Summary:

- In 3Q24, Northrop Grumman delivered another strong quarter, posting revenues of 9.9 billion, representing a 2.6% y/y growth. During this period, the company scored a total net awards of $11.7 billion.

- Operating margins have improved and NOC is on track to deliver its first margin expansion in eight years. Importantly, NOC remains confident that margins will eventually revert to its norm.

- NOC is likely to continue to benefit from a surge in defense spending as geopolitical tensions remain elevated. The company expects topline to grow 4.86% in FY2024 and 3.5% in FY2025.

- Unfortunately, valuation analysis suggests that market participants have fully priced in the potential of NOC. The risk/reward profile of NOC is unattractive, with a potential downside of 11% if margin erodes due to China’s export ban.

Sundry Photography

Introduction

Based on my analysis, there is limited upside potential for Northrop Grumman (NYSE:NOC). Even though the company operates in an environment with tailwinds (e.g. rising defense spending, persistent elevated tensions between countries), my valuation model suggests that, at best, there will be a 4.5% upside. Moreover, there are multiple risks looming that may affect NOC’s margin in the near future (e.g. China export ban of Gallium). In this report, I will demonstrate why investors should avoid NOC at the moment.

Company Overview

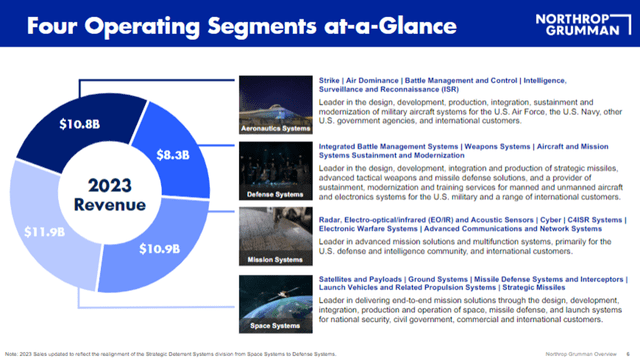

NOC is an aerospace and defense technology company based in the United States that delivers a broad range of products and services, including but not limited to space systems, military aircraft, advanced weapons, communications, cybersecurity. The company operates primarily through four segments: (1) Aeronautics Systems, (2) Defense Systems, (3) Mission Systems, and (4) Space Systems.

NOC Revenue Breakdown (Company Overview Document)

According to the company’s latest overview, 88% of the company’s revenues are derived from the United States. Restricted sales (i.e. DoD or Intelligence Agencies) takes up more than 30% of the company’s revenues, while the following largest two clients are the Air Force and Navy, contributing about 17% and 15% respectively. Finally, NOC operates on two types of contracts: (1) Cost Type Contract, and (2) Fixed Priced Contract; currently fixed priced contracts take up close to 47% of the total.

Latest Developments

In 3Q24, NOC posted revenues of $9.9 billion, representing a growth of 2.26% y/y and a decline of -2.17% q/q. All operating segments except for Space Systems saw growth. Space related sales declined by 3% y/y. During this period, the company scored a total net awards of $11.7 billion, bringing a total backlog of $85 billion. Margins improved slightly, with operating margin and net margin expanding by 81bps and 68 bps as compared to the same period last year. For the period, net income surged by 9.50% y/y.

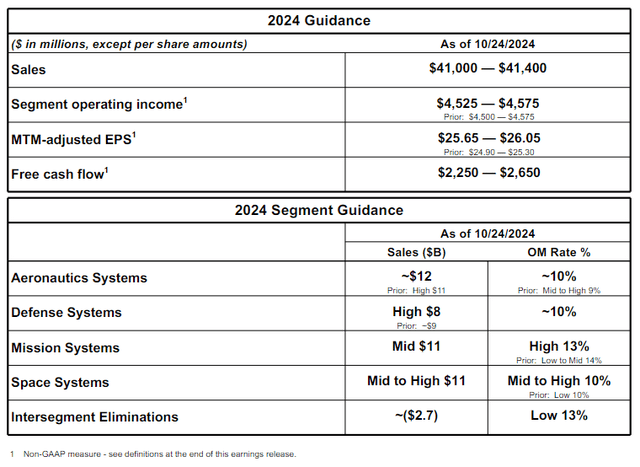

NOC’s Guidance 2024 (Press Release)

NOC raised guidance for the entire year of FY2024, demonstrating management confidence. Total sales and FCF for FY2024 are expected to come in at $41.2 billion and $2.45 billion, representing a 4.86% y/y and 16.67% growth respectively. NOC raised expectations for operating income and EPS from $4.53 billion and $25.1 to $4.55 billion and $25.85. Intersegment eliminations will most likely come in at around 13%.

