crazy hot right now:

In periods like now, we usually see the most bullish reaction from the assets of “the longest duration” so to speak – in terms of equities, it’s usually unprofitable growth stocks, which have been falling for many quarters. NIO is the perfect fit, and it follows the theoretical rules:

But NIO isn’t just an unprofitable growth stock.

Their recent introduction of the SkyOS operating system and the Banyan 3 smart system, along with the development of the Shenji NX9031 chip for smart driving, makes NIO one of the most innovative car brands today, in my view. The launch of the ONVO brand’s 1st model – the L60 – is expected to further boost sales, with a target of reaching a supply capacity of ~10,000 units by the end of the year. This model is priced competitively at only RMB290,900, which is about RMB30,000 cheaper than the Tesla (TSLA) Model Y for comparison, positioning NIO quite well in the Chinese market.

NIO’s business itself is already growing quite well. The vehicle margin rose to 12.2%, against a 6.2% margin compared with the same quarter last year, because material costs dropped further. The gross margin also rose to 9.7%, which is still low, but against 1% a year ago it looks like a great achievement to me. Even with all those gains, NIO reported a net loss of RMB5 billion, down 16.7% from last year, showing that it’s still early to talk seriously about profitability. Anyway, the cash balance continues to be strong – NIO reported cash and cash equivalents of RMB41.6 billion as of June 30, 2024, which should make it easy to take advantage of future opportunities to invest and grow the business.

I like NIO’s efforts to extend its charging and swapping network, which seems to be strategically in time. According to a recent press release, NIO has established more than 2,561 power swap stations and more than 23,000 chargers worldwide, helping to meet users’ strong demand. The Power Up Partner Plan aims to provide access to NIO’s charging network in every county in mainland China by mid-2025, which will likely further facilitate sales growth and market penetration.

The management is looking to reach an end-of-year vehicle margin of about 15% and a 3rd factory with a capacity of ~100,000 units (scheduled to come online in Q3 next year). The goal is to increase monthly delivery volumes to 30,000-40,000 units for the NIO brand and a long-term vehicle margin of 25%. The goal for the ONVO brand in particular is a 15% vehicle margin with a competitive pricing position and cutting-edge technology.

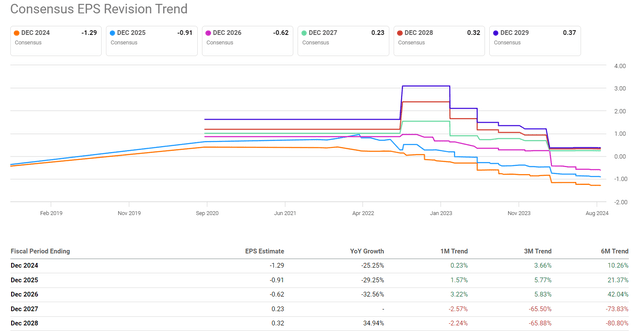

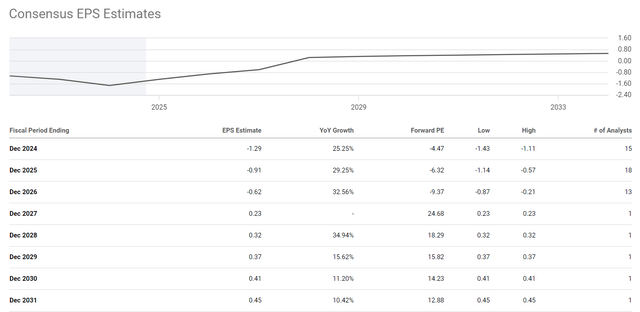

Based on all that, perhaps we’ll see a continuation of the earnings revisions to the upside, which so far touched only the next 3 years:

As I noted above, it’s too early to hope for a bottom-line break even any time soon, but anyway, the market is expecting to see the first positive adjusted EPS in FY2027, so the consensus is already quite pessimistic, leaving little room for much downside from here.

Honestly, I don’t know if NIO indeed is poised for sustained growth in the long term through its heavy investments in tech, infrastructure, and market expansion. However, I believe the short-to-medium-term momentum is likely to continue as the market participants continue to reprice the Chinese equities.

