Summary:

- Novavax, Inc. soars after settling Covid-19 vaccine dispute and positive peer numbers, but the future remains bleak with the cash balance under pressure.

- The settlement with Gavi requires Novavax to pay $475 million through 2028, potentially totaling $700 million in cash and vaccines.

- The company will report Q4 results next week, with the focus on whether Novavax can maintain enough vaccine sales to cover operating expenses to prevent further cash burn.

Bloomberg/Bloomberg via Getty Images

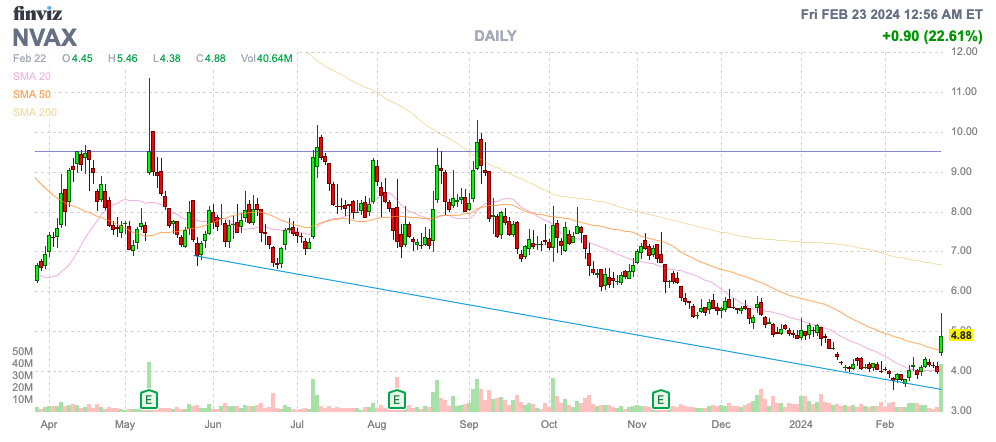

Novavax, Inc. (NASDAQ:NVAX) soared on Thursday following the settlement of a Covid-19 vaccine dispute and positive numbers from a peer. The biotech still has a bleak future and the annual settlement payments will pressure cash. My investment thesis remains Bearish on NVAX stock following the big rally.

Source: Finviz

Settlement

Prior to the open on February 22, Novavax announced a key settlement with Gavi to solve a dispute over Covid-19 vaccines. The biotech faced up to a $700 million payout due to a dispute on undelivered vaccines pre-paid by Gavi.

Under the terms, Novavax will now have to pay $475 million to Gavi through 2028, if not offset by vaccine credits. Novavax paid an initial payment of $75 million, with deferred payments of $80 million annually.

The annual cash obligation would be offset or reduced pursuant to an $80 million annual vaccine credit, which may be used for qualifying sales of any of the vaccines funded by Gavi for supply to low-income and lower-middle income countries. On top of this, Novavax appears on the hook for another $225 million of additional vaccine credits over the five-year term.

In total, Novavax still appears on the hook for up to $700 million worth of cash and vaccines. The one reason the market liked the news is the extended terms for payment, so the biotech can avoid any immediate cash crunch.

The company ended Q3’23 with a cash balance of only $666 million. Naturally, the market fears were for a large upfront payment to squeeze the remaining cash balance, but Novavax only had to pay out $75 million initially.

Upcoming Q4

Novavax is set to report Q4 ’23 results prior to the open on February 28. The biotech should report a solid quarter due to the Covid-19 vaccine seasonality shifting sales to the winter months.

Due to slow Covid-19 vaccine uptake, Novavax had already forecast some sales slipping into Q1 ’24, with combined sales targeted to top $600 million. The official guidance for 2024 was cut to ~$1.3 billion, with Q1 sales of $300 million included in the target due to late approvals pushing some drug sales out into the March quarter.

In a sign the quarterly results, or at least guidance, will disappoint, the company announced a staff reduction of ~12% of the global staff count. The company announced these job cuts are part of the original plans to reduce costs, with a target of lowering the workforce by 30% below the Q1 ’23 levels.

