Summary:

- NCLH continues to show evidence of a successful turnaround; the company generated revenues and EPS of $2.4 billion and $0.40, indicating year-on-year growth of 8% and 33% respectively.

- For the third time this year, NCLH has raised guidance for FY2024, signaling management’s confidence in achieving their goals.

- NCLH has implemented multiple initiatives for sustained revenue growth, margin optimization, and debt reduction, offering significant upside potential for investors.

- Fears of high leverage are likely overblown. NCLH’s short-term liquidity and operating cashflow is likely sufficient to cover upcoming obligations.

- Valuation analysis suggests that NCLH’s share price should range between $28.75 and $35.03, representing upside potential of more than 80%.

kynny

Introduction

Since the cruise industry got battered due to COVID-19, the share price of Norwegian Cruise Line Holdings (NYSE:NCLH) has yet to stage a successful comeback. Four years after the global lockdown, the global economy recovered and total consumer spending surged close to 20% above pre-Covid levels. Unfortunately, the share price of NCLH remained relatively depressed.

As someone who loves turnaround situations, I cannot help but wonder if this presents an opportunity or a value trap. Based on my analysis, the worst is over for NCLH and there exists multiple initiatives and tailwinds that position the company for success. More importantly, the upside potential for this company severely outweighs any downside risk. In this initiation report, I will demonstrate why investors should start to accumulate this struggling asset.

Successfully Turning Around the Ship

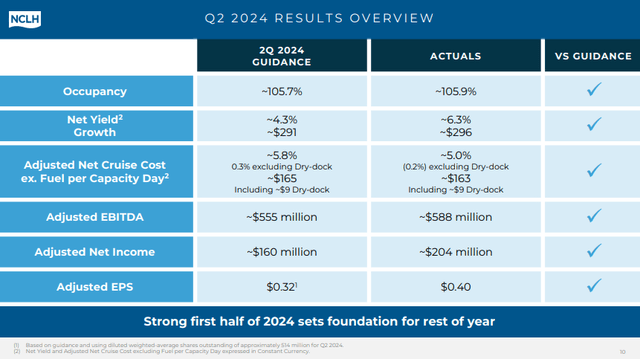

Results Overview (NCLH 2Q24 Earnings Presentation)

For the past couple of quarters, NCLH has posted strong operating performance, indicating that the company is on track for a successful turnaround. Not surprisingly, the company has exceeded its guidance again in the latest quarter. In 2Q24, NCLH generated revenues of $2.4 billion, representing 8% year-on-year growth. EPS for the quarter came in at $0.40, representing 33% year-on-year growth. In addition, occupancy rate and net yield growth came in at 105.90% and 6.3%, beating guidance by 20bps and 200 bps respectively.

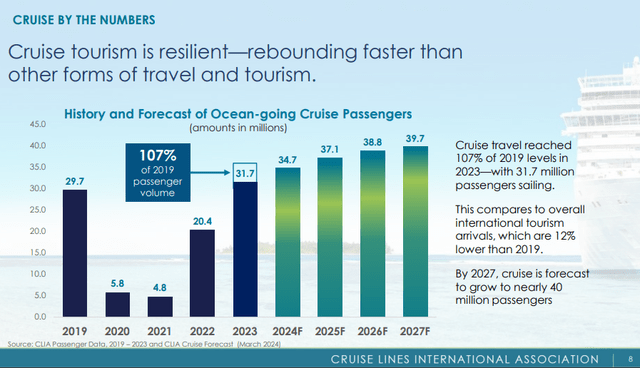

Historical Cruise Passengers (CLIA – State of Cruise Industry 2024)

Short-term outlook for the company remains highly optimistic due to industry. According to the latest State of the Cruise Industry Report, the industry’s passenger volume has already exceeded 2019 levels (i.e., pre-Covid levels), representing 107% of passenger volume. On the company level, NCLH’s forward book position and total advanced ticket sales continue to strengthen. During the latest earnings call, Harry Sommer, CEO of NCLH, indicated that “In the second quarter, we continue to see strong bookings, with our 12-month forward book position at the upper end of our optimal range on strong pricing.”. Total advanced ticket sales have surged to $3.9 billion, representing a growth of 11% year-on-year. Additionally, pre-booked onboard revenue for the company maintains a solid growth, surging by 15%. Typically, higher pre-cruise spending typically translates to further spending throughout the guest’s cruise journey.

