Summary:

- NCLH is struggling with low margins, high costs, and a higher weighted cost of capital compared to returns on invested capital.

- Despite record bookings and growth in capacity, NCLH has failed to provide stock appreciation to shareholders since their IPO in 2013.

- Fundamental analysis shows NCLH trades at a slight discount compared to better performing peers, but I have concerns about debt levels, negative free cash flow, and shareholder dilution.

Adam Smigielski

Investment thesis

I previously wrote about the growing cruise line industry with articles on two competitors of Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) when I discussed Royal Caribbean Cruises Ltd. (RCL) as the clear industry winner in the article titled “Royal Caribbean Cruises: Estimated Earnings Already Priced In,“ and Carnival Corporation & plc (CCL) as an overvalued company in the article titled “Carnival Corporation: Significantly Overvalued.“ In this rapidly growing vacation industry, I wanted to see if one of the other cruise line companies would present a fundamental value opportunity as RCL did before the company went on such a tear with rapid stock appreciation.

Norwegian Cruise Line Holdings Ltd. (NCLH) is a cruise line company that is still trading near their IPO price, and the stock has struggled to recover from the impact of the pandemic. However, as you will see with the fundamental analysis below, NCLH may be a sinking ship with declining margins, rapid growth in costs compared to revenue growth, and higher weighted cost of capital than returns on invested capital. These negative fundamental factors are concerning when evaluating a company when considering them for a long-term investment. Based on these fundamentals, I am designating NCLH as sell, meaning that I would not buy this today as it does not present a fundamental value proposition unless we see improvement in their margins given that return on equity is recently very positive.

Industry Outline

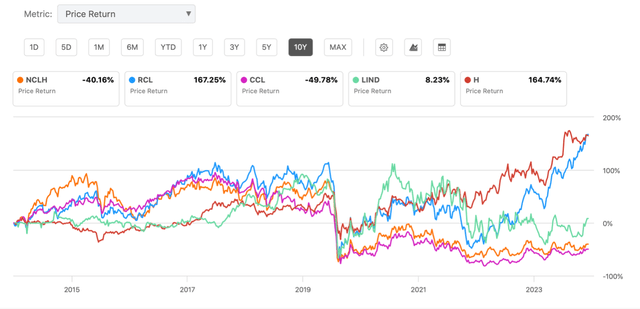

Founded in 1966, Norwegian Cruise Line Holdings Ltd. (NCLH) is an international cruise line company in the consumer discretionary sector and hotels, resorts, and cruise lines industry. Since their IPO back in 2013 they have failed to return anything to investors and over the last year, the stock has declined about 5% while peers in the sector like Royal Caribbean Cruises Ltd. (RCL) have outperformed the sector and the market. As you can see in the chart below, compared to other cruise lines over the last decade and another peer in the sector, Hyatt Hotels Corporation (H), NCLH has failed to provide stock appreciation to shareholders. However, as companies in this sector were significantly impacted by the pandemic, an analysis of their current fundamentals will indicate whether or not they are posed for a breakout as seen with one of their peers, RCL.

NCLH: Industry peer comparison of price performance over the last decade. (Seeking Alpha)

Latest Earnings

Following their most recent earnings call, Norwegian Cruise Line Holdings Ltd. mentioned that they have record bookings, increases in prices, and that they will be building 8 new ships across their brands. As they have described with their forward-looking 12-month bookings statement, Norwegian Cruise Line Holdings Ltd. is benefiting from a strong consumer as cruise line vacations continue to be in high demand during these good economic times. However, as you will see with their margin breakdown below, despite their record traffic and the higher prices they are charging, margins for the company continue to be negatively impacted as costs increase at a faster pace than total revenue, which is concerning. Moreover, they mentioned that they excluded the costs of fuel in some of their calculations, which is something to note that they are highlighting numbers/growth while excluding costs. It’s understandable given the high inflation rates of commodities like fuel, however, other companies, like The Hershey Company (HSY), have described the total impact of commodity inflation in their calls to help investors fully understand. Additionally, the company mentioned headwinds over the next year due to a higher number of dry-docking days, which will have a significant impact on costs in the short term.

