Summary:

- Norwegian Cruise Line hit a new 52-week high on positive bookings comments from JPMorgan.

- The cruise line already discussed record advance ticket sales heading into Q2.

- The stock is cheap once EPS normalizes in the next couple of years.

frantic00

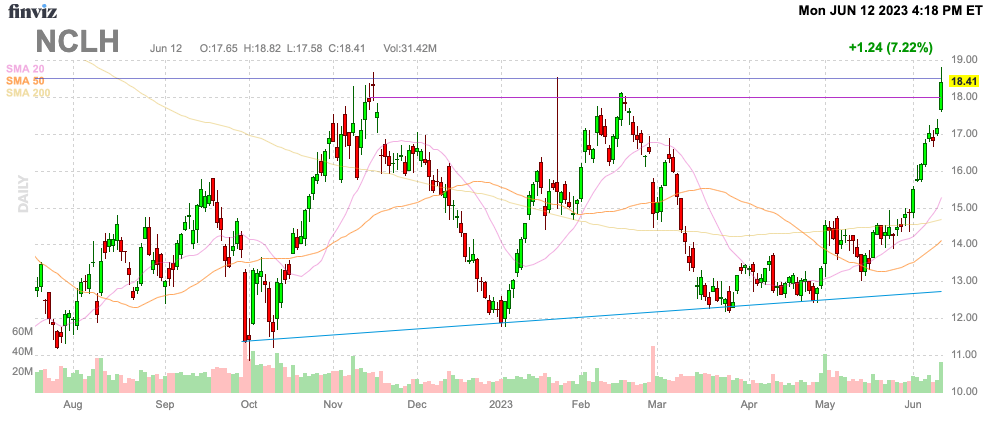

In no surprise here, Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) has received a massive boost. The cruise line has now rallied dramatically before the company has even returned to reporting profitable results, yet the snapback in profits is only beginning. My investment thesis remains Bullish on the stock, even after the recent rally to $18.

Source: Finviz

Profit Rebound

The stock is rallying to yearly highs as JPMorgan confirmed bullish booking trends remain intact, though analyst Matthew Boss did maintain a Neutral rating on Norwegian Cruise Line with a $16 price target.

The cruise lines have generally reported a return to normal operations in the spring, with capacity again topping 100% levels. Norwegian last reported Q1’23 results in early May with occupancy hitting 101.5% before even starting the real Spring season with a target for hitting ~105% in the current quarter.

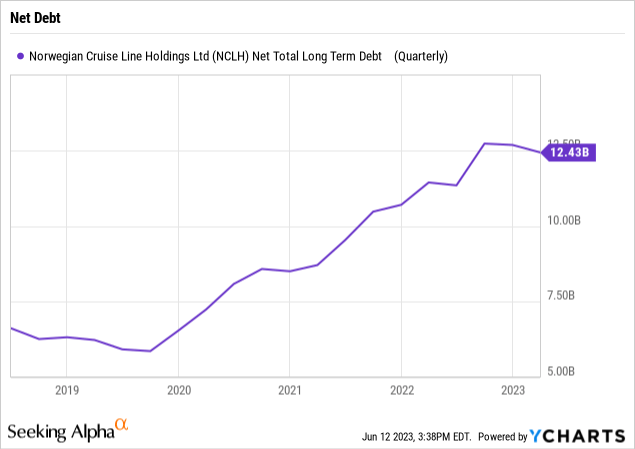

As highlighted in our previous research, advanced bookings were so strong the company saw record bookings of over $3 billion in Q1’23, leading to a record advance ticket sales balance of ~$3.4 billion. These much higher ticket sales levels has led to positive cash flows, helping with the debt balances.

