Summary:

- Novavax reported a net loss of $0.76/share and $84.5M in revenue, beating estimates but cutting guidance due to lower COVID-19 vaccine sales.

- Revenue has declined since 2022, prompting a substantial cost reduction program set to refocus the company on 4 key value drivers.

- A collaboration with Sanofi offers flexibility and potential growth, allowing Novavax to focus on developing a COVID-19/influenza combination (CIC) and seasonal influenza vaccines.

- Despite effective products, reduced guidance and restructuring uncertainty make NVAX stock a hold, with the Sanofi partnership and upcoming milestones as a potential bullish catalyst.

A Healthcare Worker Prepares a Dose of COVID-19 Vaccine. Morsa Images

Novavax (NASDAQ:NVAX) reported earnings Tuesday morning that beat estimates on the top and bottom line, reporting a net loss of $0.76/share and revenue of $84.5M for the quarter. However, the stock closed a solid 6.1% lower as the company cut its 2024 full-year guidance on lower than expected sales of its COVID-19 vaccine.

Revenues have shrunk since peaking in 2022, as vaccine uptake lagged behind Pfizer (PFE) and Moderna (MRNA). The company’s COVID-19 vaccine Nuvaxovid remains the company’s sole product, but has represented a small share of a shrinking pie. Now the company has entered into a substantial cost reduction program, shrinking R&D in order to adjust to this new business reality.

This year has seen some positives, primarily a collaboration with Sanofi (SNY) in a partnership announced earlier this year. This has given Novavax flexibility to transition away from its prior business model with Sanofi leading the way in commercialization, freeing Novavax to focus on new product development. In addition, the clinical hold on late-stage development of the company’s COVID-19/influenza combination was lifted as of Friday, freeing Novavax to pursue a Phase III clinical study. This is a major development, potentially paving the way for additional milestone payments in the coming year.

While Novavax has an effective vaccine product, the negative trend of reduced guidance along with the uncertainty of restructuring make the stock a hold. However, the silver lining of collaboration with Sanofi may be a bullish catalyst in the coming year. This partnership appears to be the best catalyst for a turnaround in the near-term.

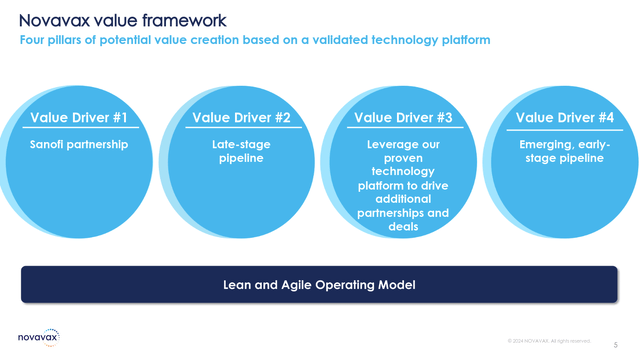

Novavax Q3 Earnings Call: Value Drivers

CEO John C. Jacobs began the earnings call identifying the value drivers of Novavax’s business strategy. First and most importantly, the previously announced Sanofi partnership intends to find synergy through combining Novavax’s “proprietary protein and nanoparticle technologies, Matrix-M adjuvant R&D expertise” with Sanofi’s world-class expertise in the commercialization of innovative vaccines.

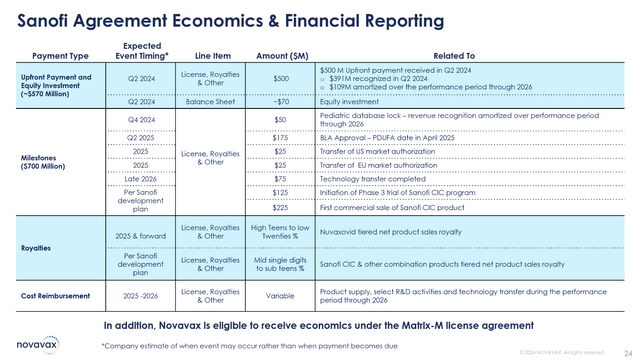

The deal provided an initial cash payment of $500 million up-front and a $70 million equity investment in Novavax. Moving forward, the company is eligible for up to $700 million in additional milestone payments based on sales of its Nuvaxovid vaccine. This was a huge plus for the company, which had earlier this year been forced to issue a “going concern” notice. As a result, the stock shot up from 52-week lows of under $4/share. With the stock around $8.46/share as of this writing, an investment is much less risky compared to earlier this year.

