Summary:

- Norwegian Cruise Line Holdings is experiencing record demand for new cruises, with strong booking and pricing trends.

- The company has an improved risk profile and valuation, putting shares into a potential buy-the-drop kind of situation.

- Norwegian Cruise Line Holdings has the potential for earnings growth through accelerated debt repayments in 2024.

dimarik

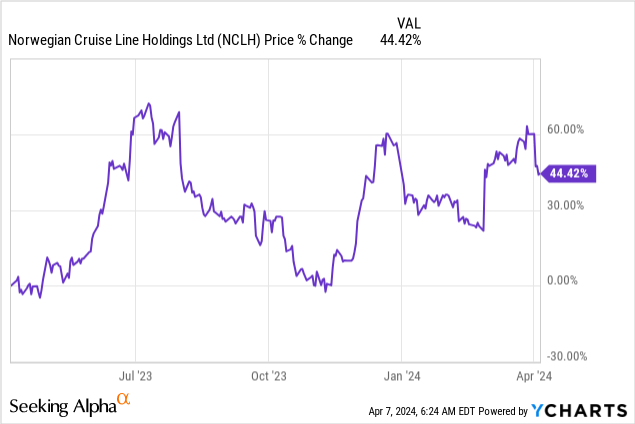

Norwegian Cruise Line Holdings (NYSE:NCLH) is seeing record demand for new ocean-going cruises amid a strong spending environment and an upward trajectory in cruise passengers after the COVID-19 pandemic. I believe the recent drop in the company’s share price is a buy-the-drop kind of opportunity considering that the company is seeing impressive booking and pricing trends in its business. With the share price dipping lately, likely due to profit taking, I believe the risk profile has improved here, and I see upside due to the company’s improved ability to make accelerated debt repayments in 2024.

Previous rating

I rated Norwegian Cruise Line Holdings a hold in December as the company saw a strong share repricing in the fourth-quarter despite a deteriorating risk situation in the Red Sea. Houthi rebels started to attack container ships in the fourth quarter, which caused some concerns about booking trends on my part. Recently, however, shares have corrected again without any major company announcement, and pricing trends have not been affected… which I believe has improved the value proposition for NCLH again. Additionally, Norwegian Cruise Line Holdings reported strong pricing and booking trends for its future ocean-going cruises and returned to full-year operating income profitability in FY 2023. An additional lever for the company’s earnings growth may come from accelerated debt repayments in FY 2024.

Strong operational conditions in the cruise line market

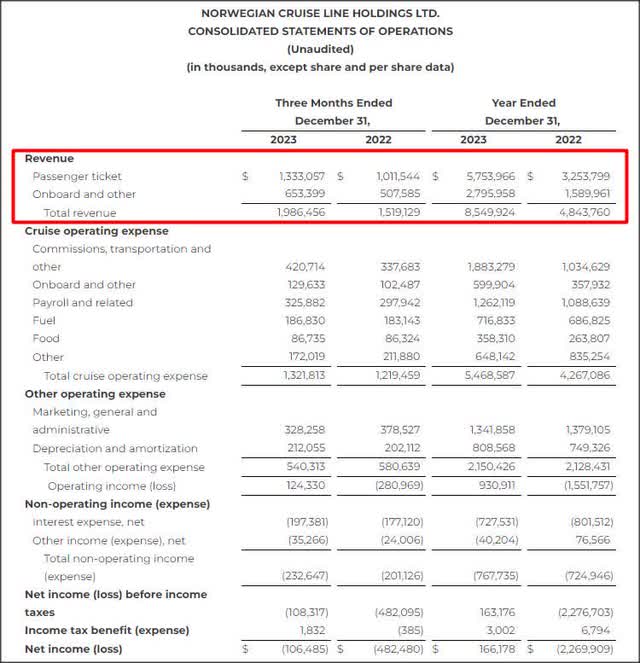

Norwegian Cruise Line Holdings generated very solid results for its fourth-quarter as well as FY 2023 due to a broad-based sector recovery that has been fundamentally supported by a post-pandemic return of passengers to cruise ships. The company’s results were released at the end of February, and they showed improving trends in all major key metrics (revenue, operating income, EPS). As a result, the cruise line company recorded very strong revenues in FY 2023: Norwegian Cruise Line Holdings generated $8.6B in total revenues, showing 77% year-over-year growth.

This growth was chiefly driven by growth in passenger ticket sales, as pent-up demand for ocean-going cruises was fully unleashed in FY 2023. As you can see below, Norwegian Cruise Line Holdings also returned to positive operating income profitability on a full-year basis in FY 2023, a major milestone achievement for the cruise line company after the COVID-19 pandemic decimated the industry. With $930.9M operating income, NCLH has seen a massive $2.5B swing in operating profitability year over year.

