Summary:

- Northrop Grumman stock continues to significantly underperform the defense sector and the broader market.

- In this article, I will discuss the reasons for the underperformance and why I believe a window of opportunity is beginning to open.

- In addition to operational fundamentals, a look at the balance sheet and growth prospects, I will also highlight some key risks of an investment in NOC shares.

- The article includes the results of my bottom-up discounted cash flow valuation, which identifies Northrop as a “great company at a reasonable price”.

KGrif/iStock Editorial via Getty Images

Introduction

As of late, shares of major defense contractor Northrop Grumman Corp. (NYSE:NOC) can’t seem to find a bottom. NOC is now almost back to the 52-week low of $415 and it will be interesting to see if support holds. As a long-term investor, I obviously don’t put much weight on technicals, but watching some basic indicators has served me well nonetheless.

What concerns me much more is whether the current NOC share price could represent a solid opportunity to initiate a long-term position. My regular readers know that I consider it important to have portfolio exposure to defense companies. While I’ve added significantly to my holdings in RTX Corp. (RTX) and L3Harris Technologies, Inc. (LHX) over the past year, I haven’t added to my third defense position – Lockheed Martin Corp. (LMT) – in quite some time. Since I’m more or less satisfied with the size of the three positions, I’ve been considering adding a fourth defense position for some time.

As I will discuss in this article, once again hopefully in a balanced manner, I believe that Northrop Grumman shares are a great fit for my portfolio. In addition to the operating fundamentals, a look at the balance sheet and growth prospects, I will also point out key risks – but for the sake of brevity in an intrinsic form. Finally, I will share my valuation of Northrop Grumman stock, based on a bottom-up discounted cash flow model.

Northrop Grumman’s Business – Diversified, Yet Concentrated

As a U.S. defense company, it is hardly surprising that the Department of Defense is one of Northrop’s main customers. As such, the company’s future is heavily dependent on defense spending and the growth of the defense budget. While I typically try to avoid investing in companies with particularly strong government influence, defense companies are a notable exception as they add industrial exposure to my portfolio, albeit in a non-cyclical or even anti-cyclical manner.

While a third of Northrop’s 2023 sales were to undisclosed customers, we know that the U.S. Air Force and U.S. Navy contributed 17% and 15% of the company’s sales, respectively. International diversification is also important with 12% of 2023 sales, but make no mistake – Northrop is, to a significant extent, a “bet” on the U.S. defense budget, to put it bluntly. However, the current conflict in Ukraine and the emerging trend of significantly higher defense spending in the European Union should lead to strong growth in Northrop’s International segment.

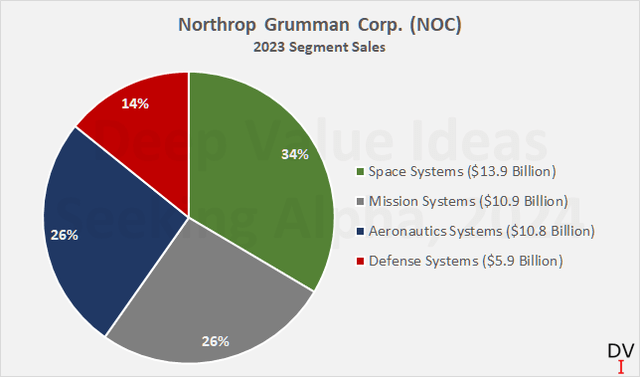

Despite its focus on defense, Northrop Grumman is by no means a pure-play defense company. Its largest segment – Space Systems – develops and manufactures satellites and payloads as well as related ground systems and launch vehicles, but of course also missile interception and defense systems (see slide 25 ff. of the last investor presentation for details). While this segment was responsible for a third of Northrop’s sales in 2023 (Figure 1, green), the corresponding order backlog amounted to almost 50% of the total order backlog ($40.5 billion out of a total of $84.2 billion, 2.1x 2023 sales). Through this segment, I believe Northrop is the ideal play on the growing militarization of space (besides L3Harris, see my last article).

