Summary:

- The NCHL management has shown great competency in managing the elevated interest rate risks, attributed to the debt swap to mostly fixed rates by FQ2’23.

- While Brent has risen dramatically to $93.53 at the time of writing, potentially increasing its Fuel Expenses, the management has also hedged part of the fuel risks through derivative agreements.

- The cruise booking trends have surpassed pre-COVID levels, with NCHL reporting excellent advanced ticket sales of $3.5B and ~60% in booked position over the next twelve months.

- However, due to its minimal Free Cash Flow generation, we may see the Cruise Line refinance its debts at elevated interest rates, depending on the market funding condition.

- Therefore, NCHL is only suitable for investors whom are patient, since big ships turn rather slowly, with a wide gap to its pre-pandemic profitability.

.shock/iStock via Getty Images

The Cruise Line Investment Thesis Remains Mixed

We previously covered The Royal Caribbean Cruises (RCL) and Carnival Corporation (CCL) in various other articles, covering their stocks’ optimistic rally thanks to the robust booking trends, despite the impacted profitability and elevated debt levels.

For this particular article, we will be looking at Norwegian Cruise Line Holdings (NYSE:NCLH) and sharing our findings about the stock, continuing the theme surrounding the Cruise Line sector.

NCLH needs no introduction, as a cruise line company that is incorporated in Florida, while operating multiple cruise brands across different price points internationally. It is important to note the company is comparatively smaller with 31 ships as of August 2023, compared to RCL at 64 ships and CCL at over 90 ships.

As a result, it is unsurprising that CCL’s Market Cap is notably smaller at $7.38B at the time of writing, compared to RCL at $25.19B and CCL at $18.88B.

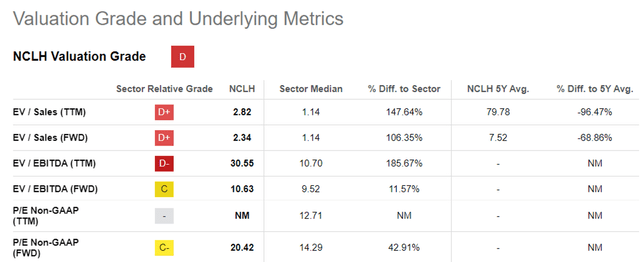

NCLH 6M EV/Revenue, EV/ EBITDA, & P/E Valuations

For now, NCLH trades at NTM EV/ Sales of 2.34x, NTM EV/ EBITDA of 10.63x, and NTM adj P/E of 20.42x, moderated compared to its 1Y mean of 2.82x/ 30.55x/ 237.25x, though elevated against its 3Y pre-pandemic mean of 2.98x/ 9.56x/ 11.37x, respectively.

The premium P/E valuation is notable indeed, compared to the Cruise Lines sector median of 14.29x, RCL’s 15.86x, and CCL’s 15.11x, implying NCLH’s profitable growth cadence.

This premium valuation is probably attributed to NCLH’s excellent annualized revenues of $8.8B (+22.2% QoQ/ +84.8% YoY), adj EBITDA of $2.06B (+120% QoQ/ + 379.5% YoY), and adj EPS of $1.20 (+200% QoQ/ +126.3% YoY) in FQ2’23.

These numbers imply a drastic improvement from the hyper-pandemic losses, while somewhat nearing its pre-pandemic FY2019 levels of $6.46B/ $1.93B/ $5.09, respectively.

It is apparent that NCLH, as with its peers in the Cruise Liner sector, is similarly suffering from elevated interest expenses, thanks to the massive debts taken on during the peak hyper-pandemic period and the bank’s sustained rate hike thus far.

For example, the Cruise Line reports an annualized net interest expenses of $710.8M (+3.7% QoQ/ +23% YoY), attributed to the long-term debts of $13.1B (inline QoQ/ -1% YoY) by the latest quarter. This is compared to the FY2019 debt levels of $6.04B (+4.6% YoY).

However, we believe NCLH’s prospects remain decent moving forward, given the management’s highly prudent debt swap, with 12% of its long-term debts carrying variable interest rate (-4 points QoQ/ -15 YoY).

This strategy has effectively reduced the Cruise Line’s variable annualized interest expense by -$4.5M on a QoQ basis and by -$19.8M on a YoY basis by FQ2’23, based on “one percentage point increase in annual Term SOFR interest rates.”

With it remaining to be seen when the Fed may eventually pivot, despite the rate freeze in the September 2023 FOMC meeting, we believe NCLH’s debt risks may moderate from henceforth.

While Brent has risen dramatically to $93.53 at the time of writing (+11.4% QoQ/ inline YoY/ +55.8% from FY2019 levels of $60s), potentially increasing NCLH’s Fuel Expenses from the $164.24M reported in FQ2’23 (-15.7% QoQ/ -9.3% YoY), we are not overly concerned for now.

This is because the management has also hedged part of the fuel risks through derivative agreements, allowing them to halve the potential increase in the anticipated fuel expenses through 2023.

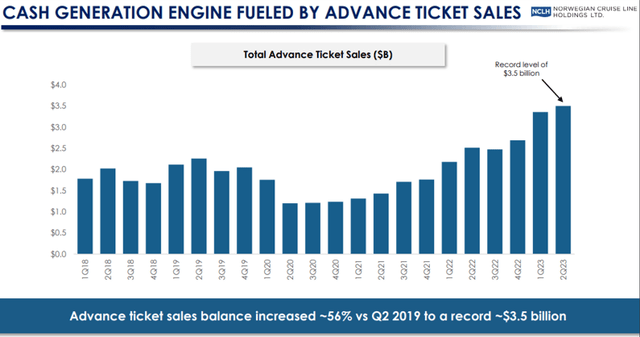

NCLH’s Advanced Ticket Sales

On the one hand, NCLH investors must note that the actual impact of the federal student loan repayment from October 2023 onward remains to be seen, since the North American region comprises $1.22B or the equivalent 55.4% of its FQ2’23 revenues. The EU comprises $880.1M or the equivalent of 40% of its top-line as well.

