Summary:

- Novavax reported Q2 earnings with a miss on EPS and revenue, causing a drop in share price, but recovered after the earnings call.

- Novavax is making progress with internal vaccine candidates, Sanofi partnership, and potential market opportunities, despite disappointing Q2 earnings.

- I provide my thoughts on the quarter, and will highlight a few downside risks that investors should consider.

- I discuss my updated NVAX strategy.

MCCAIG

It has been less than a month since my last Novavax (NASDAQ:NVAX) article, where I discussed partnership with Sanofi (SNY) and updates on their COVID-19 and H5N1 bird flu vaccine programs. Those updates forced me to revise my NVAX strategy to account for upcoming catalysts and the possibility of a sustained rally. Well, that rally turned into a malaise fade over the past few weeks. However, the ticker has experienced a shot of volatility over the past few trading sessions after the company released their Q2 earnings, with a miss on EPS and revenue. Novavax posted that their GAAP EPS came in at $0.99, which missed the Street’s estimates by $0.68. The company also had a 2.1% drop in their revenue and came up $13M short of the Street’s expectations. The subpar performance forced the company to cut and augment their full-year guidance, which caused the share price to drop from around $11 per share down to the $8 handle. However, the company was able to rally the troops with a strong showing in their earnings call, where they stressed the potential benefits of their partnership with Sanofi. As a result, the share price recovered after the opening bell and ended the day in the green. Personally, I am not overly concerned about the weak Q2 earnings, thanks to Novavax’s partnership with Sanofi, cash position, and progress in their own vaccine development.

I intend to review the company’s Q2 earnings and recent developments. Then, I will discuss my views on the quarter and will highlight some of their growth prospects. In addition, I will point out some notable downside risks that NVAX investors need to consider when managing their position. Finally, I take a look at the charts to see if I need to update my current strategy.

Q2 Performance

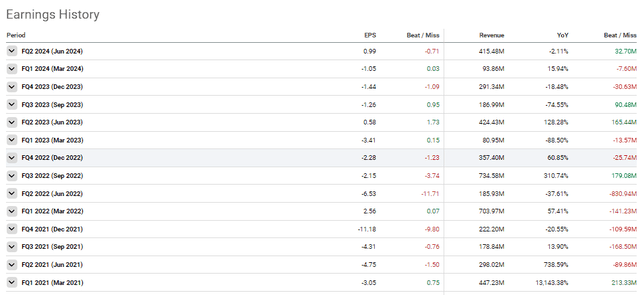

It is safe to say that Novavax has had an erratic earnings history since launching their COVID-19 vaccine. The pandemic was a boon for vaccine companies that were able to produce a viable candidate. Unfortunately, Novavax did not get the preferential treatment that other companies were given, and the company’s commercial performance has not been stellar.

Novavax Earnings History (Seeking Alpha)

For Q2, 2024, Novavax was able to pull in $415M in revenue, which is a slight decrease from $424M in Q2 of last year. However, I would point out that $391M of the revenue came from licensing and royalties, thanks to the upfront payment from the Sanofi deal. Therefore, Novavax only pulled in $19.9M in COVID-19 vaccines, a 93% decrease year-over-year.

On the bright side, the company recorded a nice bump in net income, hitting $162M versus $58M in Q2 of last year. Furthermore, Novavax made some headway with their efforts to streamline operations. Management reported that they were able to cut R&D expenses by more than half. The company’s SG&A expenses did pop up from $94M to $101M for the quarter; however, it was noted that this increase was ascribed to the costs of the Sanofi deal.

Taking a look at their bankroll, the company closed out the quarter with $1.1B in cash and investments, up from the $584M they had at the end of 2023.

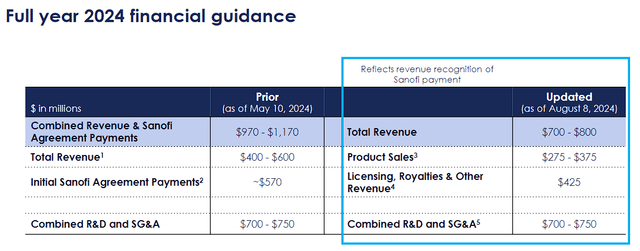

Novavax Full-Year Guidance Update (Novavax)

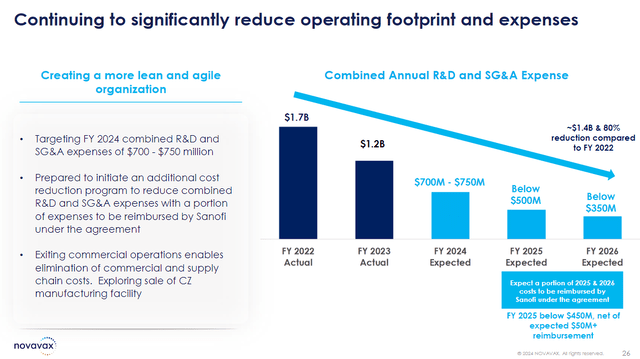

The company’s Q2 disappointing earnings forced them to recalibrate their full-year guidance. Now, management expects the company’s total revenue to drop in the range of $700M-$800M. In addition, the company projects their combined R&D and SG&A expenses to come in between $700M-$750M.

