Summary:

- Lyn Alden separates travel stocks into two categories: investable and tradeable.

- NCLH has a better risk versus reward compared to its neighbors in the travel sector.

- The methodology of using Elliott Wave Theory and Fibonacci Pinball suggests a high-probability buy setup for NCLH.

ChristianChan

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

Scanning the horizon we search for that setup that can provide an advantageous risk versus reward and perhaps give us an edge in trading. We sift through literally hundreds of charts on a daily basis looking for the structure of price that shows an imminent turn may be near. Also, Lyn Alden’s commentary and analysis on the fundamental side helps us locate the synergy between a favorable landscape and a chart setup. Here’s what we are currently seeing in the travel sector.

Lyn Alden Talks Travel

The following are some of Lyn’s recent comments regarding the travel sector overall, with a brief glance at an example, (CCL) Carnival Cruise Lines.

“For travel-related stocks, I separate them into two categories.

The first category is investable, meaning that they are long-term compounders with economic moats. Examples like American Express (AXP), Booking Holdings (BKNG), and various international airport stocks fit this bill, and I’ve been bullish on them for years. The large ongoing fiscal deficits in the United States are fueling a lot of travel and leisure among the upper quartile of the country’s income spectrum, and these types of companies benefit from that.

The second category is tradeable, meaning that they lack an economic moat, and do not compound well, but have can make for decent trades. Airline stocks and cruise stocks meet this description. During the pandemic, a lot of them had to issue dilutive equity at cheap prices, or issue a ton of debt, and basically de-capitalize themselves. They now enjoy recovering prospects, but from a very weak base, and with junk-quality credit ratings.

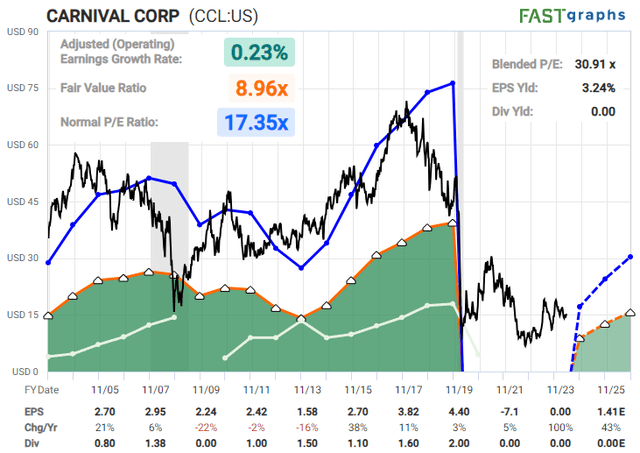

Carnival (CCL) is an example of that:

Meanwhile, TSA numbers are at record highs, meaning that people are traveling on airlines in the United States at greater numbers than ever before. This is true for many other countries as well. I’m bullish on overall travel and leisure, but especially for the volatile non-compounders, it’s useful to use technical sentiment for risk management. As a fundamental investor, I prefer focusing on the long-term compounders.” – Lyn Alden

What Is The Wave Setup For NCLH?

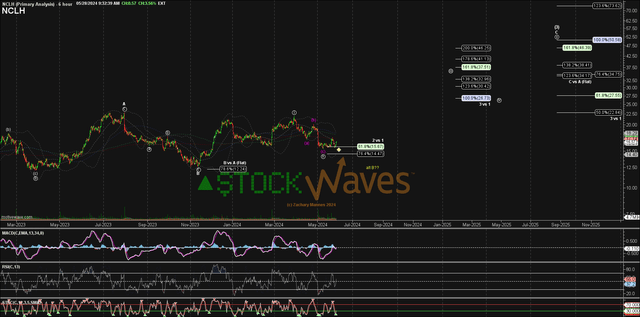

Let’s take Lyn’s advice and look at this one from a trading perspective. This is an active Wave Setup for us. You will easily notice the disparity between other similar tickers in the sector. Here’s what the Norwegian Cruise Line (NYSE:NCLH) chart is telling us:

