Summary:

- Advanced Micro Devices, Inc.’s results aren’t particularly exciting as the company sits near all-time highs.

- The company is competitive in CPUs and increasing competitiveness in datacenter, though other segments seem to be suffering.

- We question whether AMD can gain enough datacenter boost to justify its valuation before we expect margins and revenue growth to slow down.

JHVEPhoto

Advanced Micro Devices, Inc. (NASDAQ: NASDAQ:AMD) disappointed the market after earnings, with a double-digit share price decline. Unfortunately, despite continued growth in its AI business, the company wants to see more evidence that AMD is becoming a market leader. Historically, we were largely bullish on AMD from 2018 to 2021, and in our most recent article, we discussed competition with Nvidia (NVDA).

However, as we’ll see throughout this article, we are reverting to our bearish opinion we had in the in-between times, as we believe too much exuberance in AMD’s share price will hurt its ability to drive meaningful returns.

AMD Opportunities

AMD sees several opportunities across its impressive portfolio of assets.

However, the company’s largest opportunity is clearly in datacenters, as seen with the number of products that the company has been launching. The company is focused on leadership here, as it works to gain market share from leader Nvidia. In the CPU space, the company’s EPYC offerings are strong, and we expect will remain strong.

The company’s gaming segment is weaker in our view, where the company focuses on a lower part of the market. Nvidia, the gaming GPU larger, effectively has no competition. Overall, in terms of total addressable market, or TAM, the company clearly has numerous opportunities.

AMD Financial Results 3Q

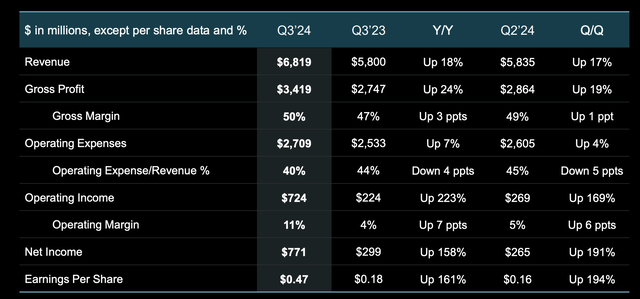

Financially, the company’s datacenter business helped drive 18% YoY revenue growth.

Those financial results were despite weakness in the company’s gaming segment. The company’s stronger revenue helped support a 50% gross margin, up 3% YoY, with $3.4 billion in gross profit. That’s some of the highest profit the company has seen about its margins in a while. At the bottom line, the company saw an EPS of $0.47 / share.

That puts the company at a P/E of ~70 based on its current share price. The company needs growth to justify its valuation, and it needs that growth through continued successful competition.

AMD Segment Performance

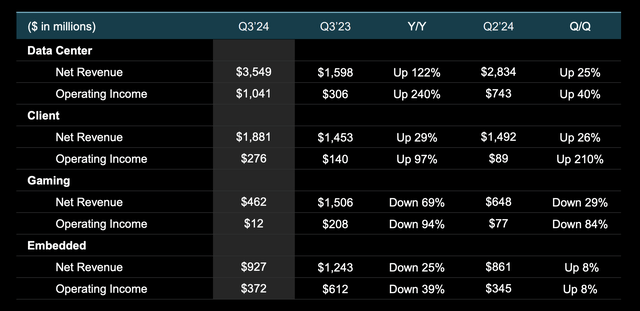

From a segment performance, the company has seen mixed results.

The company’s datacenter business remains incredibly strong as overall demand remains high. Meta’s latest live open-source model continues to see strong performance. The company’s client CPU business also remains dominant with Intel, taking advantage of Intel’s shortcomings to continue performing quite well.

The company’s embedded segment has seen hefty weakness, along with the company’s gaming segment. In our view, it’s clear that the company has shifted resources from gaming to client and data center, as Nvidia has outperformed the company here handily. It’s been many years since the company was competitive at the top end.

AMD Financial Outlook

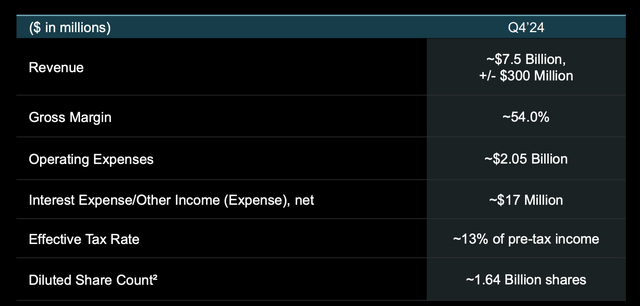

Financially, the company’s outlook for 4Q 2024 remains strong, however, the market was clearly disappointed given flat lining growth.

The company expects ~$7.5 billion in revenue, with ~54% margins showing expansion on both fronts. Operating expenses will be manageable, and interest expenditures will be negligible. It’s also a substantial decline in the company’s operating expenses YoY. This is a strong improvement for the company and its assets.

Effectively, in the company’s earnings, there’s nothing particularly surprising here.

Our View

AMD is a strong company with a solid portfolio of assets, and the company has performed well since our original recommendations as it’s been increasingly able to compete with Intel and the company’s struggles.

However, the company’s modest guidance and the strength of Nvidia add questions about the company’s ability to compete over the long term. We expect the company to be able to push down Nvidia’s margins with its offerings. However, we question whether the company will be able to grow revenue substantially before the AI hype dies down.

Given the company’s slowing growth in its guidance, we think this is a risk worth noting. At a P/E of ~70x, the company needs to grow revenue substantially and sustain it to generate future returns. We think the company will struggle to do that and with nothing particularly exciting or convincing us otherwise in its earnings, we rate it as a HOLD currently.

Thesis Risk

The largest risk to our thesis is that AMD is expanding market share. Continued growth in the market along with expanding market share and margins could enable the company to drive increased shareholder returns. That would make the company a more valuable investment opportunity for the long term.

Conclusion

AMD has an impressive portfolio of assets. The company has not only shown a unique ability to compete in CPUs, but it’s becoming increasingly competitive in AI GPUs, as the company has chased the opportunities where it sees it. We see the company remaining competitive in CPUs. However, in GPUs Nvidia is leaping forward on all fronts as well.

We expect the net result to be weaker margins, which will combine with what we expect to be slowing down long-term demand for GPUs. Given AMD’s current lofty valuation, that’s concerning to us. We do expect AMD’s CPU dominance to continue, but that doesn’t justify the valuation by itself. Overall, as a result, we rate AMD as a HOLD at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.