Overall, the outlook for both NCLH and the cruise industry remains favorable; it is clear that the company’s darkest days are over and NCLH is now sailing towards the horizon of light. Looking forward, the company have raised guidance for the third time for FY2024. Net yield growth is likely to settle at 6.4% and 8.2% for 3Q24 and 8.2% for FY2024. The company expects to generate EPS of $0.92 and $1.53 for 3Q24 and $1.53 respectively.

Sustained Revenue Capacity Expansion Through Strategic Initiatives

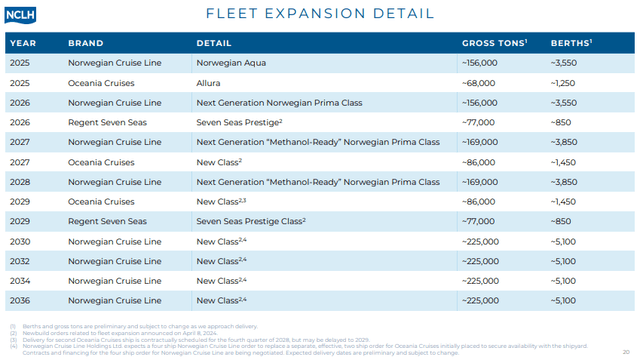

Fleet Expansion Details (NCLH 2Q24 Earnings Presentation)

It is important to highlight that in terms of NCLH’s sales, the company has already staged a successful comeback from Covid-19. For reference, occupancy rates due to the effects of Covid-19 were 51.4% for 4Q21 and 85% for 3Q22. Occupancy rates are estimated to be at 105.7% for 2Q24 and is expected to increase 250bps to 108.2% for 3Q24. This indicates that the company is already operating close to peak capacity. Therefore, to ensure sustainable growth, NCLH remains committed to its fleet expansion plans.

In 2025, NCLH expects an additional two ships to join its current, bringing the total number of operational cruises to 34. Although two ships may seem negligible, my analysis suggests that the average revenue per ship is approximately $280 million. Accounting for a slight price inflation, we should expect $588 million in revenue contribution from these two ships, representing 6% of the company’s revenue in FY2023.

In fact, long-term plans to further expand revenue capacity have been laid out by the company. By FY2027, we should expect NCLH to have an expanded fleet size of 38 ships. The additional 6 ships are expected to contribute at least $1.94 billion to the company’s top-line per year. To put into context, NCLH generated $8.9 billion in total revenues for FY2023, indicating that the expansion of 6 ships will contribute at least another 20% to the top-line.

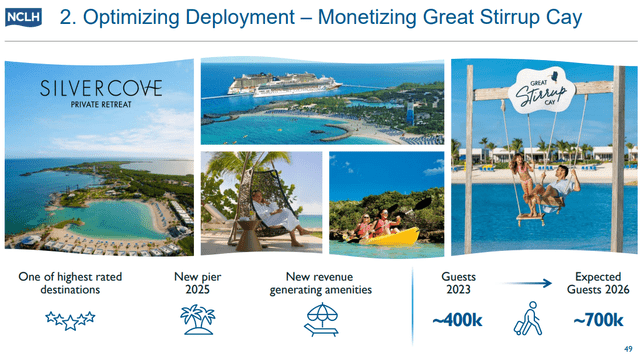

Great Stirrup Cay (NCLH 2024 Investor Day)

Apart from the fleet expansion plan, the company is also pulling other levels to ensure growth sustainability. One of these growth initiatives is none other than the company’s enhancement of the Great Stirrup Cay. By 2025, Great Stirrup Cay will be getting an additional pier, allowing the total visitors to the island to increase by more than 50% and driving new areas of monetization for NCLH. The plan to further monetize the island is in its initial stages and it is likely that we will see the company unveiling more surprises for investors in the foreseeable future.

Further Margin Expansion By Optimizing Revenue and Operating Costs

Apart from ensuring sustainable revenue growth, NCLH has implemented multiple strategies to achieve historical margins. Currently, the company’s margins are still far from optimal and are well-below pre-Covid levels. For reference, NCLH’s gross profit margin and operating income margin in is 43% and 18% for FY2019 as compared to 38.68% and 14.40% for 2Q24.

