Summary:

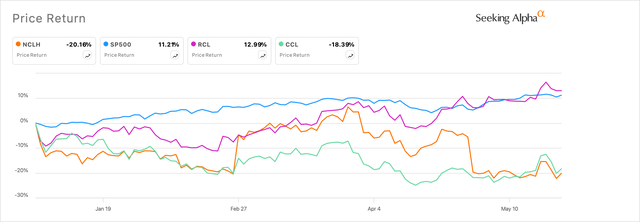

- Norwegian Cruise Line Holdings has underperformed its peers in terms of stock market returns.

- The company has updated its guidance for FY24, showing slight improvements in net yields.

- Norwegian’s focus on growth areas, such as ordering new ships and investing in private islands, could lead to additional growth in 2024.

- My models still see ~25% upside after I account for debt servicing.

Adam Smigielski/E+ via Getty Images

Investment Thesis

Barring Norwegian Cruise Line Holdings (NYSE:NCLH), cruise stocks generally enjoyed 2024 with the organic demand tailwinds in their sail. Carnival Corp. (CCL) returned over 40% in 2023, while the largest cruise operator of them all, in terms of market cap, Royal Caribbean Cruises (RCL), delivered at least twice the returns as compared to Carnival Corp. in 2023. Compared to them, Norwegian Cruise Line Holdings delivered sub-par performance, returning low double-digit returns in the stock market.

On a year-to-date basis, Norwegian’s stock continues to languish at the bottom, as seen in Exhibit A below, after projecting growth targets that missed consensus estimates.

Exhibit A: Norwegian Cruise Line’s stock has severely underwhelmed so far in 2024 (sa)

Norwegian concluded their 2024 Investor Day, which showed some improvements in contrast to their previous FY24 projections.

Based on my analysis of Norwegian Cruise Lines’ improved forecasts, I believe the stock now provides a compelling outlook, leading me to initiate a Buy rating on the stock.

Note: I will be referring to Norwegian Cruise Lines as just Norwegian in this note.

Updates to Guidance in 2024 Investor Day

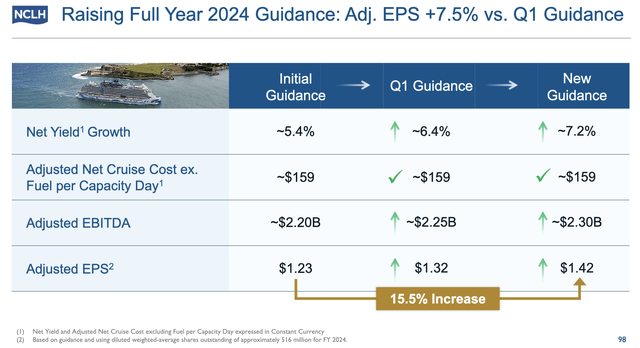

First, Norwegian’s management batted itself into a corner in their Q1 earnings call when they projected a full-year FY24 outlook for the company’s expected net yield to grow 6.4% versus FY23. Net yields are an important headline metric for cruise operators that accounts for revenues earned from passenger ticket pricing and items passengers spend onboard the cruise, such as dining, massage, onshore activities, etc., after costs such as agent commissions, transportation, and other expenses.

Per Norwegian’s management, this was supposedly an upgrade in their outlook given that they had previously forecasted net yields to grow just 5.4% y/y in FY24. Obviously, this was not well appreciated, especially when Norwegian’s peers were guiding their respective FY24 net yields to grow in the ~10% mark. This definitely put pressure on Norwegian’s management, and they came out on Investor Day with some more updates to their FY24 guidance, with net yields looking slightly better. I have added this to the table below.

|

Norwegian FY24 1st guidance |

Norwegian FY24 2nd guidance |

Norwegian FY24 final guidance |

Royal Caribbean |

Carnival Corp |

|

|

Projected Net Yield FY24 growth rate |

~5.4% |

~6.4% |

~7.2% |

~9.5% |

~9.5% |

Here’s a screenshot from their Investor Day presentation that summarizes key forward-looking metrics in Exhibit B below.

