Summary:

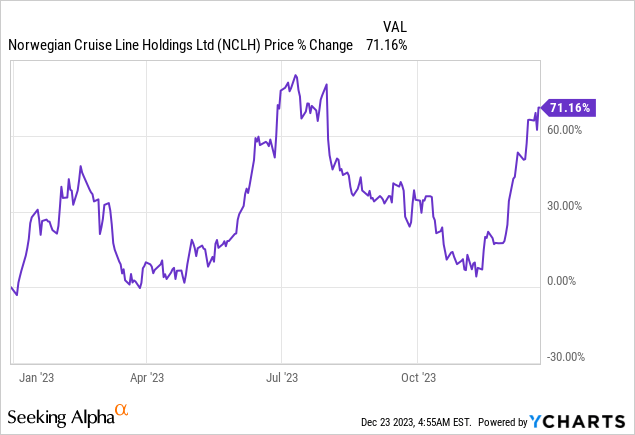

- Norwegian Cruise Line Holdings has seen a strong share price revaluation since November.

- The company’s outlook for FY 2024 is overall solid, but risks are growing.

- The recent turmoil in the Red Sea and the Middle East conflict pose risks to the company’s booking situation and growth potential.

jgroup

Norwegian Cruise Line Holdings (NYSE:NCLH) has seen a strong share price revaluation since the beginning of November. The cruise line company benefited from an improving industry outlook throughout FY 2023 and advance ticket sales recently hit a record for the company. The outlook for the cruise industry has blemished a little bit, however, due to the escalation of the war in Israel as well as attacks on container shipping in the Red Sea. Norwegian Cruise Line Holdings already warned of a deteriorating outlook for the Middle East recently as well. With shares revaluing sharply higher since November and the risk profile deteriorating, I believe a downgrade to hold is the most sensible response to recent industry developments.

Previous coverage

I recommended investors to “Buy The Drop” in August as the company’s and the industry’s prospects for a normalization of conditions in the cruise line market steadily improved. Booking trends and the overall industry outlook in terms of passenger numbers, expected for 2023, also looked attractive. However, due to growing turmoil in the Red Sea, which is related to the Israel-Gaza conflict, the risk profile for cruise line companies has deteriorated recently and I am treading a little bit more carefully here, especially after Norwegian Cruise Line Holdings has had such a strong run-up in price in the last two months.

The risk matrix is changing

Besides a much higher valuation since my last work on the cruise line company, the risk situation has not exactly improved. in response to the war in Israel, Houthi Rebels have started to attack container ships in the strategically important Bab el-Mandeb Strait which caused a number of shipping companies to suspend their routes in the Red Sea. This has already led to an uptick in container freight rates and longer transit times. But these troubles are not just limited to container shipping companies.

Increasing tensions in the Middle East also have the potential to disrupt the company’s regional cruise outlook and its booking situation.

In the third-quarter earnings release, Norwegian Cruise Line Holdings warned of a deteriorating booking trend affecting routes to the Middle East and specifically announced that it would stop all port calls in Israel for the coming year. According to Norwegian Cruise Line Holdings’ Q3’23 disclosures, the Middle Eastern market accounts for 4% of capacity in FY 2024:

In addition, as a result of the escalation of the conflict in Israel, the Company has cancelled and redirected all calls to Israel and certain calls to the surrounding region for the remainder of 2023. The Company is also in the process of cancelling all calls to Israel in 2024 as well, and will continue to closely monitor and evaluate future sailings and adjust as needed. Prior to the conflict, approximately 7% of capacity in the fourth quarter of 2023 and 4% of capacity for the full year 2024 visited the Middle East.

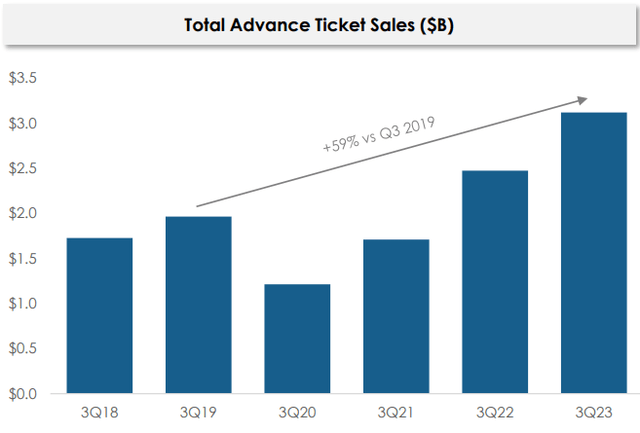

Norwegian Cruise Line Holdings’ overall booking situation was healthy in the third-quarter, however, as the company did report strong growth in advance ticket sales. Despite a dip in bookings related to the Hawaii fires and the war in Israel, the cruise line company had approximately $3.1B in advance ticket sales… which was almost 60% higher than in the third quarter of 2019, the year before the COVID-19 pandemic decimated the cruise line industry.

