Summary:

- Novavax’s Q1 2024 earnings were so-so, but a major partnership with Sanofi sent its share price soaring by 200%.

- The Sanofi deal provides essential funding but restricts Novavax’s future earning potential, making it reliant on revenue streams from Sanofi.

- Novavax’s long-term prospects may be challenging as it may struggle to develop new products and could see its revenue streams dry up post-2025.

- In this review ahead of Q2 earnings (to be announced on August 6) I take a deeper look at the Sanofi deal, and what to expect from Q2 earnings.

peepo

Investment Overview

I last provided coverage of Novavax (NASDAQ:NVAX) – the Gaithersburg, Maryland based developer of “innovative vaccines to prevent serious infectious diseases”, ahead of the company’s Q1 2024 earnings in early May.

Frankly, I was not especially optimistic about the company’s prospects, although I did not rule out a surprise – I wrote as follows:

The days of wild share price fluctuations and spikes >$100 per share are a long way behind Novavax now – a spike into the double digits would frankly be surprising in the current climate, as management wrestles with financial problems, announcing plans to let go ~30% of staff when announcing its 2023 earnings.

With that said, Novavax does have an effective, approvable vaccine product that may be capable of driving “blockbuster” revenues for many years to come, if a long-term private COVID vaccination market emerges, as many believe it will.

As such, Novavax retains the ability to surprise the market, as nobody quite knows what to expect from the company, or how its target market may develop over the coming years.

In my conclusion, I wrote:

My expectations aren’t especially high for the upcoming earnings. I would not expect the company to report much in the way of revenues as most of the APA agreements are likely to be settled later in the year, I’d assume, and the fall vaccination season is the key period for earnings commercial revenues.

Where the company may offer investors hope is with some positive developments in terms of the approval of its BLA in the US, and early development of its vaccine targeting the newest strain of COVID, so that it is ready to be launched and compete against its rival vaccines as early as possible.

Management will also (hopefully) update on progress with commercial and retail partners – one major deal could transform the company’s fortunes, but will any company step up and make nuvaxovid a central part of its plans to compete in COVID markets?

What actually happened was that, while reporting a so-so set of earnings – revenues of $94m, up from $81m in the prior year period, a net loss of $(148m), compared to $(294m) in the prior year period, and a cash position of $496m, Novavax shocked the market by announcing a major partnership with French Pharma Sanofi (SNY), potentially worth multi-billions of dollars in revenue, which sent its share price soaring from $4.50 per share, to $13.50 per share, overnight – a gain of 200%.

I am certainly not going to claim I saw this deal coming – I ruled out Novavax’s share price reaching double digits under almost any circumstance, but today it trades at over $16.50 per share.

With Q2 earnings set to be released in ten days’ time, on August 6, I felt this would be a good time to update my thesis, factoring in the impact of a deal that completely reversed Novavax’s fortunes – in the short-to-medium term at least – and speculating about how far this fresh momentum can carry the company, and the long-term effect on its share price and valuation.

Before we discuss Q2 earnings in detail, let’s first recap the company, and the Sanofi deal.

Novavax Seals Sensational Sanofi Deal In Q1 2024

Prior to Q1 earnings Novavax had warned investors that “conditions or events existed that raised substantial doubt about our ability to continue as a going concern” – the reasons for this can be traced to its failure to establish its COVID vaccine, Nuvaxovid, alongside Moderna’s (MRNA) Spikevax and Pfizer’s (PFE) Comirnaty as a preferred vaccine option for major governments’ – here is what I wrote in May:

Novavax is arguably best known for being the company that – very nearly – challenged the supremacy of the messenger-RNA vaccines developed by Moderna (MRNA) and Pfizer (PFE) / BioNTech (BNTX), that earned ~$135bn of revenues during the COVID pandemic era of 2021-2023.

Novavax received ~$1.8bn of funding from Operation Warp Speed (“OWS”), the Trump administration’s vaccine accelerator program, in 2020, but despite delivering some strong safety and efficacy readouts, comparable to Moderna’s SpikeVax and Pfizer / BioNTech’s Comirnaty, delays to completing Phase 3 studies meant that Nuvaxovid did not receive Emergency Use Authorisation in the US until July 2022.

