Summary:

- NIO’s outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

- Management has committed to reaching breakeven profitability by 2026. However, its execution in its new growth segments is pivotal.

- NIO reportedly has a 48% market share in its core premium segment. Yet, it has not been sufficient to reach sustainable profitability.

- While it has demonstrated more robust vehicle margins recently, it remains to be seen whether it could be sustained.

- I argue why investors shouldn’t linger on and assess a buying opportunity on this highly speculative stock.

Getty Images

NIO: Outperformance Fizzled Out – What’s Next?

NIO Inc. (NYSE:NIO) investors have struggled to replicate its previous outperformance as the stock topped out in early October. I had already cautioned investors not to be enamored with NIO’s previous rally. I highlighted the challenges with more intense competition in lower-priced segments that the company intends to enter. Hence, I’m not surprised that its surge has fizzled out, as reality returns to NIO, even as the EV maker reported its recent earnings release.

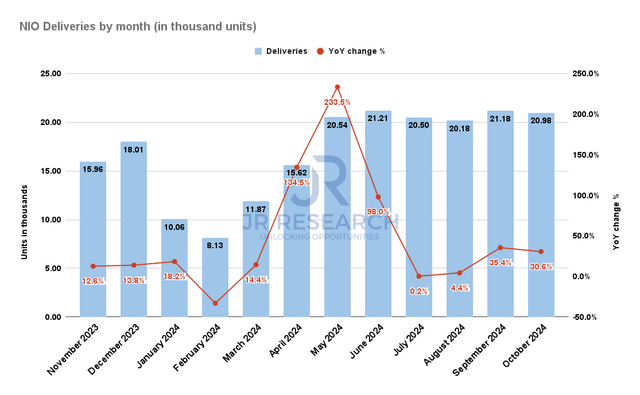

Nio delivery by month (Nio filings)

In NIO’s Q3 earnings release, the EV maker surpassed Wall Street’s revenue estimates, bolstering its ability to execute more impressively. Accordingly, NIO’s deliveries have continued to grow more than 30% YoY over the past two months, underscoring its improved production execution. However, the company’s optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO’s revised guidance for Q4 revenue is below Wall Street’s consensus, heightening potential pricing headwinds that are expected to carry forward to Q4.

Accordingly, NIO has made changes to its promotional strategies, lifting its margin accretion. Despite that, the anticipated changes to its product mix (including lower-priced segments) affected NIO’s ASP profile. As a result, I assess it has resulted in more uncertain revenue dynamics for NIO, even as it attempts to ramp up its production scale through 2025 in its bid to elevate its growth prospects.

Management underscored its commitment to its core premium business segment. Notwithstanding NIO’s optimism and conviction, the lack of profitability, despite reportedly owning a market share of 48% in the premium segment (BEVs priced above RMB300K), is somewhat disappointing. Hence, I assess that NIO has likely faced challenges in scaling up its opportunities in its core market segment, behooving a segue to target lower-priced models.

NIO’s Ability To Reach Breakeven Will be Scrutinized

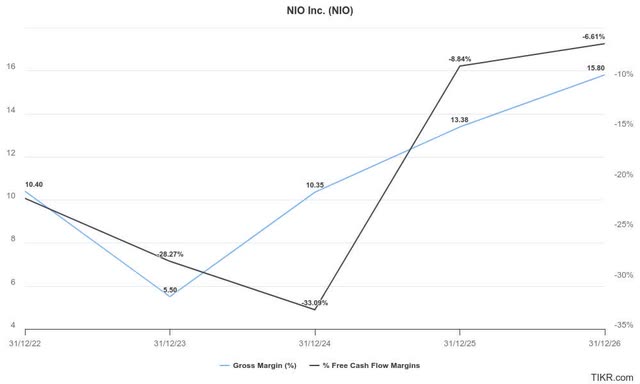

I must still afford credit to management’s execution in Q3, as it indicated it reached free cash flow profitability. Moreover, it also communicated an improvement in vehicle margin outlook for Q4 for its core premium segment, reaching 15%. Hence, it’s expected to continue lifting NIO’s profitability trajectory through FY2026. Despite that, analysts don’t expect NIO to reach free cash flow profitability on a full-year basis through the FY2026 forecast period.

