Summary:

- Northrop Grumman to report Q2 earnings, with expectations of slowdown in key growth programs and pressure on margins from fixed-cost contracts.

- Signs of emerging growth areas internationally, with potential for increased contracts in Europe and focus on high-end threats like missiles and drones.

- Valuation indicates capped upside, with expectations of 4.5% CAGR in sales and 16-17% CAGR in operating income over the next three years.

mjf795

Investment Thesis

Northrop Grumman (NYSE:NOC) is set to report its Q2 FY24 earnings report this Thursday, July 25th, before markets open.

The company has already set expectations early on this year that its key growth programs, such as the B-21 and Sentinel, as well as its entire Space Segment, are expected to see slowdowns as domestic defense budgets indicate flattish spending in these areas. Then, the company is also cycling through a range of fixed-cost contracts that were picked up before the pandemic when inflation was far lower. These contracts are still putting pressure on Northrop’s margins.

But there are signs of emerging growth areas at the same time. With geopolitical tensions still elevated, there is scope for Northrop to compete for contracts on an international level while competing for hot-commodity programs such as missiles as well as uncrewed aerial vehicles such as the Triton.

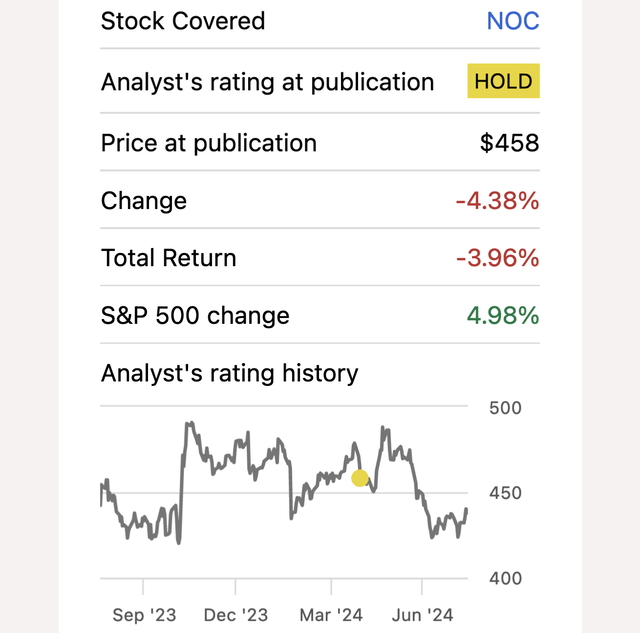

The upcoming Q2 earnings this week should give management another opportunity to expand on the next set of growth initiatives. At the moment, my valuation models indicate Northrop is fairly valued, and I will continue to recommend a Hold on this defense company.

Margins, Contract Wins and Backlog in Focus

In my previous coverage of Northrop Grumman, I explained how the company was feeling pressure from a decade of fixed-cost contracts that the company had acquired in an era where inflation was more tame than current inflation rates. Despite management sounding optimistic per my last coverage, I believed that “the implications of the contracts picked up by Northrop over the last many years will weigh down on the company for some time,” leading me to recommend a Hold rating with an estimated target price of $469.

Exhibit A: Author’s previous estimates for Northrop Grumman’s estimated share price (Seeking Alpha)

Since then, the company has reported their Q1 FY24 earnings report, which pointed to total sales growing 8.6% y/y to $10.1 billion, 3.3% higher than what markets were expecting, while beating expectations on GAAP EPS by 55 cents to report $6.32 in earnings per share. At the same time, Northrop’s management reiterated their year-end projections for FY24 sales to rise 4.4% to $40.8-41.2 billion, while GAAP EPS would be expected to be in a range of $24.45-24.85.

In what has been a reasonable effort demonstrated by management to revert its margins to the mean average, the company is now competing for contracts selectively, making sure that they can follow through on fulfilling the contracts with the right cost structure. While the company passed on the opportunity to bid for the U.S. Air Force’s 6th generation NGAD program, management highlighted similar efforts on the Q1 call, where they would only bid for drone contracts focused on high-end threats and pass other drone contracts such as non-survivable drone programs, which were more low-cost incentives for the company to pursue.

As long as the company competes and bids for contracts that are more cost-type, it should help get their gross margins back up above the 20% mark. Currently, Northrop’s gross margin still hovers at the 16.7% mark, and I would prefer to see this margin move higher to their normalized range above the 20% mark.

|

Contract Type |

TTM |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Cost-Type |

53% |

53% |

51% |

51% |

50% |

49% |

|

Fixed-Price |

47% |

47% |

49% |

49% |

50% |

51% |

The company’s backlog now stands at $78.9 billion, rising just 1.8% y/y per its earnings report. Since then, Northrop has won a few modification-related contracts with the U.S. Navy, while also extending its reach internationally by winning another contract for the Global Hawk aircraft sustainment program.

Any indication of the backlog growing back into the mid-single-digit range will give a major boost to Northrop Grumman’s stock.

