Summary:

- Novavax announced Q1 2024 results with a beat on EPS and a miss on revenue, causing a surge in premarket trading.

- Novavax finalized a licensing agreement with Sanofi worth up to $1.2B, boosting its COVID-19 vaccine commercial performance.

- The Sanofi deal revitalizes the outlook for Novavax, providing immediate cash infusion, long-term revenue streams, and a narrowed focus.

Luis Alvarez

Novavax (NASDAQ:NVAX) has just announced mixed Q1 2024 earnings with a beat on EPS and a miss on revenue. NVAX surged by around 175% in premarket trading as investors applauded that their net loss narrowed by around 50% year-over-year to $148M, thanks to a 16% increase in revenue. In addition, investors were relieved to see the removal of the company’s going concern notice in the 10-Q, which was one of the geneses of the ticker’s relentless sell-off. However, I believe the primary cause of the spike in share price was thanks to Novavax finalizing a licensing agreement with Sanofi (SNY) worth up to $1.2B, to boost its COVID-19 vaccine commercial performance and Novavax’s Matrix-M adjuvant. I was elated to see the Sanofi news after waiting over three years for one of the big vaccine firms who sat out of the COVID-19 vaccine race to choose Novavax. Back then, NVAX was “My Magnum Opus Investment Idea” as it rocketed 6000% from my previous article due to investors bidding up anything related to the pandemic. Well, Novavax did not secure a big-name partnership to take over its commercialization efforts and the bigger names with inside connections got preferential treatment from every organization associated with the pandemic response. Now my NVAX bull thesis has been revitalized, forcing me to reassess my dormant position.

I intend to review the known details of the Sanofi partnership and will discuss how it revitalized my outlook for Novavax. Then, I point out some downside risks that investors should consider when managing their NVAX position. Finally, I reveal my plans for remodeling my NVAX strategy as we head into the second half of 2024.

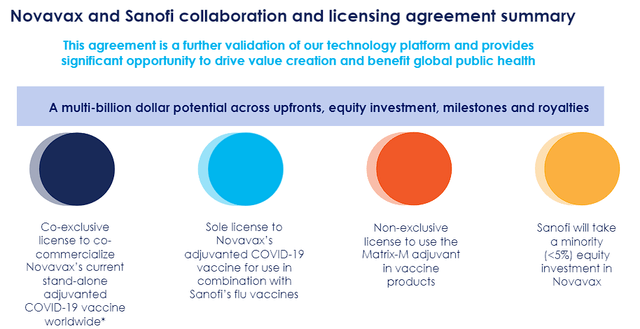

Overview of the Sanofi Deal

The Sanofi co-exclusive licensing agreement is a huge step forward for Novavax, opening up a potential multi-billion dollar revenue opportunity. Under the agreement, Novavax and Sanofi will co-commercialize Novavax’s adjuvanted COVID-19 vaccine globally, apart from regions where Novavax has already signed partnerships. Additionally, the collaboration involves the development of novel COVID-19/Flu combination vaccines employing Novavax’s Matrix-M adjuvant technology.

Novavax and Sanofi Collaboration Summary (Novavax)

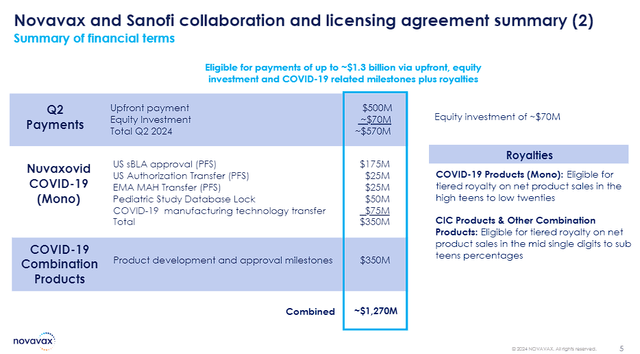

In return, Sanofi will also make a sizeable commitment to Novavax, including a $500M upfront payment and about $70M minority investment in NVAX. In addition, Novavax is eligible for $700M in near-term milestones related to COVID-19 and combo vaccine development, along with ongoing royalties on product sales.

Novavax and Sanofi Deal Summary (Novavax)

So, the COVID-19 vaccine and COVID/Flu combo vaccine products alone, can provide Novavax with a combined ~$1.27B in the near term.