Figure 1: Northrop Grumman Corp. (NOC): 2023 segment sales (own work, based on company filings)

As a note of caution, this segment also includes the next generation Ground Based Strategic Deterrent (GBSD), an oft-cited growth driver for NOC. While I am also convinced of the project’s importance for Northrop, it should be kept in mind, however, that the LGM-35 Sentinel missile system is still in the early stages of development and recently triggered a so-called Nunn-McCurdy breach review due to expected significant cost overruns (p. 30, 2023 10-K). While I personally do not believe that the survival of the project is actually in jeopardy due to the age of the Minuteman III and the strategic importance of the program, this is likely one of the reasons for the poor performance of NOC stock in recent months.

On a positive note, while the program is delayed by at least two years, it is expected to run until the mid-to-late 2070s, resulting in predictable long-term revenues for NOC, due in part to maintenance and modernization contracts.

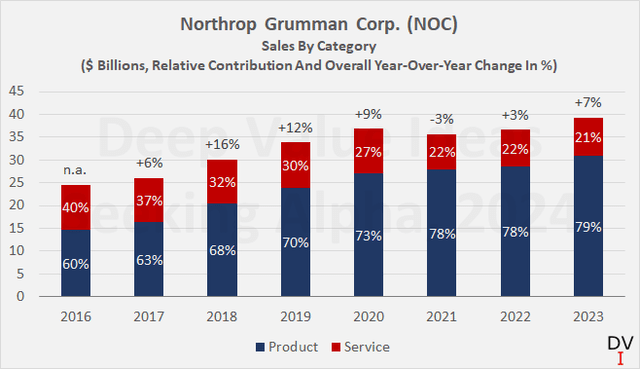

On a consolidated basis, Northrop currently generates 21% of its sales from services (Figure 2), a percentage that should increase significantly as the GBSD and also the B-21 program (see below) mature, reducing free cash flow volatility and making NOC stock an ideal candidate for a long-term income-oriented portfolio.

Figure 2: Northrop Grumman Corp. (NOC): Historical product and service sales as well as year-over-year consolidated sales growth (own work, based on company filings)

Mission Systems, Northrop’s second largest segment (Figure 1, gray), develops and manufactures so-called C4ISR systems (Command, Control, Communications and Computers, Intelligence, Surveillance and Reconnaissance), similar to L3Harris. Other products include electronic warfare systems, cyber solutions and a wide range of sensors. The segment’s order backlog accounted for 13% of the total order backlog at the end of 2023. Exemplary projects include the F-35 radar system (Lockheed) and its communication, navigation and identification avionics suite, as well as LAIRCM , a defense system for large transport aircraft consisting of a missile warning system and an infrared laser jammer.

Same as Mission Systems, Aeronautics Systems also contributed 26% of Northrop’s 2023 sales (Figure 1, blue), and the segment’s year-end backlog accounted for 23% of total backlog. The segment includes key projects such as the massive B-21 Raider program and, of course, the B-2 Spirit.

On a side note, the $1.6 billion charge taken in connection with the B-21 program is probably the main reason for the recent poor performance of NOC stock. However, considering the current inflationary environment and the fact that management has previously disclosed the possibility of a loss-making production of some of the low-rate initial production batches, I would not over-interpret this charge. Nevertheless, as a developer of highly complex aircraft, Northrop relies on a large number of suppliers and therefore has a potentially risky supply chain. In addition, the high proportion of fixed-price contracts (around 50%) harbors the risk of additional cost overruns.

Other notable projects include the MQ-4C Triton and the Global Hawk drones (long-endurance maritime surveillance), and Northrop also manufactures the fuselage for the F/A-18 and F-35, allowing the company to capitalize on the sharp increase in demand for the latter from Europe.

Defense Systems is Northrop’s smallest segment, with a sales contribution of 14% in 2023 (Figure 1, red) and an order backlog contribution of 10% at the end of the year. The company’s air and missile defense systems are manufactured for the U.S. and Poland. In my view, it is reasonable to expect Northrop to continue to benefit from growing demand in Europe, also in light of Sweden having joined NATO in March 2024.