Norwegian Cruise Line Holdings

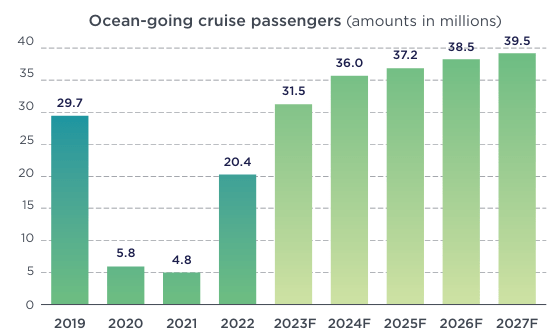

The outlook for the cruise line industry is still favorable, and strong consumer spending and falling inflation are likely contributing to this positive operating environment. According to the Cruise Line International Association, passenger volumes for the cruise line industry are continued to expect to trend up in FY 2024, which would likely lead to new passenger records for Norwegian Cruise Line Holdings.

FY 2022 and 2023 were already strong rebound years for the industry and the current year is expected to see 36M cruise line passengers which, if true, would exceed the 2019 pre-pandemic passenger record by a solid 21%. As the third-largest cruise line company by market cap, NCLH is a good way to participate in the growth of this industry. Additionally, NCLH has a stronger catalyst for earnings growth related to its balance sheet restructuring/debt repayments.

CLIA

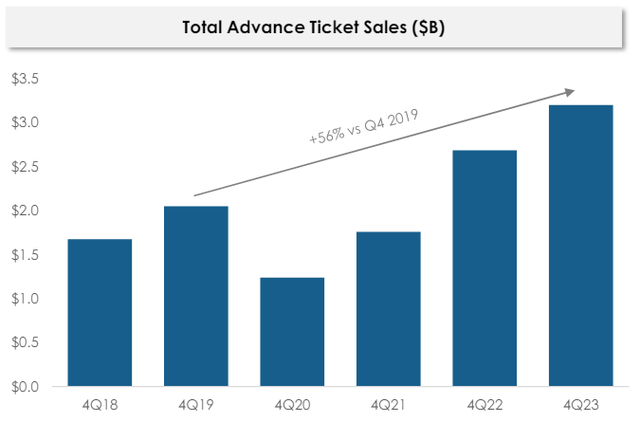

Norwegian Cruise Line Holdings is also seeing strong booking trends in its business, resulting in record advance ticket sales. The cruise line company’s advance ticket sales increased 56% compared to Q4’23, adding to the company’s pricing strength.

Norwegian Cruise Line Holdings

According to Norwegian Cruise Line Holdings’ latest earnings release, the company is seeing record pricing strength for its upcoming ocean-going cruises and recent Red Sea turmoil has not made a major dent in the company’s core business trends:

The Company continues to experience healthy consumer demand and is at an all-time high booked position and pricing reflective of some of the best booking weeks in the Company’s history beginning with Black Friday and Cyber Monday. Additionally, onboard revenue per Passenger Cruise Day remains robust, up 20% in the quarter compared to 2019, with broad-based strength across all revenue streams.

A potential lever for earnings growth for NCLH

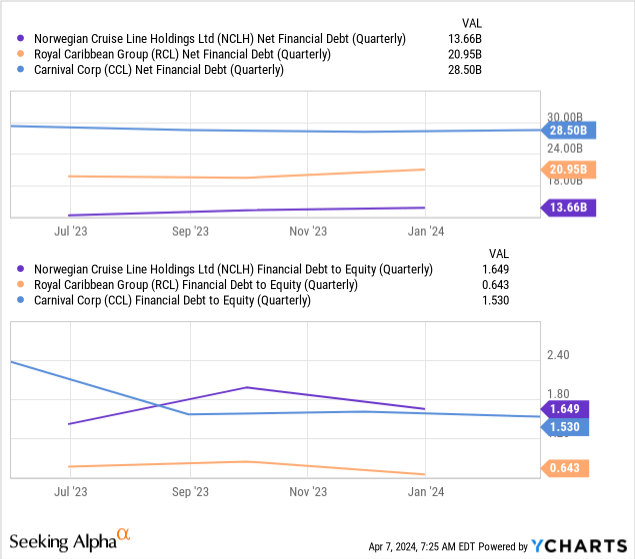

The cruise line company still has a ton of debt to service, which could weigh on the company’s valuation going forward. Norwegian Cruise Line Holdings has the highest leverage ratio in the sector, although not the highest absolute amount. Norwegian Cruise Line Holdings’ had $13.7B in net financial debt and a leverage ratio of 1.7X. Royal Caribbean Cruises (RCL) and Carnival (CCL) have more absolute levels of debt, but stronger balance sheets… leading to lower financial leverage. The average leverage ratio of the three companies discussed here is 1.3X.