Management telegraphed its commitment to reaching breakeven profitability by the end of 2026. However, it’s also predicated on NIO’s capabilities to continue to lift its production scale, which is pivotal to improving its operating leverage. Given the scaling challenges the company faced in its core business over the past year, investors will likely scrutinize its ability to ramp production and deliveries in its lower-priced segments. However, given the execution risks as NIO navigates entering more competitively priced businesses, revenue expectations must be calibrated for potentially higher volatility to account for unanticipated disappointment.

NIO’s forward outlook suggests deliveries of between 72K and 75K. Based on the 20.98K vehicles it delivered in October, the company needs to post average monthly deliveries of 25.5K to 27K in November and December 2024. Hence, it’s expected to be another record quarter for NIO as it seeks to reach its 20% long-term targeted vehicle margin for its core business segment.

NIO: Valuation Re-rating Depends On Its Execution

NIO Quant Grades (Seeking Alpha)

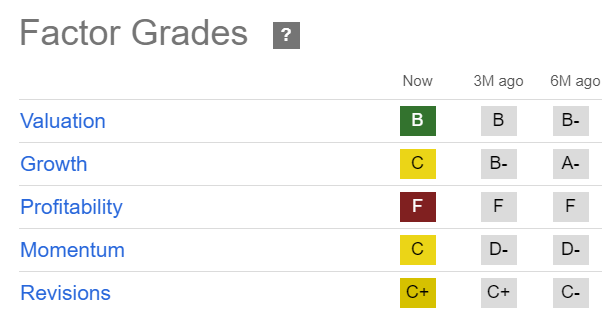

Despite that, Wall Street’s revisions to NIO’s estimates are mixed, highlighting the uncertainties surrounding the changes in its product mix as it continues its production ramp. Buying sentiments on NIO are neutral at best (“C” momentum grade), although it seems to mark an improvement over the past six months.

While NIO’s “B” valuation grade seems to bolster its relatively undervalued thesis, investors are urged not to throw caution to the wind. As compared to its consumer discretionary sector peers (XLY), NIO’s unprofitability is expected to be a significant headwind against its valuation re-rating. Moreover, the execution risks inherent in its product mix adjustments and more aggressive forward outlook could intensify the need to post more robust performances in Q4. Hence, the market is expected to remain uncertain about NIO’s ramp profile over the next two quarters.

Is NIO Stock A Buy, Sell, Or Hold?

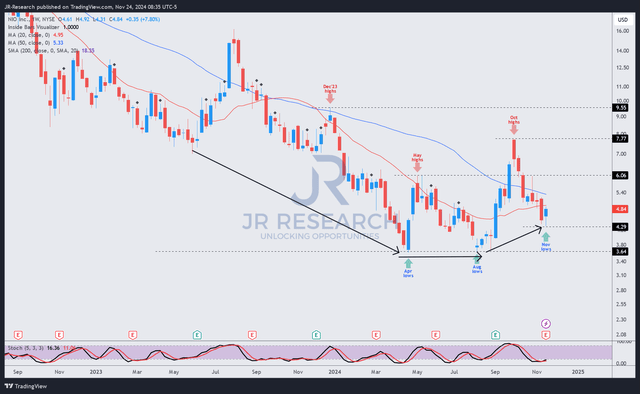

NIO price chart (weekly, medium-term) (TradingView)

Notwithstanding my caution, NIO’s price action suggests the recent selling intensity has likely been tempered as dip buyers attempt to find an opportunity to return.

As seen above, NIO has managed to climb out of its previous August 2024 lows as buying momentum improved. Hence, a possible mean-reversion opportunity could be in the works as the stock attempts to recover from deeply oversold levels.

Despite that, NIO’s structural downtrend thesis hasn’t been decisively reversed, behooving caution. While NIO has communicated an improved outlook through 2025, it’s highly dependent on its ability to ramp production and meet its delivery targets immaculately. Although the market has likely reflected caution in its valuation and price action, I assess it prudent to stay on the sidelines, allowing more time for NIO to validate the changes in its product cycles and go-to-market strategies.

Rating: Maintain Hold.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!