Summary:

- Apple stock has fallen 10% in the past three months due to a potentially heightened normalized rate environment and emerging cracks in its moat.

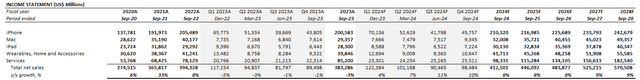

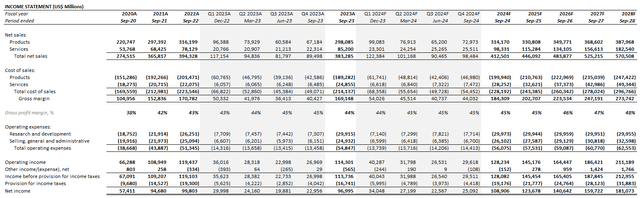

- Despite inline results during the September quarter, persistent revenue declines are a telling tale of higher-than-expected vulnerability to the mixed consumer spending backdrop heading into the holiday shopping season.

- While persistent margin expansion driven by resilient services sales growth is commendable, tepid product sales are likely to remain an offsetting headwind in the near-term.

Justin Sullivan/Getty Images News

Apple stock (NASDAQ:AAPL) has fallen about 10% over the past three months, dragged by the combination of a potentially heightened normalized rate environment that has dulled the luster of its cash flows, as well as emerging cracks to its moat amidst a softening global consumer spending environment. This is corroborated by persistent revenue declines during the fiscal fourth quarter, which was in line with the increasing string of tempered market expectations observed over the past three months despite the release of new iPhones in the period.

Looking ahead, we expect limited near-term upside potential in the stock given Apple’s lack of outrunning growth drivers. Specifically, ongoing regulatory and geopolitical risks pertaining to Apple’s operations in China, alongside continued consumer weakness in its core U.S. market, are likely to weigh on its product sales some more. This is expected to overshadow the near-term prospects of a modest recovery in Mac sales, which will likely be complemented by the latest line-up fitted with M3 silicon, after four consecutive quarters of declines that have underperformed industry shipments. Meanwhile, higher margin services revenue growth also is expected to start stabilizing amidst intensifying competition and normalizing growth across Apple’s devices installed base. Taken together, the modest near-term fundamental outlook at Apple is likely to weigh on the durability of its valuation premium at current levels, underscoring the stock’s vulnerability to broader market volatility ahead.

The iPhone Suffers Setback from a Growing China Problem

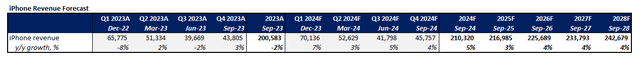

iPhone revenue grew 3% y/y to $43.8 billion during the September quarter, driven primarily by robust demand for the premium iPhone 15 Pro. The results were much milder relative to new iPhone launches observed in prior years. This is in line with market expectations that the impact of global consumer weakness was likely more prominent on demand for the standard iPhone 15, which got less of an upgrade on the performance aspects relative to its predecessor. Demand from China – the largest smartphone market in the world – also was stifled by the combination of a weak post-pandemic recovery in the region, alongside intensifying competition from local brands such as Huawei’s newest Mate 60 Pro, which rivals the iPhone 15 family.

Although Apple does not separately disclose its iPhone sales by region, market estimates demand from China has fallen to one of its lowest levels on record. With Huawei recently introducing the Mate 60 Pro equipped with 5G technology, superior camera quality, and competitive performance with its advanced proprietary “Kirin” silicon based on the 7nm process node, Apple has been snubbed of its market leadership in the Chinese smartphone market. The setback mirrors the slowdown in iPhone sales in China during 2018 with the emergence of local brands – spanning Oppo, Vivo and Honor – that have gained consumer interest in the region with their splashy celebrity sponsors and marketing campaigns.