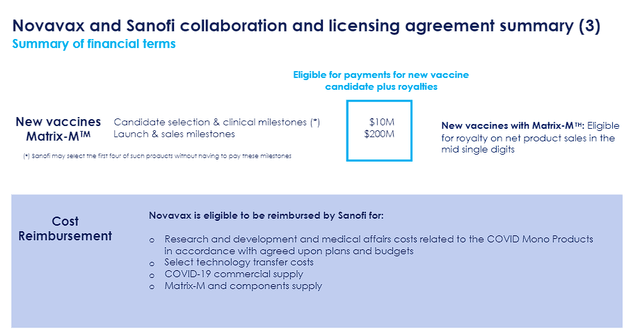

Novavax and Sanofi Deal Details (Novavax )

The biggest upside comes from the potential development of new vaccines with Novavax’s Matrix-M adjuvant. The company will be eligible for clinical milestones and royalty payments that could add up to billions in revenue in the coming years and decades.

My Views On The Deal

For me, the Sanofi agreement highlights the potential of Novavax’s technology platform and its ability to cultivate value in the global vaccine market. Sanofi is one of the world’s biggest and best vaccine makers, so this potentially multi-billion dollar deal validates Novavax’s technology both clinically and commercially. I don’t believe Sanofi would commit to a deal of this magnitude if it wasn’t enthralled with Novavax’s nanoparticle technology and their Matrix-M adjuvant. I can’t think of a better partner to help commercialize a vaccine you have created, and that can maximize the potential of the vaccine technology that you developed. For me, this deal is a true endorsement of Novavax and their efforts to develop cutting-edge vaccine technology.

Secondly, I have to stress that this is not exclusively a COVID-19 vaccine deal… So, there are multiple pieces that could provide Novavax with milestones and royalties in the coming years. This is not just a $1.3B deal for the near-term milestones… it is a potentially multi-billion dollar deal when you add in the Matrix-M milestones and royalties over time. The hope is that Sanofi takes Matrix-M and utilizes it to develop multiple new products providing Novavax with a steady stream of partnership revenue for a prolonged period of time.

Thirdly, the Sanofi deal will immediately have a material and strategic impact on Novavax’s operations going forward. Novavax stated that half of the cash is coming within 10 days of signing the Sanofi deal, which has already encouraged Novavax to update their 2024 financial guidance to the range of $970M to $1.17B and remove the company’s going concern warning. Furthermore, the deal will allow Novavax to have a leaner operating model as Sanofi helps with some of the heavy lifting on the commercial side, as well as providing cost reimbursements and supply agreements. Thus, allowing Novavax to devote more of their resources and attention to their R&D efforts along with their current pipeline programs that are in the clinic.

To summarize:

- Legitimate Partner

- Immediate Cash Infusion

- Long-term Revenue Streams

- Narrowed Focus

Sounds like a major win for Novavax.

Revitalized NVAX

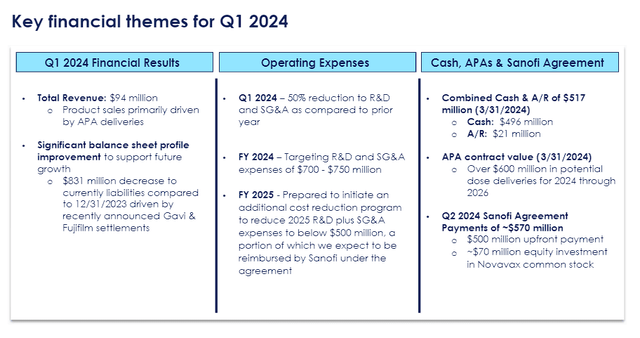

The Sanofi deal has rejuvenated my outlook on NVAX and altered my bull thesis. Admittedly, I didn’t have much hope for the company going into their Q1 earnings, and their results confirmed that they were struggling with the COVID-19 vaccine hangover. The company’s only reported $94M total revenue in Q1 and they were in a cost-cutting mode to conserve their cash position.

Novavax Q1 2024 Earnings Overview (Novavax)

It appears the company was just trying to be as prudent as possible but still maintain operations to get the 2025 COVID-19 vaccine ready for the season, while hopefully moving some of their pipeline programs closer to the finish line.