On the other hand, we are not overly concerned, with the US labor market and retail spending remaining robust in August 2023, with the EU similarly reporting moderating inflation and brighter outlooks by 2024.

This cadence is also demonstrated by NCLH’s excellent advanced ticket sales of $3.5B (+7% QoQ/ +40% YoY/ +52% from FQ2’19 levels) in FQ2’23, with ~60% in booked position over the next twelve months.

Demand for cruises appears to be excellent across the board as well, with CCL reporting growing customer deposits of $7.2B (+26.3% QoQ/ +44% YoY/ +24.1% from FQ2’19 levels), with RCL’s at $5.7B (+7.5% QoQ/ +35.7% YoY/ +46.1% from FQ2’19 levels) in the latest quarter.

Travel bookings remain robust, with the AITA reporting excellent international air traffic in July 2023, with the month’s passenger load factor [PLF] of 85.7% indicating the “highest monthly international PLF ever recorded.”

With the global travel booking trends already normalizing and cruise demand exceeding pre-COVID levels, we believe NCLH’s prospects look much brighter ahead, significantly aided by the increased likelihood of a soft landing in 2024.

There Are Still Risks To The Cruise Line Investment Thesis After All

Then again, investors must also temper their intermediate-term expectations for the NCLH investment thesis, attributed to the company’s minimal annualized Free Cash Flow generation of $1.18B in the latest quarter (+11.7% QoQ/ +193.4% YoY).

With $4.08B of debts maturing through 2025 and deteriorating liquidity of $899.1M (+28.3% QoQ/ -52.7% YoY) by the latest quarter, we may see the company further refinance its debts at elevated interest rates, depending on the market funding condition.

These suggest prolonged profitability headwind over the next few years, since we do not expects NCLH’s interest expenses to moderate any time soon, as demonstrated by the consensus FY2025 adj EPS estimates of $2.13, compared to FY2019 levels of $5.07.

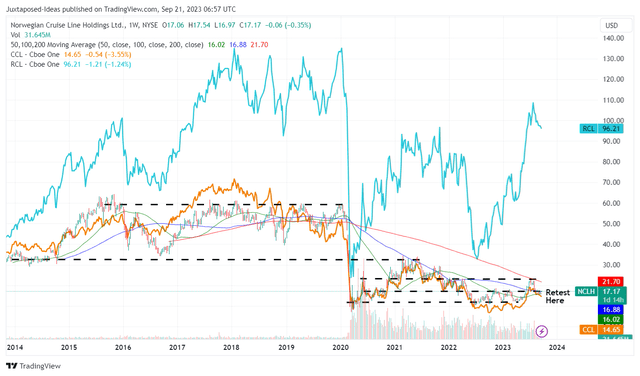

NCLH 10Y Stock Price

Perhaps, this may explain why the NCLH stock has yet to recover since the drastic correction in March 2020, a pessimistic situation that it is shared with CCL.

Due to its elevated debts and interest expenses, we believe that it may be more prudent to refer to NCLH’s EPS profitability, instead of the adj EBITDA.

For now, the management has raised its FY2023 profit guidance to adj EPS of $0.80 (+117.2% YoY). Combined with the FWD P/E valuation of 20.42x, it seems that the stock is trading near its fair value of $16.33.

Assuming a future moderation in its P/E valuations to pre-pandemic levels of 11.37x, nearing the sector median, we are also looking at a long-term price target of $24.21, implying an upside of +41.4% from current levels, based on the consensus FY2025 adj EPS estimates of $2.13.

We believed that this valuation method may be more prudent for now, until most of its debt headwinds are moderated, despite the optimistic booking momentum and the projected top-line CAGR of +27.4% through FY2025, compared to the pre-pandemic levels of +9.9%.

Based on the Seeking Alpha consensus estimates, NCLH may only return to pre-pandemic levels of profitability from FY2028 onwards, implying that anyone looking to add the stock must be very patient indeed.

So, Is NCLH Stock A Buy, Sell, or Hold?

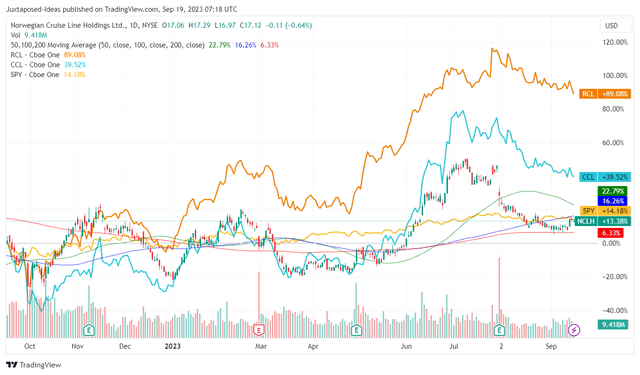

NCLH 1Y Stock Performance

Therefore, we believe that the answer to whether the NCLH stock is a Buy/ Sell/ Hold may not be that easy to answer indeed. Based on the stock’s underperformance over the past year, it appears that Mr. Market is pessimistic as well.

However, we are convinced that the management may be competent enough to slowly steer the big ship towards profitability, while “optimizing its debt structure.”

As a result of the attractive risk reward ratio at these depressed levels, we are cautiously rating the NCLH stock as a Buy here.

However, since big ships turn rather slowly, with a wide gap to its pre-pandemic profitability, its eventual stock reversal may not suit those looking for quick gains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.