In addition to intensifying competition, broader macroeconomic weakness in China and ongoing geopolitical disputes with the U.S. also have weighed on iPhone sales in the world’s largest smartphone market. China’s economic recovery from the pandemic era trough has been “fragile,” as it remains pressured by weak indicators in the property sector responsible for the bulk of the nation’s GDP. Although the region’s Q3 retail sales were stronger than expected at 5.5%, with the jobless rate improving to its lowest in almost two years at 5%, the welcomed figures continue to be overshadowed by a persistent property slump. This has largely been exacerbated further by Chinese property developer Country Garden’s default on its dollar bond this month, bringing the sector’s “credit squeeze” back into focus. Persistent deflationary risks, a brewing debt problem among local Chinese governments, and the elevated jobless rate also shed uncertainties over the sustainability of the recent rebound observed in China’s consumer spending environment.

Citing national security concerns, the Chinese government also has ordered a ban on the use of iPhones across government agencies and state-backed organizations, expanding a similar order on the government use of foreign-branded PCs. Taken together, Apple faces a sticky situation in the Chinese market for its iPhone sales over the near term.

However, the China headwinds are likely to be partially compensated by an anticipated pickup in iPhone demand heading into the December quarter due to seasonality tailwinds. Returning inventory to address iPhone 15 order backlogs also is expected to boost revenue growth in the current quarter. Yet the pickup date for new iPhone reservations – particularly the Pro models – remains in the mid-November timeline, in line with the schedule disclosed on Apple’s website shortly after the iPhone 15’s launch, indicating demand has likely slowed. The trend foreshadows an earlier-than-expected timeline to normalization in iPhone 15 demand through the remainder of fiscal 2024, fast-tracked by ongoing macroeconomic and geopolitical uncertainties in Apple’s key growth regions.

As a result, our base case forecast expects iPhone sales to grow by 5% y/y to $210.3 billion in fiscal 2024. The anticipated sequential acceleration in the December quarter, driven by order backlog realization and seasonal tailwinds, is likely to be followed by sequential declines through the remainder of the fiscal year as demand normalizes.

A Mixed Mac Recovery Outlook

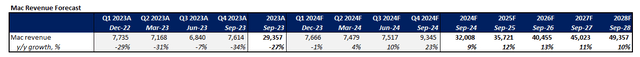

Meanwhile, Mac sales declined sharply y/y during the September quarter to $7.6 billion. The results were in line with management’s expectations due to the tough prior year comparison and weak PC demand environment. Specifically, global PC shipments have continued to fall year-over-year during the calendar third quarter, though at a slower pace than previous quarters with restored sequential growth. Apple ceding two percentage points of its market share as a result after a 24% y/y drop in Mac shipments during the period.

Again, the segment is likely slated to benefit from seasonal tailwinds heading into Apple’s strongest quarter of the year, buoyed by holiday shopping trends. The all-new M3-fitted slate of MacBook Pros and iMacs announced earlier this week also is expected to drive a much-needed complementary boost to demand by encouraging an upgrade cycle.

During the “Scary Fast” launch event on the eve of Halloween, Apple introduced its latest and greatest in-house silicon for Mac applications. The M3 chip line comes in three variations – the standard M3, M3 Pro and M3 Max – with all of them based on the latest 3nm process node, underscoring a step-up in performance and power efficiency from its predecessor which was based on the 5nm process node. Specifically, the M3 silicon represents the first mass market client computing processor based on the 3nm process node, highlighting its market-leading performance and competitive TCO driven by incremental power efficiencies. The chip’s performance improvements also are expected to address increasing client compute demands resulting from the rise of AI applications for PCs, potentially aiding Apple’s monetization of related opportunities despite its limited exposure in the nascent technology relative to its big tech peers.

The M3 silicon will first become available in the revamped iMac and MacBook Pros, with prices ranging from $1,299 to $7,199, and deliveries starting Nov. 7. The latest silicon is expected to come to the best-selling MacBook Air and an all-new low-end MacBook Pro next year, which is expected to complement an anticipated cyclical recovery in PC demand.