On a positive note, the company has grown capacity by 8% year over year, gown advanced ticket sales by 30% which indicates high future demand, and they grew by 16.2% on the top line. They also beat their earnings per share estimates. This company is displaying high demand for their product and high year/year growth, with a positive 12-month outlook for continued record foot traffic. If they continue to beat their earnings, improve their costs and become more efficient as they had mentioned, this company may be able to do well over the long term. However, as you will see in the fundamental analysis, compared to before the pandemic, the company is still in rough shape and has not fully turned themselves around to where it would make sense on the value side for an investment today, which is why I am maintaining a sell rating.

Fundamental Analysis

Norwegian Cruise Line Holdings Ltd. currently trades at a forward GAAP P/E of 16.54, a trailing twelve-month P/E of 24.5, a 0.9 times forward price to sales ratio, and a forward EV/EBITDA ratio of 9.67. These fundamental factors are mostly in line with the sector averages. As with peers in this sector, NCLH carries a significant amount of debt compared to cash, but has high estimated earnings growth potential over the next few years. Comparing some of these fundamentals to RCL, who has not only rebounded from the impact of the pandemic but outperformed the market in the last year, RCL currently trades at a forward GAAP P/E of 15.6, a trailing twelve-month P/E of 22, a 2.64 forward price to sales ratio, and a forward EV/EBITDA of 11.2. Taking these factors into account, NCLH only trades at a slight discount, even though RCL has seen stock appreciation of over 63% in the last 12 months.

Revenue

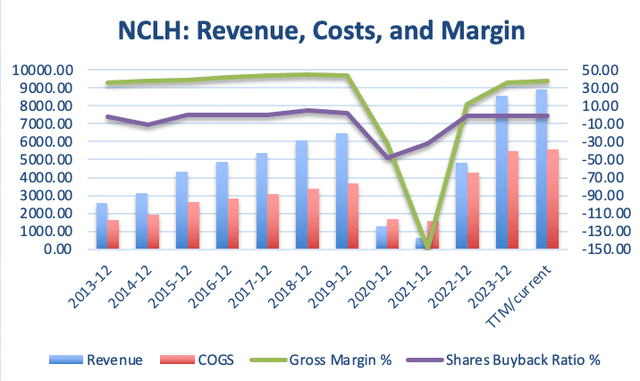

Since NCLH was significantly affected by the impact of the pandemic back in 2020, we will compare factors to 2019 to get a better estimate of how the business functions barring a black swan like event. Since 2019, revenue has grown by 38% while costs of increased by 52% and gross margins have declined by 13%. In addition to this, the company has continued to issue new shares each year to fund their business operations, which was understandable during 2020, but this is a significant dilution to shareholder value. In 2020 and 2021, NCLH issued a significant number of new shares, 48% and 32% respectively, but has now moderated to a 1% issuance over the last couple of years. Additionally, as revenue has grown modestly, but slower than increases in costs, gross margins have declined along with operating and net margins.

NCLH: Revenue and costs (left axis), and gross margins with share buyback level (right axis) over the last decade. (GuruFocus)