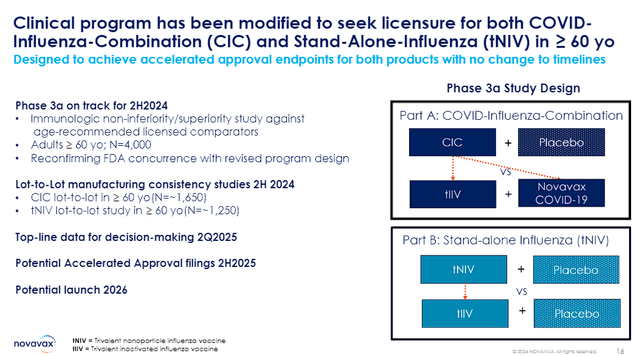

Now, Novavax can essentially go full-bore by focusing their efforts on advancing its pipeline. They are already working on the initiation of Phase III clinical trials for their COVID-19-Influenza Combination (CIC) vaccine and their standalone influenza vaccine program in the second half of This. If all goes well, those products could have potential launches by 2026.

Novavax COVID-Influenza Combo and Standalone Flu Vaccine Overview (Novavax)

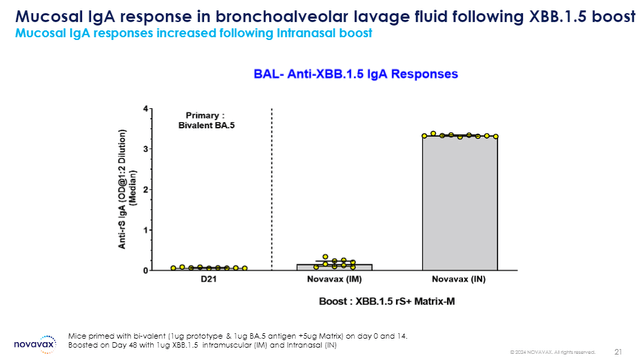

Moreover, the company can put the pedal down on the development of innovative vaccines. For instance, Novavax is developing mucosal vaccination and high-density nanoparticles. This is important because mucosal immunity should improve the likelihood of fighting off an infection, while also demising the ability to transmit the virus. Furthermore, it would be a needle-free option.

Novavax Mucosal IgA Response (Novavax)

What is more, the company mentioned that they were looking into a potential return of an RSV vaccine candidate. Admittedly, most of these developments might have happened without the Sanofi partnership on the table, but I am confident investors are more accepting of an expanded pipeline now that there is partnership revenue coming in to help unlock the company’s full R&D abilities.

Prior to the Sanofi deal, I was simply hoping we would hear an update on the 2024-2025 COVID-19 vaccine candidate and some improved commercial trends in the earnings report. Don’t get me wrong, I am happy that they are moving ahead with a potential EUA for their updated JN.1 COVID-19 vaccine for this vaccine season in August/September, and that they are going to go with a pre-filled syringe. However, that was probably going to be the highlight of the earnings call… because $94M in revenue and a reduction of current liabilities of $831M was not going to move the needle for the ticker. Now, investors don’t have to wonder if strong financial management strategies are going to be the headline moving forward. I will be looking forward to earnings calls in order to hear about new pipeline programs, Sanofi payments, royalties, or other indicators of pending growth.

The company went from “Going Concern” to exponential growth potential, signaling an abrupt change in the sentiment around the ticker.

Risks To Consider

While the Sanofi partnership should be celebrated, there are several potential downside risks that investors should consider when managing their position.

I believe the biggest risk is the dependence on Sanofi’s ability to execute their end of the deal. Surely, I am not doubting Sanofi’s ability to develop and commercialize a vaccine. However, investors need to accept that Sanofi is going to have to integrate Novavax’s COVID-19 vaccine into their portfolio and also figure out a way to combine it with their influenza vaccines. It is possible Sanofi will run into some challenges in executing these ideas or fail to hit some goal dates or projected milestones. Remember, revenue beyond the initial ~$1.3B from the Sanofi deal is largely contingent upon various milestones, including development, regulatory approvals, and product launches. So, any delays or setbacks could result in lackluster revenue and hurt the overall outlook of the partnership.

Another major concern is market competition for COVID-19 and flu vaccines. The vaccine market is highly competitive with multiple approved COVID-19 and flu vaccines already available. It is possible that the emergence of new variants or a big shift in vaccine demand could have a dramatic impact on the sales potential of Novavax’s vaccine, even with Sanofi’s backing.