NOC Is Well-positioned To Enjoy Strong Tailwinds From Rising Global Defense Budgets

Based on current indicators, the current macroeconomic and geopolitical environment highly favors defense companies. It is highly likely that we will see the demand for defense related products and services continue increasing, supporting the outlook for renowned defense companies such as NOC and other similar companies such as Lockheed Martin (LMT) or Airbus (OTCPK:EADSF).

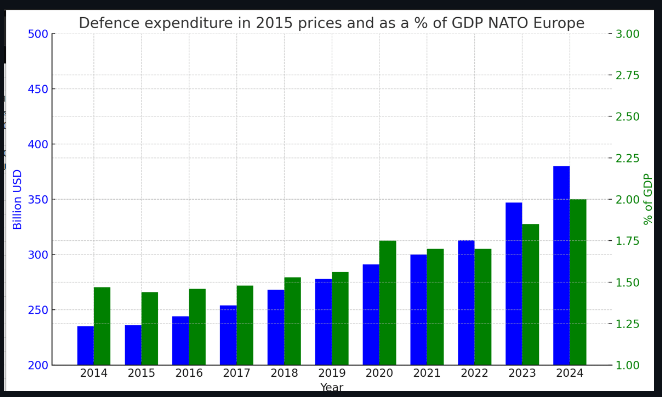

Defense Expenditures (NATO)

Across the world, there are multiple geopolitical flashpoints that have yet to abate. In Europe, we continue to see Russia fighting against Ukraine. In the Middle-East, there are multiple conflicts at play, ranging from but not limited to Israel-Gaza, Iran’s growing hostility, and Syria’s fall of Assad. In Asia, the relationship between China-Taiwan and China-Philippines remains tense.

All of these events, unfortunately for the world, will continue to encourage countries to ramp up their defense spending, benefiting defense companies. Specifically, since 2021, APAC countries have increased defense spending by 12% while MENA and EU countries have increased their spending by 27% and 19%. Moving forward, NATO is likely to further increase defense spending from 2% to 3% of total GDP, continuing to support the outlook for defense companies.

In fact, the current management of NOC has demonstrated utmost confidence in the latest earnings call. For FY2024, the company expects to generate $41.2 billion in sales for FY2024, representing a growth of about 4.86% y/y. Book to bill remains extremely elevated at 1.6x and 2x for domestic and international respectively in the recent quarter, suggesting a strong demand globally. Based on current bookings, NOC expects to post about 3 to 4% of y/y revenue growth for FY2025.

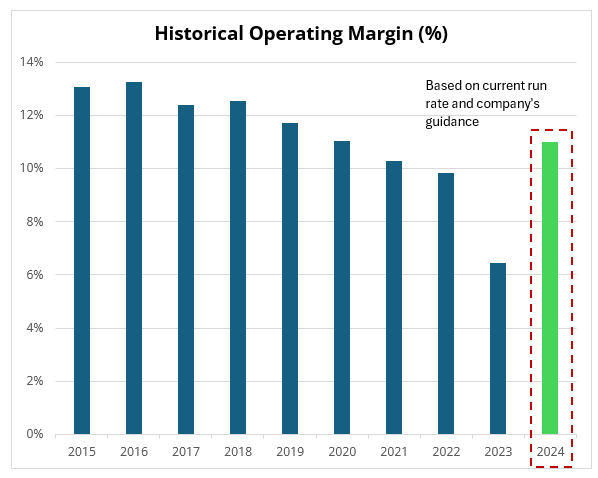

Rebounding Margins Can Bring About Further Shareholder Benefits If It Persists

Since 2016, NOC’s operating margins have declined substantially from 13% to 6%, a decay of almost half across the past eight years. Finally, in 2024, NOC has managed to enhance its operating efficiency; for the first three quarters, NOC has posted an average operating margin of about 10.81%. If the company can continue to keep this up for 4Q24, the margin expansion will be NOC’s first time in eight years. Based on management guidance, NOC expects to post an operating margin of 11%.

Operating Margin (Company Filings)

NOC’s margin expansion can be attributable to multiple factors. Specifically, NOC cited: (1) favorable macroeconomic conditions, (2) improved supply chains and workforce productivity, (3) improved Defense Systems segment, (4) and expansion of its international portfolio. Currently, the macroeconomic environment remains highly uncertain given that we will have a new administration in January 2025. Hence, there is a likelihood that these supporting factors wear off. That being said, NOC remains highly confident that the company’s margins will move back towards its historical norms as the company moves towards more fixed-priced contracts. As a reference, based on 2023 revenues, an improvement of 1% will mean a cost saving of $392 million.

