Summary:

- NIO Inc. reported solid Q2 earnings with nearly doubled sales, outperforming peers like Tesla, despite missing revenue estimates slightly.

- NIO’s vehicle margins improved to 12.2% in Q2, indicating a positive margin trajectory.

- NIO’s Q3 delivery guidance of 62,000 vehicles suggests continued growth, but profitability remains uncertain, making it a riskier investment compared to BYD.

- Chinese EV players like NIO and BYD are gaining market share globally, posing a significant threat to Western legacy automobile manufacturers.

Andy Feng

Article Thesis

NIO Inc. (NYSE:NIO) reported solid quarterly earnings results, which sent NIO’s shares soaring on Thursday. We will take a look at NIO’s compelling growth in sales volumes and its margin trajectory. NIO’s results have implications for other companies as well, such as automobile manufacturers from Europe and the US that face increasing competition from Chinese EV players.

What Happened?

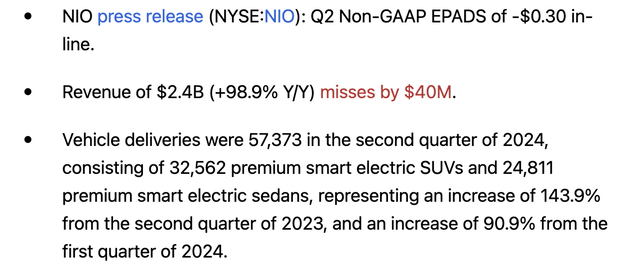

NIO Inc. reported its quarterly earnings results for its fiscal Q2 on Thursday morning. The headline numbers looked like this:

NIO’s Q2 results (Seeking Alpha)

The company missed revenue estimates slightly, but delivered excellent year-over-year growth nevertheless. Sales almost doubled, which is not only a great growth rate in general, but also compares very favorably to the growth rates that many of NIO’s peers have delivered for the second quarter. Tesla (TSLA), the highest-valued EV company in the world, delivered a revenue increase of just 2% during the most recent quarter, meaning NIO grew at almost 50x the pace of Tesla.

NIO is not yet profitable, but the net loss was in line with what was expected by the analyst community. Losses were, at least partially, driven by high advertising and sales spending, but these increased sales efforts explain why NIO was able to grow its business so much.

NIO: Improving Performance

NIO is a Chinese EV company that is mainly active in the premium segment of the overall EV market. This market segment is not overly large, but should, at least theoretically, allow for compelling margins.

The EV market around the world keeps growing, although at a somewhat lower pace in the recent past, due to factors such as weak demand for EVs in parts of Europe. In China, however, the world’s most important EV market, as well as NIO’s home market, demand remains healthy, with plug-in market share standing at almost 50% this summer.

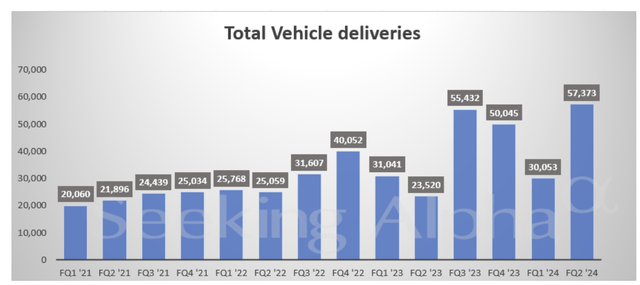

NIO did not participate in the growth of the global EV market during every quarter in the past. Instead, there were ups and downs in its delivery numbers. This was partially due to sourcing problems and supply chain issues, but a model line-up that was not well aligned with what consumers wanted also played a role in the weak vehicle delivery numbers seen in some quarters in the past:

NIO deliveries (Seeking Alpha)

The first half of 2023 was rather weak, for example, but things improved substantially in last year’s second half. Q1 of this year was somewhat weaker again, partially due to factors such as the Chinese New Year. Q2 was excellent delivery-wise, with deliveries hitting a new record high, driven by strong growth in sedan volumes, which hit 25,000 (a new record high). Meanwhile, SUV sales hit 33,000, which was a strong number as well, although not a record high — SUV sales had been even higher in last year’s Q3 and Q4.

It looks like NIO has managed to overcome any lingering supply chain issues, and consumers seem to like NIO’s current product line-up. Otherwise, the company wouldn’t be gaining any market share. Since NIO’s deliveries more than doubled over the last year, while global EV sales did not double, NIO is gaining market share at a nice pace right now.