Novavax Value Drivers (Novavax Q3 Earnings Presentation)

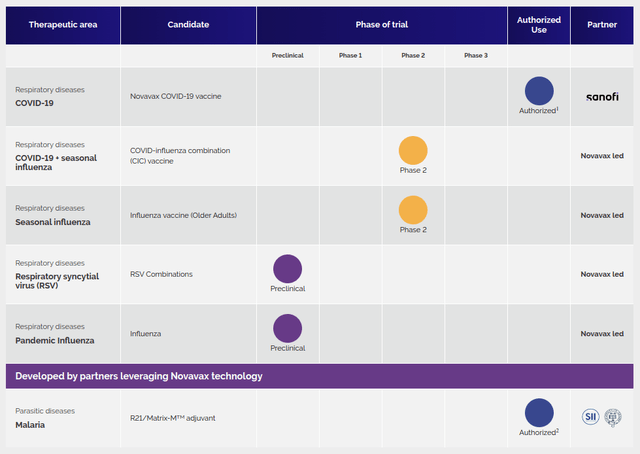

The second value driver is Novavax’s late-stage pipeline, highlighted by the lifted clinical hold on its COVID-19/influenza combination (CIC). Novavax is now accelerating toward a Phase III study (COVID-19 + seasonal influenza), which had been placed on clinical hold after the passing of a patient on the Phase II study. While this will still represent a frustrating delay, Novavax maintains that this patient’s passing was unrelated to the clinical trial.

As a third value driver, Novavax is pursuing its own seasonal influenza vaccines (in Phase II below), which will be subsequently partnered. Finally, the 4th value driver is the emerging stage early pipeline. The company’s platform technology will be leveraged in this case for other opportunities.

Novavax Pipeline (www.novavax.com)

Novavax has come a long way this year. While the company’s future was in doubt previously, it now has a cash runway and is restructuring the business to reflect lower sales of its sole product.

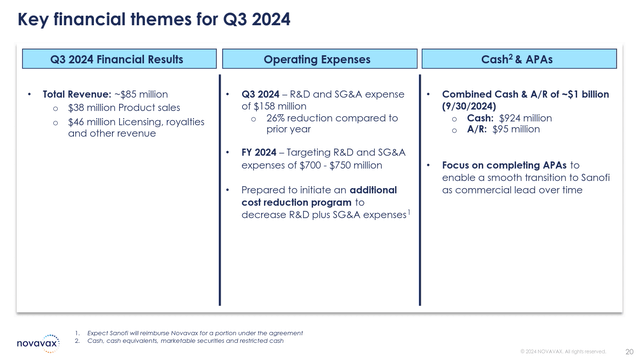

NVAX Q3 Earnings Results

Next, Jim Kelly, the company’s Executive Vice President and CFO, presented the financial results for the quarter. Total revenue of $85 million was achieved and after the Sanofi agreement substantial cash reserves of over $1 billion are on hand. The enterprise value of the company is now only $565 million. Thus, the valuation is quite low considering the relative magnitude of potential milestone payments.

Key Financial Highlights (Novavax Q3 Earnings Presentation)

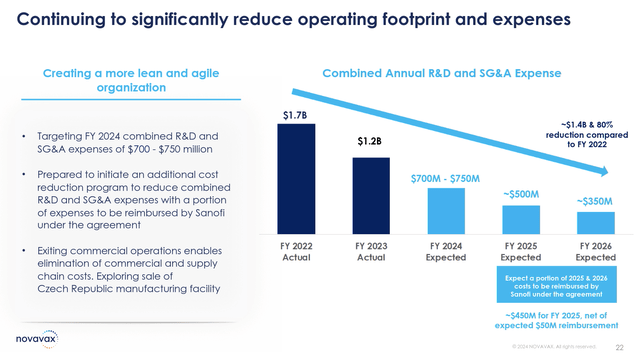

However, even with this war chest, Novavax has been spending rapidly, and a cost reduction program is being implemented to resize the R&D budget. For 2024, R&D and SG&A expenses are now $700 to $750 million. These are being slashed significantly moving into 2025 and 2026, reducing expenses to ~$500 million and ~$350 million respectively for those years. In this manner, Novavax is attempting to salvage the highest returns on investment, betting on its COVID-19/influenza combination as the nearest value driver for the company.

