Summary:

- Norwegian Cruise Line Holdings Ltd. reported a solid rebound in financials in Q1, heading into what should be a very profitable year ahead.

- The cruise line generated massive positive cash flows while the advanced order book is 60% above 2019 levels.

- Norwegian Cruise Line stock is cheap at only 9x 2024 EPS targets that appear very conservative based on peer travel numbers.

cookelma

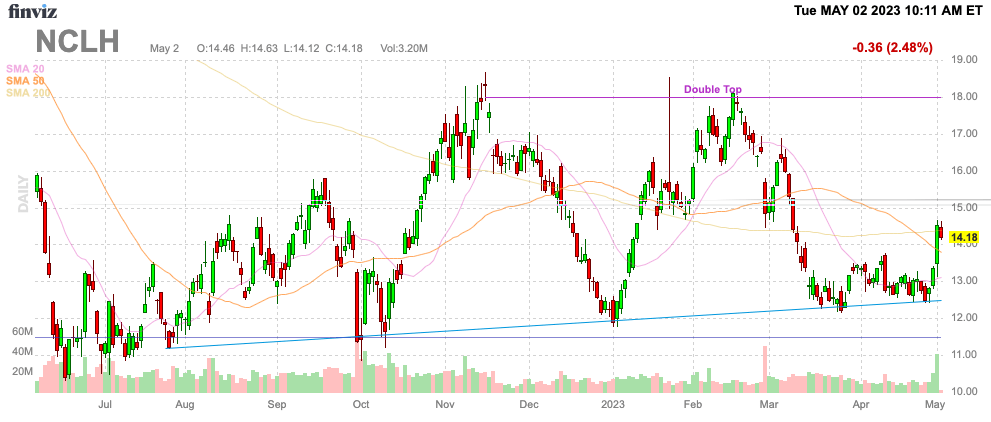

As long predicted, the cruise lines were headed towards a major inflection point around the end of Q1. Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) has now confirmed this scenario, yet the stock trades closer to the Covid lows than the recent highs. My investment thesis remains ultra Bullish on Norwegian, with the NCLH story closer and closer to being de-risked.

Source: Finviz

Big Inflection Point

Norwegian reported Q1 numbers that were very indicative of an inflection point in the cruise line sector. The data has long pointed to this outcome once the covid restrictions were removed at the end of 2022.

The cruise line reported revenues sailed past estimates in a sign of how operations have improved over the last few quarters after a long period of struggling to hit targets. A prime signal of the strength in the quarter was a big improvement in the following metrics.

- Sequential Occupancy improvement to approximately 101.5% in the quarter, exceeding guidance of 100%.

- Total revenue per Passenger Cruise Day increased approximately 17.5% as-reported and 18.3% in constant currency, compared to the same period in 2019.

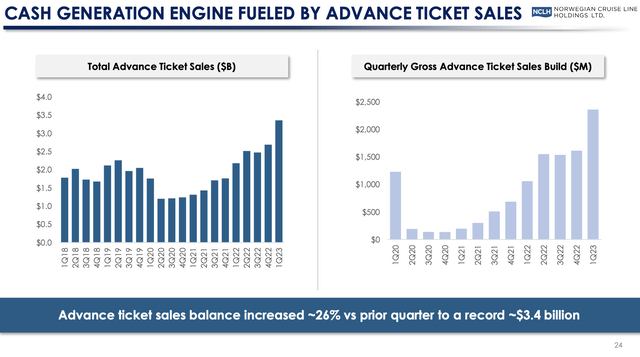

The business is now humming along again, similar to pre-covid levels. Norwegian is now reporting quarterly gross advance ticket sales at a record level along with total advance ticket sales at $3.4 billion, now reaching over 60% above the 2019 levels.

Source: Norwegian Cruise Line Q1’23 presentation

These massive ticket sales help lead to strong cash flow generation. The cruise line is adding 20% capacity this year, and the advance ticket sales remain strong, with pricing at levels far above 2019 levels, leading positive cash flows from operations of $503 million in Q1, up from a loss of $371 million last year.

The ultimate inflection point will occur in Q2, when Norwegian will start earning a profit again with a forecast for a $0.25 EPS. The cruise line is now forecast to earn $0.75 for the year, even with expectations for higher fuel costs and foreign exchange hitting numbers for the rest of 2023.

As predicted in prior research, the cruise line was logically going to follow the airline pattern of 2022. The airlines reported a large loss in Q1’22 followed by big profits in the remaining quarters of the year, ending up with Q4 profits matching or exceeding 2019 levels.

Norwegian is following this pattern after reporting a $0.30 loss to start the year. The cruise line is now predicting an EPS of $1.05 for the last 3 quarters of the year.

Back in 2019, Norwegian made the following quarterly EPS numbers:

- Q1 – $0.83

- Q2 – $1.30

- Q3 – $2.23

- Q4 – $0.73

Analysts only forecast the cruise line earning $0.10 in Q4 when holiday demand sinks, but the airlines face the same seasonal impacts. Regardless, the base case isn’t for a massive EPS beat, but just acknowledgement that airlines weren’t supposed to recapture prior EPS metrics due to higher debt levels. Even the weakened American Airlines Group (AAL) forecasts a 2023 EPS of up to $3.50 per share.

Priced For Recession

While the market has feared an oncoming recession, Norwegian saw no apparent impact from the U.S. banking crisis that occurred in March. The new CEO made this following comment on the Q1’23 earnings call:

Our target consumer remains resilient with a persistent desire for travel and experiences. Our booking window, which is our best forward-looking indicator, remains strong. In fact, we were encouraged to see that even with the banking sector-driven financial market volatility in March, we did not experience any unusual booking or cancellation activity across any of our brands.

Considering demand remains strong, the cruise line has already cut Adjusted Net Cruise Costs excluding Fuel per Capacity Day costs by 14% from 2H’22 levels of $187. The cruise line hit a cost per day of $4 below estimates in a sign Norwegian is already making vast steps to improve cost efficiency.

The company has net debt of $13.1 billion, so the investment story isn’t completely de-risked. Norwegian needs to repay some sizable debt amounts via positive cash flows in order to financially improve the ability of the cruise line to handle the next crisis.

Norwegian Cruise Line Holdings Ltd. stock only trades at 9x 2024 EPS estimates of $1.57. Norwegian appears poised to recapture a lot of the pre-covid EPS levels of $5+ similar to where the other cruise lines and airlines are already headed due in part to higher capacity in order to offset the higher interest costs and share counts.

Takeaway

The key investor takeaway is that Norwegian Cruise Line Holdings Ltd. is far too cheap here. The NCLH stock trades at a very low P/E multiple, while the cruise line appears poised to quickly start recovering a lot of the earnings power of pre-covid.

Investors should use the current Norwegian Cruise Line Holdings Ltd. weakness to load up on a premier travel company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.