Much of the risks that were priced in before came from the China macro concerns and potentially weakening consumers. I wrote about it in my previously bearish articles on NIO (and not only). But those macro headwinds are getting much softer now with the new policy updates. At the same time, I like NIO’s new initiatives with the ONVO brand that keep the management confident in the company’s ability to meet competitive pressures. We’ll see, but it looks like the company has a clear roadmap to guide its growth and development in the medium term.

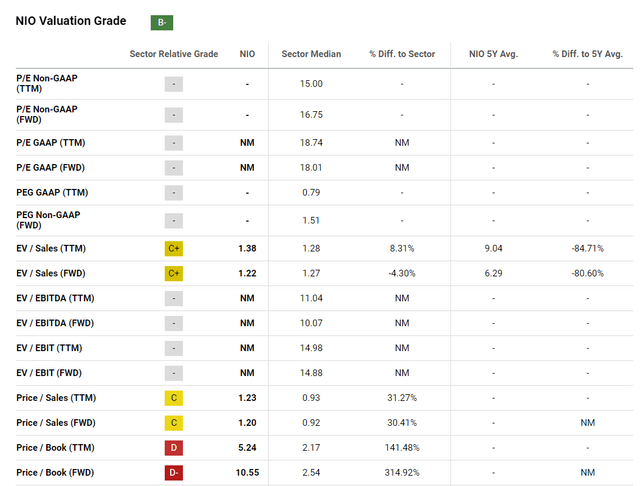

I know it’s hard to call NIO undervalued – it has no P/E or EV/EBITDA ratios for our assessment, even on the forwarding basis (again, the firm is projected to break even in FY2027). But on the sales-related ratios, NIO is trading at about the median of the Consumer Discretionary sector:

Seeking Alpha, NIO’s Valuation

NIO’s P/S ratios fell down over 80% since their 5-year peaks, so probably amid better sentiment they can go up from here. Anyway, on the cash-to-market-cap ratio, NIO still looks quite cheap to me – 57.5% of its market cap is backed by cash so to speak:

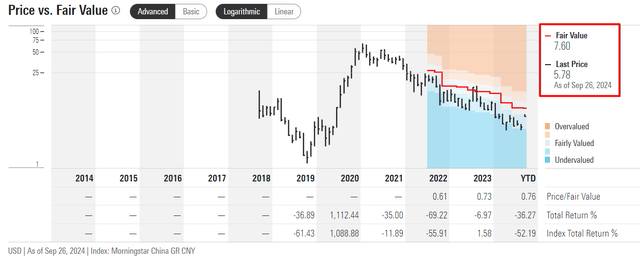

I’m not sure what is driving Morningstar Premium’s fair value models (proprietary source), but in NIO’s case we see an undervaluation of over 31%:

Morningstar Premium (proprietary source), notes added

Based on all of the above, I decided to maintain my speculative “Buy” rating for NIO for another quarter at least.

Where Can I Be Wrong?

In fact, there are a whole series of risk factors for my thesis – let me touch on the most obvious ones, which I generally covered last time.

First, I assume that the improving macro environment in China should lure Western investors (and not only Western ones) back to Chinese assets. But this could be a fallacy as it is by no means certain that a) the crisis is over and China will return to a period of stable GDP growth and b) NIO will be a good pick given its financials and deep unprofitability.

The second risk lies in my reasoning about improving the fundamentals. Again, NIO remains a deeply unprofitable company that constantly needs new capital injections. There’s a risk that the company will quickly “wipe out” any beginnings of recovery growth in its stock quotes by announcing a new share capital issuance – this is a risk I can’t rule out and simply ignore.

The third risk is that the lack of positive EBITDA does not allow us to value NIO as the financial theory recommends. This is a characteristic of a growth stock, but in any case, investors will have to wait another 3 fiscal years before they see the first positive P/E ratios.

The Bottom Line

Given the risks I listed above, I continue to look at NIO today as pure speculation for bulls. Of course, the fundamentals are moving in the right direction, and so is valuation (rising cash to market cap is a good metric). But long term, the outlook remains highly uncertain. However, considering my assumption of a better macro setup in China and also the recent updates from the firm, I decided to hold my medium-term speculative “Buy” rating.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!