Summary:

- Novavax has secured a transformative partnership with Sanofi, which includes $1.2 billion in potential payments and critical commercial support.

- The company’s COVID-19 vaccine targets the JN.1 variant, but newer Omicron variants have outpaced it, limiting competitive advantage.

- Financial stability hinges on achieving key milestones in the Sanofi partnership and successful commercialization of new vaccines.

- Despite the Sanofi deal, maintaining a “hold” position is prudent given the high-risk nature of Novavax’s future prospects.

Kelvin Murray

Introduction

Novavax’s (NASDAQ:NVAX) stock is up almost 40% since my rating upgrade to “hold” in May. The upgrade followed a collaboration with Sanofi (SNY), granting the pharma giant a license for Novavax’s adjuvanted COVID-19 vaccine for use in combination with Sanofi’s flu vaccines. Sanofi paid Novavax $500 million upfront with a potential for $700 million in milestone payments, as well as tiered double-digit percentage royalty payments on sales. The deal allowed Novavax to ditch its “going concern” doubts in its financial statements, breathing life into the company. Both Novavax and Sanofi, however, enter a race towards an influenza/COVID combination vaccine that has other runners. Moderna (MRNA) and Pfizer (PFE) are also vying for market share and already in later-stage trials, although the latter company had a setback recently after missing a key endpoint.

| Company | Current Status | Phase/Trial Results | Approval Target | Challenges/Remarks |

|---|---|---|---|---|

| Novavax/Sanofi | In collaboration, Novavax is working on a COVID-19/flu combination vaccine, with Sanofi leading commercialization. | Planned Phase 3 trial to start in Q4 2024 for standalone flu and combination vaccines, with data expected by mid-2025. | Targeting 2025 for market entry. | Strong collaboration with Sanofi, but currently in earlier stages compared to competitors. |

| Pfizer/BioNTech | Developing an mRNA-based COVID-19/flu combination vaccine. | Mixed Phase 3 results; strong response against influenza A but underwhelming against influenza B. | Still aiming for 2025, but timeline may be adjusted. | Considering formulation adjustments due to less-than-expected results for the influenza B strain. |

| Moderna | Leading the development with its mRNA-1083 combination vaccine. | Positive Phase 3 data; higher immune responses compared to existing vaccines for both flu and COVID-19. | Targeting approval by 2025. | Positioned as the front-runner, with strong Phase 3 data supporting higher efficacy across multiple virus strains. |

Here’s a look at some upcoming catalysts for NVAX:

| Expected Date | Milestone | Details |

|---|---|---|

| Q4 2024 | Launch of Phase 3 Trial for CIC and Stand-alone Flu | Novavax plans to launch a Phase 3 trial for its COVID-19 and influenza combination (CIC) vaccine and stand-alone flu vaccine. |

| Mid-2025 | Data from Phase 3 CIC and Flu Trial | Expected data from the ongoing Phase 3 trial, which will be crucial for future regulatory submissions and market entry strategies. |

| Late 2024 | Additional Cost Reduction Program | Novavax intends to initiate another cost reduction program to improve financial sustainability and operational efficiency. |

| Ongoing | Regulatory Filings and Approvals | Continuation of regulatory activities, including seeking BLA approval for its prototype COVID-19 vaccine and EUA for its 2024-2025 formula. |

Novavax’s Sanofi Pact: A Lifeboat Amid Vaccine Market Turbulence

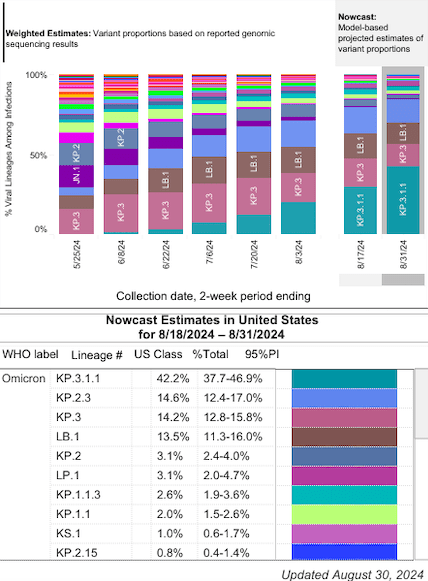

There have been a few developments since my last look. Novavax received emergency use authorization (EUA) from the FDA on Friday for its updated COVID-19 vaccine that targets the JN.1 variant. This subvariant of Omicron was prevalent last season, causing as high as 60% of total COVID cases. JN.1 has since been replaced by other Omicron subvariants like KP.3.

CDC

In this regard, Novavax seems to be a step behind, although the company has stated that their vaccine is also effective against KP.2 and KP.3 (as the variants are structurally similar to JN.1). Meanwhile, Pfizer and Moderna received an EUA for their vaccines targeting the KP.2 variant.

This is during a time when COVID cases are beginning to rise. CDC data reveals increases in test positivity, hospitalization rates, and COVID-19 deaths since April.

