Summary:

- Norwegian is expecting a strong demand environment to continue on high travel demand even as consumer sentiment is slow to recover.

- Industry peers are also guiding for a similar future, creating my credibility for the bullish forecast.

- Norwegian has a more attractive valuation than its peers making the company attractive.

Joe Raedle

Introduction

After years of losses since the onset of the pandemic, the cruise industry has been diligently recovering from strong travel demand. Finally, in 2023, with sustained travel demand, some major players are expected to turn a profit, and Norwegian Cruise Line (NYSE:NCLH) is one of that cruise lines. The company reported earnings on May 1st. During the earnings call, the company guided for a strong demand environment to continue throughout 2023 on strong travel demand. As this view is in line with the industry guidance, I believe it is reasonable to argue that the Norwegian Cruise Line will see an exception in 2023. Thus, despite a significant debt load, I am rating Norwegian Cruise Line as a buy as there are no signs of slowing travel demand. As long as the demand environment stays positive, the company will have ample room to work to deleverage its balance sheet.

Strong Company Outlook

During the earnings call, the company’s management team laid out optimistic views by saying that the “target consumer remains resilient with a persistent desire for travel and experiences.” Further, even the forward-looking indicator, the booking window, “remain[ed] strong.” This shows the strength and the potential longevity of the current travel trend as the “banking sector-driven financial market volatility in March” did not lead to ” any unusual booking or cancellation activity.” Finally, the company’s onboard revenue generation was also “performing exceptionally well.”

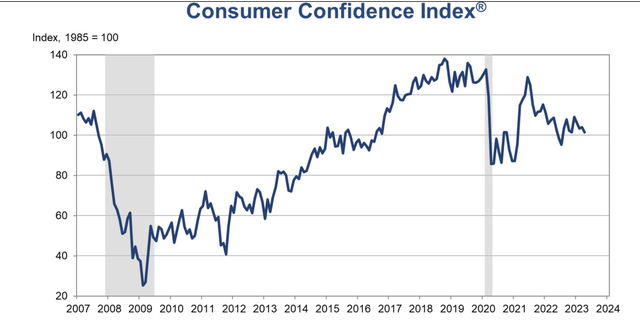

I viewed this commentary to be significant. As the picture below shows, US consumer confidence has been struggling to recover. In fact, in recent months, consumer confidence levels were shifting downwards, and because cruising is discretionary spending, it could have been one of the first expenses to cut. However, as the Norwegian’s earnings call indicates, in the current situation after the pandemic, I believe consumers, despite some economic turmoil, are valuing experiences such as cruising and travel far higher in their budget leading to the current resiliency in the industry. Therefore, despite some potential macroeconomic turmoil throughout 2023, I continue to believe that the demand environment will be positive for Norwegian Cruise Line.

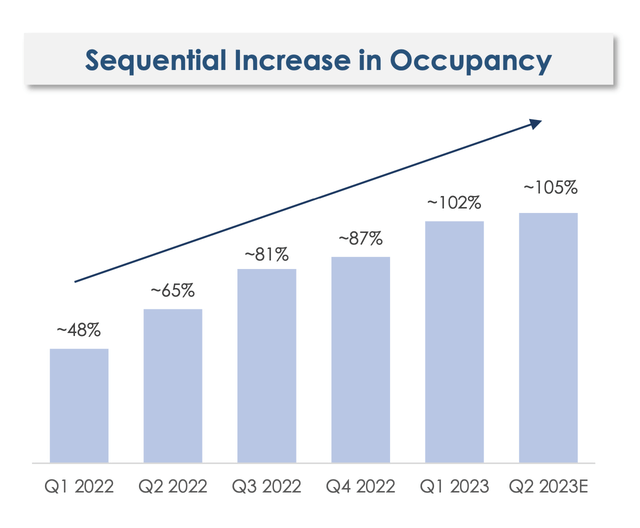

Finally, the company’s strong demand outlook and bullish occupancy rate expectation, as the chart below shows, come even after a capacity increase. In 2023, the total capacity is expected to be about 18% higher than in 2019 levels. Then, throughout the decade, the company is expecting a continued sequential capacity increase to about a 28% increase in capacity from an estimated 2023 level.

Norwegian Cruise Line Holdings

I believe this data shows the current magnitude of the travel demand environment as the occupancy rate is expected to hover over 100% even with an aggressive capacity increase.