To further optimize margins, NCLH aims to optimize revenue growth (i.e. increasing lifetime value and spending per customer) by through multiple initiatives such as enhanced revenue management, data-driven marketing strategy and maximizing spending throughout customer journey.

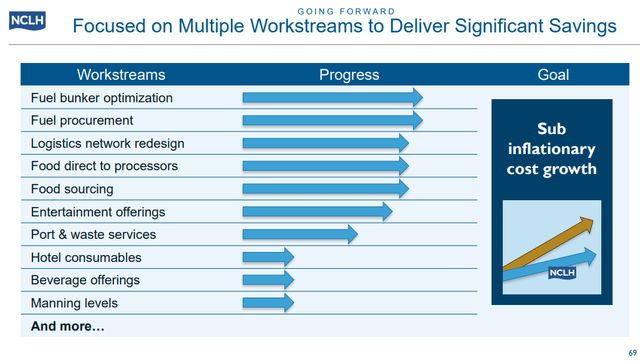

Cost Optimization Across Workstreams (NCLH 2024 Investor Day)

More importantly, recognizing its poor operating margins, NCLH will embark on a cost-saving initiative by improving on multiple workstreams. The company will focus on aspects such as tackling operating inefficiencies and reducing waste. For example, previously NCLH relied only on one vendor for its fuel. The company now utilizes more than 40 vendors across the world to ensure that it gets fairer pricing. In yet another example, NCLH removed inefficient items in the menu, reducing the total menu by 30%, allowing for further reduction in waste.

Overall, NCLH is likely to deliver more than $300 million in savings for the next three years. For context, a $100 million savings will increase the company’s net profit margin in FY2023 by 117bps, effectively expanding its net income by close to 60%. Looking ahead, the company is likely to find more avenues to optimize operating margins to achieve historical EBITDA margins by FY2026.

High Leverage with Manageable Implications

One of the major reasons why NCLH’s share price have failed to recover is likely because of the company’s enormous debt. This is not surprising considering that the company’s long-term debt and interest expense has surged from $6.05 billion and 272 million in FY2019 to $11.913 billion and $727 million in FY2023.

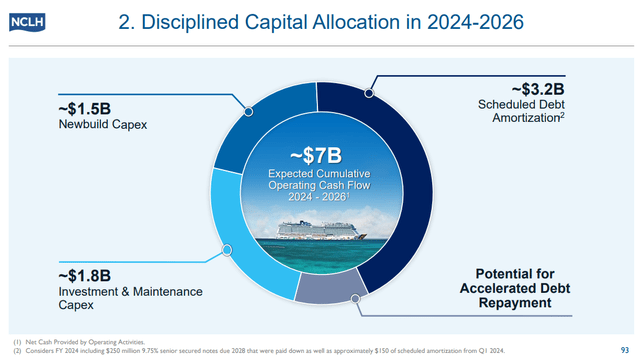

Capital Allocation Plan (NCLH Investor Day 2024)

However, it is highly likely that these fears are overblown. Investors should pay attention to net leverage levels instead of absolute debt levels. In fact, in 2Q24, the company has successfully reduced its net leverage from 7.3x to 5.9x, beating FY2014 net leverage of 6.8x. It is clear that, the company is committed to reduce its debt and is on track to achieve historical net leverage of approximately 4.5x by 2026. Based on my analysis, the company has sufficient liquidity to meet its current obligations. For the next three years, NCLH is expected to generate approximately $2 billion in operating cashflow per year. In addition, the company has a total short-term liquidity of approximately $2.7billion.

