Summary:

- Norwegian Cruise Line Holdings Ltd. stock slumped following solid Q2 2023 earnings.

- The market was disappointed with the guidance, but the management team is conservative.

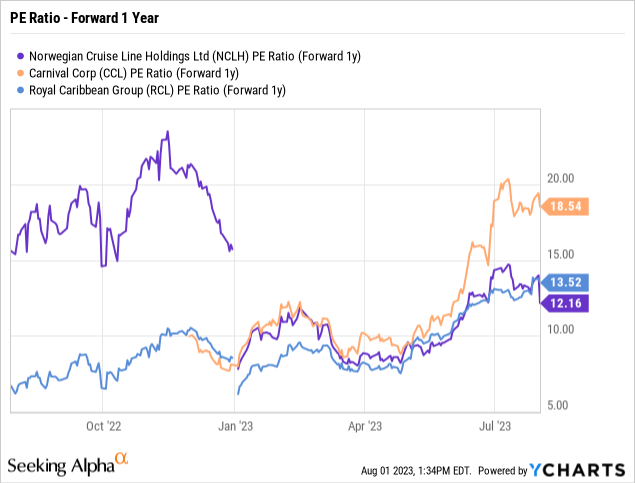

- Norwegian Cruise Line Holdings stock is now the cheapest of the cruise lines at only 12x ’24 EPS targets.

Tramino

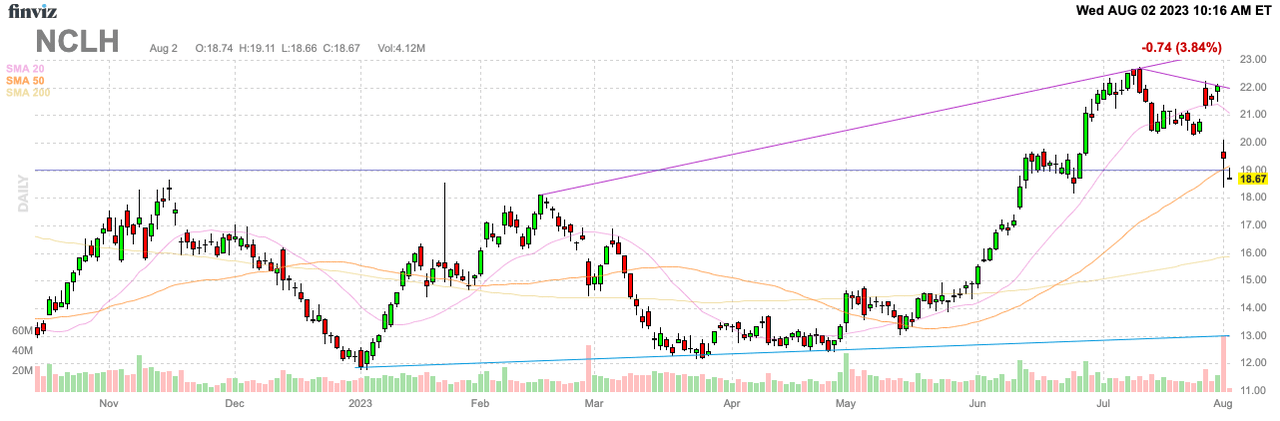

The market didn’t like the Q2 2023 earnings report from Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH), but the company delivered strong numbers. The cruise line has now returned to reporting strong profits after several years of massive losses. My investment thesis remains ultra Bullish on the stock, though the easy money is clearly over after Norwegian nearly doubled in the last few months.

Market Wanted More

The stock fell 12% following earnings, as the market clearly wanted to see Norwegian guide up more for 2023. The stock had soared heading into earnings, so a dip isn’t all that surprising.

