Summary:

- CEO insights on Argentine market potential and Brazil growth avenues are promising.

- Executives’ execution ability remains strong, reinforcing confidence in the Nu Holdings’ strategic direction.

- Despite the positive outlook, the current valuation lacks margin of safety for a buy recommendation.

Morsa Images/DigitalVision via Getty Images

Investment Thesis

I recommend holding Nu Holdings (NYSE:NU) shares. At the end of October, the company’s CEO gave an interview with many interesting insights, such as the potential of the Argentine market and growth avenues that the bank envisions for Brazil and Mexico.

I will connect these perspectives with my vision for the bank’s case. As I said in my thesis at the beginning of coverage, the company’s executives’ ability to execute has never been questioned. However, valuation still does not provide a margin of safety, especially with new risks emerging.

Eyes On Argentina

Getting straight to the point, the highlight of the interview given by Nu CEO David Vélez is that the bank is evaluating the prospects for Argentina, and an expansion into the country is not ruled out.

The CEO commented that the decision will be made in 1 to 2 years, but that the speed with which the economy is reacting is incredible. As an analyst, I welcome this feedback from Nu CEO.

Javier Milei seems to be doing a great job in the Argentine economy, as the Global X MSCI Argentina ETF (ARGT) is up 44% this year. Additionally, Nu has a great quality, which is being able to be the bank for the masses, which could be a great competitive advantage in Argentina.

In the same interview, Vélez mentioned that 60% of customers who have used the bank for more than a year have it as their main financial institution. More clues about Nu’s focus were given by him.

Perspectives For Brazil And Mexico

Vélez noted that, while Brazil can still contribute to the bank’s growth, Mexico offers the greatest potential. According to the CEO, 88% of Mexicans do not have access to credit, which is a big blue ocean for Nu Holdings.

As for Brazil, Vélez admitted that the country can still contribute to the bank’s growth, despite 95 million customers being from Brazil, and he listed some strategies. According to Vélez, Nu’s market share in key products in Brazil is still relatively low (credit cards: 14%; personal loans: 7%; investments: 2%).

Nu will make efforts to grow in these categories in Brazil, in addition to seeking solutions to serve high-income customers, where the bank does not yet have such a favorable position.

But with such positive prospects, why my neutral recommendation? One of the reasons is valuation, which we will see later, however a great risk has been growing in Brazil and I will talk a little about it below.

Sports Betting Sites Could Impact Credit

After the regulation of online sports betting in 2018, there was a boom in growth for companies in this sector in Brazil. But one fact is intriguing: most of the bettors are low-income young people (exactly the target audience of Nu).

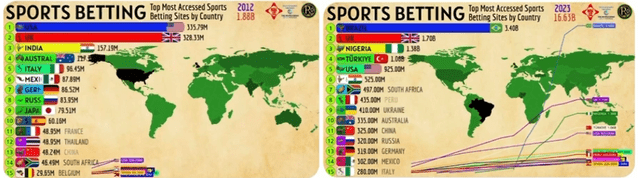

Below, we will see a very interesting graph. According to a survey, Brazil did not even appear on the list of Most Accessed Sports Betting Sites by Country in 2012. In 2023, it will occupy the first position.

Sports Betting (Royal Geografico)

This topic has already been discussed by the Brazilian Central Bank, and by research reports from big banks, which project that sports betting may have an impact on credit and default among low-income people.

This topic definitely makes me skeptical about the investment thesis in Nu, especially when I analyze the valuation and see that investors are believing that the bank will go through a very optimistic scenario without any setbacks.

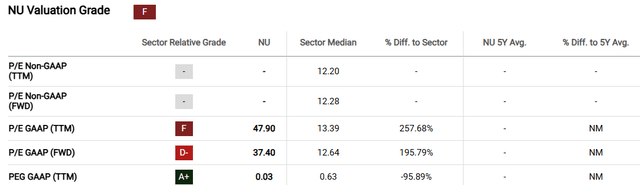

Valuation Does Not Provide A Margin Of Safety

To evaluate the company, I will use Seeking Alpha tools. As we can see below, the bank trades without any margin of safety due to the P/E, and when we consider growth with the PEG, there is also no margin of safety. This supports my recommendation to hold the shares.

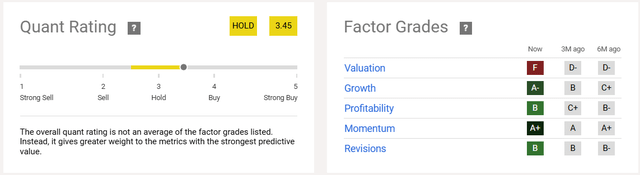

Additionally, I feel quite confident in my recommendation when I see that Seeking Alpha’s quant tools also recommend that investors hold their stocks. You can see this below.

Quant Rating And Factor Grades (Seeking Alpha)

Potential Threats To The Thesis

Although the risks associated with the rise of the sports betting market have increased, Nu has been operating in Brazil for over 10 years and invests heavily in technology to mitigate risks in its credit operations.

The Mexican market could indeed be a big blue ocean for Nu and even competitors, given the level of debanking seen in the country. In a recent earnings release, MercadoLibre (MELI) also highlighted the excellent prospects of the country.

The investment thesis is complex given that the bank’s markets are quite different, and the bank trades at a very premium valuation. Investors should conduct their analysis with great caution.

The Bottom Line

New prospects are emerging for Nu as Argentina recovers economically under Javier Milei. The decision to expand its business to the country is expected to be made within 12 to 24 months.

In Brazil, the bank intends to grow in key products such as credit cards, personal loans and investments, however, credit risks and defaults due to sports betting are on the radar.

In Mexico, the outlook is very positive, as more than 80% of the population does not have access to credit. However, these excellent prospects seem to be priced at an extremely premium valuation.

Based on this analysis, I recommend holding Nu shares. In my view, investors should be cautious because the valuation prices a scenario without setbacks, which does not seem to match reality.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.