Elevated Geopolitical Tensions Puts the Spotlight Back on Northrop’s International Opportunity

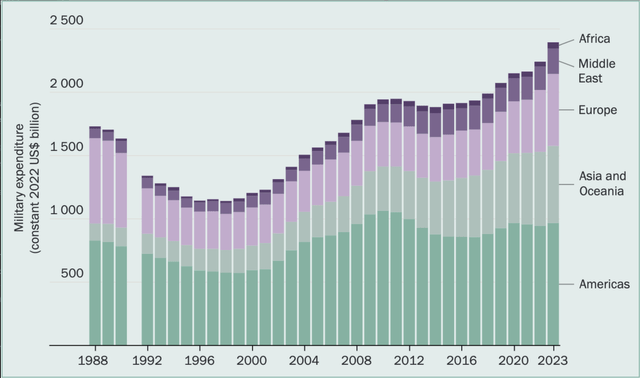

In separate coverage on the iShares U.S. Aerospace & Defense ETF (BATS:ITA), I explained how global military expenditure continues to rise in the face of elevated geopolitical tensions, growing 6.8% y/y while recording the fastest increase in defense spending since the last 10 years.

Exhibit B: Global military expenditure rises for the ninth consecutive year marking a new record high in 2023 (SIPRI)

What this report also showed is that European countries reported one of the fastest increases in defense spending, rising 16% to $600 billion in 2023. Coupled with this, NATO member countries recently pledged to increase spending at the recently concluded 75th NATO Summit.

While Europe’s current revenue contribution to Northrop’s overall revenue is marginal at ~7% of Northrop’s total revenue, growing from a 6% contribution mark a year earlier, the scope for Northrop to win more contracts internationally from export orders could also boost the growth rates.

During recent conferences such as Bernstein’s Strategic Decisions Conference, Northrop’s management revealed the scope for the company to win almost $10 billion in contracts pertaining to their IBCS (Integrated Air and Missile Defense Battle Command System) programs, with specific interest coming from European countries. In addition, opportunities in Europe for Northrop’s high-altitude, long-endurance, uncrewed vehicle, Triton, could reinvigorate growth in the company’s Aerospace segment, which is in search of a new growth catalyst after declining programs such as the F-18 and the B-2 bomber.

Northrop’s valuation indicates capped upside

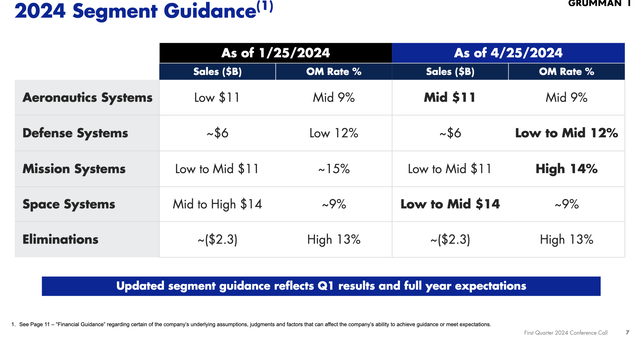

Per the Q1 earnings report, management did not change much in terms of their guidance, per Exhibit C.

Exhibit C: Northrop’s visibility of their revenue segments growth rate and operating margins (Q1 FY24 Earnings Report, Northrop Grumman)

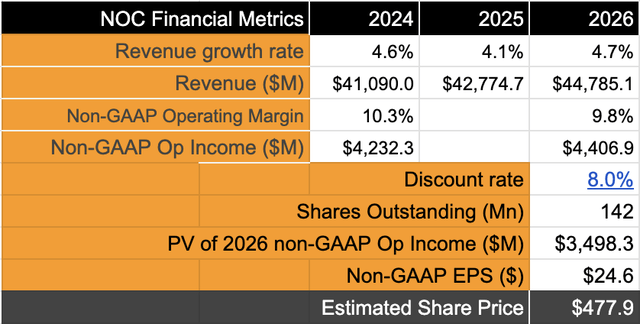

As mentioned earlier, management still expects FY24 sales to grow 4.4% to ~$41 billion. With no major improvement in growth catalysts since my last coverage, my expectations still hold for the company to grow their top line by ~4.5% CAGR over the next three years. Margins will remain pressured for now, as mentioned earlier. I still expect operating margins to hover around the 10% margin mark, implying ~16–17% CAGR in operating income. All my assumptions are based on a discount rate of 8%.

Exhibit D: Northrop Grumman’s valuation indicates capped upside (Author)

On comparing Northrop’s earnings growth rate to the S&P 500, I believe a forward PE of ~19 is warranted. This implies a 9–10% upside from current levels as the company gets ready to report its Q2 earnings.

Summarizing What To Look For in Q2 Earnings

Here is a summary of what markets will be expecting in Q2 from Northrop:

-

In Q2, markets expect Northrop Grumman to report sales to grow 4.6% y/y to ~10 billion, with $5.93 in earnings per share growing 11% y/y. Seeking Alpha’s Quant system grades Northrop’s Earnings Revisions a B rating, indicating moderate levels of earnings revisions before Northrop’s earnings

-

Any further news, such as contract modifications, etc., that may impact the company’s margins will be a headwind for the company.

-

Any further insight into contracts won or orders specifically from its ex-U.S. regions will help in upgrading its outlook as markets look for the next growth catalysts.

-

Management commentary on contracts won in the U.S. will indicate any scope for more growth in domestic revenues. I do not anticipate much on that front, since this is an election year. DoD’s still-to-be-approved FY24-25 Budget Request indicates a deceleration in Northrop’s previous growth catalysts, such as B-21 and Sentinel ICBM.

Takeaway

With the pullback that I previously expected in Northrop Grumman, the company now rests in a fair range valuation as it heads into Q2 earnings day this week. The search for the next set of growth catalysts continues, although there are some emerging signs, with Europe increasing its spending across the board. At the same time, Northrop’s Missile and Defense systems are well positioned to capture that demand. Comments from management on this front will strengthen the outlook.

For now, I believe Northrop Grumman may still be range-bound, and I recommend a Hold on the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.