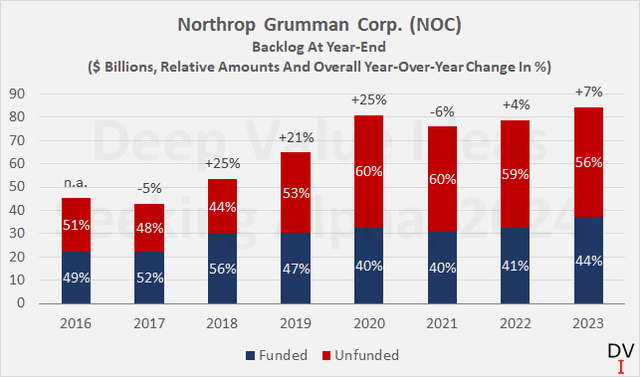

Taken together, I think Northrop’s growth trajectory is solid, particularly due to the B-21 bomber program, the GBSD program (which is now expected to cost over $130 billion), and its involvement in the F-35 program (which also runs into the 2070s). In my view, Northrop’s backlog (Figure 3) does not accurately reflect the long-term growth of its major programs and therefore should not be misconstrued as a sign of stagnation.

However, investors need to be aware that the classified programs are significant contributors and therefore visibility on future sales and earnings remains limited. It is also important to consider the company’s dependence on a large number of suppliers and thus a potentially risky supply chain. However, and considering the post-pandemic dynamics, this risk is currently well understood and therefore likely appropriately priced into the share price. Overall, Northrop’s portfolio is diversified, but the core programs are likely to be the most important cash flow drivers going forward. Therefore, a cancellation of the GBSD program (which I believe is unlikely, also due to the lack of competitors) would certainly have a significant negative impact on NOC’s share price.

Figure 3: Northrop Grumman Corp. (NOC): Historical backlog at year-end (own work, based on company filings)

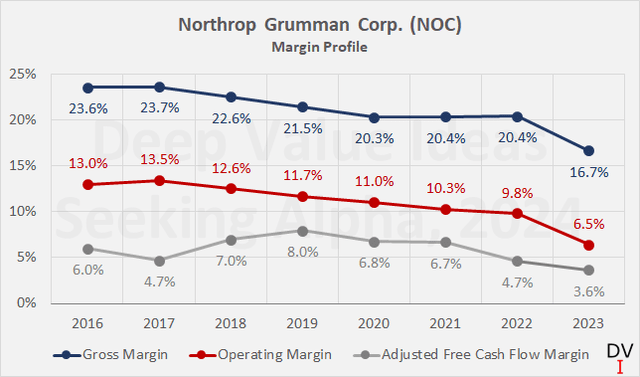

Declining Operating And Free Cash Flow Margins – What To Make Of Northrop’s Weak Profitability?

Looking at NOC’s historical margin profile (Figure 4), it appears as if the company has significant operational challenges to overcome. However, the sharp decline in operating margin in 2023 is due to the B-21 charge mentioned above, which impacted profitability by a whopping 3.9 percentage points.

I attribute the longer-term decline in profitability to higher costs and, more importantly, higher capital expenditures as Northrop’s key growth programs mature. On a side note, the 2023 adjusted free cash flow margin is only 3.6% as I have accounted for working capital movements in my analysis via a three-year rolling average. In 2023, the company recorded a comparatively significant positive working capital impact. So if we ignore working capital adjustments, Northrop’s free cash flow margin would have been around 5.0% in 2023 (but only 3.6% in 2022). However, as always, I treat stock-based compensation (SBC) as a cash expense.

Figure 4: Northrop Grumman Corp. (NOC): Historical margin profile (own work, based on company filings)

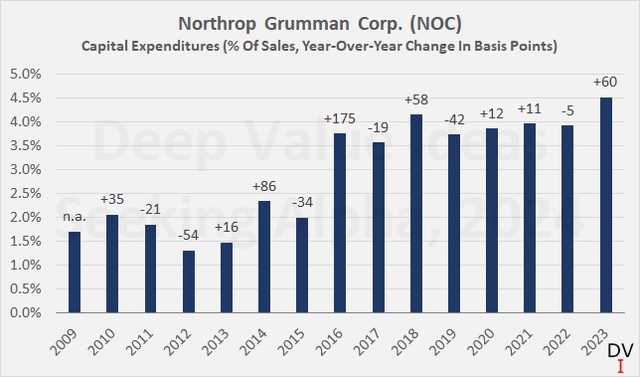

The important thing to note in the context with profitability is, in my view, that the status quo does not adequately reflect the underlying profitability of the business. Management has projected 15% annual free cash flow growth through 2026, suggesting that capital expenditures will decline going forward. Looking at Figure 5, it is clear that Northrop has invested heavily in growth in recent years.

