Summary:

- Norwegian Cruise Line Holdings is experiencing improving operating fundamentals and profits from booming demand for cruises.

- The firm has seen a strong increase in advance ticket sales and passenger ticket revenues, and returned to positive operating income.

- Norwegian Cruise Line Holdings has a strong outlook for FY 2023 and raised its adjusted EPS guidance.

- While the amount of debt is a concern, shares of NCLH remain cheap and have an attractive risk profile after the Q2 earnings drop.

Marina113

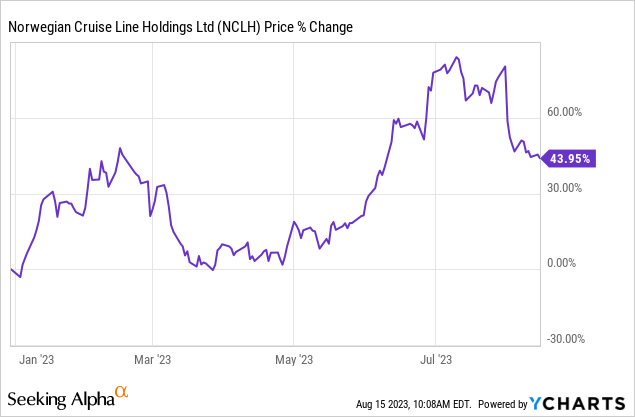

Norwegian Cruise Line Holdings (NYSE:NCLH) has seen a strong improvement of operating fundamentals after the pandemic and the cruise line company’s 20% price drop after presentation of Q2 earnings is a buying opportunity, in my opinion. Norwegian Cruise Line Holdings is also trading at a compelling price-to-earnings ratio of only 11X and the cruise line company is seeing strong demand for its cruises. With operating fundamentals improving and analysts expecting a significant year-over-year increase in earnings in FY 2024, I believe Norwegian Cruise Line Holdings is not only cheap, but also has a risk profile that is skewed to the upside after the Q2 earnings report!

Improving operating fundamentals

Norwegian Cruise Line Holdings continues to benefit from the unleashing of pent-up demand in the cruise line market. The COVID-19 pandemic obviously disrupted the cruise line business quite significantly in 2020 when regulations resulted in a complete shutdown of the industry. But the pandemic is in the rearview mirror and Norwegian Cruise Line Holdings is seeing a fundamental improvement in operating conditions.

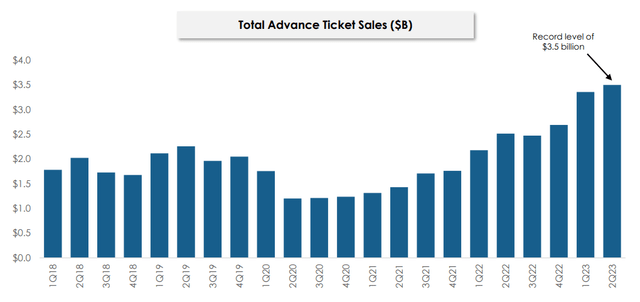

One indicator that proves booming demand for cruises is the number of advance ticket sales, which of course is a measure of demand. Norwegian Cruise Line Holdings received its highest amount of advance ticket sales worth $3.5B in Q2’23, indicating that people continue to hunger for the cruise line experience.

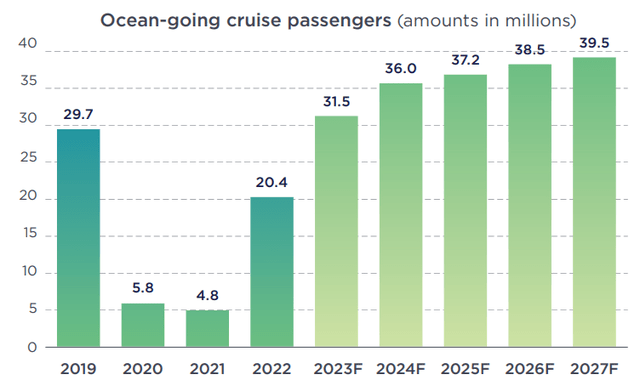

According to projections made by the Cruise Lines International Association, an industry advocacy group, 31.5M passengers are expected to go on a cruise in FY 2023, showing an increase of 54% compared to the year-earlier period and the number of passengers is also expected to continue to increase in the coming years. However, year-over-year growth rates in passenger volumes are projected to decelerate until FY 2027.

Source: Cruise Lines International Association

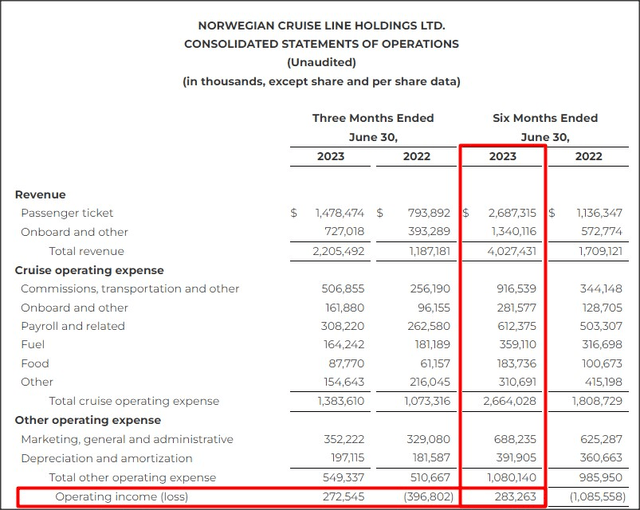

Improving operating conditions in the cruise line industry have translated into significantly higher passenger ticket revenues for Norwegian Cruise Line Holdings. The cruise line company reported an 86% increase in Q2 passenger ticket revenues and a 137% increase in H1 passenger ticket revenues. Total H1’23 revenues reached $4.0B, a post-pandemic high, and Norwegian Cruise Line Holdings once again managed to disclose positive operating income of $283M for the first six months of FY 2023. With revenues soaring and operating income turning positive again, I believe NCLH has room for a re-rating to the upside…