By that time, both Spikevax and Comirnaty, which received their EUAs in December 2020, dominated the COVID vaccine market, and although Novavax secured approvals in the UK, Canada, Australia, Switzerland, Singapore and New Zealand, and thanks to a partnership with the Serum Institute in India, South Korea, Thailand and Bangladesh, the company could not match its rivals’ earnings power, reporting revenues of $476m, $1.15bn, $1.98bn, and $984m in the four years since 2020.

Nor could Novavax return a profit in any of those years, reporting net losses of $(418m), $(1.74bn), $(658m), and $(545m) in the four years since 2020.

Prior to Nuvaxovid, Novavax had been in business for nearly 35 years without securing a single drug approval, but its unique approach to vaccine development had produced an essentially effective vaccine against COVID – the mechanism of action (“MoA”) of Nuvaxovid is described as follows by NebraskaMedicine.com:

The Novavax method uses moth cells to make spike proteins:

- Researchers select the desired genes that create certain SARS-CoV-2 antigens (spike protein).

- Researchers put the genes into a baculovirus, an insect virus.

- The baculovirus infects moth cells and replicates inside them.

- These moth cells create lots of spike proteins.

- Researchers extract and purify the spike proteins.

The vaccine also benefits from a soapbark tree extract adjuvant, Matrix-M, designed to increase the immunological effect, and in fact, its differentiation from Moderna and Pfizer messenger-RNA vaccines – hugely popular during the pandemic, but also criticised in some quarters for possessing undesirable side effects – may be what brought Sanofi to the negotiating table.

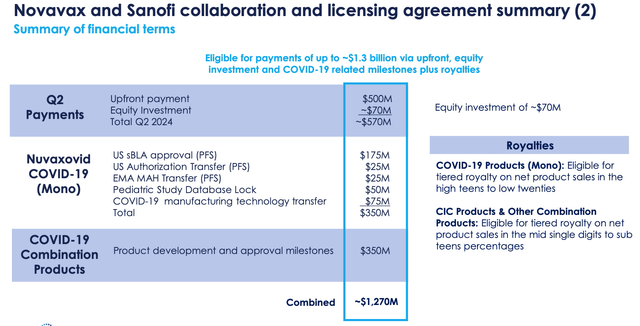

By the terms of the deal, Sanofi made a $500m upfront payment to Novavax, with a further $700m potentially payable, based on achievement of certain “development, regulatory and launch milestones”. Beginning in 2025, Sanofi says it will “book sales of Novavax’s adjuvanted COVID-19 vaccine and will support certain R&D, regulatory, and commercial expenses”, with Novavax eligible for “tiered double-digit percentage royalty payments on sales by Sanofi of COVID-19 vaccines and flu-COVID-19 combination vaccines”.

Additionally, Sanofi has taken a 5% equity stake in Novavax, and will pay up to $200m of milestone payments plus mid-single digit royalties, “for each additional Sanofi vaccine product developed under a non-exclusive license with Novavax’s Matrix-M adjuvant technology”.

Deal Makes Sense – But Novavax Had To Sell The Crown Jewels

The deal represents a significant coup for Novavax’s CEO, John Jacobs, appointed in January 2023 to succeed the retiring, long-time CEO Stanley Erck, virtually guaranteeing the company can remain financially stable for years to come, although there is a downside to the deal, in that Novavax has effectively sold the crown jewels.

By the terms of the deal, Novavax is permitted to continue developing its own influenza, COVID, and other vaccine and adjuvant products, and the company does have a COVID-Influenza (“CIC”) vaccine at the Phase 3 study stage, and a preclinical RSV vaccine program.

In its Q1 2024 quarterly report/10Q submission Novavax discusses plans for the CIC vaccine as follows:

We have previously received agreement with the U.S. FDA on a Phase 3 design, study endpoints, trivalent comparators, and size of licensure enabling safety database.

We have recently decided to modify the study to focus on individuals at higher risk by enrolling adults aged 60 years and older and to include a stand-alone influenza vaccine comparative component.

We remain on track to submit an investigational new drug application, inclusive of this new study design and initiate the study in the second half of 2024, with potential accelerated approval and launch of the CIC vaccine in the fall of 2026.

