Summary:

- Novavax, Inc. secured a lucrative deal with Sanofi, receiving potentially $1.2 billion in cash and future royalties for Covid vaccines.

- The deal significantly improved Novavax’s financial position, but the stock has already rallied from $4 to $14, limiting potential upside.

- Novavax’s future success hinges on the royalty revenue from the Sanofi deal in 2025, with limited ability to compete with Sanofi’s commercialization capabilities.

ismagilov

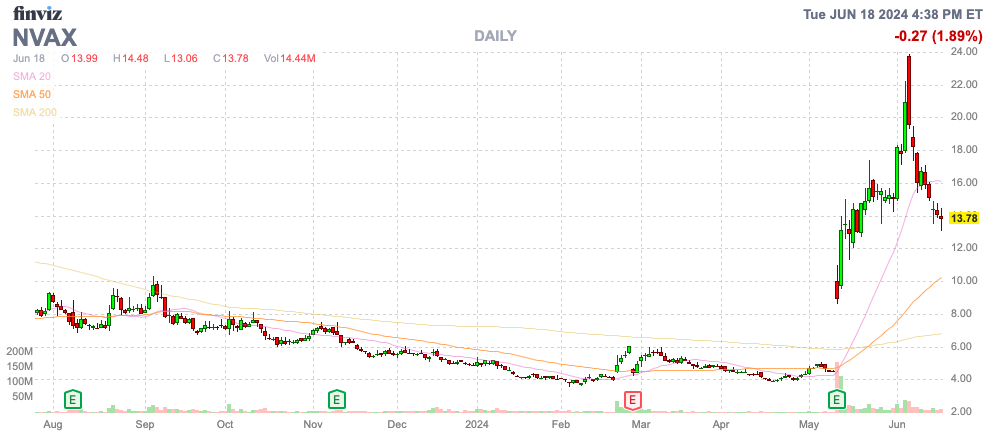

In a matter of months, Novavax, Inc. (NASDAQ:NVAX) went from a biotech with a questionable future to one flush with cash and a potentially huge royalty deal. Investors being too greedy and not alert were probably caught on the wrong side of the trade. My investment thesis is more Neutral on the biotech due to the stock now trading at nearly $14, up from only $4.

Source: Finviz

Sanofi Deal

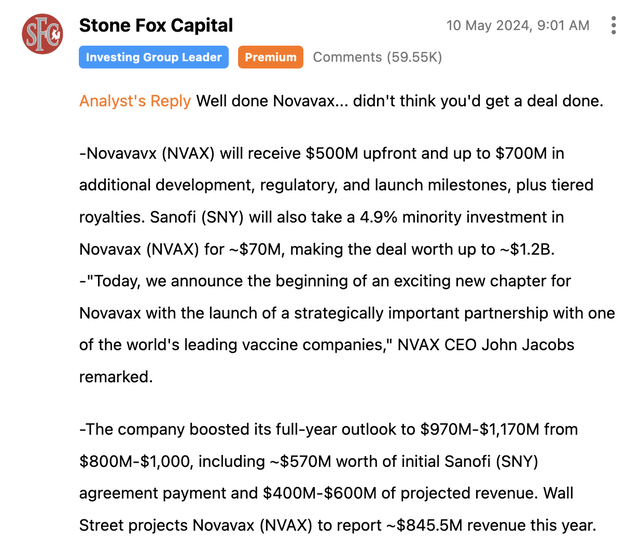

The whole investment thesis for Novavax now hinges on the Sanofi (SNY) deal announced back on May 10. As Stone Fox Capital highlighted in the comments section of our prior research, a deal appeared highly unlikely heading into the big announcement and the investment thesis was altered.

Our previous view had been very bearish on Novavax due to the weak financials. This deal alters the value of the company with the cash infusion and the potential for both royalties and additional partnership deals.

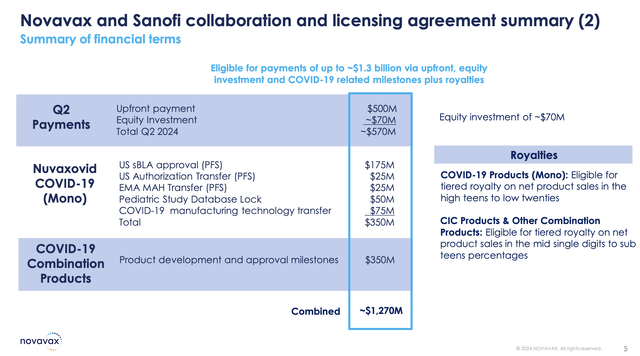

Sanofi is a massive biopharma with a $117 billion market cap, making an investment in Novavax and agreeing to sell Covid vaccines from the small biotech was a massive step. As mentioned in the comment, Novavax will get up to $1.2 billion in cash from the deal via a $500 million upfront payment and another $700 million in potential development and launch milestones.

Next year, Sanofi will sell Covid-19 vaccines and Covid-19 influenza combination vaccines, with Novavax receiving a tiered double-digit royalty percentage as follows:

Source: Novavax Q1’24 presentation

Sanofi will commercialize Nuvaxovid in the U.S., U.K. and Europe initially and worldwide over time. Novavax already has partnerships in several countries and APAs not included in this deal.

