Summary:

- Starbucks is facing challenges due to cautious customer spending, leading to a drop in foot traffic and same-store sales.

- Howard Schultz criticizes current management for operational hiccups and decline in customer experience focus, urging a return to the “founder’s mentality”.

- Despite short-term setbacks, Starbucks remains a true “EVA Monster” with a wide economic moat and attractive total return potential.

garett_mosher

What’s going on with the company?

It has become apparent that, like many of its peers in the premium/luxury goods sector, Starbucks could not remain immune to the bleak overall macro picture. Cautious customer spending has spread from high-end purchases like $100,000 Porsches and $10,000 leather bags to small-ticket items such as $10 customized beverages, leading to a staggering drop in foot traffic and same-store sales for Starbucks both globally and on its home turf. It is clear that the market has become price sensitive even in the most developed region of the world, and we remain cautious about the extent to which management can rely on price increases in the coming years. As you will see, despite its expanding global footprint, Starbucks’ U.S. operations are still crucial for incremental value generation, so turning the ship around in its most mature region requires immense management attention.

It would be too easy to solely blame pressured consumer budgets, though. Arguably, early warning signs suggest that some of the current weakness might be (partially) self-induced. Crucially, we find the recent criticism from Starbucks’ founder noteworthy, highlighting operational hiccups and a decline in management’s focus on customer experience:

Senior leaders—including board members—need to spend more time with those who wear the green apron. One of their first actions should be to reinvent the mobile ordering and payment platform—which Starbucks pioneered—to once again make it the uplifting experience it was designed to be. – Howard Schultz, founder and ex-CEO

Even though we believe that such a public feud is not in the best interest of the shareholders, he clearly has a point that the current CEO (handpicked by Howard Schultz himself) needs to reengage the “founder’s mentality.” This framework was popularized by Bain & Company consultants, considered among the most prominent researchers of founder-led companies. According to them, one of the clear defining traits of these firms is the so-called “frontline obsession,” encompassing a relentless focus on consumer experience, management attention to service details, and a strong emphasis on customer-facing employees. This aligns with Howard Schultz’s criticism, giving merit to his message, which the firm’s management team should take to heart.

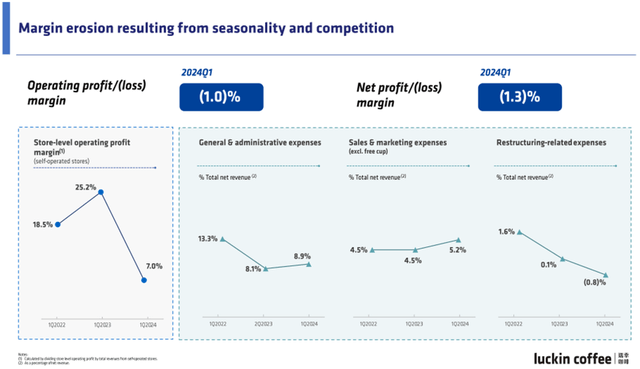

China also deserves attention, as it has been a clear drag on international results with a double-digit decline in comparable store sales in the most recent quarter, performing materially worse than other regions. Starbucks faces intense local competition in the lower price tiers in the country, and consumer downtrading in the current environment has become evident. Take a look at one of its fiercest competitors, Luckin Coffee’s most recent results: the firm’s store-level operating margin has dropped from a ~20% territory to below 10% in the past few quarters, a telltale sign that all participants suffer if a price war emerges.

Despite earlier proclamations from Starbucks’ management regarding their reluctance to engage in promotions and discounting in the Chinese market, news outlets and social media posts indicate that the company has made it “relatively easy” for consumers to buy many of its products at massive discounts. If this indeed turns out to be the strategy, we have some reservations. It would call into question the integrity of the current management team (since they stood firm by not pursuing short-term market share gains at the expense of long-term growth), and we also believe that discounting goes against Starbucks’ declared premium positioning.

It is important, however, to distinguish between short-term operational weakness and the erosion of a company’s long-term value-creating potential. Starbucks continues to rest on solid fundamentals, making it a firm member of our shortlisted group of exceptional quality-growth businesses, or EVA Monsters as we like to refer to them. For reference, Economic Value Added (EVA) measures the company’s economic profit after deducting all costs, including the cost of giving the stock’s investors a full, fair, and competitive return on their investment. Let’s delve into the key characteristics of Starbucks that support our EVA Monster classification.

How does the company make money?

Starbucks operates as a roaster, marketer, and retailer of specialty coffee, with almost 40,000 stores across 80+ countries worldwide. Its restaurants offer coffee and tea beverages, roasted whole bean and ground coffees, as well as various food products, such as pastries and breakfast sandwiches. The coffeehouse chain generates the vast majority of its revenues through company-operated stores (82% in fiscal 2023) and licensed stores (13%). While the store count distribution is roughly 50-50% between the two categories, the significant difference in their sales contribution lies in the way revenue is recognized. Under the licensed model, Starbucks receives a margin on branded products and supplies sold to the store operator along with a royalty on retail sales, while licensees are responsible for operating costs and capital investments. The company’s remaining revenues (5%) primarily include royalties received from Nestlé for distributing Starbucks-branded packaged products under the Global Coffee Alliance partnership, established in 2018.

