Summary:

- Reuters announced NIO’s plans to launch a hybrid under the Firefly brand in 2026, targeting the overseas market (Europe and the Middle East).

- With hybrids now making up over 30% of car sales in Europe and exemption from tariffs, NIO’s timing for this launch looks quite promising.

- A $2.2 billion investment from CYVN Holdings and a $3 billion investment from the Abu Dhabi government could support NIO’s Firefly brand expansion.

- Persistent cash burn, and negative cash flow mean NIO needs to improve finances in the coming years. Otherwise, large investors could lose interest in the company.

- Despite a 90% share price decline since 2021, the hybrid launch could be a turning point. Therefore, I maintain a buy rating, with a 2-3 year timeframe in mind.

hapabapa

NIO Inc. (NYSE:NIO) has recently made headlines after an unofficial announcement revealed that the company plans to launch a new hybrid under the Firefly brand in 2026, intended exclusively for international markets.

Considering that the company’s share price has declined by over 90% since early 2021, this announcement seems to be a light at the end of the tunnel.

Supported by a $2.2 billion investment from CYVN Holdings, this strategy aims to open a fresh revenue stream in the European continent, where there is a high appetite for affordable hybrids.

To be clear, my bull thesis has a long timeframe, between 2-3 years. Currently, the company is solely focused on EVs, with fundamentals showing a high cash burn and negative operating income.

However, I am convinced that the hybrid line in Europe could be a turning point for the company. Therefore, I assign a buy rating for this stock.

I will provide the rationale behind my rating below, starting with a quick look at price action.

Price Action

Since its peak in early 2021 at $66, the share price has declined by over 90%, currently trading slightly above $5.

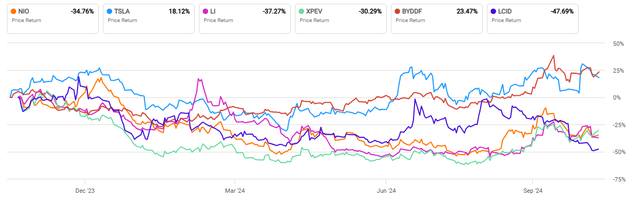

When comparing the returns of the stock to some of its industry peers over the last 12 months, one can see a clear division.

Tesla (TSLA) and BYD (OTCPK:BYDDF) are leading in terms of returns, while the remaining EV manufacturers are falling behind.

Below, I discuss in detail why I believe NIO will be able to turn around.

Multi-Brand Strategy And a Potential New Overseas Hybrid Line

The multi-brand strategy of the company involves operating three brands, each targeting a specific market segment and consumer preferences. These are:

- NIO: This brand targets the premium EV market segment.

- ONVO: This brand serves the mass market segment with family-oriented EVs

- Firefly: The company plans to launch this new brand at its annual event, scheduled for December 21, 2024. Firefly’s initial market entry (serving the mass market) is set for China by the end of 2024, with a rollout in Europe in the first half of 2025.

At the moment, the company is a pure-play EV manufacturer.

However, several sources (here, here, and here) are talking about the introduction of its first hybrid model under the Firefly brand, targeting overseas markets exclusively.

Notice my emphasis on the word exclusively!

This strategic decision is one of the key pillars of my bull thesis. As a matter of fact, it may be the main one, considering the dire fundamentals of the company (a topic I will discuss below).

It seems that one of the NIO’s main investors, CYVN Holdings, has put some pressure on the company to improve its sales in markets like the Middle East, where EV infrastructure is not yet fully developed.

Additionally, the European Union has imposed new tariffs exceeding 20% on NIO’s EVs for the next five years, on top of an existing 10% import duty.

However, hybrids remain exempt from these tariffs.

At the end of 2023, CYVN Holdings poured $2.2 billion into the company to facilitate the expansion with the Firefly brand.

The hybrid vehicle, developed under the Firefly brand, is expected to launch in late 2026, with deliveries commencing in 2027.

Therefore, I want to emphasize here that my bull thesis is for a longer timeframe, around 2-3 years. Don’t expect shares to explode in December, though.

Hybrids Are Kings In Europe

The main reason I am encouraged by the hybrid launch in Europe is because Europeans have a strong appetite for this type of vehicle.

To put things in perspective, in August 2024, sales of fully electric vehicles in the European Union dropped by 43.9%, marking the fourth consecutive month of decline.

In contrast, hybrid car sales rose by 6.6%, achieving a market share of 31.3%.

It seems that the increase in Hybrid sales is attributed to their affordability. Of course, infrastructure challenges play a role as well, however, as a European, I don’t think infrastructure is the main contributing factor.

Therefore, I support their strategic decision to cater the hybrid Firefly model to a mass market in this region, competing with models like the Toyota Yaris, the Ford Kuga, or the Renault Clio E-Tech.