Notable Updates

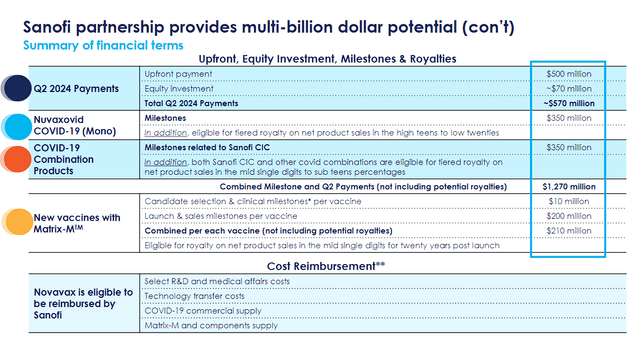

The Novavax-Sanofi partnership announcement was arguably one of the most notable events in biotech during the second quarter. Not only does Sanofi’s interest in Novavax’s technology provide validation, but it also provides the company an opportunity to potentially collect billions in milestones and royalties. So far, Novavax has already earned a $570M upfront payment and equity investment.

Novavax Sanofi Deal Financial Terms (Novavax)

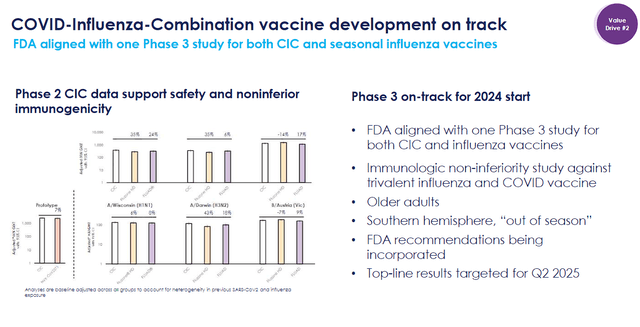

Novavax is also making significant progress with their internal vaccine candidates. The company’s COVID-19-Influenza Combination “CIC” vaccine is heading toward Phase III trials in the coming months, alongside an individual influenza vaccine. Results are expected from these pivotal trials by mid-2025. An approved CIC vaccine would provide dual protection against both COVID-19 and influenza, which could be a huge win for Novavax, as it would be set to capture substantial market share.

Novavax CIC Vaccine Developmental Track (Novavax)

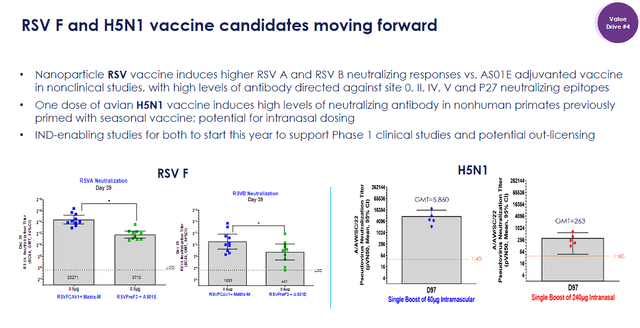

Beyond COVID-19, Novavax’s RSV vaccine candidate has shown promising marks in preclinical studies that outperformed an AS01E adjuvanted vaccine. This is noteworthy, considering that RSV is a major global health crisis.

In fact, RSV leads to ~33M cases of acute lower respiratory infections each year. Furthermore, RSV causes 3M hospitalizations and between 60K to 200K deaths in children under five years old. In the US, RSV is guilty of generating 58K to 80K hospitalizations of kids under one year of age. RSV also significantly impacts the elderly, with ~177K hospitalizations and 14K deaths in patients 65 years old and older each year. In the U.S. alone, RSV is expected to cost $1B annually, just to manage RSV in children under five years old. Clearly, an operative RSV vaccine would be a substantial market opportunity for Novavax.

