Summary:

- Novavax will announce its Q1 2024 earnings this Friday, 10th May.

- The company reported revenues of $476m, $1.15bn, $1.98bn, and $984m in the four years since 2020, with heavy net losses in each of those years.

- Novavax plans to focus on commercial markets and move away from advance purchase agreements, with a goal of achieving full approval for its vaccine.

- It’s hard to escape the conclusion that having been second best during the pandemic era, Novavax may run into the same problems in a commercial COVID vaccine market.

- The company will update on its BLA application, preparation for the fall vaccine season, APA revenues, and its cost management program, but it’s hard to see how Q1 earnings will wow Wall Street or generate upside.

J Studios/DigitalVision via Getty Images

Investment Overview

Novavax (NASDAQ:NVAX), the Gaithersburg, Maryland headquartered specialist vaccine developer will announce its Q1 2024 earnings this Friday, 10th May.

Novavax is arguably best known for being the company that – very nearly – challenged the supremacy of the messenger-RNA vaccines developed by Moderna (MRNA) and Pfizer (PFE) / BioNTech (BNTX), that earned ~$135bn of revenues during the COVID pandemic era of 2021 – 2023.

Novavax received ~$1.8bn of funding from Operation Warp Speed (“OWS”), the Trump administration’s vaccine accelerator program, in 2020, but despite delivering some strong safety and efficacy readouts, comparable to Moderna’s SpikeVax and Pfizer / BioNTech’s Comirnaty, delays to completing Phase 3 studies meant that Novavax’ Nuvaxovid did not receive Emergency Use Authorisation in the US until July 2022.

By that time, both Spikevax and Comirnaty, which received their EUAs in December 2020, dominated the COVID vaccine market, and although Novavax secured approvals in the UK, Canada, Australia, Switzerland, Singapore and New Zealand, and thanks to a partnership with the Serum Institute in India, South Korea, Thailand and Bangladesh, the company could not match its rivals’ earnings power, reporting revenues of $476m, $1.15bn, $1.98bn, and $984m in the four years since 2020.

Nor could Novavax return a profit in any of those years, reporting net losses of $(418m), $(1.74bn), $(658m), and $(545m) in the four years since 2020.

Prior to the pandemic, Novavax – without a product approval in the company’s history – was developing vaccines against influenza and RSV, and its shares traded ~$5. During the pandemic, shares reached highs of >$170 in August 2020, >$290 in February 2021, >$250 in August 2021, and >$75 in July 2022, when the US EUA was received.

Today, however, Novavax stock is once again trading <$5, although around the time company announced its Q4 2023 and full year 2023 earnings in late February, it briefly traded >$6 per share, and after sinking <$4 per share last month, has enjoyed a small rally to current price of $4.75 per share.

The days of wild share price fluctuations and spikes >$100 per share are a long way behind Novavax now – a spike into the double digits would frankly be surprising in the current climate, as management wrestles with financial problems, announcing plans to let go ~30% of staff when announcing its 2023 earnings.

With that said, Novavax does have an effective, approvable vaccine product that may be capable of driving “blockbuster” revenues for many years to come, if a long-term private COVID vaccination market emerges, as many believe it will. As such, Novavax retains the ability to surprise the market, as nobody quite knows what to expect from the company, or how its target market may develop over the coming years.

In the remainder of this post I’ll discuss what highlights are likely to be under scrutiny when Novavax announced its Q1 2024 revenues. Let’s begin by looking at 2023 highlights.

Novavax 2023 Earnings Review

When I covered Novavax back in October 2023, management was guiding for full-year 2023 revenues of $1.3bn – $1.5bn, and product sales of $960m – $1.14bn. Not for the first time, the company ultimately fell well short of that guidance.

Product sales in 2023 came to $531m, with $251m earned in Q4, implying some beneficial tailwinds from the fall vaccine season, but ultimately, $984m of revenues for the year – which included $427k worth of grant revenues (presumably dating back to the OWS funding) was well short of expectations. Total product sales for the year were $531m, versus $1.55bn in the prior year.

On the plus side, cost of sales for the year of $343k was down 62% year-on-year, R&D expenses of $738k down 40% year-on-year, and with SG&A flat year-on-year, at $469k, total expenses shrank from $2.62bn in 2022, to $1.55bn. With revenues down by ~$1bn year-on-year, net loss was $(545m), or $(5.4) per share, which, although an improvement on $(8.42) in 2022, highlights the financial problems faced by the company.

