Summary:

- Norwegian Cruise Line Holdings Ltd. has faced short-term travel issues in select locations, impacting Q4 numbers.

- Despite record revenues and strong cash flows, cruise line stocks have fallen back to Covid lows in the past month.

- The stock trades at only 9x 2024 EPS targets that now appear very conservative after the Q4 short-term impacts.

Gregor Roach/iStock Editorial via Getty Images

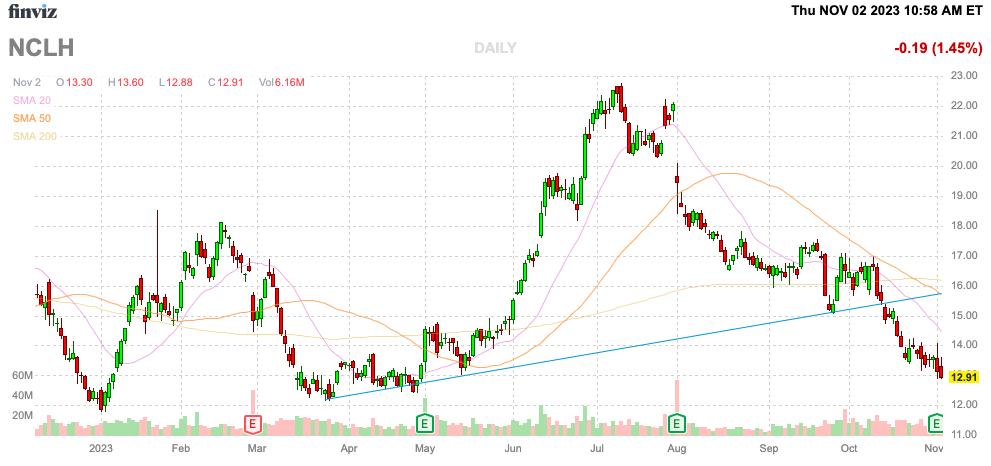

The cruise lines made a remarkable rebound from years of being shut down due to Covid, and now the market is dumping the stocks. Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) has run into short-term travel issues in select locations hit by natural disasters or conflict hitting upcoming Q4 numbers. My investment thesis remains ultra Bullish on the stock trading at the lows while the long-term prospects remain strong.

Source: Finviz

Pushing Through

The cruise line stocks have fallen back to Covid lows the last month despite the companies back to reporting record revenues and even profits. Norwegian Cruise line definitely faces some headwinds in Q4 due to fuel and global events, but the business should just as easily snap back in 2024 and beyond.

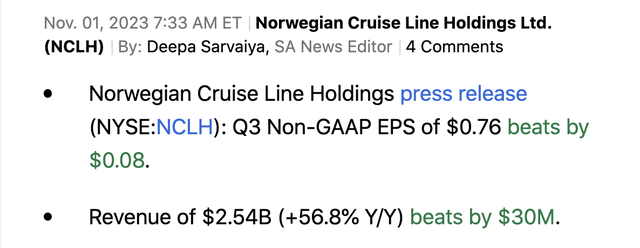

Norwegian easily beat Q3 ’23 consensus estimates as follows:

The company generated a strong $0.76 EPS during the quarter on record revenues of $2.5 billion, though Norwegian reported a pre-Covid EPS during the September quarter of $2.23. The cruise lines definitely face an EPS headwind due to higher debt loads and diluted shares outstanding now.

The stock slumped due to the weak guidance for Q4. Norwegian was highly profitable in the December quarter back in 2019, but the company just guided to a small loss in the quarter.

Norwegian faces a double whammy in Q4, where 13% of capacity is impacted by global events. The Maui fires impacted 6% of Q4 sailings, but the Hawaii business is already back close to normal levels.

The bigger issue is the sailings to Israel and the Middle East. Norwegian had 7% of Q4 sailings focused on the area while the 2024 capacity was only 4%.

The company faces 13% of capacity impacted during parts of Q4, but only 4% is impacted for 2024. Norwegian can shift most of the 2024 itineraries to avoid any major travel issues in 2024, but the short-term impacts to Q4 are hard to overcome.

Norwegian guided to a loss of $0.15 in Q4, while consensus estimates were up at a very small profit of $0.02. The cruise line now expects a $0.73 profit in 2023 after the Q3 beat and Q4 guide down, down from a prior estimate of $0.80.

The market should focus more on the solid Q3 beat in a more normal environment. Norwegian faced too much impact from uncontrollable global events in Q4 that the cruise line will easily overcome in 2024.

Focus On Future

The stock should’ve rallied on the news of strong cruise demand. Norwegian guided to strong 2024 bookings as follows on the Q3’23 earnings call (emphasis added):

On a 12-month forward basis, our book position continues to be at record levels within our optimal ranges and at higher prices. While we are very pleased with our progress so far in building our book for 2024 and beyond, we are also keeping a close eye on the evolving macroeconomics and geopolitical landscape and are ready enable to adapt if needed.

The odd part here is that nothing about the results suggest 2024 EPS estimates should be cut. Analysts have now lowered 2024 targets to $1.39 per share, down from $1.55 last week prior to earnings.

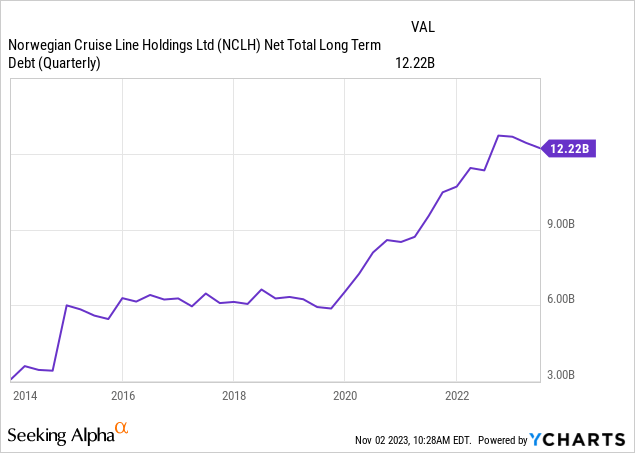

Norwegian still faces a big headwinds with interest expenses. The company guided to $200 million in expenses during Q4, up from $181 million in Q3.

The net debt position has improved in the last year and interest rates appear to have peaked. Norwegian has a diluted share count of 512 million shares, so a substantial EPS boost will come over the next few years just from repaying debt and reducing interest expenses.

The company has generated $1.75 billion in operating cash flows so far this year. The advanced ticket sales hit a record high of $3.1 billion in Q3, up ~59% from Q3’19.

Norwegian has an unquestioned profitable future now. The stock trades at only 9x lowered 2024 EPS targets. Our view remains that the consensus estimates for 2024 shouldn’t be falling based on the Q3’23 numbers and updated guidance providing upside potential.

More importantly, EPS soars again in 2025 to nearly $2 due to Norwegian having an easy path to boosting EPS from simply lowering interest expenses via either repaying debt or eventually refinancing at lower interest rates in the next year. The stock is too cheap with a $2+ EPS target.

Takeaway

The key investor takeaway is that Norwegian Cruise Line Holdings Ltd. has already returned to record revenues. The company will spend the next few years working to turn these higher revenues into large earnings gains from efficiency improvements and lower interest expenses from simply repaying debt.

Investors should use the stock weakness to load up on Norwegian with the stock trading at Covid lows despite the business mode completely de-risked now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.