Value creation: What type of moat rating is warranted?

We tend to prefer companies whose businesses are protected by large and enduring economic moats, as buying their stock at the right price generally leads to outperformance, as outlined in our research article. The existence of a durable competitive advantage is essential to sustain outstanding profitability, and this is where qualitative, subjective judgment comes into play.

Starbucks is one of the few operators in the restaurant industry that, in our view, deserves a wide-moat rating, with its brand serving as the major moat source. We especially like the resilient business model (across cycles) and the direct-to-consumer sales channel, which consists of a large number of everyday repeat transactions. Make no mistake: the company’s primary product is not coffee but the “Starbucks Experience,” built upon a superior and personalized barista service, high-end stores, and convenience through a seamless digital ecosystem. The firm’s pricing power is evidenced by its unparalleled new unit economics (~50% and ~70% ROI for stores opened in the U.S. and China, respectively), suggesting 1-2 year payback periods for new store openings. Starbucks also has an extremely loyal consumer base, underscored by its flagship Starbucks Rewards program, comprising ~33 million active members in the U.S.

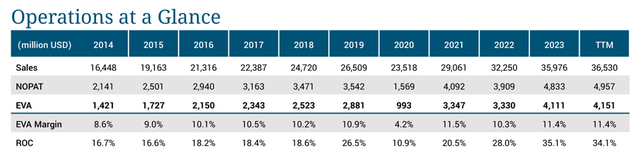

From a quantitative standpoint, EVA Monsters are characterized by consistently high returns on invested capital and EVA Margin levels. In the EVA framework, the EVA Margin (EVA/Sales) will serve as our ratio to define a company’s moat. It is the percentage of sales that ends up as EVA after all operating expenses, taxes, and capital charges have been paid. This indicator consolidates pricing power, operational efficiency, and the quality of asset management into one overall score that effectively measures business model productivity.

Source: The FALCON Method Inc. based on data from Institutional Shareholder Services Inc.

Just by glancing at the above table, it becomes apparent that Starbucks excels on the quantitative front as well. It boasts a 10%+ EVA Margin and strong double-digit return on capital (ROC) figures, firmly above the market’s average. For reference, the typical company in the S&P 500 index is capable of delivering an EVA Margin below 5% and a ROC barely above 10%.

Fundamental return and valuation

The company’s EVA growth trajectory has three major drivers: same-store sales growth, store count growth, and margin expansion, although their emphases differ across geographic regions. The U.S. is Starbucks’ most mature market (74% of revenue in fiscal 2023), where the primary source of future EVA growth is an increase in same-store sales, estimated at 5-7% annually by management. We believe this is overly optimistic (we employ ~4% same-store sales growth in our model). Elsewhere, China could become an important growth driver (~9% of revenue), with a rapidly expanding store count alongside a healthy increase in same-store sales, projected to come in at 10% and 1-3%, respectively. Management aims to significantly increase its global store count to reach ~55,000 by the end of the decade. On a companywide basis, we project a 6-8% annualized medium-term sales growth, coupled with a slight margin expansion due to sales leverage and cost optimization. In aggregate, we believe the annualized EVA growth could slightly outpace Starbucks’ top-line trajectory on a 5-year horizon.

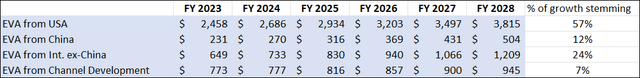

An important caveat is that Starbucks’ U.S. operations continue to remain quintessential in terms of incremental EVA generation in the next few years. Look at the table below, depicting the aggregate future EVA contribution from various regions based on our 5-year bottom-up financial model. The contrast between China and the U.S. becomes apparent, with the dynamically growing region contributing only 12% of incremental EVA according to our estimates, whereas Starbucks’ most mature market could be responsible for more than 50%. Howard Schultz’s remarks on “fixing” the company’s U.S. operations are on point, and downplaying the home market’s importance in shareholder value creation would be a dire mistake.

Source: The FALCON Method Inc.

Switching gears to capital allocation, this firm appears to be a capital-light compounder, as relatively low levels of reinvestment yield very healthy growth rates while leaving plenty of cash to be distributed to the owners. We expect shareholder distributions (dividends and share repurchases) to add ~4 percentage points to the annualized total return formula going forward. Along with the profitable growth component, this results in a fundamental return outlook in the 12-15% range.