Despite the EUA, I don’t think there’s any reason to believe Novavax will suddenly gain share against much larger companies and household names like Moderna and Pfizer. In fact, Novavax recently cut its revenue outlook for 2024 from ~$1 billion to ~$750 million due to lower demand for its COVID-19 vaccine.

Novavax’s partnership with Sanofi is progressing. Sanofi’s combination vaccine, which incorporates Novavax’s COVID-19 vaccine, is expected to begin a Phase 3 trial before winter, with top-line data expected by mid-2025. Novavax could receive milestone payments based on clinical success and regulatory approval, while commercial success would result in royalty payments. The company anticipates marketization in time for the 2025/2026 influenza season. With this outlook, the company expects to reveal an expanded clinical pipeline before the end of the year.

Q2 Earnings

Novavax reported revenue of $415.484 million, largely driven by the Sanofi collaboration. Product sales of just $19.9 million were down from $285.163 million in Q2 2023. EPS was $0.99, which missed analyst’s estimates of $1.36. Nonetheless, this is a significant improvement compared to past performance. Net income was $162.381 million for the quarter. R&D expenses decreased to $107 million, down from $219 million in the same period last year. SG&A expenses rose slightly to $101 million due to fees associated with the Sanofi agreement.

Financial Health

As of June 30, Novavax had $680.162 million in cash and cash equivalents. Marketable securities totaled $369.432 million. Total current assets were $1.2 billion, while total current liabilities equaled $1.157 billion. This means that their current ratio is just over 1, which isn’t ideal, but should reasonably cover short-term obligations. Novavax does owe $533.431 million in “deferred revenue” and $168.848 million in “convertible notes payable.”

The company’s revenues are variable and now heavily reliant on milestone payments. Although they reported net income in Q2, it was primarily due to one-time payments from the Sanofi collaboration. However, Novavax is likely to receive additional major milestone payments, which will help to offset their OpEx (see table below). So, for the time being, I will defer estimating the cash runway, assuming that the milestone payments expected over the next two years will bring the company close to profitability.

| Expected Date | Milestone | Details |

|---|---|---|

| Q4 2024 | Database Lock | $50 million upon completion of database lock for COVID-19 vaccine. |

| April 2025 | BLA Approval | $175 million upon FDA approval of the Biologics License Application (BLA). |

| Late 2025 | Authorization Transfer | $225 million related to transferring authorization to Sanofi for commercialization. |

| Late 2026 | Technology Transfer Completion | $75 million for completing technology transfer obligations. |

| 2025-2026 | COVID-Flu Combination Vaccine Milestones | $350 million for development and first commercial sale of the combination vaccine. |

NVAX Stock: Risk/Reward Analysis and Investment Recommendation

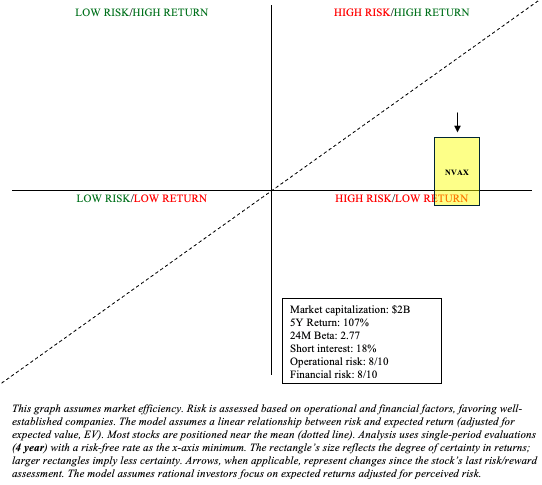

To summarize, the company has significantly improved its prospects following the Sanofi agreement. They were clearly unsuccessful in going it alone in the competitive vaccine market. Novavax’s partnership with Sanofi, which has a long history of developing and commercializing vaccines around the world (for example, influenza, pediatric vaccines, and travel vaccines), makes the company viable. As discussed in a previous article, although Novavax’s “surrendering” their technology makes this far less like a lottery ticket, we can now have reasonable expectations of returns (maintain “hold“). Relative to my previous risk/reward analysis, I have slightly reduced NVAX’s prospective returns due to its stock rallying 40% as the market digests the Sanofi partnership.

Author

Despite Novavax’s efforts to reduce OpEx, the company still faces significant operational and financial risks. As previously mentioned, the company is heavily reliant on Sanofi’s partnership for revenues, and if clinical trials are successful, Sanofi will face competition from Pfizer and Moderna in the COVID/influenza combination vaccine market. Importantly, any developments that even threaten Novavax’s receipt of said milestone payments could result in a sudden and significant drop in its stock. Still, for those who want in on a piece of the potentially lucrative influenza/COVID combination vaccine market, NVAX, as a Quadrant 1 stock (high risk/high reward), may serve its purpose within a barbell portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.