Figure 5: Northrop Grumman Corp. (NOC): Historical capital expenditures, as a percentage of sales (own work, based on company filings)

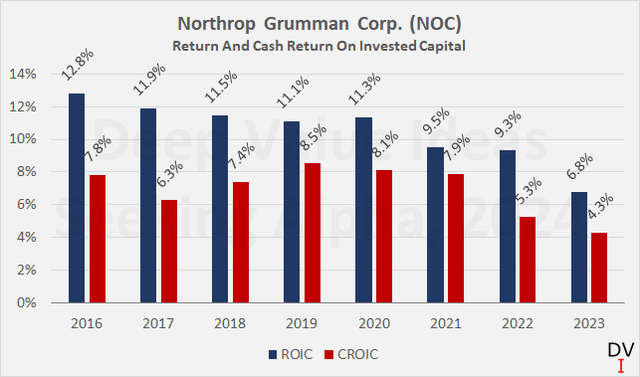

Eventually, a convergence of depreciation and amortization (currently approximately $1.3 billion annually) and capital expenditures ($1.8 billion in 2023) and thus a significant increase of NOC’s free cash flow margin can be expected. I have taken this normalization into account in my discounted cash flow model discussed in the final section of this article. In addition to improving margins, I believe it is a reasonable expectation that Northrop’s return on invested capital (both in terms of after-tax net operating income – ROIC – and free cash flow – CROIC) will also improve going forward (Figure 6).

Figure 6: Northrop Grumman Corp. (NOC): Return and cash return on invested capital (own work, based on company filings)

Have The Significant Investments And Shareholder Returns Taken Their Toll On NOC’s Balance Sheet?

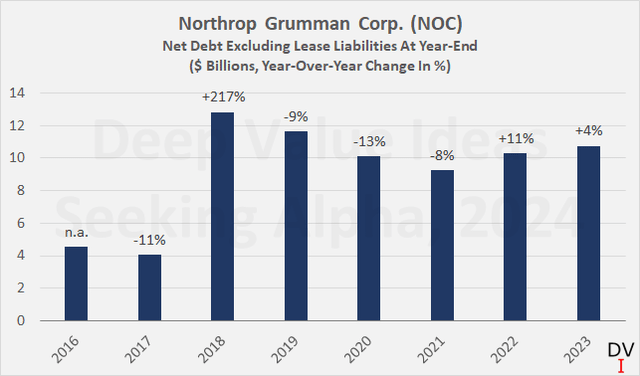

Given the significant capex, comparatively weak profitability and continued solid shareholder returns (e.g., $2.3 billion in dividends and share buybacks in 2023 vs $2.05 billion in unadjusted free cash flow), it could be expected that Northrop’s balance sheet is fairly leveraged.

However, Northrop generally maintains a solid cash position (e.g., $3.1 billion at the end of Q1 2024) and its net debt has not changed significantly since the acquisition of Orbital ATK for $9.2 billion in 2018 (Figure 7).

Figure 7: Northrop Grumman Corp. (NOC): Historical net debt at year-end (own work, based on company filings)

Northrop’s current long-term credit rating is Baa1 with a stable outlook, after an upgrade in August 2021. This is definitely solid and on par with RTX Corp’s rating (negative outlook, mainly due to debt-financed share buybacks), but weaker than Lockheed-Martin Corp’s (A2, stable outlook) and General Dynamics Corp’s (GD, A3, positive outlook) rating.

The company’s leverage in terms of free cash flow has naturally increased due to the above-mentioned effects, but a significant improvement is expected going forward. Comparing net interest expense to free cash flow before adjusting for working capital movements (i.e. the cash more or less actually generated in a given year), Northrop’s interest coverage ratio hovers around 4-5x. That’s not great, of course, but manageable, and expected to improve going forward.