In contrast, the company projects EV market penetration in China to reach over 80% within the next 2-3 years. Therefore, it makes sense why they don’t plan to roll out the hybrid in their home country.

I recommend keeping an open eye for more details on their future hybrid plans at the company’s annual event in December.

Other Growth Drivers

Focusing now on their EVs, the company has an attractive BaaS (Battery-as-a-Service) plan. Essentially, NIO’s battery leasing subscription plan is designed to lower the upfront costs of their EVs.

BaaS decouples the battery from vehicle ownership, allowing customers to purchase a NIO car without owning the battery outright.

Instead, they subscribe to a battery plan that suits their driving needs, allowing them to swap, upgrade, or replace batteries at NIO’s charging and swapping stations.

As a matter of fact, I believe this program might be too good for consumers (and not so much for the company).

If I can swap batteries after a certain time, then I don’t really care about taking care of the batteries. Therefore I wouldn’t sweat if I discharged the batteries below minimums, or left them uncharged for a long period of time.

Moving on to other growth drivers, the company expects production to ramp up to 20,000 units per month by 2025 for the ONVO models. Their plan is to open a new third factory to increase capacity for Q3 2025.

Additionally, the company has been aggressively building power swap stations, with 2,561 stations globally and 52 million total swaps completed to date.

Their goal is to have swap stations in every county in China by the end of 2025.

To this date, they’re getting pretty close to making a profit from these swap stations. The company is averaging 30-40 swaps/day, with a minimum profitability threshold of 60 swaps/day.

Finally, management is targeting an improvement in vehicle margins of 15% by the end of the year, and 25% in the long run. As a side note, the vehicle margin in Q1 this year was only 9.2%. In Q2, it improved to 12.2%.

Valuation

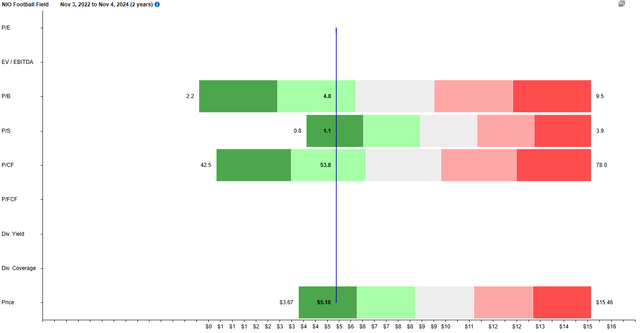

A quick look at the valuation ratios of the company shows most of them trading close to historical lows.

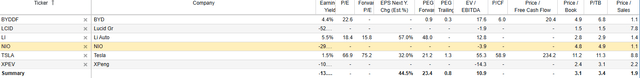

If we compare these ratios to some of the company’s competitors, NIO doesn’t seem to be overvalued.

The table above was sorted in descending order by P/B. If we use P/S, NIO is the cheapest company (along with BYDDF).

Risks

In my view, NIO is one of those stocks where the narrative plays a more fundamental role in their future growth than the current financial results.

If we look at the fundamentals today, and we consider a shorter timeframe, the outlook doesn’t look particularly positive.

Both operating and net income are negative, and the number of outstanding shares has gone up in the past year. For example, SG&A expenses jumped by over 31% in Q2 2024 due to marketing and sales efforts.

Did they translate into more sales? Yes. However, with operating income (TTM) sitting at negative $3 billion, I wouldn’t pop a bottle of champagne just yet.

The cash flow statement shows a negative free cash flow of $2.14 billion for FY 2023, leading to a negative FCF/share of $1.3.

The balance statement shows cash and equivalents sitting at $3.39 billion at the end of the last quarter.

Considering that the company burned $2.14 billion last year (negative FCF), it needs to become profitable in the next few years. Otherwise, investors could lose their conviction in the company.

Aside from these risks, there is no doubt they will face competitive pressure in the hybrid market in Europe. Additionally, if they outperform the current hybrid manufacturers in this region, I wouldn’t be surprised to see new tariffs imposed on Chinese hybrid manufacturers.

Conclusion

Putting all these factors together, I rate NIO as a buy.

I will be direct.

The main driver behind my buy rating is the recent (although unofficial) announcement that the company plans to enter the European hybrid market in 2026.

NIO’s new Firefly brand will certainly open new revenue streams in Europe, where hybrids are in high demand and less affected by the EU’s EV tariffs. Could there be new regulations if Firefly gains a significant market share in Europe? Maybe. But until then, there is a long path ahead.

In my view, if NIO can create a mass-market hybrid that’s affordable and offers features similar to the Toyota Yaris or Ford Puma, it could be a game-changer for the company in the next 2-3 years.

Until then, negative net income, negative cash flows, and heavy spending are serious risks to consider. When looking at the income statement, the current pessimism that surrounds this stock is justified. Therefore, until 2026 (at least), I don’t expect any short-term miracles in profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.