However, the segment’s anticipated return to growth in the near term will likely remain clouded by the mixed consumer spending outlook. Specifically, household savings have continued to decline below pre-pandemic levels on the back of persistent inflationary pressures and borrowing costs, while delinquency rates are also on a gradual upsurge. Consumer confidence has also dropped to a “five-month low in October” as a result. Taken together, we expect Mac segment sales to total $32.0 billion in fiscal 2024, representing growth of 9% y/y. The assumption considers a pickup in demand in the December quarter, driven by seasonal tailwinds and an M3-driven upgrade cycle. The pace of growth is likely to moderate through the first half of calendar 2024, before picking up again heading into the back-to-school season that is expected to coincide with the anticipated launch of M3 MacBook Airs and the low-end M3 MacBook Pro catered to educational use cases.

Services Spotlight

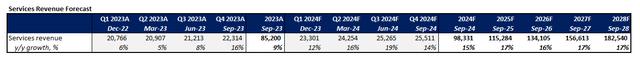

Apple’s services segment remains a spotlight, with double-digit y/y revenue growth and sequential acceleration in the fiscal fourth quarter. Paid subscription growth also had a strong showing, with the count surpassing 1 billion in the last 12 months.

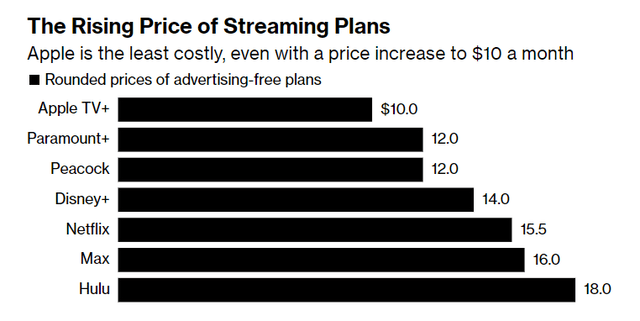

The high margin segment is expected to benefit from an incremental boost in growth heading into the new fiscal year with its recent price increases implemented in the U.S. and certain markets overseas. Specifically, TV+ subscription rates increased for the second time since its launch in 2019, from $6.99 per month to $9.99 per month (or $69 per year to now $99 per year). Yet it remains the lowest-priced offering among the major competing streaming platforms currently available in the market, with TV+ also being the only ad-free service left of its kind. Not only does this underscore TV+’s growing value proposition to the consumer, but it also reduces risks of churn despite tightening consumer discretionary budgets and rising competition in the market. American households are already subscribed to 3.7 streaming services on average, fuelled primarily by the combination of cord-cutting dollars moving online and the increasing availability of different platforms to choose from.

Other price increases were observed in Arcade (increase from $4.99 per month to $6.99 per month), News+ ($12.99 from $9.99), and the Apple One bundle (basic plan at $19.95 from $16.95; family plan from $22.95 to $25.95; premier plan from $32.95 to $37.95).

Looking ahead, services sales are expected to remain a key driver of Apple’s growth and margin expansion roadmap. Specifically, services sales growth will be primarily driven by the expanded monetization of Apple’s stabilizing devices installed base. And the segment’s growing revenue contribution will inadvertently place a more evident impact on the company’s consolidated profitability and cash flows going forward. The step-up in services sales also will be key to reinforcing stickiness in Apple’s broader ecosystem, driving retention in adjacent product sales over the longer term, while also inadvertently enabling incremental services sales, thus driving a flywheel effect to minimize risks of churn.

Fundamental and Valuation Update

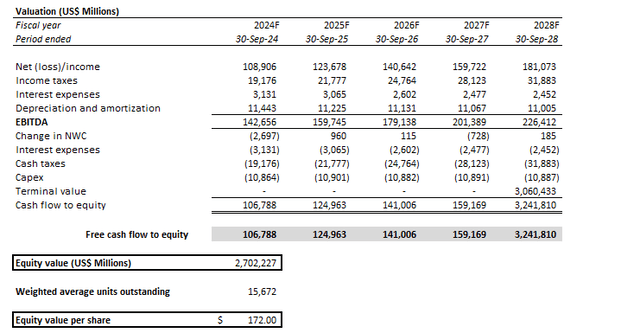

Taken together with our modest base case forecast for iPad and Wearables, Home and Accessories revenue, Apple is expected to grow net sales by 8% y/y to $412.5 billion in fiscal 2024. Total revenue is expected to expand at a 6.7% five-year CAGR, in line with normalizing demand trends in its existing product line-up (+4.3% five-year CAGR), which will be partially offset by continued resilience in monetization of its expansive devices installed base through the continued ramp of services sales (+13.2% five-year CAGR).