For the RSV vaccine, Novavax says (on its Q1 2024 earnings call) that in terms of neutralising responses:

We have driven six fold increase for RSV A compared to the licensed GSK-vaccine, which represents the difference of titers from 3,700 to over 23,000. And for RSV B, a titer difference from 440 to over 1,500.

Based on our previous clinical experience with a related construct, we are evaluating whether additional preclinical or toxicology studies are required. Partnering discussions for this antigen are ongoing.

For my money, the progress and setbacks discussed above for both candidates sounds all too familiar. Yes, Novavax is capable of designing vaccine prospects with decent efficacy and safety profiles, but the pace of development is usually not fast enough, and usually, Novavax is beaten to the punch by larger or more agile companies.

Recently, two new RSV vaccines have been approved by the FDA – Pfizer’s Abrysvo, and GSK’s (GSK) Arexvy, with a third candidate developed by Moderna likely to be approved this year. As such, the market opportunity for Novavax candidate already looks niche, and the company is likely to struggle to find a partner to help move this project forward.

Furthermore, with Sanofi now having access to all of Novavax’s knowhow in relation to its COVID vaccine, and its adjuvant, the chances of its producing a better CIC vaccine than its new partner seem minimal – Sanofi is a global vaccine giant, after all, with an influenza vaccine generating over $3bn revenues per annum.

In essence, then, while we can say that the Sanofi deal has provided Novavax with essential funding, it has, in another way, significantly restricted the company’s future earning potential.

Novavax / Sanofi deal breakdown (Q1 2024 earnings presentation)

Shown above is a breakdown of all the milestone payments Novavax is eligible to receive from Sanofi, and the royalties it may receive. Personally, I can see all of the listed milestones being achieved and Novavax receiving the full $1.27bn of milestone payments, and here is what CEO Jacobs had to say about the remainder of the deal structure on the Q1 2024 earnings call:

By licensing Sanofi to use our Nuvaxovid to develop their own combination Flu and COVID products, and to use Matrix-M as a component of other vaccines across their portfolio, we expect to realize substantial additional royalties and milestones valued potentially in the billions of dollars, driven by Sanofi’s product development and commercialization efforts over the years and decades to come.

Jacobs points out that each new product Sanofi developed with Matrix-M is worth up to $200m of milestones, plus single digit royalties, so five new products would equal $1bn in milestones alone, but is this realistic? Today, Sanofi markets and sells a handful of vaccines, so would the company realistically develop five new vaccines using Matrix-M?

Equally, if Nuvaxovid finds a +$1bn per annum revenue opportunity within the private COVID vaccine market, then Novavax could earn ~$200m per annum for many years to come, but again, is this realistic?

If the private COVID market matches the influenza market in size – ~$10bn per annum – Nuvaxovid may theoretically be able to claim a 10% share of the market, but in 2023, Moderna’s market research shows that only 11% of Americans got a COVID shot, while 44% opted for a flu jab.

If Sanofi develops a flu/COVID combo shot, Novavax will receive $350m of milestone payments (according to my understanding), plus double-digit royalties on all revenues. This is the best opportunity for my money. Sanofi’s flu jab currently generates ~$2.7bn per annum, so if a CIC jab could match, or exceed, that figure, Novavax, with a 15% royalty, for example, could earn $450m per annum.

Looking Ahead – Previewing Q2 Earnings & Speculating About The Long Term

In Q1 2024, Novavax was able to reduce its R&D and SG&A spend by 50% year-on-year – and decrease its current liabilities by $831m, in part due to settling ongoing disputes with GAVI, the vaccine alliance, and with Fujifilm, relating to manufacturing. The total consideration due to GAVI was ~$700m, while Fujifilm received ~$150m (Source: 10Q submission).

Novavax’s goal is to reduce R&D and SG&A expense in 2024 to $750m, and then to reduce them to $500m in 2025. In Q1, the combined R&D plus SG&A figure was ~$179m, and I would expect to see a similar figure in Q2, now that the workforce has been reduced by 30%, and with the target in mind.