End of year cash position was reported as $569m, down from $1.34bn at the end of 2022, and the company reduced its convertible notes payable down from $491m, to $168m at the end of 2023.

In terms of forward guidance (whilst acknowledging that Novavax rarely meets its own guidance targets), management is forecasting for revenues of $800m – $1bn in 2024, with combined R&D and SG&A costs of $700 – $800m. Profitability in 2024 feels unlikely, however, given we must add cost of sales, tax, and other expenses to the R&D and SG&A costs.

Looking Ahead – What Can Novavax Achieve This Year – & In The Longer Term?

In 2023, Novavax earned $30m of its revenues in the US, $268m in Europe, and $233m across the rest of the world (“ROW”), compared to $194m in the US, $823m in Europe, and $537m ROW in 2022.

The bulk of the company’s revenues have historically been earned through advance purchase agreements (“APAs”), and in its 2023 earnings press release, Novavax states that it has:

Potential APA deliveries for 2024 through 2026 of over $1 billion consisting primarily of deliveries to Australia, New Zealand, Canada, Israel and Europe

If all such orders are executed then Novavax would exceed its 2024 guidance on APAs alone, so this is one area investors will be hoping management can provide an update on when Q1 earnings are announced this Friday.

With that said, Novavax’ long term plan is to move away from APAs and intensify its focus on commercial markets. As the company CEO, John Jacobs, who replaced long-time CEO Stanley Erck around one year ago, with the latter paying the price for failing to bring nuvaxovid to key markets fast enough, told an audience at the recent TD Cowen Healthcare conference:

We continue to get the majority of our revenue…from outside the US through APAs that will be ongoing through 2026. Over the next three years, we migrate away from APA to a fully commercialized marketplace by 2027.

It’s very important that we begin to penetrate and perform well in commercial markets. This coming year in the US, as well as in Europe, where we move to tenders in countries like Italy and Spain that we’re targeting private pharmacy markets in France and UK which we’re targeting believe will have success in.

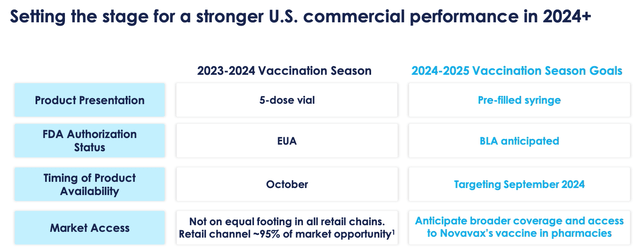

So the lessons learned certainly get beyond the rest of these first have a better presentation of our products. So we’re targeting a pre-filled syringe in 2024 from a five-dose vial.

Commenting on the proportion of revenues that would be derived from APAs in 2024, CEO Jacobs told the audience:

it’s 500 million to 600 million range for APA business outside of the United States. A large majority of that coming from Australia, New Zealand, Canada, but our European APA ended last year. And then you have commercial revenues, 300 million to 400 million range, you’re at midpoint 350 between the US and select European countries.

In order to succeed with a pivot into traditional commercial markets, Novavax would ideally want to secure a full approval for its drug, rather than having to apply for an EUA each time it releases a new nuvaxovid shot, targeting the latest strain. The target is determined by the Vaccines and Related Biological Products Advisory Committee (“VRBPAC”) on an annual basis, and this year, VRBPAC will announce its decision this month, a month earlier than last year, giving vaccine makers more time to prepare their shots.

Novavax management says it expects its Biologics Licence Application (“BLA”) to be approved by the Food and Drug Agency (“FDA”) this year, which will allow it to focus more resources on marketing and promotion as opposed to regulatory matters.

Novavax US commercial performance analysis (Q423 earnings presentation)

As we can see above, Novavax believes it will be more agile in 2024 and beyond, with a more convenient, pre-filled syringe product, a fully authorised product, more time to prepare, and better relations with health insurers and pharmacies making it easier for patients to purchase a COVID vaccination.

Similarly, goals for Europe, APAC, and Canada are to streamline the product offering, and focus on core markets only, as APAs are gradually replaced by commercial sales.

It is hard to criticise the company’s strategy, but there are several risks and drawbacks to consider. Firstly, competition will be present in the form of mRNA vaccines, which the public are more familiar with, and, despite some negative publicity, will quite possibly seek out ahead of Nuvaxovid when considering getting a private vaccination.