Investors also need to consider regulatory risks regarding the potential approvals for the combined vaccines or the use of Novavax’s adjuvant technology in Sanofi’s products. It is possible that Sanofi will find some hurdles using Novavax’s tech that could pose a risk to the partnership.

Last but not least, IP concerns… It is possible that Novavax and Sanofi run into intellectual property disputes or legal challenges related to rights to products, or simply technology transfer. Obviously, this would lead to complications, delays, or possible termination of the partnership.

Indeed, Novavax has ways to mitigate these risks along with strong contingency plans in their own pipeline. The company is weighing their options about what they will do with current and future programs, which should diversify their revenue streams and not be solely reliant on Sanofi for income. Still, investors have accept that the market is going fixate on the success of the Sanofi partnership for the foreseeable future. Any indication that the partnership is not going smoothly will likely have a severe impact on NVAX’s performance.

My Plan

Seeing that Sanofi could provide Novavax with billions in revenue in the coming years and NVAX’s market cap is around $623M, I would say that the ticker is undervalued for the initial payments from the Sanofi deal alone. As a result, I am looking to reanimate my NVAX position after years of waiting for signs of a solid reversal.

At the moment, NVAX is trading around $8.80 per share, which is above Buy Threshold is $8.00 per share. My Buy Thresholds are the highest share price I am willing to pay for a ticker based on a combination of fundamental and technical analysis. The fundamental outlook for NVAX has changed following the Sanofi deal, so I am upgrading my Buy Threshold to $25 per share. I must make note that $25 per share will be the limit, but it does not mean I am always willing to buy. I must see that the ticker’s technical conditions have changed and a clear setup is forming on the Daily Chart.

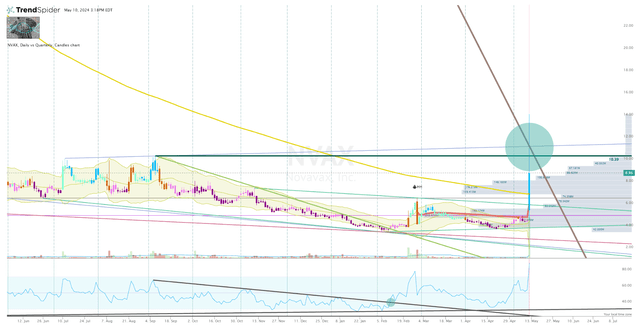

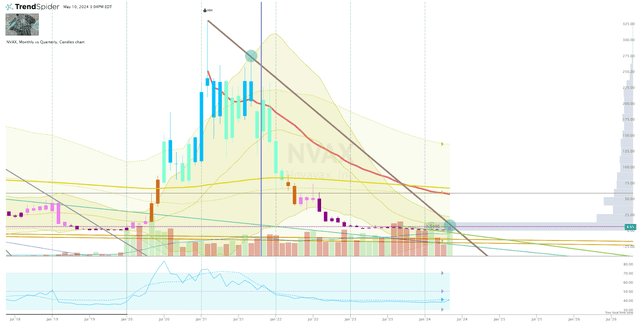

Looking at the monthly chart, we can see that NVAX tested the downtrend ray from the 2021 high… but it failed to hold above that line following the deal’s announcement.

NVAX Monthly Chart (Trendspider)

I am looking for NVAX to break and hold above that downtrend ray before clicking the buy button.

When Will That Happen?

Looking at the Daily Chart, we can see that the share price spike above that line briefly, and has retreated in the second half of the trading day. Typically, I would say this is a red flag, but I am assume there are a lot of investors that have been sitting on NVAX shares that were looking to unload to either book some profits or lighten the load. So, I think it is possible that NVAX sees a continuation at some point next week as the market digests the news.

In addition, the ticker is now trading above the 200-day EMA and the anchored VWAP from the proximal high. Furthermore, it is bullish on the Go-No-Go indicator. I am not saying a break of that downtrend ray is imminent, but some signs of bullish momentum might finally break the multi-year downtrend.

Once the ticker breaks and holds above that line, I will consider making a hefty addition to my NVAX position. Subsequently, I will set sell orders around $60 per share to book some profits and return my position to “House Money” status.

Long term, NVAX will remain in the Compounding Healthcare “Bio Boom” speculative portfolio for at least five more years, or until it graduates to my growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVAX, SNY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.