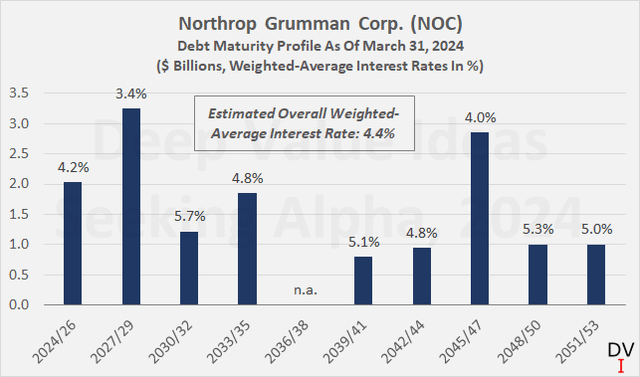

In this context, it is important to assess whether NOC’s interest expenses will increase in the future, especially due to the refinancing of upcoming maturities. However, I was pleasantly surprised that the company’s maturity profile (including the debt issuance in Q1 2024) is well-balanced. The bonds issued in Q1 had a weighted-average interest rate of 5.0% and thus had a slightly negative impact on Northrop’s overall interest rate, but I am inclined to say that this is insignificant. The company’s estimated weighted-average interest rate remains at a healthy 4.4%, and given the data in Figure 8, I expect little impact from refinancing upcoming maturities, even if the current interest rate environment prevails for the time being.

Figure 8: Northrop Grumman Corp. (NOC): Debt maturity profile at the end of Q1 2024 (own work, based on company filings)

Taken together, I think Northrop’s balance sheet is in good shape, also because of the very manageable pension-related liabilities (see this, admittedly somewhat older, article of mine). The ratio of unfunded pension liabilities to total assets has fallen by four percentage points to 3.7% (data for Q1 2024 end) since my last article, in which I gave the figure for 2021 (7.7%).

Conclusion – Why NOC Stock Is A Buy And What Investors Can Expect Going Forward

Northrop Grumman is a high-quality defense company with a healthy balance sheet and solid growth prospects. Its portfolio is well diversified, but a small number of key projects will be predominantly responsible for future growth, in addition to the expected growth in demand from Europe. The B-21 Raider program as well as the – currently somewhat uncertain – GBSD program should not only provide NOC with predictable long-term product sales, but also an increasingly strong contribution from maintenance and upgrade programs. In my view, the scale of the B-21 and GBSD programs, as well as the significant involvement in Lockheed’s F-35 program, underline Northrop’s strong economic moat.

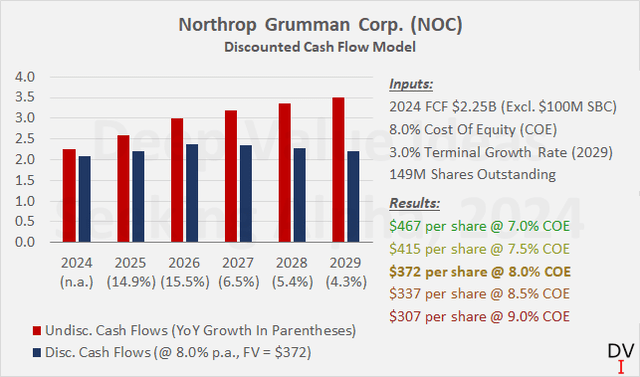

Determining Northrop’s value via discounted future free cash flows using a 2021-2023 average estimate is not the right way to approach the situation, in my view. The company is currently investing heavily in growth, so I built a bottom-up discounted cash flow model starting out from current sales and near-term growth expectations. Discussing all the details is probably beyond the scope of this article, but most importantly, I have included in my model a normalization of Northrop’s relative capital expenditures to 3.0% of sales and thus a convergence with depreciation and amortization. The resulting free cash flow growth rates are shown in Figure 9, along with other assumptions underlying the model, which also gives the fair value of NOC stock for a range of expected costs of equity.

Figure 9: Northrop Grumman Corp. (NOC): Discounted cash flow model (own work, based on company filings)