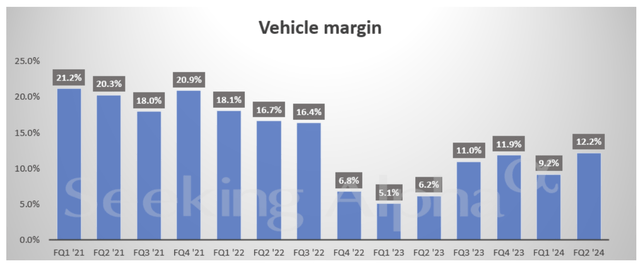

Even better, NIO was able to grow its deliveries nicely during the second quarter while also growing its vehicle margin. That number stood at 12.2% during Q2, which was the highest level seen since the end of 2022. Margins were higher in early 2022 and in 2021, when the global EV market was substantially undersupplied and when manufacturers were able to demand high prices. But since production volumes expanded through 2022 and beyond, markets are not undersupplied any longer. Tesla and others lowered their vehicle prices substantially over the last two years or so, which has made the margins of many EV companies decline. Tesla, NIO, and many others saw their vehicle margins come under pressure. NIO’s vehicle margins are still below the peak levels seen in 2021 and 2022, but it is great news that margins are improving once again, as we can see in the following chart:

NIO’s vehicle margin (Seeking Alpha)

Looking at the margins, things are moving in the right direction at NIO right now. NIO should be able to grow its volumes further during the second half of the year, which should result in some scale advantages. I would thus not be surprised to see NIO generate further vehicle margin improvement during the current quarter and Q4.

Speaking of the current quarter, NIO Inc. guides for vehicle deliveries of around 62,000, which implies an improvement in the 10% range compared to the second quarter. While NIO’s sequential growth rate was better during the second quarter (as Q1 was rather weak), I believe that a 10% sequential growth rate is still pretty solid. If NIO was able to keep that growth rate through the end of the year, Q4 deliveries would be close to 70,000, or around 280,000 annualized. Considering NIO is a rather young EV company focused on the premium market segment, that would be a very solid result, I believe.

NIO And Other Chinese EV Players Versus Western Legacy Automobile Companies

When it comes to gas-powered vehicles, legacy players still control almost the entire market. Japan-based Toyota (TM), Europe-based Volkswagen (OTCPK:VWAGY) and Stellantis (STLA), and US-based automobile giants Ford (F) and General Motors (GM) have a large market share. When we look at the premium segment, where NIO is active, Mercedes (OTCPK:MBGAF) and BMW (OTCPK:BMWYY) are important players as well.

But many analysts believe that the gas-powered vehicle market will decline over time, as consumers increasingly switch to EVs. This does not hold true in all markets, but at least in China, Europe, and the US, EVs will likely continue to gain market share over the coming decade. This is partially due to consumer taste changes and partially due to political pressures, such as subsidies for EVs, or even gas-powered vehicle bans.

While legacy automobile companies don’t have to worry about NIO and other Chinese EV players when it comes to their ICE businesses, NIO and the other Chinese EV players are formidable competitors in the EV field.

On the day of NIO’s earnings release, when NIO’s shares traded up by double-digits, Ford and GM were down 2% and 1%, respectively. Ford is also down substantially on a year-to-date basis, while GM has done well so far in 2024 when it comes to delivering share-price gains, partially fueled by GM’s massive buybacks.

Stellantis, Volkswagen, GM, Ford, and so on have broad model line-ups, but the majority of their sales are not generated in the premium segment NIO is active in. NIO is thus not a core competitor, even though NIO likely nibbles at their market share in the higher-priced categories. Still, at least volume-wise, mass-market EV player BYD (OTCPK:BYDDY) is a more important competitor for these Western mass-market manufacturers — and BYD thus also is a bigger threat, I believe.

And it looks like some of these legacy players do indeed have problems: Volkswagen is battling with weak profitability for its core brand and is considering plant closures and layoffs to improve efficiency and to reduce costs. Ford has also announced layoffs in Europe this summer — it is very much possible that increased exports of Chinese EVs to Europe play a role. While recently announced tariffs on Chinese EVs in Europe may help Western automobile companies to some degree, it nevertheless looks like Chinese automobile companies are gaining share around the globe, which goes hand in hand with market share losses for non-Chinese companies. China has access to raw materials, and has comparatively low labor costs, while energy costs are also lower compared to many other countries. On top of that, Chinese automobile companies have solid tech in the EV space. All in all, this makes for a pretty strong combination. It would not be surprising to see Chinese automobile companies grow further in the coming years, including NIO and BYD, but also Li Auto (LI) and XPeng (XPEV).

Is NIO A Buy?

NIO’s deliveries during Q2 looked good, and the delivery guidance for Q3 is compelling as well. Recent margin improvements are another positive factor. That being said, NIO is still losing money, and we don’t know when the company will hit profitability. This makes NIO a riskier investment compared to profitable EV companies such as BYD, I believe. While NIO could be worthy of a closer look for an enterprising investor who likes its premium line-up, I believe that BYD is a better choice here, making me give NIO a neutral rating for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!