Margins

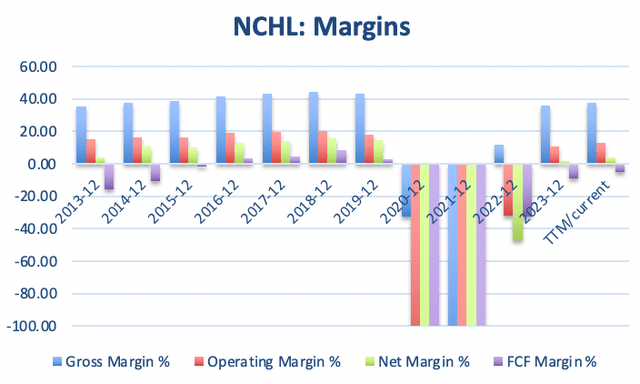

As you can see in the chart below, margins remained relatively consistent prior to the impact of the pandemic, with gross margins hovering right above 40% from 2016-2019. Additionally, the company maintained a positive free cash flow margin over this time, net margins over 12%, and operating margins over 18%. These are all positive signs that would indicate a good company. However, in recent years, gross margins has not rebounded to pre-pandemic levels, free cash flow margin remains negative, operating margins are at 12.7% on a trailing twelve-month basis, and net margins are only 3.84%. These values represent significant declines compared to 2019 levels, and the company currently has record bookings along with higher prices. If record demand is there, it is concerning the company is struggling to recover free cash flow margins a few years out of the pandemic. However, as margins are only one of the factors in a fundamental analysis, let’s look at NCLH’s return on invested capital and return on equity.

NCLH: Gross, operating, net, and free cash flow margins over the last decade. To note, I edited the bottom range to show up to negative 100%, if the margin compression exceeded this limit as in 2020 and 2021, it is not shown past -100%. (GuruFocus)

Returns on Investment

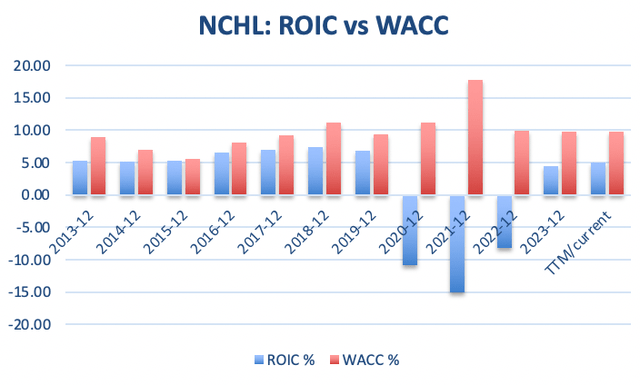

Over the last decade, Norwegian Cruise Line Holdings Ltd. has had lower return on invested capital (ROIC) than weighted cost of capital (WACC). One fundamental metric of good companies is a positive (ROIC-WACC) ratio, which would be one indication that management is making good investment decisions. As you can see in the chart below, ROIC was significantly affected by the pandemic from 2020 to 2022 and has still not recovered to 2019 levels. WACC has normalized back to 2019 levels with only a 4% increase since then based on the trailing twelve-month value. However, current ROIC is 26% lower than in 2019. If NCLH can start to improve ROIC over the next few quarters while maintaining their WACC level around 9-10%, this would warrant additional analysis to see if improvements in the company’s business structure can be maintained and if it makes sense on a fundamental basis for investment at that point. As you will see with return on equity, this company may be starting to turn around.

NCLH: Return on invested capital ((ROIC)) versus weighted cost of capital ((WACC)) since 2013. (GuruFocus)

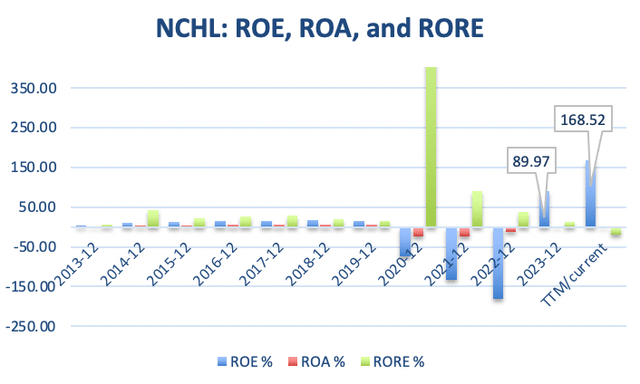

Over the last decade, Norwegian Cruise Line Holdings Ltd has struggled to provide consistent returns on equity (ROE), returns on assets (ROA), and returns on retained earnings (RORE). However, over the trailing-twelve months, and in 2023, ROE has begun to rise at a significant level providing an 89% and 168% return. This makes sense with the current vacation trend of consumers wanting experiences which cruise lines provide and have a large market for. Moreover, this high ROE does pique my interest as we see similar values with RCL, which has performed very well for investors. However, I’m concerned that we are only seeing positive/consistent growth in ROE rather than in all three metrics. Currently, ROA sits around 1-2% while RORE is negative. This is one indication to me that the company has not fully turned around yet from the impact of the pandemic and will continue to struggle in the near future, likely until they can improve their margins. If these fundamentals can return to 2019 levels, NCHL would warrant additional analysis, but at this time these are additional areas of concern and further reasons I believe the stock warrants a sell rating.

