Summary:

- Southwest Airlines Co. is known for its customer-friendly policies, such as free checked bags and friendly employees.

- However, there are drawbacks to flying with Southwest, including the cattle-call boarding process and outdated technology.

- Southwest’s financial situation has been impacted by the pandemic, with a decrease in net income and a suspension of dividends.

lsannes

I’m an investor who agrees with John D. Rockefeller on the value of dividends. I definitely get joy when seeing them hit my retirement fund or my brokerage account. They provide positive reinforcement by seeing a real return on my investment. There are some tech stocks that have grown quickly that do not pay dividends, and that is probably a reason for their growth. However, if those companies are shady and go the way of Enron, an investor would never see a penny from their investments unless they sold some of the shares at a profit before the company went belly-up.

Outside of a very small investment in Vanguard’s S&P 500 fund (VOO) and companies held in some index funds in retirement, I hold no companies that do not pay a dividend. I’m always looking into stocks that have a strong history of paying dividends for my portfolio. One area of economy that I utilize and understand is the airline industry. One of the better performers over the long run has been Southwest Airlines Co. (NYSE:LUV). However, I’m reluctant to purchase any shares in the company at present.

Pros of Flying LUV

Southwest is one of the largest U.S.-based carriers. The company is well-known for its policy of giving customers two free checked bags. Some other airlines have rolled out “basic economy” fares that don’t allow even a full carry-on bag without an extra charge. This is a big benefit of flying Southwest. The company’s route map has expanded greatly in recent years, with flights now offered to Hawaii, Mexico, and the Caribbean. On the flights I’ve taken with Southwest, the employees I’ve interacted with have tended to be quite friendly.

Cons of Flying Southwest

Many people complain about the cattle-call loading process that’s a feature of Southwest. Unless you’re able to check in exactly 24 hours before takeoff, you’re likely to wind up in a middle seat separated from others in your traveling party. I’ve sat hitting refresh on the link for checking in at 24 hours before the flight and still wound up toward the end of the boarding process.

LUV has a fairly outdated tech system. This was a major issue when the company had widespread cancellations and stranded travelers around Christmas travel in 2022. Old IT and a point-to-point route map (most airlines use a hub-and-spoke system) were identified as major reasons for the problems that arose. Many travelers were pretty unhappy with the way this played out.

Finances

Southwest, along with the rest of the airline industry, was hit hard during 2020 and the travel restrictions tied to COVID-19. Revenue grew at a decent clip between 2013 and 2019, from $16.885 billion to $20.948 billion. It’s not a massively rapid rate of growth, but Southwest is a large company with a major footprint, so rapid growth outside of the purchase of a competitor is unlikely. Revenue on the December 2020 annual report fell off a cliff. For FY 2020, revenue dropped to $7.826 billion. It’s recovered to $21.585 billion for 2022, and the last 12 months have seen revenue of $22.843 billion.

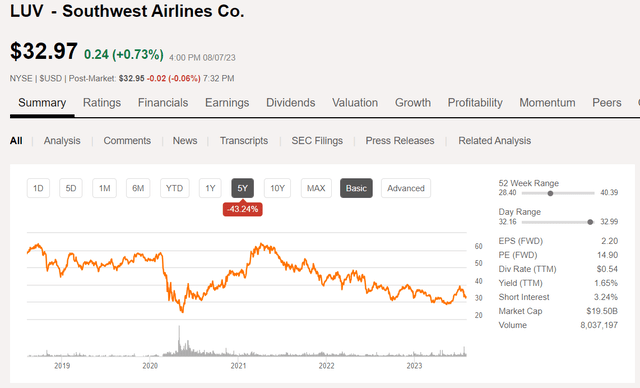

However, even with the higher revenue, net income has dropped quite a bit. The airline industry is not cheap to operate. Fuel prices in the past year have been higher than they’ve been in recent years, and this hits the bottom line. Between 2015 and 2019, net income for Southwest was never below $2.181 billion. That turned into a loss of more than $3 billion in 2020. Income for the December 2022 annual report came in at $539 million, about a fourth of what it had been pre-pandemic. The current share price of LUV is lower than it was five years ago. Therefore, it’s not been a good investment even for those who are interested in total return.

Southwest five-year returns (Seeking Alpha)

However, the company appears to possibly have an improving financial situation. The most recent quarterly report, released in late July 2023, showed a net income of $683 million just for the quarter. This exceeded the net income for all of 2022. The most recent quarter came on the heels of a $159 million loss in the previous quarter. Those numbers were hurt by the $380 million hit incurred from the operational issues around Christmas travel noted above. Without that major problem, there should have been a net income of between $150 and $250 million (depending upon the tax bill). However, one quarter does not a turnaround make.

Those operational problems are liable to occur again until the company improves its IT services. That is a concern going forward. However, they are not guaranteed. People are flying with Southwest. The company’s load factor was 83.4% in the most recent quarter, which means that five of every six seats is filled, on average. A number that compares well with the competition.

Southwest has also diluted its shareholders in recent years. The company aggressively bought its own shares between 2013 and 2019, but this turned around beginning in 2020. In the period since the pandemic, the number of shares on the market has increased from 538 million to 594 million. This means that each individual shareholder owns less of Southwest. Additionally, the increase in shares outstanding hurts the earnings per share, likely providing a drag on share prices.

Dividends

Southwest suspended its dividend during the pandemic. Investors went nearly three years without a payment. This was a requirement for airlines that took COVID relief money from the federal government. With the end of that aid, the company reinstituted its dividend.

The current dividend is where it was when it was suspended–$0.18 per quarter per share. Dividends had skyrocketed from 2012, when they were just $0.0045 per share. It will be interesting to see if the dividend growth resumes in the future, but at this point, it remains to be seen.

The current yield is 1.65%, while the payout ratio is 57.45%. If this was a regular consumer stock, there might be more margin for growing the dividend. However, the airline industry is quite volatile. Plane traffic is hurt badly in economic downturns, even if they are not tied to global pandemic lockdowns. Businesses will cut down on trips for executives and salespeople, and leisure travelers are less likely to take trips when their jobs are threatened. This very discretionary nature of airline purchases means that airline dividends are less sure than they might be for consumer staple companies and retail businesses like Coca-Cola (KO) or Walmart (WMT).

Conclusion

As an income-focused investor, I’m not likely to purchase Southwest or any airline companies in the near term. The yield is not impressive, and the industry is extremely volatile. The time to invest would likely be during a recession, when air travel is lower. The companies that survive will likely provide better returns after streamlining operations and then growing the number of flights to meet whatever the new reality happens to be when the economy rebounds.

Southwest has decided to improve the company’s technology, promising to spend $1.3 billion on upgrades this year. However, until LUV’s tech is up-to-date, problems like the one that arose in late 2022 are a possibility that could cause both financial hits, as well as hits to customer goodwill. The yield is not terribly attractive when there are other options that have similar yields without a pause in payments while also giving regular growth in less volatile industries. If I held Southwest, I’d likely hold. However, I’m not likely to purchase for income or growth at present.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment professional. The preceding is intended for informational and educational purposes. Please make sure to perform due diligence before investing in equities, as losses up to all capital invested can occur.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.