Summary:

- Global geopolitical tensions are high, but I don’t foresee a full-scale global war.

- Northrop Grumman’s innovation-driven growth, anti-cyclical demand, and expanding international programs position it well for sustained revenue and technological leadership.

- Despite current high valuations, NOC’s strong fundamentals, dividend growth, and buybacks make it a compelling buy on corrections.

- Elevated global tensions and NATO’s need for innovation support resilient demand for NOC, enhancing its stability and long-term growth potential.

Richard Drury

(A Lengthy) Introduction

Global geopolitical risks are high – and still rising.

- The war in Ukraine has been going on for more than two and a half years without any sign of an imminent peace deal.

- China continues to signal that it is ready to achieve “reunification” with Taiwan. That’s a different way of saying it is looking to take over the island.

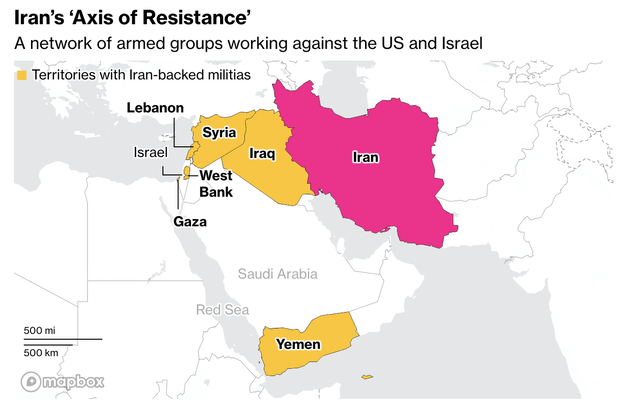

- The situation in the Middle East continues to escalate.

Especially, the latest attack from Iran on Israel caused many people to believe that we are one step closer to World War III. This was the title of The Wall Street Journal on the morning after the attacks.

The Wall Street Journal

While it is very hard to assess a “hot” geopolitical situation because 99% of all decisions are made behind closed doors, we can assume Iran responded to Israel’s successful operations that took out Hezbollah’s leadership in recent weeks, significantly weakening the Iranian proxy in the region.

The response was a barrage of roughly 200 ballistic missiles on Tuesday night, similar to the attack it had launched in April. While I will not downplay the severity of the attack (I would not want to switch places with my Israeli friends), I am not worried about a third-world war.

For starters, Iran remains a toothless tiger. The nation’s second attack was unable to do any serious damage. The loss of life was minimal with only one reported death, which was a Palestinian man hit by debris from a ballistic missile, as almost all missiles were intercepted.

Even worse (for Iran) is that in its April attack, more than half of its missiles failed to reach Israel. Although the nation has ballistic missiles like the Shahab with a range of more than 1,200 miles, it lacks the technology to conduct a strike that could overwhelm Israel’s defense network.

On top of that, Iran did nothing during the weeks when Israel took out its proxies in Lebanon and even informed the United States ahead of the second attack on Israel.

Bloomberg

Moreover, a world-war-like escalation is impossible without the involvement of China and Russia. While China is rapidly investing in its defense capabilities, it continues to show severe technology issues, including burning aircraft carriers and the sinking of its newest nuclear submarine. Although these are just two examples, the nation continues to lack the knowledge to compete with the U.S. on technology.

Russia, meanwhile, is unable to push Ukraine out of its own country (Kursk region), after having lost ground to a “surprise” attack. Although Russia is clearly stronger and making slow progress in Ukraine, it has lost the vast majority of its assets in the war and has shown to be unable to make quick gains against an inferior army at its own border.

The reason I’m bringing all of this up is because the United States has the only army capable of winning an overseas war. This includes a huge supply chain advantage, advanced military technology, and hardware (like Navy ships) that can reach every inch of the globe.

In other words, while I am by no means downplaying how serious the current situation is, I do not see any risk of a widespread world war, regardless of the Israeli response to Iran’s attack. No major superpower is capable of engaging in a serious war.