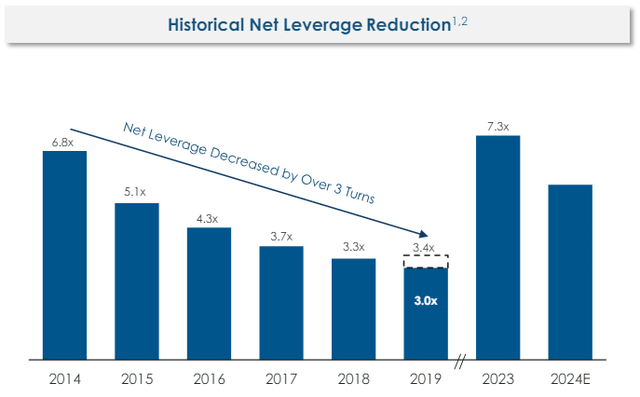

Therefore, Norwegian Cruise Line Holdings has much more potential to clean up its balance sheet and create a catalyst for earnings growth all by itself. The cruise line company therefore could boost its earnings growth going forward by restructuring its balance sheet and accelerating debt repayments… especially now that booking and pricing trends are so favorable. Norwegian Cruise Line Holdings repaid a massive $1.9B in debt last year, which included its $875 million Revolving Loan Facility.

The cruise line company has said that it will prioritize debt repayments in 2024 and further reduce its leverage ratio in a bid to optimize its balance sheet. If NCLH repays a similar amount of cash this year as it did last year ($1.9B), it could reduce its outstanding debt by approximately 14%.

Norwegian Cruise Line Holdings

Potential upside to $25

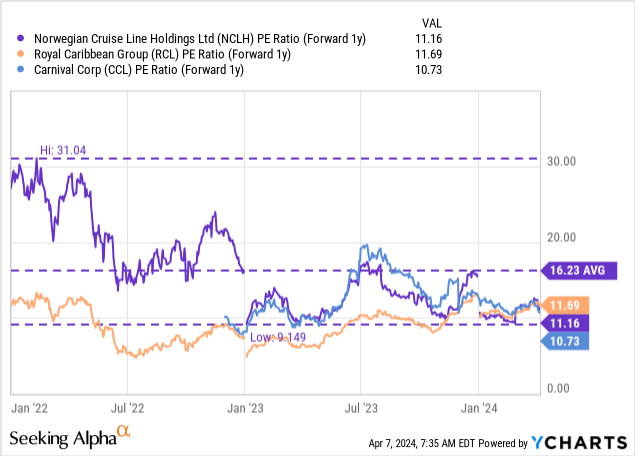

NCLH’s shares are currently valued at a P/E ratio of 11.2X, which is broadly in-line with the valuation multipliers of Royal Caribbean Group (11.7X) and Carnival (10.7X) as well as the industry average P/E ratio of 11.2X. Norwegian Cruise Line Holding is also currently trading slightly well below the 3-year average P/E ratio of 16.2X, which is another indication that shares may have a favorable risk profile for investors considering to buy the drop here.

In my opinion, Norwegian Cruise Line Holdings could trade at a 15X P/E ratio under the condition that the cruise line company manages to free up cash by repaying more debt in FY 2024 and that it brings its leverage ratio in-line with its rivals. I am using a P/E ratio because NCLH already returned to profitability in FY 2023, as did Royal Caribbean Cruises.

Norwegian Cruise Line Holdings is projected to generate stronger EPS growth this year than its rivals in the industry and the cruise line company has stronger upside in its EPS estimates, in my opinion, due to the possibility of a balance sheet restructuring… which I believe supports the buy case. NCLH is expected to generate 85% EPS growth this year, while Carnival is projected to return to profitability only this year (on a full-year basis). RCL is expected to grow its EPS 48% this year and is already profitable. In terms of EPS growth potential, NCLH seems undervalued relative to its rivals.

A fair value P/E ratio of 15X (EPS estimate of $1.69 per-share for FY 2025) — which would still be below the 3-year average P/E ratio — translates into a fair value share price of $25. My fair value estimate for NCLH is a dynamic number and will change with the progress the company is making in terms of its deleveraging and the impact this will have on the company’s EPS estimates.

Risks with NCLH

Norwegian Cruise Line Holdings is dependent on consumer spending and buoyant spending attitudes on the part of its passengers. If the industry were to see signs of slowing advance ticket sales and weakening pricing power (metrics that I monitor) then the sector may be headed for an earnings recession and the company may have to delay its deleveraging strategy. A delay in debt repayments may prevent a re-pricing of the shares, and it is therefore a key risk to the investment presentation. What would change my mind about Norwegian Cruise Line Holdings is if the company were to see falling passenger numbers and lower passenger ticket sales.

Final thoughts

Norwegian Cruise Line Holdings benefits from improving operating fundamentals in the cruise line industry, driven chiefly by a post-pandemic rebound in passenger volumes. While shares are valued broadly in-line with those of other cruise line companies, I believe Norwegian Cruise Line Holdings has a stronger lever to fuel its earnings growth going forward as the company is focused on repaying debt and has a higher leverage ratio. Booking trends have also not been affected by recent turmoil in the Red Sea, and Norwegian Cruise Line Holdings returned to full-year operating profitability last year… which are two favorable developments as well. I see shares of NCLH as a speculative buy and believe they have revaluation potential to $25!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.