NOC is a Well-established Cash Generator That Has A Track Record Of Returning Value to Shareholders

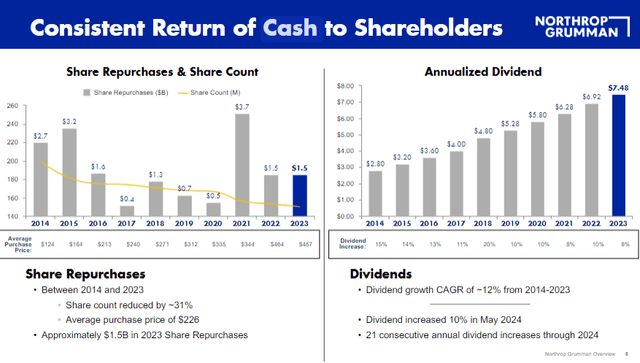

Investors should note that NOC has always been a consistent cashflow generator. For more than 20 years, the company has always generated positive free cash flow. More importantly, the company has a strong track record of delivering value to shareholders. Between 2014 and 2023, NOC has reduced its total share count by close to 31% while dividends have increased 21 consecutive times at a CAGR of 12%.

Historical Shareholder Returns (Earnings Presentation)

Looking ahead, NOC expects to generate FCF of $2.45 billion, increasing by close to 16.67% y/y. Hence, there is a strong likelihood that the company will once again return value to shareholders through further share repurchases or increasing its dividend. Without accounting for capital appreciation, the estimated total shareholder returns based on current market capitalization and NOC’s FY2023 repurchases and dividends is approximately 4%.

Valuation & Other Potential Risks

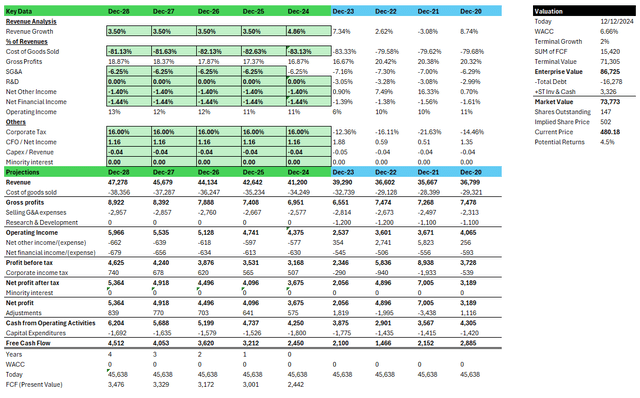

To ascertain NOC’s intrinsic value, I have utilized a DCF valuation model with the following assumptions:

- NOC to achieve its revenue guidance of 4.86% and 3.5% for FY2024 and FY2025. Revenue to remain stagnant at 3.5% through FY2028.

- NOC’s operating margin slowly improved from 11% to its normalized rate of 13% by FY2028.

- Terminal Growth of 2% and WACC of 6.66%.

Based on these assumptions, the implied share price of NOC will be $502, presenting an upside of merely 4.5%. This suggests that market participants have already fully priced in the potential of NOC.

Valuation Analysis (Author’s Projections)

It is important to note that the above model is based on the assumption that NOC is able to improve its margins over the next couple of years. However, we should all remember that the United States is still fully reliant on a couple of key minerals for the semiconductor and defense industries. There is a likelihood that if a trade war 2.0 occurs, we will see NOC’s margins deteriorate again. In fact, China has already stopped the export of multiple critical minerals such as Gallium, which the United States is 100% dependent on.

If we assume that operating margin deteriorate to 2023 levels, my model suggests that there is a potential downside of 11%. Given that there is no huge margin of safety and the risk/reward is fairly unattractive, I believe investors should probably stay away from NOC at the moment.

Closing Remarks

Overall, NOC is still an outstanding company operating in a macro environment with multiple tailwinds. From a business and operational perspective, there is no doubt that NOC will continue to post strong results. Moreover, I sincerely believe that the relationships between countries today are extremely fragile; thus, every country who has to means will continue to invest in their military capabilities, benefiting companies like NOC. Unfortunately, based on the current share price, upside potential is limited.

That being said, I will continue to monitor NOC. NOC will be a good pick if there is a sudden correction (that does not affect its fundamentals), presenting a more attractive risk/reward profile for us to capitalize on. Looking forward, investors should closely monitor the developments surrounding NATO and a potential trade war. If a trade war happens, there is a strong likelihood that we see margin erosion for NOC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.