Summary:

- Nu Holdings has nearly doubled since my December 2023 article, and shares are up 80% YTD.

- The company’s hyper-growth trajectory and still undemanding valuation make it a compelling investment opportunity even after the recent rise.

- Nu showcases extremely attractive unit economics, with low customer acquisition costs, compared to very high lifetime value.

- Investors will do well by ignoring their bias and adding Nu to their portfolio.

Bambu Productions

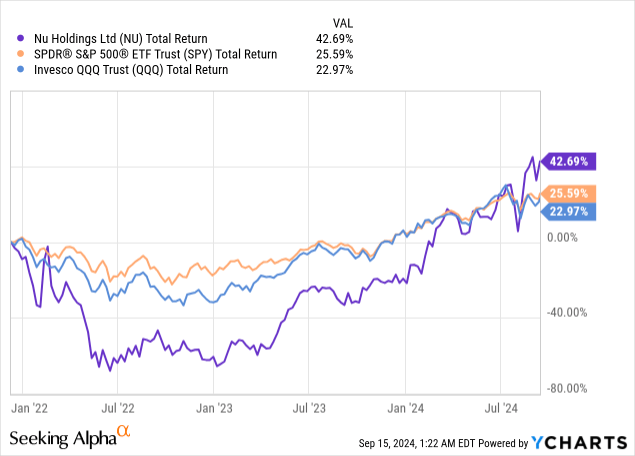

Nu Holdings (NYSE:NU) became one of my best calls as an analyst, with the stock nearly doubling since my December 2023 article.

Shares are up 80% YTD and yet I still find them extremely attractive.

Let’s dive into the company’s hyper-growth trajectory and its undemanding valuation.

Recapping Three Years Since Nu’s IPO

I published my first article on Nu in December 2023, naming it my top pick for 2024, with a ‘Strong Buy’ rating. Even though shares performed well from the get go, I maintained the ‘Strong Buy’ rating in my two follow-up articles in March and June.

Nu’s IPO took place in January 2022, at the peak of the post-covid valuation bubble. It was a fast-growing unprofitable company at the time, but was able to achieve a $41 billion valuation, reflecting both the market environment back then, but also very high investor enthusiasm about the company’s growth prospects.

It took Nu two years to regain the IPO valuation, and I’m willing to bet it’ll never see it again. During this period, Nu became one of the most successful growth stories in public markets.

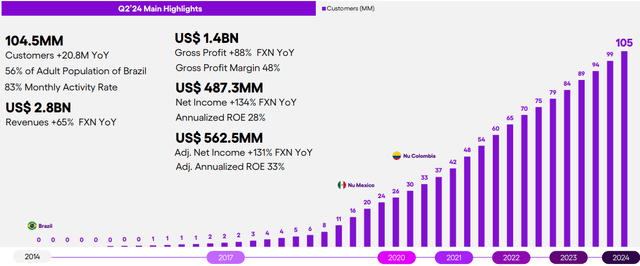

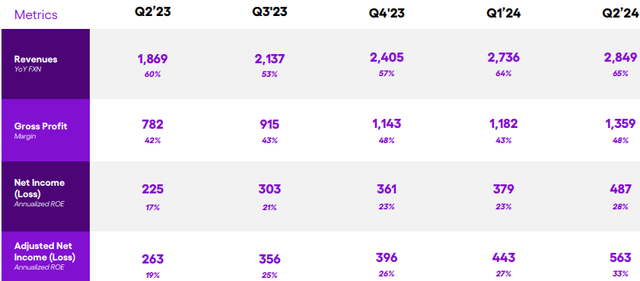

It’s on pace to nearly 7x its revenues in three years, while going from an operating loss of $170 million to an operating profit of over $2.6 billion. And, despite its larger scale, Nu is still growing rapidly, showcasing 52% revenue growth and 114% EPS growth in the recent quarter.

So, what’s Nu’s secret and how long is the hyper-growth runway? Let’s answer that now.

Nu’s Unit Economics Are Arguably The Most Attractive I Encountered

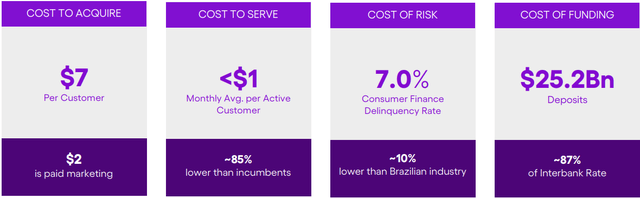

For essentially every business, you can narrow down the unit economics into two metrics. One is the cost to acquire a customer, and the second is the average customer lifetime value, which in simple words is how much profit you’ll generate from said customer.

Nu Holdings Q2’24 Presentation

In Nu’s case, the company barely spends on marketing and acquiring customers, thanks to its ability to drive ultra high customer satisfaction for unserved or underserved populations. Just think about it, what if a truly amazing service came to your neighbourhood? The kind of business that both saves you money and provides exceptional customer service. How long will it take for you to tell all your friends about it? Very quickly everybody in the neighbourhood will know about it, and then the next, and the next.

