Summary:

- Northrop Grumman Q2 earnings show modest margin expansion, with 10% revenue growth and 5% segment operating income growth.

- Northrop Grumman increases full-year earnings guidance, with sales and segment operating income guidance raised.

- Despite premium valuation, Northrop Grumman stock is a buy based on the global threat environment and long-term profitability prospects.

KGrif/iStock Editorial via Getty Images

In May, I covered Northrop Grumman (NYSE:NOC) and attached a Hold rating to the stock with a $482 price target. The stock is currently trading north of $500, and I believe it is a good time to re-evaluate my price target on the stock, even more so since Northrop Grumman has lifted its full-year profit guidance.

Northrop Grumman Q2 2024 Earnings Show Modest Margin Expansion

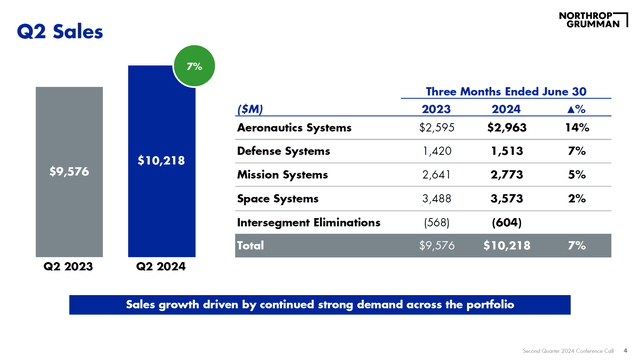

During the second quarter, Northrop Grumman sales grew 7% to $10.2 billion, beating analyst estimates for NOC Q2 2024 revenues by $200 million. Aeronautics sales increased by $368 million 14% driven by higher volumes on the MQ-4C Triton and more production and sustainment on the F-35 program driven by timing of materials receipts. Earnings grew 6% pointing to a margin reduction of 70 basis points to 10% driven by a higher share of lower margin programs in the mix and lower positive catch up adjustments.

Defense Systems sales grew 7% during the quarter, exceeding $1.5 billion in quarterly sales, while profit grew 23% indicating a margin expansion from 11.7% to 13.5%. Sales growth was driven by a ramp up in ammunition programs, higher order quantities for the Guided Missile Launch Rocket System, a ramp up on the Stand-in Attack Weapon volume and higher volume for the Integrated Battled Command System program, partially offset by lower training program revenues. Profits grew to $204 million or 23% driven by higher net EAC adjustments as cost efficiencies positively enhanced the outlook for costs to complete programs.

Mission System sales grew 5% to $2.641 billion driven by higher microelectronics volumes, timing of material receipts on marine programs and higher volumes on the Surface Electronic Warfare Improvement Program as well as full rate production of the G/ATOR radar partially offset by sales decreases on F-35 Mission System sales. Operating income decreased by 10% to $361 million due to negative cost adjustments on certain radar programs and contract mix.

Space System sales grew 2% driven by the Tranche 2 Transport layer, the HALO lunar program and material receipts in support of Amazon’s Project Kuiper. Operating income increased 14% to $324 million, while margins expanded 100 bps to 9.1%. This was driven by lower negative catch up adjustments on contract execution, contract mix and the absence of a $15 million write off in commercial inventory that was recognized in the comparable quarter last year.

So, overall, we are seeing 10% growth in revenues and 5% growth in segment operating income. The gap in the operating income growth was driven by the Mission Systems margin contraction. Earnings per share rose from $5.34 to $6.36 or 19% growth. Backlog stood at $83.1 billion, with a book-to-bill ratio of 1.5x during the quarter.

Northrop Grumman Increases Earnings Guidance

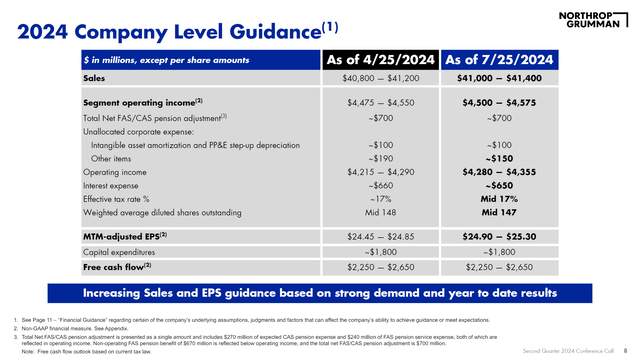

For the full year, Northrop Grumman increased the sales guidance by $200 million, while segment operating income guidance increased by $25 million to $4.5 billion at the low end and $4.575 billion at the high end. Combined with a $40 million lower expense on other items, it brings the operating profit to $4.25 billion at the low end and $4.355 billion at the high end. Combined with a lower share count, that resulted in a $0.45 to $0.55 lift to the adjusted EPS.

Sales guidance for Aeronautics has increased from mid-$11 billion to high $11 billion, with the margin rate increasing from mid-9% to mid to high 9%. Mission Systems have been guided up from low to mid $11 billion to mid-$11 billion, with margins moderating from high 14% to low to mid 14%. For Space and Defense Systems, we couldn’t establish a change in guidance as the Sentinel program has been transferred to the Defense Systems segment, which skews the sales and margin outlook.

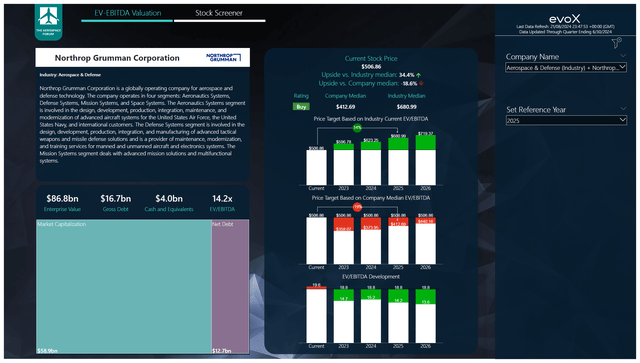

A Premium Valuation For Northrop Grumman

The reality for Northrop Grumman stock is that is not a cheap stock when valued against the company median, and that previously drove my Hold rating. However, at this point, I believe that letting the stock trade in between is reasonable. The global threat environment remains at elevated levels, and Northrop Grumman provides key capabilities for the US and its allies. Allowing the stock to trade in between the company median and the peer group EV/EBITDA multiple provides a $547 price target providing 8% upside with more upside in the years thereafter. Analyst estimates on EBITDA have not seen huge changes. It was around 1.4% higher for 2024 at $5.77 billion and on free cash flow, the estimates have gone up 3.4% between 2024 and 2026 with a 5.5% bump to the free cash flow estimate for 2024.

Conclusion: Northrop Grumman Stock Is A Buy On Multiple Expansion

I believe that Northrop Grumman stock is a buy, and that rating is based on the assumption that the current threat level globally should allow for a premium valuation on EV/EBITDA given the capabilities that Northrop Grumman can provide. Northrop Grumman has an $83 billion backlog it can lean on and while the B-21 and Sentinel programs are seeing significant cost pressures, I believe that over the longer term, these will be profitable programs and with its portfolio, Northrop Grumman will remain relevant on production and sustainment front for years and decades to come.

Admittedly, the stock is expensive compared to the company median valuation. So, if there is a cool down in the stock price that would add to the appeal of Northrop Grumman, but at this point, I have a buy rating on the name even though a buyer now would pay a significant premium against the company median valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.