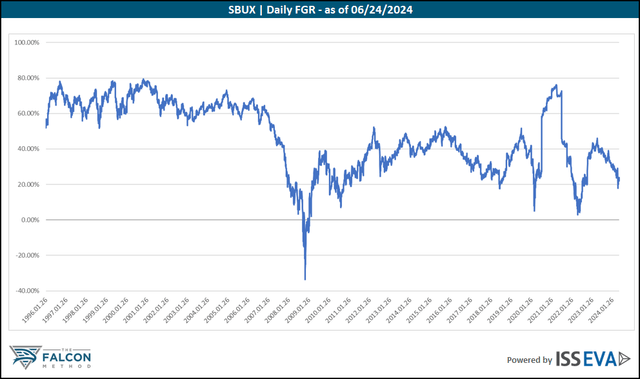

The second step in computing the prospective total return is estimating the impact of valuation. We use the Future Growth Reliance (FGR) metric, which indicates how much incremental EVA growth is expected as a percentage of the stock’s Market Value (MV). A higher number means higher valuation. See our publication for further details.

Take a look at the chart below, which contains daily FGR metrics: Starbucks’ current FGR stands at 22%. For reference, the stock has traded at a more favorable valuation at only 11% of the time since 1996. Based on its quality and growth profile, we believe a ~30% FGR is more than reasonable for Starbucks. From today’s price, we think the sentiment component could provide a tangible tailwind to the already attractive low-double-digit fundamental return potential.

Source: The FALCON Method Inc. based on data from Institutional Shareholder Services Inc.

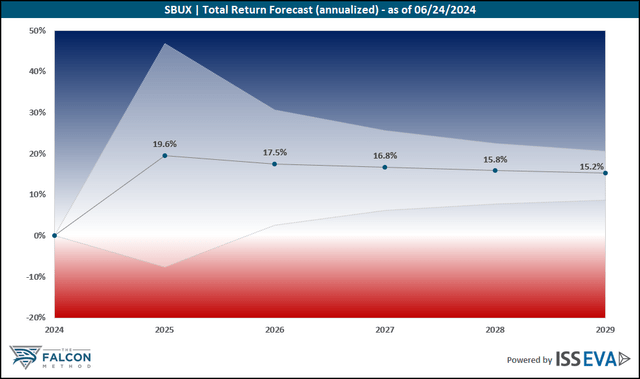

Putting the pieces together, we build a 5-year EVA-based financial model for each company we cover. Our models employ both an enterprising and a conservative fundamental scenario, reflecting our assumptions for sales growth and the underlying profitability. We also consider the impact of shareholder distributions (dividends and share buybacks), which add to the fundamental return outlook alongside the annualized EVA growth component.

Regarding the “exit multiple”, we consider an FGR range that seems feasible based on the historical valuation profile and the underlying business growth characteristics. The annualized total return is highly dependent on the length of time it takes for the FGR to reach the level included in our model; this is one of the main reasons why you may see significant differences between the one and 5-year annualized total return percentages in the charts. The lower end of the shaded band represents our conservative scenario, the upper end shows the result of the enterprising calculation, while we also marked the midpoint values.

Here’s what the annualized total-return outlook looks like for Starbucks from today’s levels, considering the inputs outlined above:

Source: The FALCON Method Inc.

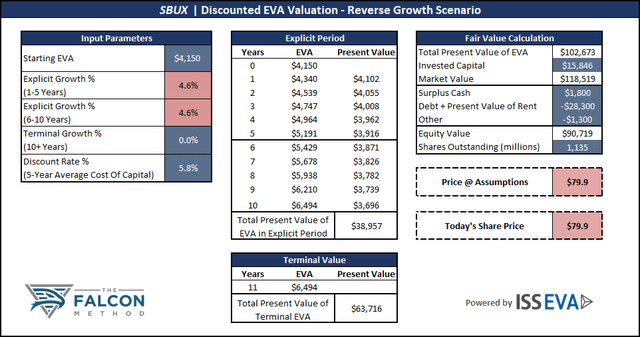

Turning our valuation framework upside-down, we also like to compute the market’s expectations baked into the current share price, expressed as the annualized EVA growth rate that would justify the stock’s current valuation. By taking a glimpse at the reverse growth scenario, it is clear that a ~5% annualized 10-year EVA growth rate implied by the current share price seems overly pessimistic, considering the outlined business characteristics. This also supports our thesis that Starbucks’ shares seem attractively valued at today’s levels.

Source: The FALCON Method Inc.

Final assessment

We view the ongoing operational setback as merely a glitch in the otherwise promising, long-term profitable growth potential of this exceptional company. Blaming external factors alone would be an oversimplification. Management’s steps in reestablishing Starbucks’ famous frontline obsession remain the key aspect to monitor, and keeping the brand’s premium positioning in China also deserves attention.

On the other hand, closer involvement of Howard Schultz, despite his handpicked successor at the helm, would be a major red flag, suggesting that the firm’s culture might not be as robust without his presence. We would mitigate this inherent risk by more cautious position sizing but not pass up on this name entirely.

Overall, we believe Starbucks deserves a position at a price around, but preferably below $80 in a diversified quality-growth portfolio. From these levels, the prospective annualized total return surpasses the 15% threshold over our 5-year explicit modeling period, making shares attractive for contrarian-minded investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.