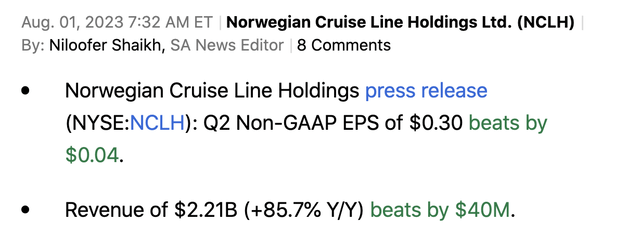

The cruise line beat Q2’23 consensus estimates as follows:

The reported numbers were very solid, but the issue popped up with the Q3 and full year guidance. Though, the market always seems to forget the concept of management providing conservative numbers.

Norwegian only guided to a Q2 EPS of $0.25 and ended up reporting $0.30 in the quarter. The company guided to an EPS of $0.70 for Q3 and $0.80 for the year, up $0.05 from the prior guidance of $0.75 for 2023.

The issue here is that analysts were forecasting $0.79 for Q3 and already had targets up at $0.80 for the full year. Technically, the updated guidance from Norwegian forecasts a slightly higher EPS in Q4 from the current analyst estimates for a small loss, but the market is interpreting the issue as all negative.

The odd part of the story is that cruise lines are back to reporting solid beats now that the business is more predictable based on past trends without any regulatory hiccups from Covid. Norwegian just beat Q2 numbers easily and investors should assume some conservative guidance for Q3 as well.

Another issue Norwegian will slowly overcome is the excessive interest expenses. The company spent $171 million on interest expense in Q2 and forecasts the number jumping to $185 million in Q3 due to higher interest rates.

The cruise line was only spending ~$70 million per quarter on interest expenses. A huge difference in the EPS earned back in 2019, and now is the up to $450 million in annual higher interest expenses.

As the company lowers debt levels from the current net levels of $12.2 billion, interest expenses will dip and EPS and cash flows will rise.

New Highs

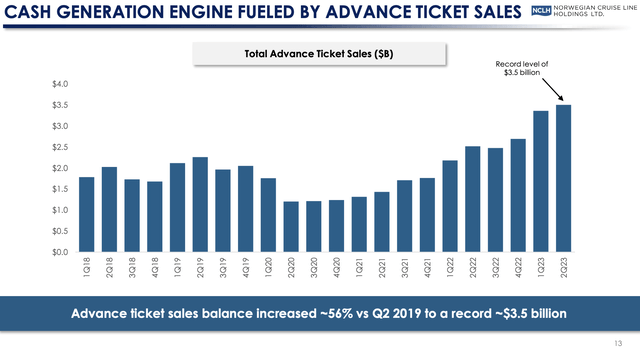

Norwegian is generating higher yields and the advance ticket sales are nearly double prior levels at $3.5 billion. The cruise line is operating with higher capacity at levels 19% above Q2’19 levels and forecasting net yields jump at least 5% from 2019 levels.

Source: Norwegian Q2’23 presentation

As our thesis has long discussed, Norwegian should be able to regain the 2019 EPS levels despite higher share counts and existing debt issues. The company forecasts capacity growth levels reaching 50% by 2028.

The market hasn’t always grasped that the cruise sector will have higher capacity and higher ticket prices. If not for all of the Covid impacts, the cruise lines would have far higher profits by now, some 3 years after the shutdowns.

The company provided no reason for analysts to alter the targets for EPS to nearly double next year to $1.54. The stock only trades at 12x forward EPS targets making Norwegian a bargain in the cruise line sector, especially after the dip following earnings.

Norwegian still has a massive path back to prior EPS levels of $5. Analysts aren’t even forecasting the cruise line to approach 50% of 2019 EPS levels of $5 as fully diluted shares swell to 460 million for the full year, or double 2019 levels.

Takeaway

The key investor takeaway is that Norwegian Cruise Line Holdings Ltd. stock is too cheap here at only 12x forward EPS targets. The cruise line has a path to much higher earnings from improving margins, and the ability to cut interest expenses down the road will provide an immediate boost to EPS.

Investors should use any weakness to load up on Norwegian.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.