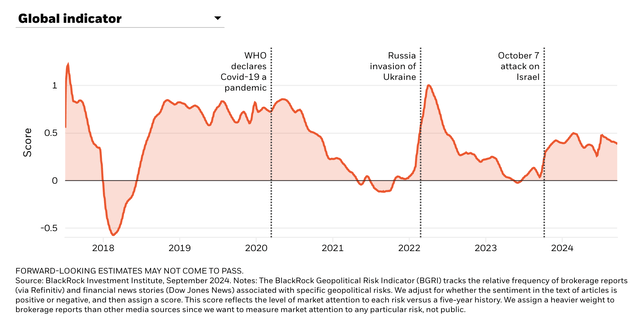

Nonetheless, rising global tensions are a reason to be cautious. This is also visible in BlackRock’s Geopolitical Risk Indicator. This indicator has been consistently elevated since the October 7, 2023 attack on Israel.

BlackRock

This brings me to defense stocks, an industry that accounts for more than a fifth of my portfolio. As one can imagine, this industry is currently the reason why my portfolio is trading at an all-time high, supported by energy royalty stocks that benefit from rising tensions in the oil-rich Middle East.

I sometimes comment (with all due respect to the situation) that I have the perfect war portfolio without ever having made the deliberate decision to benefit from future wars. Note that I also own a lot of energy stocks.

See, as I have discussed in prior articles, I never invested in defense stocks because I expected war. I started aggressively buying these stocks in 2020, before Russia set foot in Ukraine (except for Crimea) and Israel became the target of the October 2023 attacks.

I buy defense stocks for other reasons:

- The need for innovation: Large defense contractors make most of their money on large innovative contracts used to modernize defense capabilities.

- Their anti-cyclical demand: Because these companies make the most money from government contracts, they tend to come with subdued financial risks. The “big guys” also come with pricing power, as the government needs to give them room for margins. Without healthy margins, risks are the entire supply chain gets “squeezed,” which could hurt its stability.

- Most defense companies have terrific dividend growth track records and business models capable of beating the S&P 500 over time.

The other day, a defense specialist told me that big defense corporations are better off without war. While that may sound like an obvious lie, he made the case that if a company were to attempt price gouging, it would be much easier in a period without geopolitical threats.

After all, in a full-blown war, the focus is on producing as many missiles, tanks, and planes as possible. This creates new competition, as a government will do everything in its power to boost volumes. It’s a horrible environment for the margins of established players.

Right now, however, the environment is perfect for defense contractors. Geopolitical tensions are high, but not too high, post-pandemic supply chain issues are largely resolved, and there’s an increasing emphasis on major next-gen defense programs to modernize NATO’s defense capabilities.

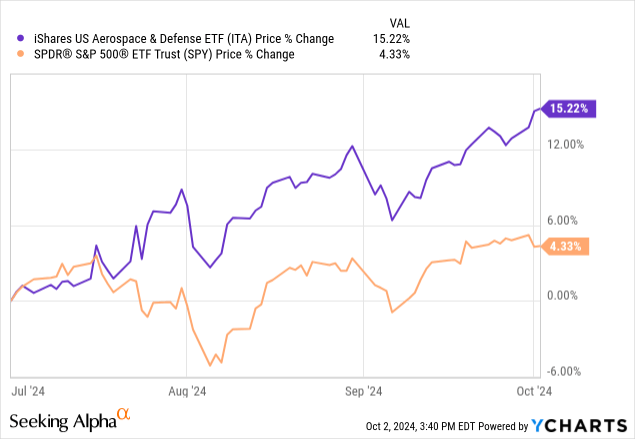

This is perfect for Northrop Grumman (NYSE:NOC), one of my largest defense contractor investments. My most recent article on the stock was written on July 26, titled “Betting Big On Defense: Northrop Grumman Is Back.” Since then, shares are up 13%, beating the S&P 500 by roughly ten points.

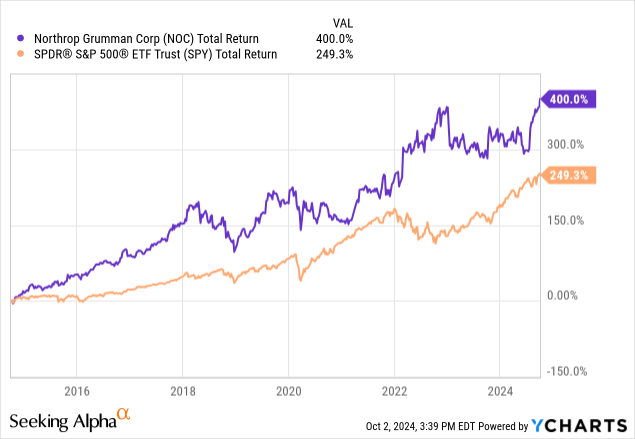

Over the past ten years, NOC has returned 400%, beating the S&P 500 by roughly 150 points.

