Summary:

- Novavax, Inc.’s Sanofi partnership provides much-needed financial support via upfront and milestone payments, stabilizing its finances.

- Combination vaccines are set to be an essential market, but competitors like Pfizer and Moderna are further along.

- The deal shifts Novavax’s strategy to licensing technology, reducing risk but surrendering potential competitive advantages.

- The Sanofi agreement moves Novavax from “Strong Sell” to “Hold,” indicating a cautious improvement in its outlook.

Paul Sutherland/DigitalVision via Getty Images

Novavax Secures Lifeline with Sanofi Collaboration, Recalibrates Strategy

Novavax, Inc. (NASDAQ:NVAX) stock is up more than 100% after the company released its first-quarter earnings report, which included a welcomed surprise. The company announced a major agreement with pharmaceutical giant Sanofi (SNY). The two will co-commercialize Novavax’s COVID-19 vaccine, and Sanofi was granted:

“a sole license to Novavax’s adjuvanted COVID-19 vaccine for use in combination with Sanofi’s flu vaccines while Novavax retains the right to and is developing its own COVID-19-Influenza Combination vaccine candidate.”

Sanofi will invest approximately $70 million in equity and pay $500 million upfront. There could be another $700 million in milestone payments for COVID-19 and combination vaccine development. After this development, Novavax removed their “going concern” notice that indicated their business was once in jeopardy.

The agreement breathes new life into Novavax. Furthermore, Sanofi is entering the race for the COVID-19 influenza vaccine market, which is expected to be worth more than $8 billion. Because COVID is expected to join influenza as a seasonal risk, these combination vaccines are expected to become standard and eventually replace a large share of the standalone seasonal influenza vaccines.

There are a few players vying for this market. I recently penned an article on Moderna’s (MRNA) Phase 3 mRNA combination vaccine. The vaccine could be on the market within a couple of years. Pfizer (PFE) and BioNTech (BNTX) are also developing a mRNA combination vaccine. Their vaccine received Fast Track designation from the FDA after reporting positive Phase 1/2 data. The vaccine is currently in Phase 3.

By entering into this agreement, Novavax forfeits a competitive advantage. However, the massive upfront payment and the potential for “tiered double-digit percentage royalty payments on sales” were enough to entice Novavax to license their technology.

This represents a shift in strategy for Novavax (licensing their technology rather than developing and commercializing its own vaccines), which failed to secure a significant share of the COVID vaccine market during the pandemic due to scaling production challenges and competition. This is a reasonable evolution for a company that clearly didn’t have the capacity to develop, market, and scale a COVID vaccine on their own.

Turning to the income statement, total revenue for Q1 was $93.855 million. The cost of sales was $59.209 million, implying a gross margin of only approximately 37%. R&D and SG&A expenses were $92.679 million and $86.798 million, respectively. Their net loss was $147.55 million. This is a major improvement from the same period last year, in which they recorded a net loss of $293.9 million. Novavax plans on additional cost reductions to reduce R&D and SG&A expenses to below $750 million in 2024. The company’s full-year revenue guidance, now including the Sanofi deal, was adjusted from $800 million and $1 billion to $970 million and $1.17 billion.

Novavax’s Financial Health

Looking at the balance sheet, as of March 31, Novavax reported $480.586 million in cash and cash equivalents. Total current assets were $727.1 million, while total current liabilities were $804.382 million. This implies a current ratio under 1, which isn’t desirable. However, as Novavax anticipates receiving $500 million from Sanofi this month, this should be vastly improved. Novavax has $841.473 million in long-term deferred revenue and $168.432 million in convertible notes payable.

Because Novavax is not consistently profitable, I will now estimate the cash runway based on historical figures. Net cash used in operating activities was $83.555 million for Q1. Because the $500 million upfront payment is reasonably assured, their liquid assets are $980.586 million. This implies a cash runway of nearly three years. However, this historical estimate has limitations. It does not account for any liabilities that may be due, nor does it account for possible milestone payments from Sanofi.

NVAX Stock – Risk Reward Analysis and Investment Recommendation

In light of these significant developments, I need to reconsider my previous “Strong Sell” rating on Novavax, as a deal like this was not on my bingo card. Novavax was a “going concern” at the time, with a current ratio of just 0.68. Its stock was plummeting, and its cash burn appeared out of control.

The recent Sanofi deal significantly reduces the company’s financial risk, at least in the short term. Furthermore, some operational risk is eliminated, albeit at the expense of some alpha that they could have generated if they had gone it alone successfully (a very low probability). But, in light of past challenges, this seems like a prudent move.

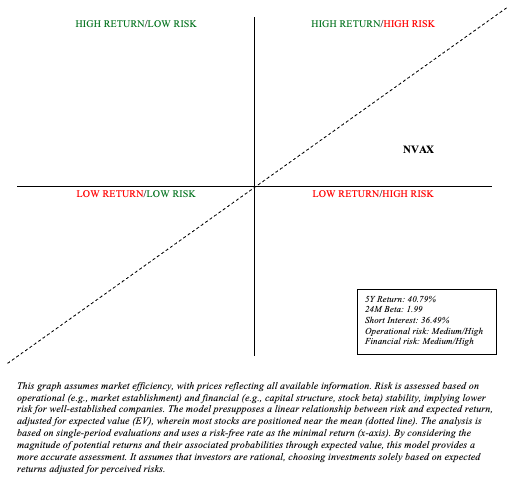

I think the deal moves Novavax from a Quadrant 4 investment (high risk/low return) to a Quadrant 1 investment (high risk/high return), meriting a rating upgrade to “Hold.” The probability of Novavax securing sustainable returns has considerably increased following this agreement.

Author’s visual representation

While Novavax, Inc. has gained visibility, this remains a risky investment. Its stock is extremely volatile (24M beta of 1.99), and its 5-year return of 49.79% does not inspire confidence. The company is still a distance from achieving consistent and reliable profitability, and it faces long-term financial challenges. Furthermore, the COVID-Influenza combination vaccine market prospects are uncertain, so I factored this into my projections for NVAX’s potential return. Sanofi’s offering appears to be years behind that of pharmaceutical behemoths like Pfizer. By the time Novavax technology is finally embraced by the market, one or more leaders may be entrenched.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.