Exhibit B: Norwegian’s updated FY24 outlook (2024 Investor Day Presentation, Norwegian Cruise Lines)

Based on their updated net yield growth figures, that should translate to at least $9 billion in expected revenue this year, per slide.

One can see how Norwegian’s previous expected net yields were falling far behind the competition. This either pointed to slowing consumer trends that were uniquely seen in Norwegian’s cruise business or to management being conservative.

But Norwegian’s management sounded more optimistic in their Investor Day presentation versus their Q1 FY24 presentation as they presented growth areas that they were prioritizing.

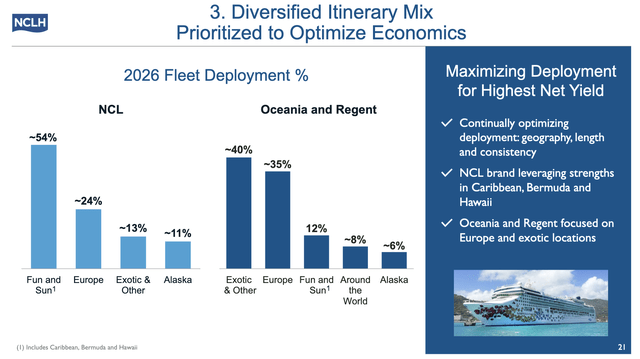

The Miami-based cruise operator mentioned they have ordered 13 new ships, 4 of which are expected to replace aging ships this year, subject to financing. Each of these 13 ships is expected to increase passenger capacity by at least 9% on a per-ship basis, with their higher-end Oceania cruise ship capacity expected to increase by over 20% and their luxury line, Regent, seeing ships that will increase capacity by 13%. This seems promising since both their Oceania and Regent lines have a share of high-net-worth-income [HNI] cruisers. I’ve added a slide below in Exhibit C that shows how management plans to deploy their ships across cruise locations by 2026.

Exhibit C: Norwegian Cruise Ship Deployment Plan by 2026 (2024 Investor Day Presentation, Norwegian Cruise Lines)

Management also mentioned initiatives around investments that focus on private islands in the Bahamas/Belize region. This was also stated by management in their Q1 FY24 call, where they mentioned investments being made, especially in the Bahamas’ Great Stirrup Cay.

Investing in private islands is a smart idea, in my opinion, and is quite similar to the strategy used by its larger peer, Royal Caribbean, since this expands the scope for passengers to spend more onboard.

The bullish case for growth in Norwegian

There are two reasons why I believe Norwegian could see additional growth in 2024, and one of them is ironically the reason that constrained Norwegian’s from issuing stronger guidance.

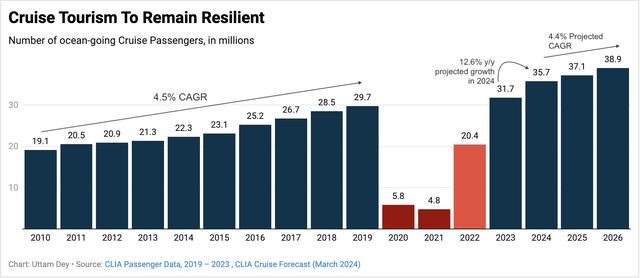

First, the entire cruise industry continues to see growth in 2024, and most cruise operators announced record bookings in their individual Q1 earnings reports. According to the CLIA, as seen in Exhibit D, the number of ocean-going passengers is expected to rise by 12.6% in 2024, and growth is supposed to normalize between 2024 and 2026 at a ~4.4% CAGR more in line with the pre-pandemic growth rates of 4.5%.