Novavax RSV and Bird Flu Overview (Novavax)

Furthermore, Novavax is still managing its H5N1 avian influenza vaccine candidate. Early preclinical studies in primates previously primed with a seasonal vaccine highlighted the vaccine’s ability to facilitate high levels of neutralizing antibodies. The company is also looking into intranasal dosing, which could enhance the vaccine’s efficacy and improve its ease of administration. The company is looking to start IND-enabling studies this year, with hopes to move the vaccine into Phase I and potentially out-license it to a partner.

My Thoughts On The Quarter

My takeaway for the quarter comes down to the structural changes and financial transactions that will allow the company to move on from a COVID-19 vaccine company. Novavax made efforts to improve operational efficiency with reductions in R&D and SG&A while strengthening their financials from payments from the Sanofi deal. Furthermore, Novavax is attempting to streamline operations by exploring potential sales of manufacturing facilities to further reduce its operational footprint, and get another injection of funds.

Novavax Expense Projections (Novavax)

Novavax reported a solid cash position of approximately $1.1B, which should support their ongoing R&D activities and help them advance their own vaccine candidates, as well as have some flexibility to consider other growth opportunities.

Indeed, Novavax’s Q2 commercial numbers were a bit disappointing. However, it’s important to recognize that the COVID-19 vaccine market has weakened, with most major players reporting significant declines in COVID-related sales this year. So, the lackluster vaccine sales are not exactly a surprise and is not really on strong verdict for the company. Admittedly, the weakening COVID vaccine market does not bode well for Novavax in the near term, as the market continues to punish COVID stocks that are failing to report growth. However, I am going to point to the strengthening of Novavax’s finances and operational enhancements that will position them for sustainable growth.

Considering Some Risks

Despite my bullish outlook on the ticker, Novavax faces several hallmark risks that could impact their near-term and long-term performance. Primarily, we have to accept that the competition in the fierce competition in the vaccine arena is strong, with Big Pharma and emerging biopharma attempting to outperform one another. In addition, Novavax has to worry about regulatory risks, supply chain issues, IP, litigation, finances, and the market designating them as a COVID-stock, or a COVID-play.

Thankfully, the Sanofi partnership should moderate some of the risks mentioned above. On the other hand, that makes the success of the Sanofi partnership pivotal to Novavax’s financial outlook and the ticker’s performance. Any delays in the development or commercialization of any Sanofi-related vaccine program could hurt revenue projections. In addition, any setback could spark speculation amongst investors about a potential termination of the partnership. Keep in mind, NVAX investors have been hearing the company promote this deal as a multi-billion dollar opportunity, so, any setback would most likely have a big impact on the share price. Although the Sanofi partnership could be incredibly lucrative for Novavax in the coming years, the stock will most likely be chained to the partnership’s success going forward… good, or bad.

Considering these risks, I am maintaining my NVAX conviction level of 3 out of 5, and the ticker will remain in my “Bio Boom” speculative portfolio.

Checking The Plan

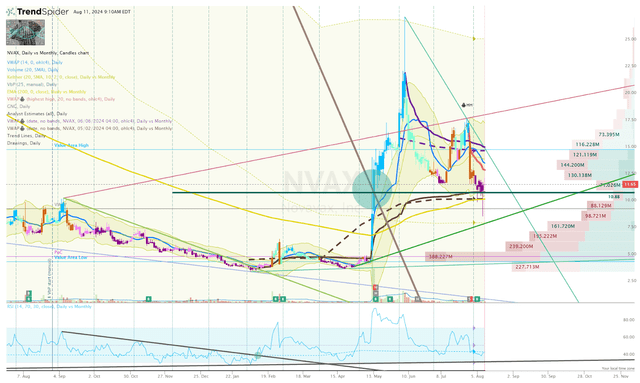

In my previous article, I disclosed that I was looking to trade NVAX around catalysts in order to book some profits while amassing a core position for a long-term investment. In addition, I also revealed that I had upgraded my Buy Threshold to $25 per share, which will be the limit I am willing to buy NVAX. At that time, the ticker was trading was volatile, so I set buy and sell orders hoping to take advantage of the extreme trading environment.

NVAX Daily Chart (TrendSpider)

Unfortunately, the share price did not drop down to my standing order just above the uptrend ray from the low in April of 2024.

Now, I am scratching that order and will look to place another buy order at a higher share price. The ticker remains above the 200-day EMA and is above the proximal-low anchored VWAP. So, I will keep an eye on the Go-No-Go indicator to see if it turns bullish, and place an order once I see signs of a potential reversal.

On the other hand, I will keep my sell orders around $45 and $60 per share to book some profits and return my position to “House Money” status.

Long-term, I still expect NVAX to remain in the Compounding Healthcare “Bio Boom” speculative portfolio for at least five more years, or until it graduates to my growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVAX, SNY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.