NCLH: Return on equity, return on assets, and return on retained earnings over the last 10 years. (GuruFocus)

Per Share Value

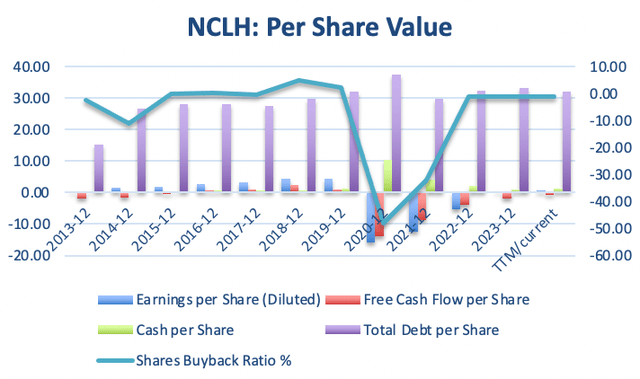

Reviewing the value of owning shares in Norwegian Cruise Line Holdings Ltd. over the last decade, it’s obvious as shown in the chart below that the company has a significant amount of debt compared to cash and free cash flow, which is one indicator that makes this a riskier investment than others. If the market falls out of this recent bull run, and the economy starts to put pressure on the consumer, NCLH’s record bookings would be impacted in this very competitive industry, which may bring the debt levels into greater scrutiny. In good economic conditions, high debt levels usually do not translate to issues as the company can continue to bring in revenue to pay off debt, however, if the economy takes a turn for the worse, I would be concerned about the debt level of all of my investments.

Further, as you can see in the chart below, earnings per share are almost non-existent and are 84% lower than in 2019. Additionally, the company has a negative free cash flow rate with a low level of cash per share. As the company continues to burn through cash in the upcoming quarters with a higher number of dry-docking days, I would be concerned of the impact on margins and earnings. Moreover, the Norwegian Cruise Line Holdings Ltd. continues to dilute shareholders with a negative share buyback rate to fund their operations. This was necessary during the pandemic, however, they continue to sell about 1% more each year since 2022. 1% is not as concerning as the pandemic levels, but it’s something to note in your analysis, as they are not continually providing value to you as a shareholder of common stock.

NCLH: per share value for earnings per share, free cash flow per share, debt level, and cash on hand (left axis); and share buyback percentage on the right axis. (GuruFocus)

Limitations

My investment thesis is limited, with the focus being on fundamental analysis and focusing on the last ten years of available stock data to produce the graphs and argument for this analysis. As this is solely focused on the numbers, the company’s story may cause the stock to rise as investors believe they will hit their high earnings estimates over the next few years due to consumer demand. Additionally, as this is focused on historical data, the company may perform differently than they have over the last decade because past performance does not indicate future performance. Moreover, as they had to deal with a black swan type of market event with the pandemic in 2020, the fundamentals and business structure were significantly impacted which has a drag on the current prospects.

Conclusion

In conclusion, I believe Norwegian Cruise Line Holdings Ltd. (NCLH) presents a speculative, risky investment, and I am rating this as a sell today based on the short-term headwinds this company faces and the current poor fundamentals, which are worse than what I look for when investing in a company. I believe that there’s a chance here the company will turn things around soon as we are seeing a large increase in returns on equity and record bookings, but my concerns are with the rest of the poor fundamentals which indicate that the company is not a good long-term investment at this time. If we see improvements in other key fundamentals such as net margin increases and higher returns on invested capital and returns on assets while maintaining current costs, this company will warrant reconsideration. You should do your own research before making any investment decisions and take into account your own risk profile, as this article and my research is based on my opinions and tolerance for risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.