This is exactly why Nu only has to spend a miserable $7 to acquire a customer. On top of that, Nu’s unparalleled capital-light scalable operating model produces a monthly cost to serve that’s below $1 per active customer.

Nu Holdings Q2’24 Presentation

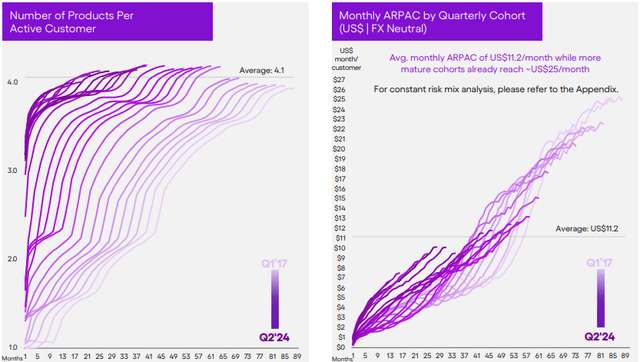

As you can see on the graph above, over time, Nu is becoming better in accelerating customer maturation, meaning that a new customer gets to the average ARPAC and product adoption level much quicker.

I can think of a handful of businesses with extremely simple yet extremely attractive unit economics, the likes of Costco (COST), or Chipotle (CMG). Although these wouldn’t be the first choice for most people when looking for Nu comparisons, I think they have a big thing in common. These are companies that found a winning formula, and all they have to do is replicate it across geographies, and customer cohorts, while staying true to their core value proposition.

Nu Holdings Q2’24 Presentation

This is exactly what Nu is doing, as it surpasses 105 million customers across three geographies.

Addressing A Popular Investor Worry: Investing In A Lender

Nu is a bank. Lending is its primary business, and it’ll only become more meaningful over time. I completely understand that the casual ‘quality’ investor automatically crosses off such companies from their list, and I have nothing to say about that.

However, investors that are a bit more nuanced and open minded, can benefit from going outside their comfort zone from time to time, if they’re willing to the work. Understanding Nu’s credit business is quite easy.

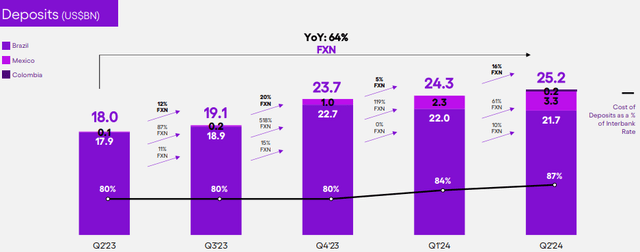

First of all, like every bank, Nu funds its loans with customer deposits. It is able to attract more and more deposits by offering industry-leading interest rates, driven by its extremely lean operation.

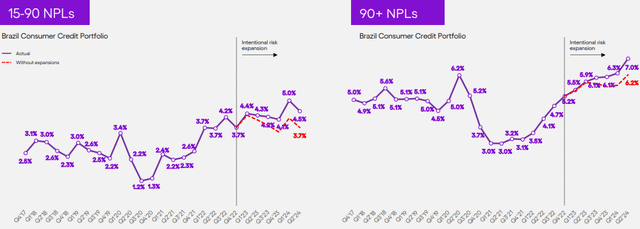

Nu Holdings Q2’24 Presentation

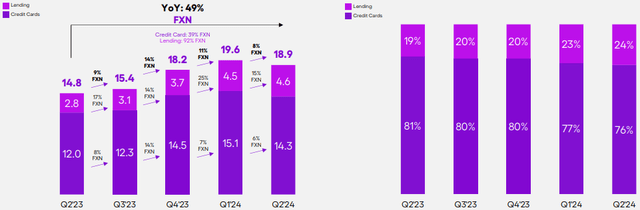

The company’s $18.9 billion credit portfolio, growing 49% Y/Y, is comprised of carded (76%) and non-carded (24%) loans:

Nu Holdings Q2’24 Presentation

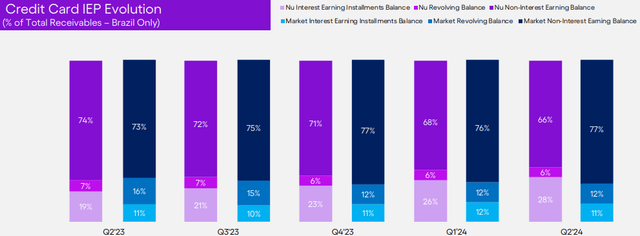

On carded loans, Nu is constantly improving its portfolio mix, and as of Q1’24, has a better interest-earning balance portion compared to the market:

Nu Holdings Q2’24 Presentation

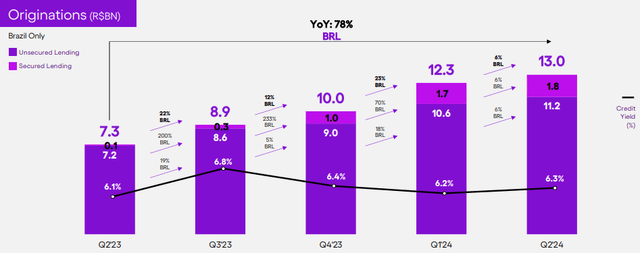

On non-carded loans, Nu offers a diversified portfolio of loans, which can be aggregated under two categories – Secured (lower risk lower yield), and Unsecured (higher risk, higher yield). Although the secured portion is outgrowing the unsecured, Nu still maintains very attractive yields:

Nu Holdings Q2’24 Presentation

As is the case for all lenders, there will always be a certain portion of loans that are ‘non-performing’, meaning the borrower is unable to repay their debt. This is a feature, not a bug.