Hence, based on this very lengthy introduction, I’ll use the second part of this article to explain why Northrop Grumman is in a great spot to benefit from the current complicated geopolitical environment.

Innovation-Driven Returns

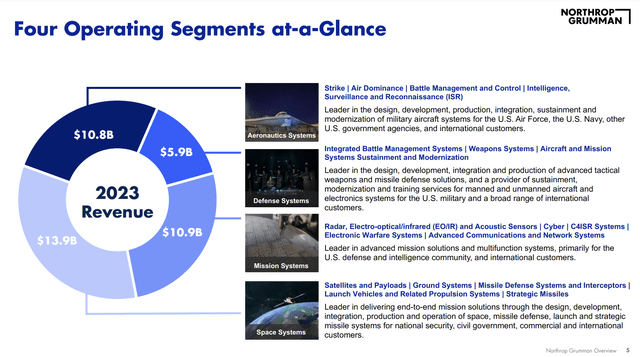

As I wrote in my prior article, Northrop is one of the most diversified defense contractors. This includes exposure to four advanced segments that cover every aspect of the modern defense environment, including space, advanced missiles, next-gen aerospace programs, and intelligence.

Northrop Grumman Corp.

What makes NOC, so special is that almost all of its major defense programs are “mission-critical,” meaning it does not just produce generic products like artillery grenades or other products that can be easily produced by others.

That’s why the company’s CEO, Kathy Warden, had some very positive comments during the Morgan Stanley Annual Laguna Conference on September 12. As some of your readers may know from prior articles, the defense budget continues to be an issue. In recent years, we have seen a lot of continuing solutions with minimal budget hikes. Inflation made this worse, as it pressured real defense spending. However:

[…] we do see bipartisan support and discussion even as deficits increase to have a healthy defense budget that supports the advancement of U.S. capability and continues to support our allies, which largely have been supported through supplementals, but some of that coming into the base budget as well. – Kathy Warden (NOC CEO)

In other words, in addition to accelerating international budgets (a highly attractive market for American contractors), we are seeing a focus on mission-critical defense programs, which offsets the general pressure on real defense spending.

Currently, Northrop has three times as many international programs as it did six years ago. This includes international air and missile defense programs and tactical programs like the AARGM-ER, which is an advanced anti-radiation guided missile for extended ranges that is integrated into programs like the F/A 18 and all three variants of the F-35.

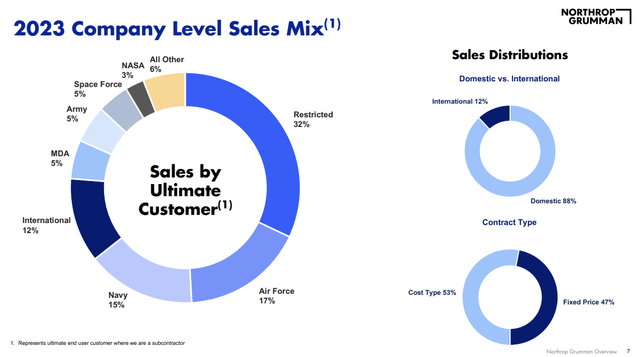

It is also a perfect missile for European partners, who are currently modernizing their armed forces in light of the war in Ukraine. Note that last year, just 12% of NOC sales went to non-American customers. This makes sense, as NOC produces a lot of defense products that are mainly used by the U.S. defense forces due to their advanced nature. Some of these are simply not meant for export.

This also explains why almost a third of its sales were classified last year. To the best of my knowledge, that’s the biggest share of classified sales among all defense giants.

Northrop Grumman Corp.

Now, it seems like the company is increasingly benefitting from international sales. On top of expanding its international programs, it is dealing with at least ten nations interested in advanced programs like the AARGM-ER missile.

On top of that, it is seeing progress in two of its biggest programs “ever.” These programs are the B-21 Raider and the Sentinel. The first one is the most advanced bomber. The second program is the ground-based leg of the nuclear triad.