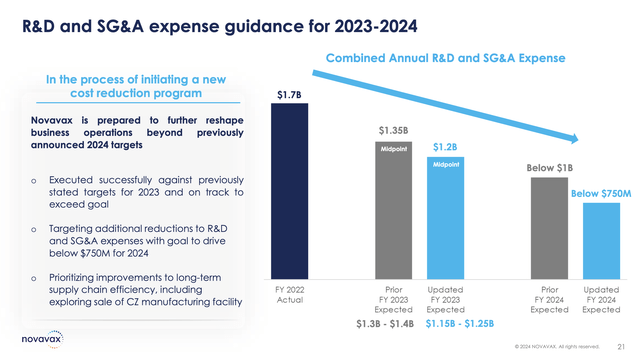

Novavax was still spending at a run rate of ~$850 million on operating expenses during Q3 ’23. These cuts are apparently needed to reach the goal of cutting expenses to $750 million for 2024. Some of the benefits from these job cuts won’t even be realized until 2025.

Source: Novavax Q3’24 presentation

Moderna (MRNA) just reported Q4 ’23 results that technically beat analyst estimates, probably contributing to the positive sentiment on Novavax. The reality, though, is that Moderna continues to guide towards a 50% dip in 2024 sales with any uptick in 2025 revenues due an RSV vaccine that ironically Novavax had long attempted to gain approval on, but the company constantly failed to meet endpoint targets.

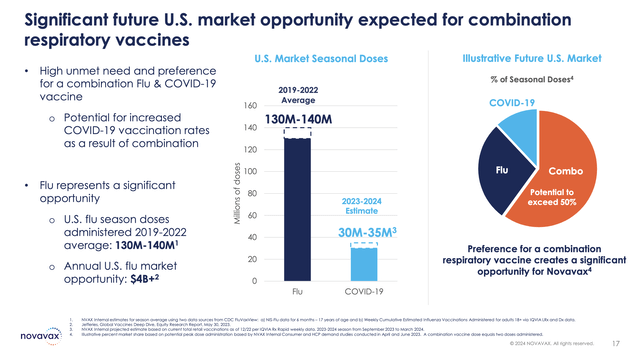

The fear here is that if Covid-19 vaccine sales remain depressed at the 30 to 35 million dose level in the U.S., Novavax won’t have much market share to grab. The main opportunity ahead presented by management is the potential for a combination respiratory vaccine with current U.S. flu shots in the 130+ million range annually, but the issue is that Novavax won’t have this vaccine approved until 2026, at the earliest, and Moderna and Pfizer (PFE) are pursuing a similar vaccine combination and considering an option to include RSV in the mix.

Source: Novavax Q4’23 presentation

A big focus on the Q4 earnings report next week will be the focus on the cash balance. Novavax would have to make another $240 million in cash payments to Gavi by 2026, and the cash balance could become extremely pressured by that point with $315 million paid to Gavi at that point.

The biotech enters 2024 with analysts forecasting a $1 billion annual sales rate matched up with an operating cost basis of $750 million. Novavax would have to produce large gross margins on the limited ongoing Covid-19 vaccine sales in order to generate a profit.

Investors will want to laser focus on whether the company will burn cash annually going forward. Also, one has to wonder on the flip side whether cutting R&D quarterly to $100 million or below is large enough to effectively compete on vaccine development with Moderna and Pfizer.

Takeaway

The key investor takeaway is that Novavax isn’t any further appealing after the large settlement with Gavi. The market now knows the details of the settlement, but Novavax still has a large financial commitment to meet.

The stock has a limited market cap, but Novavax, Inc. investors should really question the path to profits and whether the current cash balance is enough to sustain the business considering the cash drip from the Gavi settlement and weak Covid-19 vaccine demand. The new management team has done a better job managing operations, but Novavax has to move away from the 3rd option in the Covid-19 vaccine market before the stock ever becomes appealing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.