Secondly, from an APA perspective, there is a risk that governments and agencies will renege on agreements, or that Novavax may struggle to fulfil orders, as happened with the GAVI international vaccine group. Novavax failed to deliver vaccines to GAVI within the agreed timeframe and ultimately has agreed to pay back to the agency $475m by 2028, with Gavi no longer requiring the vaccines.

Thirdly, no one truly knows what to expect from a private COVID vaccine market i.e. will consumers be prepared to pay for COVID shots, and will health insurers provide reimbursement for shots, as happens with the flu market, or will the demand for COVID vaccinations simply fizzle out, other than occasionally government buying for its elderly populations?

Novavax CEO Jacobs told the audience at TD Cowen’s conference that “everyone assumed it would be roughly 25% to 35% of the market similar to flu”, i.e. that 25-25% of Americans would seek out a COVID jab, but that market did not seem to materialise last year.

Moderna is guiding for $4bn of revenues from its “respiratory” vaccine franchise this year, with the vast majority of revenues occurring in the second half of the year – presumably owing to an expected large demand for fall COVID vaccinations.

Clearly, if such a market does not emerge, when its APAs are exhausted, Novavax may have an unsellable product on its hands, and if even if such a market does arrive, Novavax will once again be scrapping with the MRNA giants Moderna and Pfizer for market share.

There is nothing wrong with Novavax’s vaccine per se, although it takes a little more time to prepare new versions targeting new strains, and its preparation is a little more complex in some ways – according to NebraskaMedicine.com:

The Novavax method uses moth cells to make spike proteins:

- Researchers select the desired genes that create certain SARS-CoV-2 antigens (spike protein).

- Researchers put the genes into a baculovirus, an insect virus.

- The baculovirus infects moth cells and replicates inside them.

- These moth cells create lots of spike proteins.

- Researchers extract and purify the spike proteins.

The vaccine also comes with a soapbark tree extract adjuvant to increase the immunological effect, allowing a smaller overall dose to be used. During the pandemic period, Novavax struggled to successfully manufacture and distribute its product, damaging its reputation, and even though markets are much smaller today, there is still a risk the company could fall short again when taking on the MRNA giants in a private COVID market.

Concluding Thoughts – What Am I expecting From Q1 24 Earnings & Business Updates?

When it comes to Novavax, it is sometimes hard to avoid tagging the company as the “also-ran”, or bridesmaid (i.e. “never the bride”) of the pandemic period, a company that might have earned revenues in the double digit billions, but ultimately fell short in several key areas – pace of clinical studies, manufacturing and infrastructure, and arguably, a vaccine product that fell narrowly short of matching the MRNA vaccines for convenience, efficacy, and speed of rollout.

As such, my expectations aren’t especially high for the upcoming earnings. I would not expect the company to report much in the way of revenues as most of the APA agreements are likely to be settled later in the year, I’d assume, and the fall vaccination season is the key period for earnings commercial revenues.

Where the company may offer investors hope is with some positive developments in terms of the approval of its BLA in the US, and early development of its vaccine targeting the newest strain of COVID, so that it is ready to be launched and compete against its rival vaccines as early as possible.

Management will also (hopefully) update on progress with commercial and retail partners – one major deal could transform the company’s fortunes, but will any company step up and make nuvaxovid a central part of its plans to compete in COVID markets?

Finally, I’d be hoping to hear more around the development of Novavax’s dual COVID / influenza vaccine. In its Q4 earnings press release, management stated it expected to:

initiate a pivotal Phase 3 trial for COVID-19-Influenza Combination (CIC) vaccine candidate in the second half of 2024, with potential for accelerated approval and anticipated launch in 2026

Once again, this is not a concept unique to Novavax – the likes of Pfizer / Moderna are also focused on creating such a vaccine.

With a market cap of just over $600m at the time of writing, some might call the company undervalued if it does succeed with its BLA and finds this years’ fall vaccine season to be larger than last year’s – the company is arguably better prepared this year than last.

I’d agree with that sentiment, however I expect the main focus of Novavax’ earnings may be around cost savings and trimming expenses as the company’s tries to ensure it can remain a going concern long-term.

The very real threat that when fall arrives, is that demand for COVID vaccines doesn’t meet expectations to become influenza sized, i.e. ~$10bn per annum, or that demand for Nuvaxovid fails to materialise. In that event, Novavax will essentially have only a single approved product, for which there is no demand.

That will weigh heavily on the company valuation until management can prove otherwise, and since management cannot provide updates in this regard on Friday, I’d make Novavax stock a “hold”. The story of Novavax remains what could have been, not what is coming, and I don’t see that changing on Friday.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.