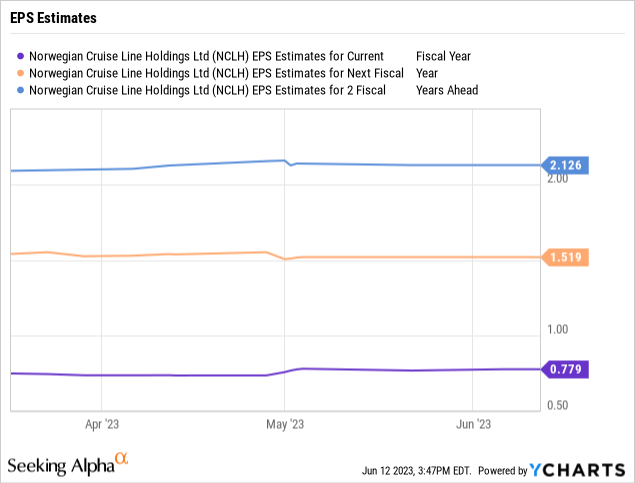

Analysts haven’t made any exceptional adjustments to EPS estimates, but Norwegian is forecast to go from reporting another larger loss in Q1 to solid profits going forward. Remember, a lot of the COVID restrictions weren’t removed until the October time frame last year, so the cruise lines are only now getting into sailings where advanced bookings were mostly made with removed restrictions.

The consensus estimates have Norwegian quickly going from turning profitable in Q2’23 to reaching an EPS estimate of $1.52 in 2024 to $2.13 in 2025. In comparison, the cruise line earned $5.09 back in 2019.

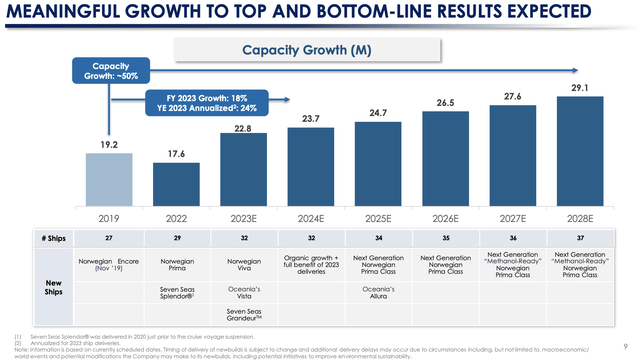

In essence, the analyst numbers appear very conservative here. Norwegian just launched the Vista ship back in May, and the cruise line already has added three ships above the 27 level in 2018.

The company is forecasting a large capacity bump from the 2019 levels, and part of the bookings boost is due to the higher capacity levels. Norwegian has an ultimate goal for 2028 capacity to end up 50% above 2019 levels.

Source: Norwegian Cruise Q1’23 presentation

Rethinking Normal

A lot of investors have held wrong views on the return to normal in the sector. The thought was that Norwegian couldn’t return to pre-COVID stock levels of $60 due to higher debt levels and additional shares outstanding.

The problem with this widely held view is that Norwegian would trade closer to $90 by now under normal conditions, with a 10% annualized return. The key is that investors completely forget that the market would’ve normally expanded in the last four years, far beyond the 2019 levels where the stock traded at $60.

When one looks at the stock now up at $18 in relation to $60, Norwegian still seems relatively cheap. The cruise line has seen net debt double in this period with higher outstanding share counts, but the view is a lot different when one assumes a $90 relatively price comparison and the higher passenger volumes ahead.

The share count has nearly doubled in the period to 422 million shares outstanding now. Just based on a normalized EPS on the higher share count would get Norwegian back up to a $2.55 EPS just on the 2019 capacity levels.

The company has higher interest expenses, offsetting the higher capacity levels going forward. Once Norwegian starts repaying more debt from the positive cash flows and profits, the higher capacity will contribute a positive boost and the debt impact will fade away.

In essence, the consensus analyst EPS estimates of $2.13 in 2025 appear far too conservative. Norwegian will benefit from nearly 30% additional capacity in 2025 and interest expenses will tilt back towards 2019 levels.

The cruise line isn’t likely to approach 2019 EPS levels anytime soon, but investors should start expecting a $3 to $4 EPS a few years out from now.

Takeaway

The key investor takeaway is that Norwegian Cruise Line is far too cheap here, even with the stock trading at yearly highs. The cruise line is just now starting to return to profits, and investors need to start viewing how much the industry would’ve advanced in the last four years vs. comparisons to 2019.

Investors should buy Norwegian on the breakout above prior resistance at $18.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.