Exhibit D: Cruise tourism to remain resilient in FY24 (CLIA)

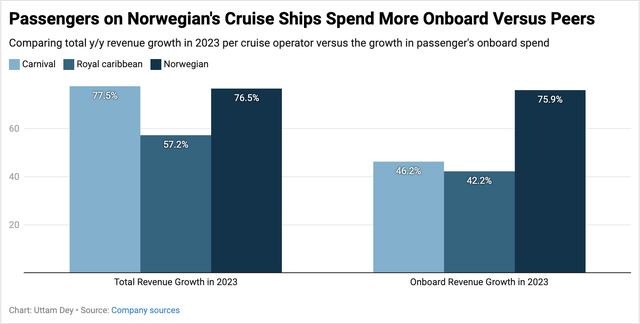

The second reason that I find unique to Norwegian is based on the strength of their cruise passenger demographic, which sees them spend a lot more on the cruise. Per the Investor Day presentation, 84% of the company’s bookings originate from the USA/Canada region and are a mix of GenX and Millennial higher income passengers. The mix of HNI cruisers means more spending while on the cruise in addition to revenues that are earned from ticket bookings. In Exhibit E, I show how higher spend by passengers onboard Norwegian’s cruise vessels meant Norwegian saw relatively higher Onboard Revenue growth in FY23.

Exhibit E: Norwegian’s passengers spend relatively higher once onboard the ship (Company sources)

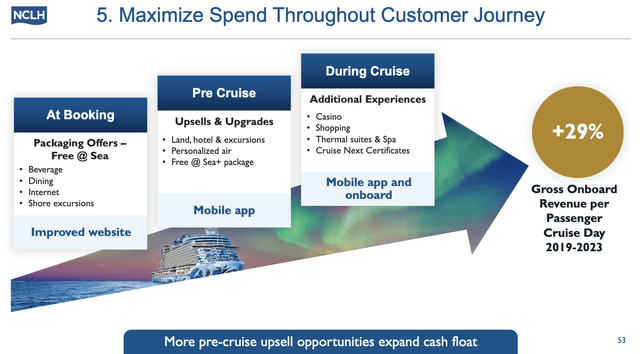

In my opinion, this is a very meaningful revenue segment for Norwegian because Onboard Revenue accounted for ~49% of Norwegian’s revenues in 2023. Here’s another slide from their Investor Day that shows how customers spend onboard Norwegian’s cruise ships.

Exhibit F: Passengers spend on Norwegian’s Cruise Ships (2024 Investor Day Presentation, Norwegian Cruise Lines)

Given that cruise operators have reported strong bookings through Q1, I believe these trends will uniquely boost Norwegian’s outlook as we proceed through the year when most cruises have already set sail. I believe management will be conservative in guiding FY24 numbers since it is usually easier to predict bookings from ticket sales than onboard revenue.

These trends, in my opinion, will create lumpy performances in the first half of FY24 but should get better as we move through the second half of FY24, assuming there are no macroeconomic shocks that reverse the consumer spending outlook.

Norwegian’s Capital Structure Risks

I will admit that Norwegian’s balance sheet is a big risk, especially if the economy swings into recession, halting all consumer spending, especially discretionary spending.

There is no secret here that Norwegian is a debt-heavy business, which has gotten even larger after the company had to raise its debt levels by almost two times while at the same time diluting its share base to raise enough funds to keep the business afloat.

Per its recent 10-Q, Norwegian is severely indebted, carrying ~$14 billion in debt and about half a billion in cash. That means Norwegian will have to walk a thin line, refinancing its debt at interest rates it deems most favorable for itself and its shareholders while raising its cash flow outlook.

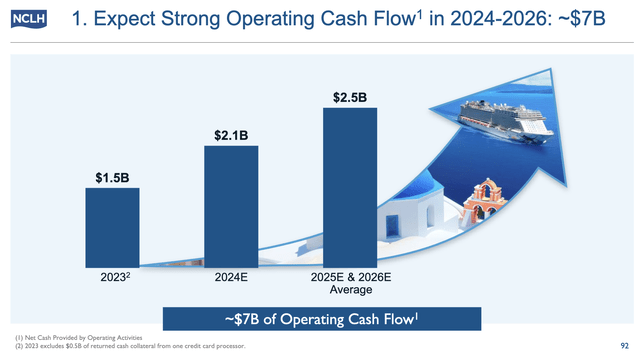

But as long as demand sustains and consumers continue to spend on cruises, Norwegian should be able to inch closer to holding debt leverage closer to its pre-pandemic levels. Management has issued some meaningful guidance towards raising cash flow targets into 2026, as I have attached in Exhibit G below.