Chart by Zac Mannes – StockWaves – Elliott Wave Trader

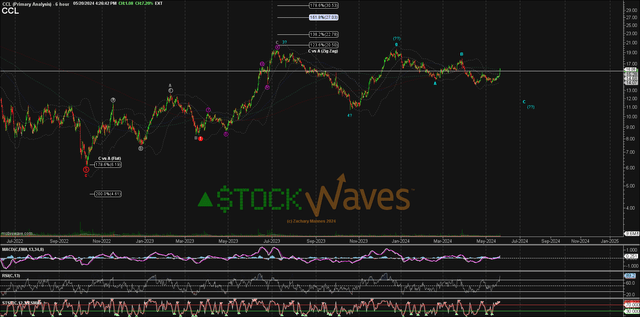

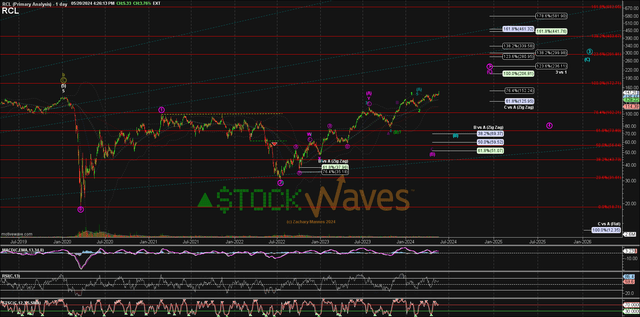

But, briefly compare that with its neighbors, (CCL) and (RCL):

Chart by Zac Mannes – StockWaves – Elliott Wave Trader Chart by Zac Mannes – StockWaves – Elliott Wave Trader

You readily see that the (NCLH) chart clearly has a better risk versus reward at this moment in time. Here are the specifics of the setup. Current support is at $15.67. This setup as shown would invalidate at a move under $15.40. The resistance overhead is at $21.70 with a target possible in the next larger move at as high as $34.75.

So, to boil this down to actionable intel, should price move under $15.40 on a sustained basis then it is more likely that the alternative path is playing out and a wider ‘B’ wave is under way with a target of the $12 – $13 range. The primary path is for the $15.40 level or higher to hold and for price to advance in wave circle ‘iii’ next. You can see this primary path as plotted on the chart.

Fibonacci Pinball Paints The Way

Those familiar with our methodology know that we employ Elliott Wave Theory. One of the persistent protests against Elliott Wave is that it is too subjective. The bias of the technicians can somehow be melded onto the chart and cause distortion of what really is likely to play out. However, when Fibonacci Pinball is used as an overlay, much of the subjectivity is removed. Why can we say this?

It would be quite informative for you to take the time and requisite effort to review Avi Gilburt’s series of articles that explain in depth the why’s and how’s of our methodology. Should you be so inclined, we encourage you to start here with Part-1 of the six part series entitled, “This Analysis Will Change The Way You Invest Forever”.

You know, to be frank, that is quite the affirmation, wouldn’t you agree? Even Avi will recognize that it takes conviction to put forth such a statement. Here’s a recent comment of his regarding this very topic:

“Even if you have thought me to be eccentric or a complete crackpot (which I, my 8,000 subscribers, and almost 1,000 money manager clients can assure you I am not), please consider the items I am discussing in these missives with an open mind. Those that have done so have seen their ability to navigate our financial markets much improve. But, you must keep an open mind to consider these matters seriously. Ultimately, my goal is to help those willing to open their minds protect themselves from what I believe can be a very difficult financial environment over the coming decade or two.” – Avi Gilburt

Conclusion

Our methodology is pointing to a high-probability buy setup for (NCLH) in the near term. Not all paths will play out as illustrated. We view the markets from a probabilistic standpoint. But at the same time, we have specific levels to indicate when it’s time to step aside or even change our stance and shift our weight.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NCLH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities! Get leading Elliott Wave analysis from our team, along with fundamental insights and macro analysis from top author Lyn Alden Schwartzer.

“Stockwaves is my bread and butter, and that’s only catching maybe 10% of the charts they throw out! I had 7-10x+ trades with SW last year, and dozens more that were “slackers” (LOL) with “only” 3-4-5x returns. Amazing!” (Nicole)

Click here for a FREE TRIAL.