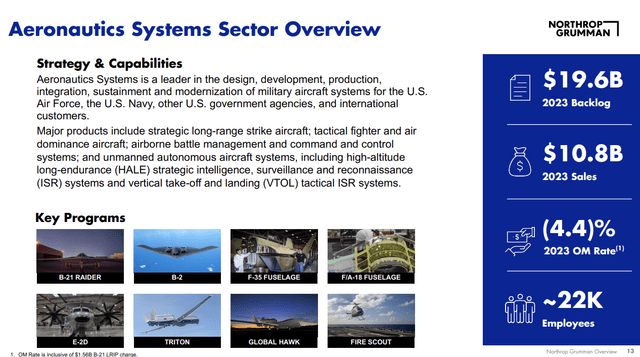

These two programs account for 15% of its sales. The F-35 jet accounts for 10% of its sales. Note that Lockheed builds the F-35. Northrop is a major supplier, including products like fuselages. It also produces the F/A-18 fuselage and is the main contractor of the B-2 (to be replaced by its B-21), E-2D, Triton, Global Hawk, and Fire Scout. This Aeronautics System sector alone entered this year with a backlog of roughly $20 billion, twice as much as last year’s sales.

Northrop Grumman Corp.

The other 75% of its sales come from programs that enjoy a lot of secular growth, including:

- Space systems

- Advanced weapon development

- Microelectronics

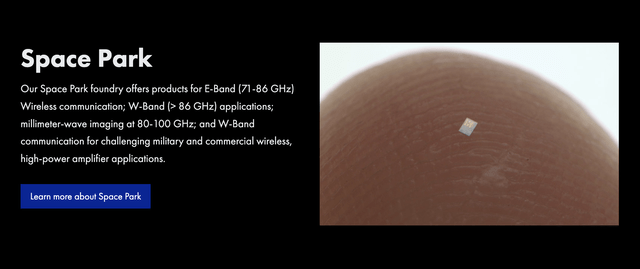

Did you know that Northrop Grumman holds the Guinness World Record for producing the fastest microchip?

According to the company, its microchips are 1,000 times more powerful than the ones in our smartphones, which is one of the reasons why I always say that although I have no direct “tech” exposure in my portfolio, my defense investments are more high-tech than any of the FANG+ components – they are just valued differently.

Northrop Grumman Corp.

With that said, major programs like the B-21 and Sentinel have been the reason for past downgrades from analysts. This was mainly due to higher-than-expected costs.

During the aforementioned conference, Northrop explained that these programs are all based on four components: development, low-rate initial production, not-to-exceed pricing, and modernization.

So far, the development phase has been less profitable than expected. The good news is that the not-to-exceed initial pricing stage is expected to be profitable, followed by a much more profitable full-production rate stage and future upgrades.

The company also learned from past mistakes, especially when it comes to new programs. For example, it will not bid to become a prime contractor for the Next Generation Air Dominance program (the F/A 18 replacement). It will become a tier-one supplier instead.

With regard to the Sentinel program, we are looking at new cost estimates due to higher-than-expected expenses for the U.S. government. However, the company is upbeat and seeing strong tailwinds that should make it one of its most profitable projects going forward.

In the meantime, we are moving full speed ahead. The program is staffed. We are executing under the program and the missile is moving along quite well as they are all those test and support equipment. The restructure is really focused on driving important decisions from the government that will affect the design on the construction scope of the program in the next phase, but the design work is well underway. – Kathy Warden (NOC CEO)

Great News For Shareholders

So far, we have discussed many positive developments, ranging from a favorable threat environment to tailwinds in key programs.

This is reflected in financial expectations.

For example, last year, the company’s Defense Systems segment grew by 5%. This year, it is expected to see high-single-digit growth. When integrating the Sentinel program, this growth outlook has strengthened, indicating that Defense Systems could become one of the fastest-growing segments by 2025, according to the company.

The demand for missiles is so strong that the Pentagon boosted investments in the supplier base earlier this year. This is a good indication of what’s to be expected in the years ahead.

Additionally, the company is moving to a higher-margin stage, aiming for a long-term margin target of 12%, supported by macroeconomic tailwinds, efficiency measures, and the aforementioned strategic shift to more profitable contracts.

- Especially the Defense System segment is perfect for margin improvement, as it currently has a lot of fixed-price contracts. When moving to a more flexible structure, supported by international demand growth, this is one of the most promising segments.

- Mission Systems: According to the company, despite facing recent challenges, Mission Systems is expected to regain momentum, benefiting from a shift back to higher-margin production work as development programs transition into production.

- Space Systems: This segment has already started to see margin improvements, supported by performance improvements and operational efficiencies.