Norwegian Cruise Line Holdings

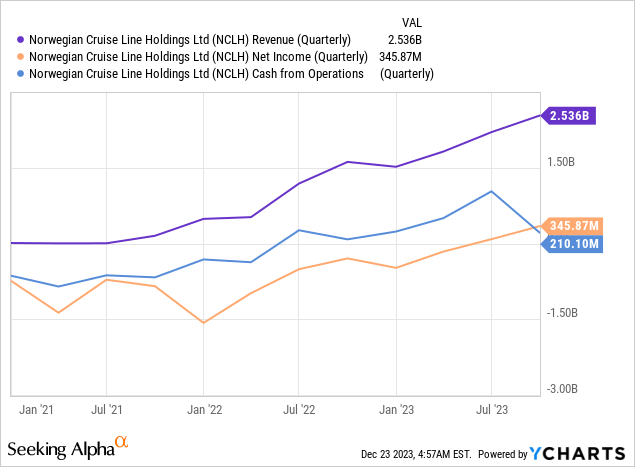

Booking trends overall remained solid and Norwegian Cruise Line Holdings’ said that its pricing trends for cruises overall were also strong in the third-quarter. The cruise line company has seen a massive rebound in its revenues, cash flow and net income in the last three years and 2024 could still be a strong year overall for the cruise line industry, as I explained here. However, risks are also growing and since the cruise line company already warned of its exposure to the Middle East, I have used the run-up in price to reduce my position by 60% and use a stop-loss to protect the remaining 40% (stop-loss at $20).

The recent escalation in the Middle East is a concern that investors may want to take seriously, especially if attacks on sea-borne traffic routes escalate. Attacks are so far limited to container ships, but a potential attack on a cruise ship would drastically change the calculus for cruise line companies that serve the Middle East.

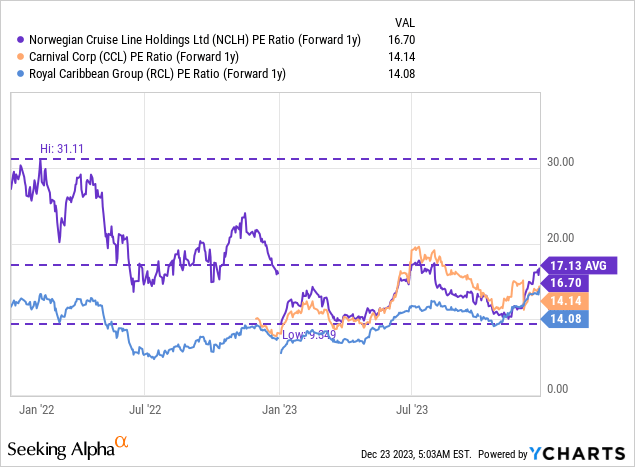

Norwegian Cruise Line Holdings’ valuation vs. rivals

Cruise line companies across the board have enjoyed fundamental valuation recoveries in the last two months. Norwegian Cruise Line Holdings is trading at a P/E ratio of 16.7X which means shares are trading very close to their 3-year average price-to-earnings ratio of 17.3X and I see limited upside here given the changing risk matrix. Cruise line companies Royal Caribbean (RCL) and Carnival (CCL) are trading at slightly lower price-to-earnings ratios of 14X, but the same risk considerations apply to them as well.

Risks with Norwegian Cruise Line Holdings

I believe a buy rating at this point is not justified considering the challenges that the cruise line industry faces, first in Hawaii and then in the Middle East. The escalation of attacks on container ships is also a dangerous development that could make the Middle Eastern cruise line market less attractive. The suspension of port calls to Israel through all of 2024 is also a concern.

Final thoughts

The security situation undoubtedly deteriorated in the last two months and the share price of Norwegian Cruise Line Holdings has not yet reacted to the changed risk matrix. Norwegian Cruise Line Holdings already warned that the security landscape in the Middle East deteriorated and that it was affecting its bookings. While Norwegian Cruise Line Holdings and its rivals are clearly benefiting from a post-COVID normalization of operating conditions in the cruise line industry, I believe a risk-driven rating downgrade appears justified. Considering that shares are also trading near its longer term P/E average, I reduced my position size by 60% and evaluate NCLH as a hold only!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.