Cost Reduction Initiative (Novavax Q3 Earnings Presentation)

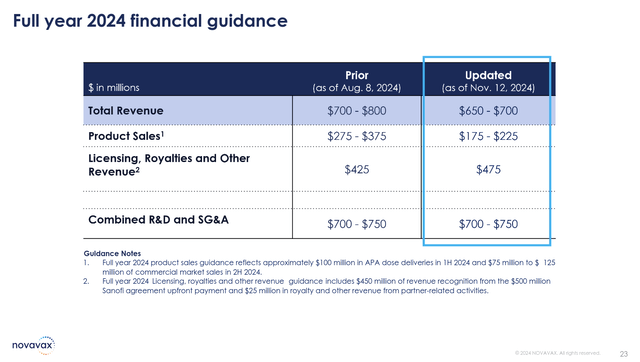

Driven primarily by COVID-19 vaccination trends in the US market, full-year guidance was reduced from a prior $700-$800 million range down to $650-$700 million for 2024. This was the primary shock that sent the stock lower in the pre-market. Time will tell if next year’s sales will finally rebound, however, Sanofi’s expertise could be a turning point.

Lowered 2024 Full Year Guidance (Novavax Q3 Earnings Presentation)

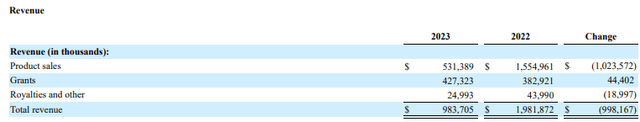

Looking at the three-year trend, peak revenues of $1.981 billion in 2022 have gone substantially lower. At the mid-point of $675 million, 2024 revenues will be only 34% of what they were at the height of the pandemic.

Annual Revenues (Novavax 2024 10K)

The future cash flows under the Sanofi agreement were next outlined on the call. Milestones of up to $700 million beyond those received as yet are in play. The main two that are uncertain value drivers for the company into 2025 are $125 million for initiation of Phase 3 trial of Sanofi CIC program and $225 million for the first commercial sale of a Sanofi CIC product. Thus, if Novavax can execute on its second value driver, there will be a significant windfall. The lifting of the clinical hold allows forward progress to resume.

Sanofi Agreement Milestones (Novavax Q3 Earnings Presentation)

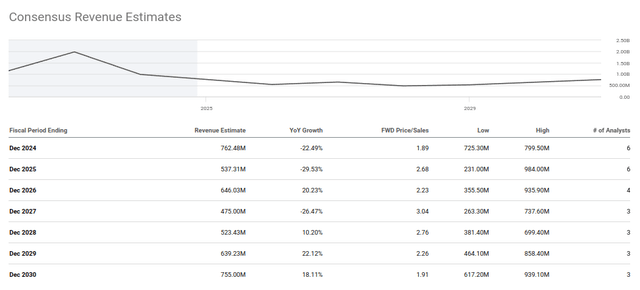

The third value driver of a seasonal influenza vaccine may also be substantial if Novavax’s platform succeeds to deliver a new product. The average analyst estimate for 2025 revenue is $537 million. Next year may be too soon to realize the full $700 million in milestone payments, but the tide may be shifting in the correct direction for Novavax.

Novavax Revenue Estimates (Seeking Alpha)

If revenues can return to growth, it would represent a major turning point for the company. It seems early to make this call, but enterprising investors may be enticed by the company’s low price/sales ratio (2.68x FWD Price/Sales). An average price/sales multiple in biotechnology is 6.44x.

Conclusions

Given the lowered guidance for 2024, it still seems early to bet on a turnaround for Novavax. However, the company has made major steps toward a turnaround this year with the Sanofi agreement and lifting of the clinical hold, allowing for the company to move into Phase III with its COVID-19/influenza combination (CIC). It must be noted that the company has only one commercialized product (Nuvaxovid) and a history of operating losses. Thus, Novavax is certainly a speculative investment.

However, with the opportunity for substantial royalties and the Sanofi partnership, the tide may be turning. I rate the company a hold at the present time, but given the magnitude of milestone payments relative to the company’s market capitalization, it is possible to envision significantly higher stock prices should the turnaround succeed.

As NVAX stock has trended lower recently, the return for betting on a successful turnaround has become more attractive. As identified above, the forward revenue estimate times an averages sales multiple nets a price target of $20/share, this seems to be an appropriate price 18-month price target if the CIC can fully unlock the potential value of milestones in the Sanofi/Novavax partnership.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.