It also helps that the company’s backlog is 30% larger than in 2019.

This bodes well for shareholders.

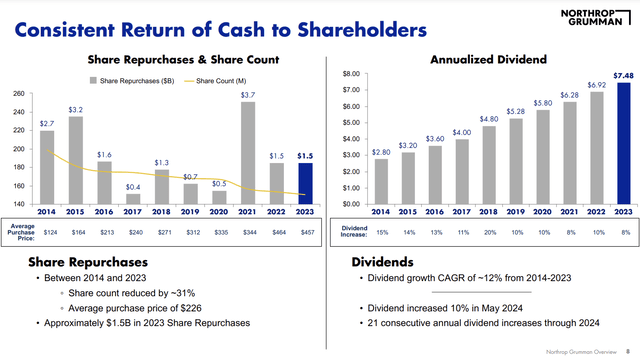

Since 2014, the company has grown its dividend by 12% per year. It has hiked its dividend for 21 consecutive years. It has also bought back almost a third of its shares during this period.

Northrop Grumman Corp.

Currently, NOC yields 1.5%. This dividend comes with a 31% payout ratio.

We have a dividend policy that we adhere to pretty closely. It has allowed us to increase the dividend, as I said, on average, 10% a year for 10 years, which we think is a really good track record and would signal to you that we continue to be committed to paying a competitive dividend. – Kathy Warden (NOC CEO)

Going forward, the company expects average annual free cash flow growth of at least 15% through 2026. This is expected to support 10% annual dividend growth and aggressive buybacks.

With all of this in mind, I have some bad news.

Northrop isn’t very cheap.

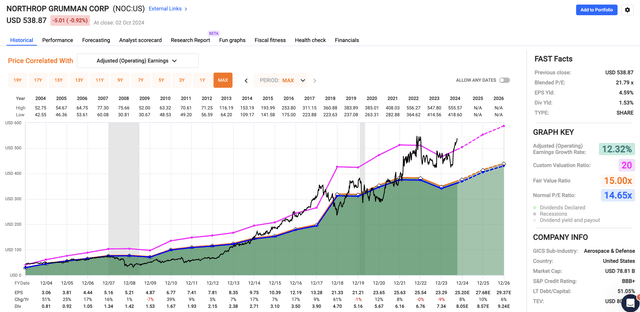

Using the FastGraph data in the chart below, NOC is expected to grow its EPS by 6-10% per year through at least 2026. I expect this to last for many years to come, based on favorable demand and margin developments.

FAST Graphs

If we apply a 20x multiple, we get a fair stock price target of roughly $590, roughly 10% above the current price.

Given long-term growth potential, I will stick to a Buy rating. However, if I had zero defense exposure, I would be a gradual buyer. I would not initiate a large position at current prices, mainly due to the euphoria in defense stocks in recent days.

On a long-term basis, I’m basically adding a bit on every 10-15% correction, which is how I have built a significant defense exposure in recent years.

Takeaway

In times of elevated global tensions, it’s easy to feel overwhelmed by geopolitical risks.

However, while the situation is serious, I don’t expect a full-scale global war on the horizon.

Instead, I’m focused on the long-term potential of defense contractors like Northrop Grumman, which benefit from elevated tensions and the desperate need of NATO members to innovate.

Hence, NOC’s innovation-driven business model, anti-cyclical demand, and expanding international programs make them a core part of my portfolio.

Though Northrop isn’t cheap right now, its strong fundamentals and growth potential keep it on my radar for long-term buying opportunities, especially on corrections.

As always, I prioritize gradual accumulation over chasing short-term momentum.

Pros & Cons

Pros:

- Innovation-Driven Growth: Northrop’s focus on next-gen defense programs like the B-21 Raider and Sentinel provides long-term revenue growth and technological leadership.

- Resilient Demand: The company benefits from anti-cyclical government contracts and a growing international demand, which support stability even in volatile markets. In general, elevated global tensions are beneficial for demand.

- Attractive Shareholder Returns: With a 21-year track record of dividend hikes and strong buybacks, Northrop consistently rewards shareholders.

Cons:

- Stock Price Volatility: Despite strong fundamentals, NOC’s stock price has seen volatility due to past issues in major programs and external factors.

- Supply Chain Risks: Ongoing supply chain challenges can impact production and financial performance.

- Defense Budget Uncertainty: Fluctuations in defense budgets could affect future revenues and order flows.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC, LMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.