Industry Outlook Supports This View

Supporting the Norwegian Cruise Line’s views, industry peers also share the same positive demand environment views for 2023.

Royal Caribbean (RCL) in their earnings call had similar views as the Norwegian Cruise Line. The company said they are experiencing bookings outpacing “2019 levels by a very wide margin” and continues to expect a “strong WAVE season.” This commentary comes even after the company’s capacity increase in 2023.

Carnival Cruise Lines (CCL) also had a similarly positive demand environment forecast. Although Carnival is still closing the demand gap compared to 2019, the company said that they “are still experiencing a record wave season,” and the company continues to expect these “favorable trends to continue.”

As the major players in the industry including Royal Caribbean and Carnival Cruise Lines also share a similar demand environment view with Norwegian Cruise Line, I believe it is reasonable to expect continued favorable demand for Norwegian further solidifying the bullish argument.

Valuation

Norwegian’s valuation is relatively cheap compared to the industry peers.

Norwegian currently trades at a forward price-to-earnings ratio of about 18.6, which is slightly lower than the Royal Caribbean’s 19.7. In comparison to Carnival, Norwegian boasts a significant valuation of multiple advantages as Carnival is not expecting to report a profit in 2023. Further, looking at the 2024 forward pe ratio, Norwegian’s multiple sits at about 9.3 while Carnival and Royal Caribbean’s ratio is about 12.4 and 11, respectively. Although all three companies are seeing a similarly strong demand environment, Norwegian Cruise Line has the most favorable valuation metrics compared to its peers.

Risk to Thesis

The biggest risk to the current bullish thesis is Norwegian’s balance sheet. Due to the pandemic, the company’s liability is burdening. According to the 2023Q1 earnings report, the company’s total assets stand at about $18.35 billion with a total liability of about $18.45 billion leading to an over 100% total liability to asset ratio. Further, about $11.9 billion of the total liability is from a long-term debt load leading to burdening interest payment levels. In the 2023Q1 quarter, the company paid about $171 million in interest expenses, which is significantly higher than about $73.5 million in 2019Q1. Considering that the quarterly interest expense accounts for about 15% of the quarterly revenue, a macroeconomic condition weakening leading to a reduced travel demand environment could pose a significant risk to the company.

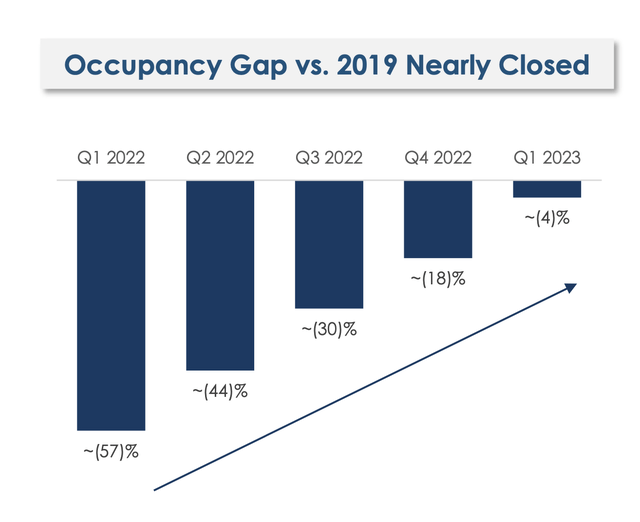

As the picture below shows, the company said that the occupancy rate difference in the first quarter compared to 2019 levels was only 4%. Yet, in 2019, the company reported a net income of about $118 million compared to a net loss of about $159 million in 2023. Interest burden was not the only reason for the difference as significant inflationary pressure led to an increase in operating expense, but as this elevated expense environment is not likely to subside to pre-pandemic levels, a weaker demand environment will likely be detrimental. Thus, investors should closely track the overall consumers’ willingness to continue traveling throughout 2023.

Norwegian Cruise Line Holdings

Summary

On the back of a strong travel demand, Norwegian Cruise Line is expected to perform well throughout 2023. The company and industry peers are all forecasting a strong demand environment even as consumer sentiment levels are struggling to recover showing consumers’ willingness to travel. Further, with the expected continued capacity increase, Norwegian is expected to enjoy a strong tailwind. Therefore, despite elevated debt levels, I believe Norwegian Cruise Line is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.