On the Q1 ’24 earnings call, the Novavax CEO highlighted the potential for the Sanofi license deal to far exceed the initial benefits of selling Covid-19 vaccines as follows (emphasis added):

By licensing Sanofi to use our Nuvaxovid to develop their own combination Flu and COVID products, and to use Matrix-M as a component of other vaccines across their portfolio. We expect to realize substantial additional royalties and milestones valued potentially in the billions of dollars, driven by Sanofi’s product development and commercialization efforts over the years and decades to come. The royalties and milestones associated with potential new vaccines, Sanofi may develop using Matrix-M as well as those royalties and milestones anticipated from sales of our COVID-19 vaccine and the development of Sanofi’s combination flu COVID and other potential combination vaccines, should help us to sustain cash flow as we invest in our own R&D in an efficient and thoughtful manner for years to come.

Novavax ended Q1 with a cash balance of $496 million. The company will collect $570 million in Q2 from the upfront payment and $70 million investment. Sanofi now owns 6.88 million shares for a value of $96 million, already providing a solid incentive to boost the valuation of the stock over time.

The small biotech should collect another $350 million this year on approval of the next Covid-19 vaccine, along with an eventual additional $350 million in milestone payments with Sanofi developing their CIC. The additional $700 million in cash payments will provide Novavax with a lot of cash.

While Covid-19 vaccine demand has plunged, a large portion of the population in the US and Europe appears set on receiving annual booster shots. Novavax is now transferring the commercialization of the vaccine and especially the potential CIC vaccine to Sanofi, considering the small struggle massively at operational execution.

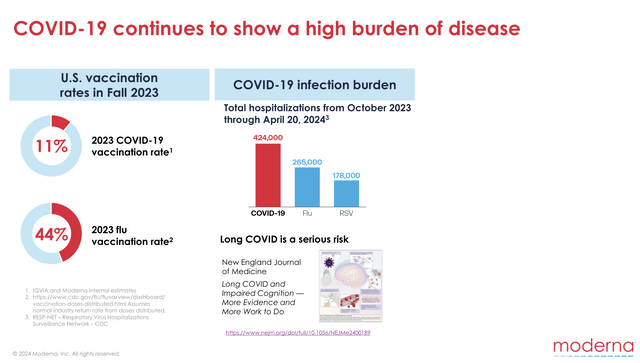

In the U.S. along, the Covid-19 vaccine rate was only 11% for the ~36 million vaccines administered while flu vaccines were 4x as high. At the same time, Covid hospitalizations were higher. The opportunity likely exists for higher vaccine rates as some of the public fear settles down.

Source: Moderna Q1’24 presentation

Reality

In essence, Novavax gets a massive partner to sell their Covid-19 related vaccines. Sanofi gives the small biotech a massive lifeline with a big cash infusion and a larger partner to compete with Pfizer (PFE) and Moderna (MRNA) for vaccine sales.

The flip side of getting the cash infusion is that royalty sales will be far less than collecting the fee for the full vaccine. Analysts have the following estimates for annual sales, generally falling to the $600 million range going forward in 2025 when the Sanofi royalties start.

Novavax will report large sales in 2024 from the initial Sanofi payments of $500 million plus. The vaccine sales were cut to only $400 to $600 million with up to $350 million in APAs from Canada, Australia, New Zealand and Israel delayed to future periods.

The company plans to reduce 2025 operating expenses to below $500 million with up to $100 million in reimbursements, making Novavax, in theory, close to profitable. The small biotech will only have $400 million in annual operating expenses.

The company ended Q1 with a cash balance of $500 million and the additional $570 million cash payment and investments in Q1. Novavax will start Q2 with a combined $1.1 billion pro forma cash balance, along with the additional major cash infusions ahead. The company burned $88 million in cash during the last quarter, and limited revenues this year could lead to substantial cash burn to quickly offset some of the cash inflows from Sanofi.

The really significant unknown is the royalty amounts Novavax could collect. If the small biotech is only collecting up to $600 million in actual Covid-19 vaccine sales this year, a 20% royalty would only amount to royalties of $120 million.

Naturally, Sanofi should be able to grow vaccine sales and the CIC vaccine in the future would provide substantial upside potential. The stock currently has a market cap of $2 billion and limited potential from additional drug approvals.

The financial equation is vastly improved, but the stock has already rallied from $4 to $14. Novavax only seems to have upside on developing a new existing drug, whereas the current opportunities in the CCI and stand-alone flu vaccine seem to have limited ability to compete with the Sanofi options, especially with Novavax having limited commercialization capabilities. The company can form a business partnership or another out-licensing agreement, though these seem unlikely, having to compete with Sanofi.

Takeaway

The key investor takeaway is that the value of Novavax is mixed now, considering the large cash balance and the unknown royalty revenue going forward in 2025. Novavax will still have plenty of costs, likely leading to the royalty revenues mostly just offsetting the expenses, requiring the biotech to have a viable drug candidate in the future to warrant a stock rally. The biggest risk in the short term is the stock closing the gap all the way to $4, or the $10 price paid by Sanofi, based on some confusion regarding the Sanofi deal and the 6+ month timeline for the deal to start on January 1.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start June, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.