In Q1, Novavax slightly upgraded its revenue guidance, to $970m – $1.17bn, including the Sanofi agreement payments, however revenue-ex Sanofi was downgraded from $800m-$1bn, to $400m-$600m. In its guidance notes the company states:

Full year 2024 guidance reflects APA expected dose delivery schedules of $150 million to $250 million and non-APA related revenue of $250 million to $350 million, subject to updated variant manufacturing and regulatory approvals, from a combination of commercial market product sales plus royalties and other revenue from our partner-related activity.

In terms of Q2 revenues, I would expect to see less than $100m, as in Q1, and probably from the fulfilment of an advanced purchase agreement (“APA”) order, as the fall vaccination season is where the bulk of commercial revenues will come from.

Having received instructions from the Vaccines and Related Biological Products Advisory Committee (“VRBPAC”) about which strain of COVID to target, the committee voted unanimously in favour of strain JN.1. Novavax is preparing to have its latest vaccine ready ahead of the fall vaccination seasons.

Novavax’s Biologics License Application (“BLA”) requesting full approval of its prototype COVID-19 vaccine has been filed with the FDA, with a decision date set for April 2024, so the company must rely on securing another Emergency Use Authorisation (“EUA”) in order to market and sell this year’s vaccine.

The forward revenue guidance does not seem to suggest Novavax is especially enthusiastic about this year’s private COVID shot market – Sanofi will assume all of this responsibility from 2025, and Novavax is trying to reduce operating costs, so it’s not likely to fund an extravagant marketing campaign.

On the plus side, however, Novavax says it will have a prefilled syringe version ready “no later than mid-August”. According to CEO Jacobs, speaking at the Jefferies Healthcare Conference in June:

That’s very important, is the first three to four weeks of the season is 40% to 50% of the market opportunity. So even a few weeks drift there could make a huge difference.

Analyst’s consensus is for Novavax to deliver $347.78m of revenue – I assume this includes part of the Sanofi money – and achieve earnings per share $0.98 on a GAAP basis, and $1.01 on a normalised basis. This feels achievable, as thanks to Sanofi, Novavax does look likely to be profitable this year.

Novavax’s market cap is $2.34bn. It was just over $600m when I last covered the company less than three months ago. And I would not necessarily expect Q2 earnings to drastically alter the share price, although with Novavax, you can never be entirely sure what is in store.

Looking further ahead, however, I’d be a little concerned. To sustain its current valuation, I’d expect Novavax would need to generate ~$500m in revenues per annum, with a price to sales ratio of ~5x, and be at least marginally profitable.

Initially, milestone payments ought to make this achievable, but the payments from Sanofi could dry up rapidly, if, for example, Sanofi develops a different type of COVID/influenza combo. In that scenario, Novavax earns no royalties.

With a drastically reduced staff and R&D budget, the chances of Novavax bringing its own vaccine to market looks remote, so, looking beyond 2025, I see a somewhat challenging environment.

Concluding Thoughts – Sanofi Deal Saved Novavax, But May Not Be Able To Revive The Company

Novavax management has stressed that the Sanofi deal does not represent the “sale” of the company, but in many ways, while the deal has almost certainly saved Novavax from bankruptcy, it does feel as though the company is unlikely to develop new products of its own going forward, and is now almost completely reliant on revenue streams from Sanofi.

I may be wrong on this score, and Novavax is nothing if not hard to predict, but a deal that saved the company may have also sapped its energy and taken away its life force. In such a scenario, so long as the royalties and milestone are rolling in, the company valuation will be supported and potentially even increase, but longer-term, if Sanofi does go down the route of an alternative CIC vaccine candidate, the Pharma may conclude that squeezing the revenue out of the current vaccine is worth the $500m outlay. It could opt against developing further products with Matrix-M or Nuvaxovid and Novavax’s revenue streams may well dry up, and hence, I am issuing a “sell” recommendation today.

Like most people, I was completely blindsided by the Sanofi deal, although after breaking down the deal and its implications, I am not sure that the 200% upside was completely justified. As with most things vaccine related, however, the market is looking at the short term, and not worrying about what happens after 2025. With that said, Novavax’s unpredictability means I may well end up revising my thesis again before the year is out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.