The ensuing cost impact is expected to be positive on the back of increasing revenue contributions from the higher margin services segment. However, we expect some incremental ramp-up cost challenges in the near term, considering the anticipated launch of the Vision Pro headwinds in the earlier half of fiscal 2024.

Apple_-_Forecasted_Financial_Information.pdf

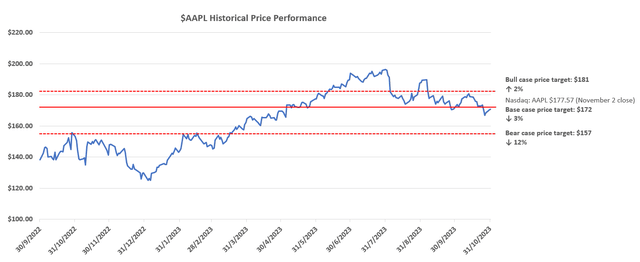

Our base case price target for the stock is $172. The price considers Apple’s adjusted risk profile relative to a higher normalized rate environment going forward, as well as its tempered growth prospects given the limited slate of TAM-expanding long-term growth drivers and the lingering impact of near-term macroeconomic uncertainties.

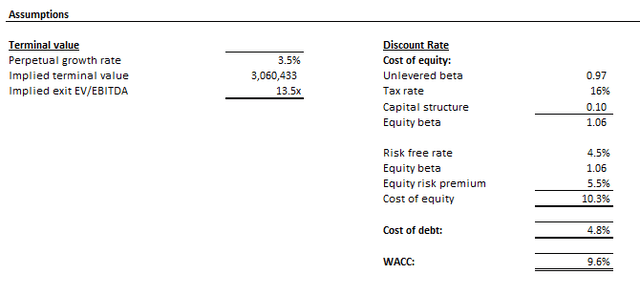

The base case price target is computed based on the discounted cash flow approach, which considers projections taken in conjunction with the fundamental forecast discussed in the earlier section. A WACC of 9.6% and implied perpetual growth rate of 3.5% are applied to reflect Apple’s risk profile relative to the elevated risk-free Treasury benchmark, as well as its economy-driving growth prospects.

Our base case forecast considers a conservative valuation premium on the stock relative to Apple’s big tech peers, given the company’s limited direct exposure to AI tailwinds that have been driving the market’s performance over the past year. Specifically, investor concerns are brewing over the potential impact of Apple’s delays in capitalizing on emerging AI opportunities. This has likely also exacerbated wariness over the durability of its moat in consumer-facing technologies amidst broader macroeconomic weakness. While Apple has long had a reputation for delaying its participation in the market’s most speculative innovations in order to perfect the user experience and integration to its broader ecosystem, its delayed generative AI push continues to be viewed by investors as a mishap, nonetheless. This is expected to remain a limiting factor on the stock’s appeal relative to its Magnificent Seven peers in the near term.

Final Thoughts

The Apple stock has lost its momentum in recent months. And tepid performance in the September quarter alongside the conservative fiscal 2024 prospects offers limited respite in the near term to take the stock back to the $3 trillion market cap sustainably. Specifically, Apple’s outlook has been clouded by weak product demand due to the combination of intensifying competition, volatile geopolitical conditions, and persistent macroeconomic uncertainties across its core Chinese and U.S. markets. While AI has largely been a market-driving theme this year, overshadowing the mixed demand environment across almost every corner of the economy, Apple as a key big tech leader has essentially missed out on the frenzy so far.

Although Apple’s profit margin expansion trajectory remains a bright spot, building on robust monetization of its stabilizing devices installed base through resilient services sales, the lack of scale in new product shipments remains a potential risk to its longer-term cash flows. Taken together, we see limited near-term upside potential in the stock from current levels, with much left to do at Apple to restore credibility to its moat in consumer-facing technologies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!