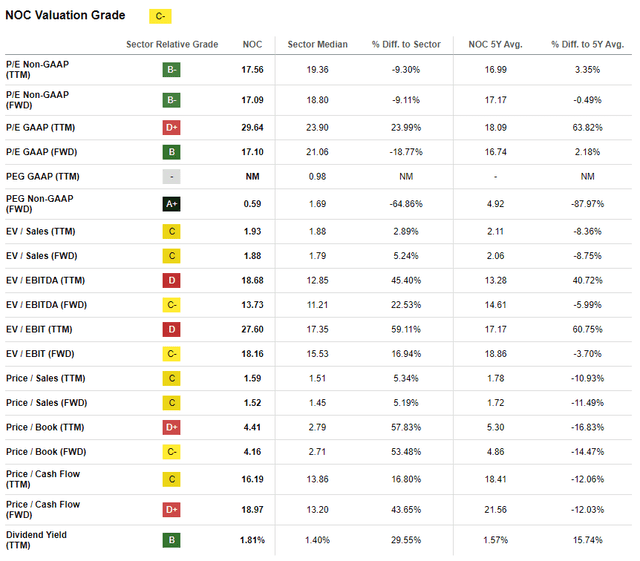

In my view, it is reasonable to use a comparatively low cost of equity given NOC’s undoubtedly strong position and solid growth prospects. However, anything below 8.0% is probably too aggressive, particularly in view of the low equity risk premium due to still high bond yields. For example, the 30-year U.S. Treasury bond currently yields 4.35%. At 8.0% and a fair value of $372, NOC shares are currently still somewhat on the expensive side today. This is also confirmed when looking at other valuation ratios (Table 1), which, however, are backward-looking and therefore do not necessarily provide a good basis for an appropriate assessment in this particular case.

Table 1: Northrop Grumman Corp. (NOC): Valuation metrics (Seeking Alpha)

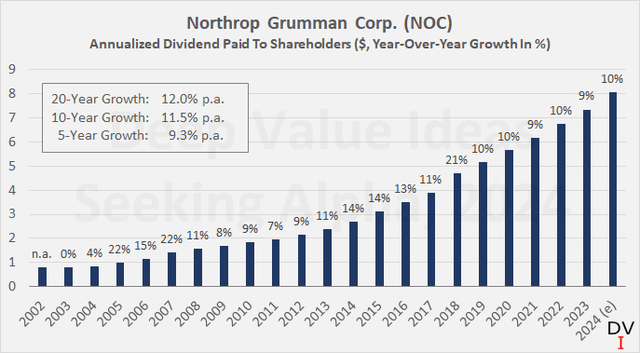

All in all, however, I think NOC is a great company at a currently fair price. The current dividend yield of 1.91% seems very low, but given the strong growth prospects, I think it’s likely that Northrop can continue to raise its dividend in the high single digits or even low double digits. The company raised its dividend for the 21st consecutive year in May 2024 by a solid 10.2%, which is in line with the long-term average (Figure 10).

Figure 10: Northrop Grumman Corp. (NOC): Historical, split-adjusted dividend track record (own work, based on company filings)

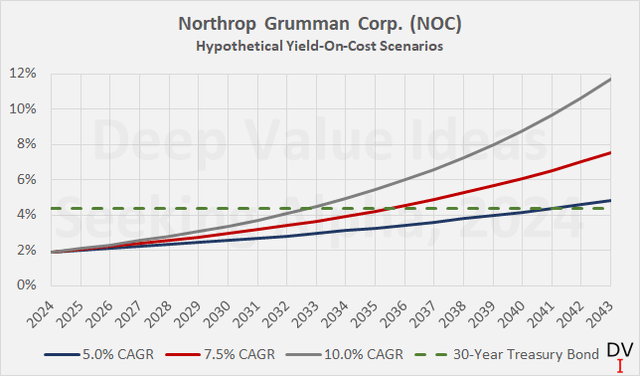

Figure 11 illustrates several possible yield-on-cost scenarios. If dividend growth slows to just 5.0% per annum, it would take 18 years for the yield-on-cost to exceed the yield of a 30-year Treasury bond. However, if an average rate of 10% per annum can be maintained, the bond’s will be surpassed in just ten years. Of course, investors should bear in mind the reinvestment risk of bonds, but of course also remember that unlike bond coupons, dividends are a discretionary payment.

Personally, I think a starting yield of 2% is acceptable to initiate a position in a stock that I expect to continue to be a solid dividend growth investment going forward. However, I am definitely not an aggressive buyer at this level, especially considering the fact that NOC stock is still somewhat on the expensive side.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Figure 11: Northrop Grumman Corp. (NOC): Hypothetical dividend growth scenarios and a comparison to the current yield on the 30-year Treasury bond (own work)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LMT, RTX, LHX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

*** Additional disclosure: I may initiate a long position in NOC stock over the next 72 hours.***

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.