Nu Holdings Q2’24 Presentation

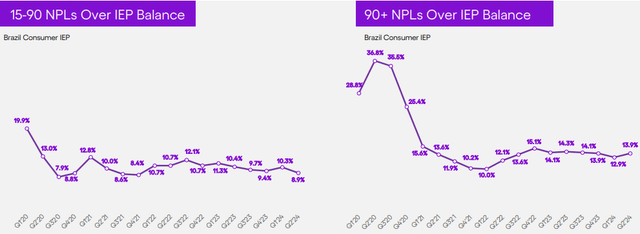

What successful lenders do is finding the optimal balance between risk and return in order to maximize value. Nu does exactly that. While NPLs are growing, the interest-earning balance is growing even faster:

Nu Holdings Q2’24 Presentation

This is what drove Nu’s all-time high risk-adjusted NIM of 11% last quarter, and in turn, an all-time high ROE:

Nu Holdings Q2’24 Presentation

Importantly, many investors don’t want to invest in lenders because of the ‘left-tail’ risk (low probability but for a crisis-level scenario). However, Nu has significant excess capital which makes such crisis scenario even more unlikely.

Valuation

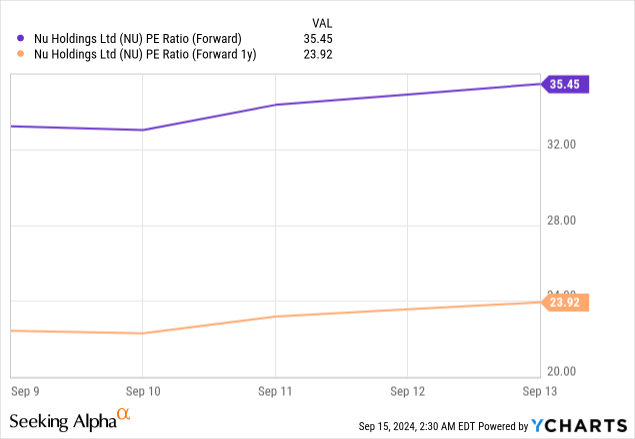

Not a lot changed since my last article (except for the fact the stock is up an additional 25%). Nu still has unquantifiable runway for growth.

In the near-to-mid-term, I expect consistent user growth in existing markets, while expanding the product portfolio, and increasing the adoption of current products.

Over time, I see the mature cohort ARPAC rising above $25, and the average cohort ARPAC increasing from the current $11.2 closer to that $25.

In the long-term, Nu is highly likely to expand into a lot more geographies, and as it becomes a mature company, its cash generation profile will probably lead to significant dividends and buybacks.

Nu is still trading at an embarrassingly low P/E relative to its hyper-growth prospects. At 24 times ’25 earnings, Nu’s PEG ratio is in the 0.55x range.

I addressed the P/B argument last article, but it’s worth to briefly revisit it here:

Traditionally, banks are evaluated based on their book value, but for an emerging digital bank like Nu, there are several flaws with this approach.

First, it doesn’t own physical branches, which are a significant asset for traditional banks.

Second, deposits (a liability) are underutilized compared to loans (an asset), resulting in less equity at the current stage.

Third, the company is still at a stage of accelerated credit allowances and doesn’t have decades of profits behind it, meaning it has yet to accumulate meaningful retained earnings.

Lastly, and most importantly, Nu is increasingly expanding outside of core banking operations into areas like investment platforms and mobile.

The bottom line, I think investors will miss out on an exceptional growth story if they stick to that P/B approach.

All in all, I estimate Nu’s fair price at $17.9 by mid-2025, reflecting a 31.5x P/E (0.75x PEG) on EPS expectations of $0.57. Although this is still great upside at 22%, it’s not as high as it was in my June article, which leads me to downgrade the stock from ‘Strong Buy’ to ‘Buy’.

Conclusion

Nu remains a key holding and a large position in my portfolio, as the company showcases one of the strongest profitable growth stories in public markets.

I expect Nu to continue to grow at a rapid pace, while constantly increasing margins, as the company’s unit economics are parallel to none.

At current valuation, near-term upside is still significant, but not as huge as it was a few months ago, which leads me to downgrade the stock to a ‘Buy’.

Let me emphasize, I’m still advocating to be aggressive buyers of Nu shares, especially on weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU, CMG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.