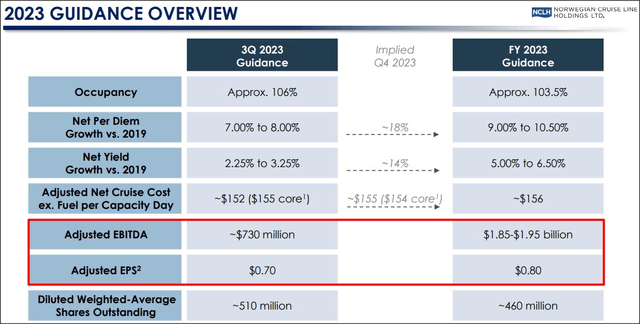

Strong outlook and guidance raise

FY 2023 is going to be a strong year for the cruise line industry from a profitability perspective as millions of passengers are set to return to cruise ships worldwide. Due to strong fundamentals and increasing passenger numbers, Norwegian Cruise Line Holdings projects $1.85-1.95B in adjusted EBITDA for FY 2023 which would represent a massive improvement over the FY 2022 adjusted EBITDA loss of $673.9M. Compared to February 2023, Norwegian Cruise Line Holdings also raised its adjusted EPS guidance from $0.70 per-share to $0.80 per-share.

Valuation of NCLH compared against other cruise line companies

Operating conditions in the cruise industry have profoundly improved following the shutdown of the industry in FY 2020 which was then followed by a 2-year long and painful recovery. However, FY 2023 is looking to be a record year, not just for Norwegian Cruise Line Holdings, but for the entire cruise line industry as well and analyst expected considerable EPS growth for all three major cruise line companies in the short term.

Norwegian Cruise Line Holdings currently offers the best deal, in my opinion: the firm’s potential is valued at a P/E ratio of 11.5X compared to P/E ratios of 17.3X for Carnival Corporation (CCL) and 12.7X for Royal Caribbean Cruises (RCL). Of all three cruise line companies, Norwegian Cruise Line Holdings has the largest expected EPS growth next year and the lowest P/E ratio.

|

Share Price |

Est. EPS FY 2024 |

Y/Y EPS Growth |

P/E Ratio |

|

|

Norwegian Cruise Line |

$17.80 |

$1.55 |

85% |

11.5x |

|

Carnival |

$16.83 |

$0.97 |

— |

17.3x |

|

Royal Caribbean |

$103.75 |

$8.17 |

35% |

12.7x |

(Source: Author)

One problem with Norwegian Cruise Line Holdings

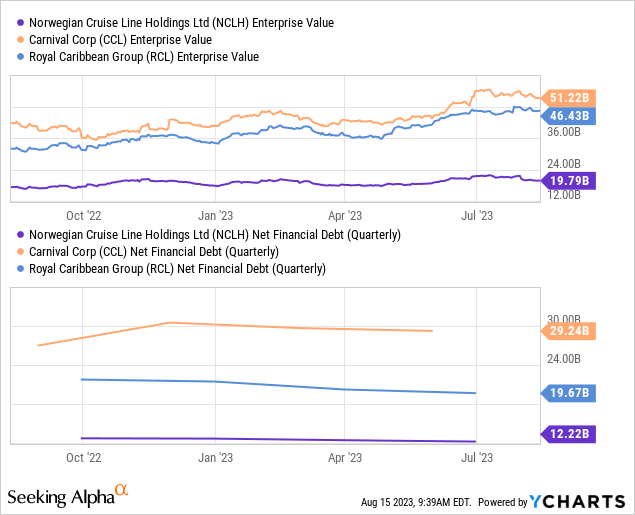

One thing that I don’t like about Norwegian Cruise Line Holdings is that the company carries a lot of debt on its balance sheet. In total, Norwegian Cruise Line Holdings owed more than $12.2B in net financial debt at the end of the second-quarter and the industry as a whole is very much indebted as well. All three cruise line companies owe a considerable amount of debt with Carnival Corp. owing the most. Huge debt loads cost a lot of money (NCLH paid $177.7M in interest expenses just in Q2’23) and Norwegian Cruise Line Holdings would have to repay some of this debt down in order to clear the path for a higher valuation.

Risks with Norwegian Cruise Line Holdings

There are a number of risks with Norwegian Cruise Line Holdings, including the potential for new pandemics which could lead to another complete shutdown of the cruise line industry. Another risk that I see relates to the high amount of debt that the industry as a whole is shouldering. Ocean-going cruises are further expensive and subject to general consumer spending trends. A recession or any event that causes spending cutbacks would likely be a negative catalyst for the cruise line industry.

Closing thoughts

Norwegian Cruise Line Holdings is an attractive investment, in my opinion, after the company’s share price dropped after the Q2 report. Norwegian Cruise Line Holdings benefits from booming demand (soaring advance ticket sales) for cruises around the world and operating trends have fundamentally improved compared to the pandemic period.

Demand and revenues are in a strong upswing following the pandemic, passenger numbers are forecasted to keep growing and the company raised its profitability outlook for FY 2023. Considering that Norwegian Cruise Line Holdings is valued at just 11X P/E and is expected to see 85% EPS growth next year, I believe shares have a risk profile that is skewed to the upside after the post-Q2 price drop!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.