Exhibit G: Norwegian’s FCF targets through FY26 (2024 Investor Day Presentation, Norwegian Cruise Lines)

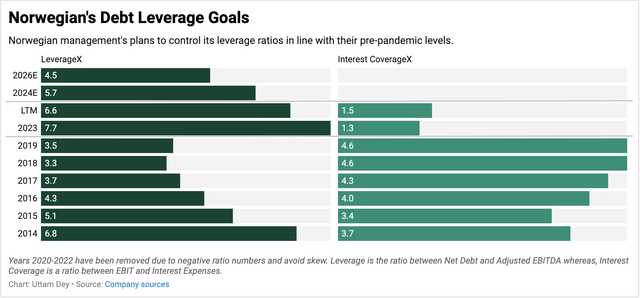

At the same time, management has also guided towards driving its debt leverage lower to its pre-pandemic levels, as I have illustrated in Exhibit H. While its interest coverage ratios are still low, I expect them to be higher based on my outlook for their adjusted EBITDA and management’s FCF outlook.

Exhibit H: Norwegian’s Debt Leverage Goals versus past trends (Company sources)

Despite its debt load, Norwegian has upside

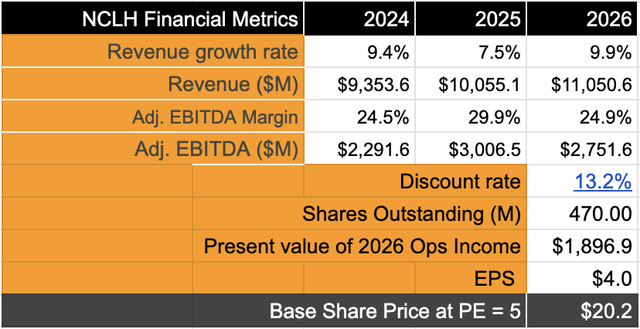

My valuation models suggest that after I account for all the interest expenses towards servicing its high debt levels, I still believe Norwegian has upside. Here are my assumptions:

-

As laid out in Exhibit B and other sections, I expect sales will grow faster than their guidance levels. For now, I assume growth rates are in line with the cruise market and its peers in the high single digits. I also expect the total market growth rates to improve through the year, so I may update my revenue growth rates for Norwegian higher through the year.

-

I expect management to achieve at least 20 b.p. of adjusted EBITDA margin expansion on average per year between 2024 and 2026. Note that management has already guided FY24 adjusted EBITDA of around ~2.3 billion, which represents a margin expansion of 270 bp.

-

Discount rates of 13.2% to account for higher risk due to its debt load versus some micro-assumptions.

-

I have assumed a significantly higher share outstanding base of ~470 million. This is because Norwegian’s management has already guided a share dilution of ~$90 million, or ~10%, in FY24 to service some of its debt. I have added slightly higher dilution rates to account for the margin of error. Post FY24, I expect dilution rates to stabilize to ~1% as higher FCF yields should help in servicing debt.

Exhibit I: Norwegian’s Valuation Model (Author)

Based on my forecasts, I estimate adjusted EBITDA to be growing 13–14% while revenue should be growing in the 8–9% range. This should warrant a double-digit forward earnings multiple if I compare Norwegian’s EBITDA growth rate to the S&P 500. However, after I account for ~$750 million of interest expenses to service debt, the net adjusted EBITDA left for investors to value implies a forward PE of ~5.

Based on my calculations, after accounting for debt servicing, I believe Norwegian still has between 24 and 26% upside. Of course, the company’s capital structure risks make this less appealing, leading me to recommend a Buy rating. Otherwise, I would have attached a Strong Buy rating.

Takeaways

Norwegian Cruise Line does have enough reason for investors to be skeptical about the stock. The inability to guide towards higher growth rates on par with its peers has not appealed to investors so far in 2024. At the same time, the company’s capital structure makes this less favorable to a broader range of investors.

However, I see strong demand in the cruise business, which should keep the momentum going for Norwegian. Plus, Norwegian’s unique customer mix of high-net-worth individuals should propel the company’s revenues higher into FY24.

I recommend a Buy on Norwegian Cruise Line’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.