Enormous Upside Potential Offsetting Downside Risk

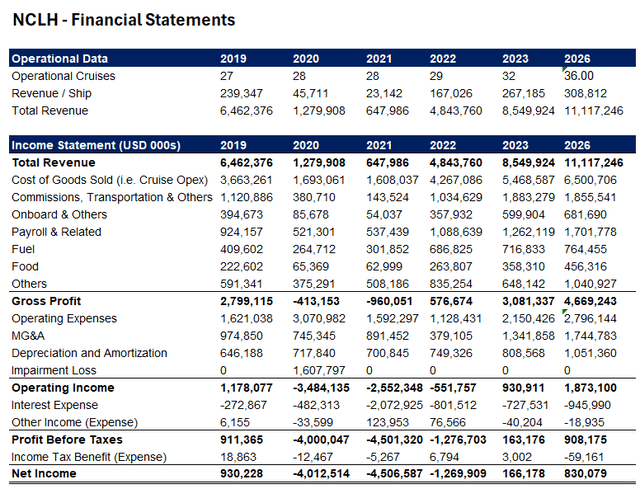

To have a sense of the company’s upside potential, I have projected the company’s financial performance up till FY2026 and applied NCLH’s historical range of price-to-earnings ratio to derive the company’s share price. The financial projection is based on several core assumptions: (1) NCLH will expand its fleet size to 36 ships by FY2026, (2) Operating income will normalize to historical levels by FY2026, and (3) Interest expense will maintain at current margins.

Projected Income Statement (Author’s Projections)

Based on these assumptions, we should expect net income for FY2026 to come in at $830 million, slightly below 2019 levels. Currently, the company has 513 million outstanding shares on a diluted basis, indicating an EPS of $1.61. Historically, the company’s median and average normalized price-to-earnings ratio is 17.48x and 21.68x. Utilizing these inputs, and assuming that NCLH achieves these assumptions, the shares of the company should be priced between $28.75 and $35.03, representing a significant upside ranging between 85% to 125%.

Geopolitical Tensions Remain as Major Risk

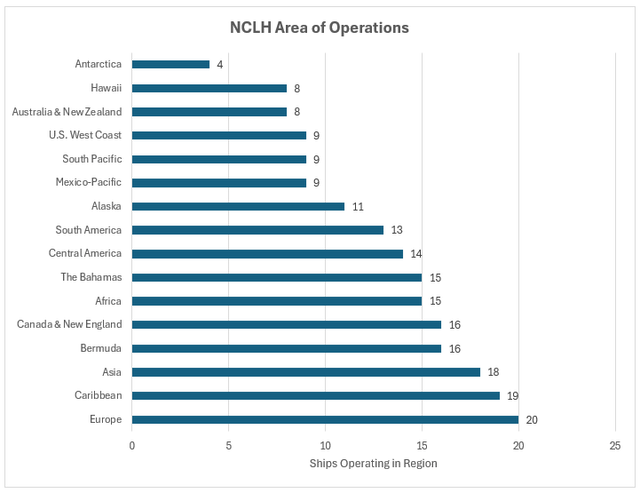

NCLH Area of Operations (Author’s Illustration)

The escalating geopolitical tensions across the world remains as NCLH’s biggest risk. In 2022, NCLH had to re-planned its itineraries and cancel sailings due to the Russian-Ukraine war, affecting approximately 5% of its capacity. In 4Q23, NCLH cancelled all calls to Israel due to the conflict in the Middle East, affecting approximately 4% of the company’s capacity. Moreover, the maritime situation in Indo-Pacific has been heating up, increasing the likelihood of conflict and affecting NCLH’s operations.

Should any of these existing conflicts further escalates and cause restrictions in travel, NCLH’s revenue will weaken substantially. Even if travelling is not permitted, the sudden change to company’s itineraries will be extremely costly and disappointing for NCLH’s customers. It is unlikely that any of these conflicts will abate in the foreseeable future.

Considering that international relations across the world will remain uncertain and NCLH is susceptible to such developments, investors should pay close attention to any geopolitical developments and their potential impact on NCLH. NCLH has survived Covid-19 at the cost of its balance sheet; unlike other companies with strong liquidity and significant cash reserves, NCLH will not survive another black swan event.

Closing Remarks

In summary, it is likely that the worst is over for NCLH and that the company is proactively laying the groundwork to optimize its operations and balance sheet. The continuous revision of guidance not only indicates the company’s success in turning around but also signals the management’s confidence in meeting their targets. The potential for further monetization and growth in the NCLH’s islands such as the Great Stirrup Cay will likely serve as positive short-term catalysts.

It is not unreasonable for investors to steer away from NCLH given that the company’s debt has expanded by more than 2x in recent years; there is still a chance for a liquidity crisis to occur that can affect the company’s long-term plans. However, a potential upside of more than 80% makes this opportunity truly hard to pass up. As Baron Rothschild once said, “The time to buy is when there’s blood in the streets, even if the blood is your own.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.