Summary:

- Cruise operators face challenges including heightened energy prices, labor costs, inflation, and massive debt loads.

- Norwegian Cruise Line Holdings Ltd. reported better-than-expected Q3 earnings, with revenue up 56.8% YoY and beating estimates by $30 million.

- The company has strong occupancy and revenue per passenger, but reduced its outlook due to the conflict in the Middle East.

- We offer you a swing trade and the justification for doing so.

FG Trade Latin/E+ via Getty Images

Here we are, a few years out of the COVID-19 pandemic, and the cruise operators are back in business. Now they face different struggles. First, heightened energy prices, these ships use tons of fuel and work to secure stable pricing and lock in rates. But prices are up. Demand remains relatively robust, a positive. Labor costs have increased dramatically, and the inflation associated with food and beverage have weighed for a number of quarters. While inflation is coming down, these are significant costs to the cruise operators.

Then there is the massive debt loads these companies have, a pressing risk given the rising interest expenses the operators have to pay. Overall we view cruise operators the same way we view airlines. That is to say, they are great trading vehicles, and abhorrent investments.

Today we discuss just reported earnings, the outlook and lay out a trade similar to the types of trade alerts we provide at our service. Let us discuss performance and the trade on Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH).

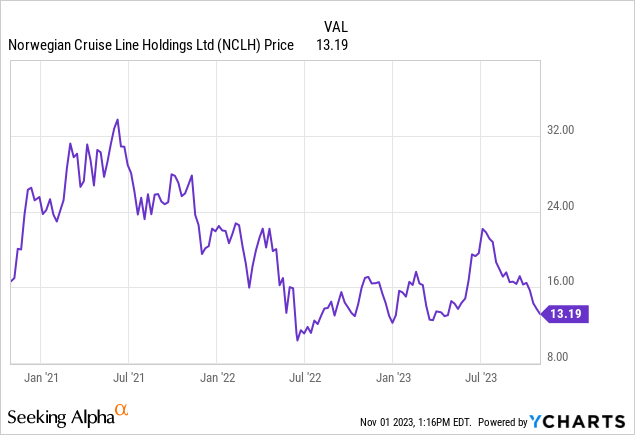

Shares have retraced sufficiently toward a base of support where we think you can scale in for several blocks, hold, then exit on the next spike. These stocks swing, and you can take advantage long and short.

The play

Buy in $0.50 blocks on way down increments in ~40% larger lots. The trade:

100 shares at $13.15.

140 shares at $12.65.

200 shares at $12.15.

280 shares at $11.65.

Then hold. Target exit: $16 if one lot, $15.00 if 2 lots, $14.00 if 3 lots, $13.50 if 4 lots. Stop $9.50

There are options considerations that work, but options trade suggestions are only provided at out investing group.

Note: This is the type of trade we typically lay out, along usually with options approaches.

Discussion of Norwegian Cruise Line Holdings Q3 earnings

The company just reported Q3 earnings, and it beat on the top and bottom lines against consensus estimates. Shares are down on the news on a guidance revision marginally lower.

So what did the top line look like? Better than expected, as revenue in the quarter was $2.54 billion and surged 56.8% year-over-year and beat estimates by $30 million. Total revenue was up 33% versus Q3 2019, pre-COVID. While inflation remains a problem, cost savings efforts on input costs led to an earnings beat. Q2 was expected to see EPS of $0.69, but EPS hit $0.76, beating by $0.08.

Fuel costs remain a headwind, as does currency issues, plus there are global events like what we saw in Maui, Hawaii and ongoing international conflict, but we are betting on a swing higher in the stock when it bases out. We think our model suggests realistic target entries and exits for returns. Moreover we continue to see strong occupancy and revenues per passenger.

Revenue per passenger

Total revenue per Passenger Cruise Day, a key metric for Norwegian and competitors, was up approximately 16 % as-reported and accounting for currency. This is compared to the pre-COVID 2019 which still reflect more normal levels. Eventually, we will be back to year-over-year comps as the COVID pandemic becomes a memory. That is strong growth. That said, 2022 was a good year, as demand jumped and the strength continues in 2023.

Occupancy averaged 106.1% in the quarter. This was strong, and was in line with guidance. Norwegian has tried to advertise longer trips with more experiential itineraries. But, as mentioned international conflict has resulted in all calls to port in Israel cancelled for the year, and into 2024. As such, full year 2023 occupancy is expected to average 102.6%, which is slightly lower than prior guidance. This will also hurt 2024 expectations barring relief of the conflict.

The company has enjoyed better revenue not just on occupancy but also pricing and strong margins. There was strong 20% capacity growth compared to 2019. Gross margin per capacity day was just under $148 in the quarter. The so-called net yield growth was 3.1% versus 2019 on a constant currency basis, meeting expectations.

Costs

Costs were reigned in as well. The gross cruise costs per capacity day was about $311 in Q3 down from $315 sequentially. Adjusted costs backing out fuel was $152, also down from $156 in Q2, and in line with guidance. Folks, the cost controls are working as this is the third consecutive quarter of lowered costs. Management indicates that the full year 2023 adjusted net cruise costs excluding fuel will be $155, a guidance revision that was an improvement from $156.

Fuel costs remain a key metric. Fuel expense was $171 million in the quarter. Fuel price per metric ton, net of hedges, decreased to $727 from $830 in 2022. That is a win. Fuel consumption was approximately 2% lower than projected reflecting an increased focus on fuel efficiency, also a win.

But as we mentioned, interest costs are rising, and it is a key risk. Interest expense was $181.2 million in 2023 compared to $152.3 million in Q3 2022, a direct result of higher rates on debt. However, the company has worked to control what it can control as cruisers return. Total debt is $13.8 billion and total liquidity is approximately $2.2 billion of which $680 million is cash. Expect ongoing refinances of debt as maturities approach.

Looking ahead

So, as we look ahead, we see reduced outlooks on capacity and revenues due to the conflict in the middle east. Fuel costs and hedging are coming down, and cost savings initiatives are working. At the end of Q3, advance ticket sales balance, including the long-term portion, was $3.1 billion, approximately 59% higher than the pre-COVID 2019 Q3. That is strong. We are seeing regular itineraries to Hawaii again as well which is key.

But overall 2023 results were pared back, all things considered. Full year 2023 adjusted EBITDA will be about $1.86 billion, within the prior range but toward the lower end, while full year 2023 adjusted EPS is expected to be $0.73, below prior guidance of $0.80, despite the EPS beat in Q3. That has caused a small selloff today.

Take home

We like a trade in Norwegian Cruise Line Holdings Ltd. stock once again. As shares pull back following Q3 earnings, we recommend scaling in and preparing for a rebound to swing trade. The outlook was reduced on global conflict, but that could be a positive catalyst if there is a resolution. While that is not appearing to happen anytime soon, keep it in mind. Cost savings are working, revenue per passenger is strong, and advance sales remain robust. We like Norwegian Cruise Line Holdings Ltd. shares here and lower.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NCLH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Cruise you way to profit

Like our idea? Get ones just like this at BAD BEAT Investing through this link and save $99, versus the regular price for a limited time. Further, prices go up later this month, so get in now at Seeking Alpha’s exclusive, high-performing investing group. Execute rapid-return trades, while finding deep value and income for the long-term. Start making real money NOW!

- Exclusive trades each week backed by expert research

- Receive a wealth of education and access tools to maximize your returns

- Generate income through capital gains & options approaches

- Understand the swings in markets