Summary:

- Nu Holdings Ltd. has rapidly expanded in Brazil and is growing in Mexico and Colombia, attracting significant investor attention, including from Warren Buffett.

- Despite a 75% YTD stock price surge, Nu Holdings offers long-term investment potential, particularly for those seeking exposure to emerging markets.

- Nu Holdings’ efficient, digital-only business model and focus on underserved low-income clients have driven impressive growth and profitability, outperforming peers.

- Despite Nu Holdings’ high valuation, I believe the stock presents a viable buying opportunity due to its potential for continued growth.

Ta Nu

The rapid growth of Nu Holdings Ltd. (NYSE:NU) in Brazil and its expansion in Mexico and Colombia, attracted significant attention from investors on Wall Street, including Warren Buffett. As of August 2024, Buffett owned 107 million shares of the company. The strong business performance is reflected in its stock price, which has surged about 75% year-to-date, largely outperforming the S&P 500 index.

Despite the significant surge in its price, I believe the stock still has room to grow, and it could be a great investment opportunity for investors seeking exposure to emerging markets.

Company Profile

Founded in Brazil in 2013, Nu Holdings Ltd operates an online banking platform under the name of NuBank in Brazil, Colombia, and Mexico. NuBank offers several financial products, including credit and prepaid cards, mobile payments, savings accounts, loans, and investment products. It also provides insurance coverage for life, auto, and home. NuBank received multiple awards, including recognition on Time’s list of 100 Most Influential Companies, Fast Company’s Most Innovative Companies, and Forbes’ World’s Best Banks.

Business Overview

I believe that NuBank’s recent success in Brazil is due to its business model, which differs substantially from that of a conventional bank. For instance, the bank doesn’t operate any physical branches, all of its products are offered through its digital platform. This approach allowed NuBank to reduce operating expenses and improve its net earnings.

Another important feature is the Bank’s focus on low-income customers, a market segment that is not typically attractive to large Banks. In the Q2 earnings call, the CFO highlighted that low-income earners make the bank’s largest customer base. In my opinion, this focus allowed the bank to grow rapidly in a market where competition is relatively low.

Lastly, by operating as a digital banking platform, and not as a full-fledged commercial bank, NuBank simplified its legal structure and avoided the burden of heavy regulations and disclosures typically required by commercial banks.

In addition to the Brazilian market, the company sees a great opportunity in its expansion plans in Colombia and Mexico. According to CEO David Velez in the Q2 earnings call, the bank has attracted about 8 million customers, which indicates a significant growth opportunity in the 120 million population in Mexico.

Relative Performance Assessment

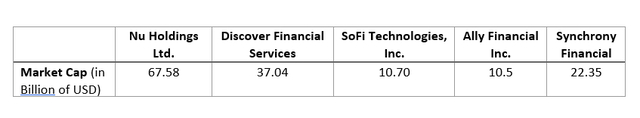

To evaluate NuBank’s performance, I have gathered financial data from the company and a selected group of digital financial institutions that I believe serves as an appropriate benchmark for NuBank. I chose not to include traditional brick-and-mortar banks, as their capital structures and business models make them less appropriate benchmarks.

For the peer group, I selected Discover (DFS), SoFi (SOFI), Ally (ALLY), and Synchrony (SYF).

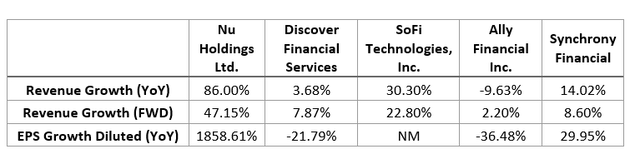

Growth

As shown in the table below, Nu Holdings’ year-over-year growth in revenues and earnings significantly outperformed its peers. The company’s forward revenue growth rate of 47.15% is considerably higher than those of its peers.

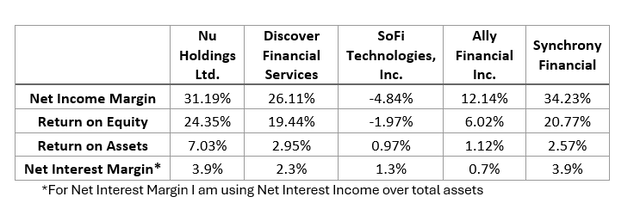

Profitability

The company’s net income margin is the second highest after Synchrony Financial, while its return on equity and return on assets are the strongest among its peers. Additionally, NuBank had the highest net interest margin.

Financial Risk

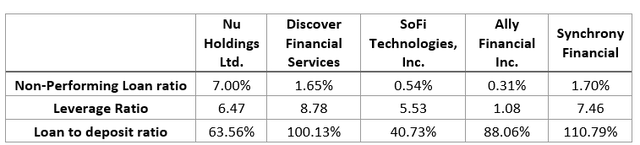

NuBank reported a 7% non-performing loan ratio in its Q2 earnings. This ratio is significantly higher than those reported by the bank’s peer group. When asked about this issue during the Q2 earnings call, the bank’s COO attributed the high figure to seasonal factors, stating that the company reduced its provision for loan losses in Q2 as it anticipated lower upcoming losses. Investors should keep a close eye on this ratio in the coming earnings reports to determine whether the loan portfolio is becoming riskier or it is just a seasonal trend.

The leverage ratio, calculated as total assets divided by total equity, reflects the level of financial risk the company is assuming. A higher ratio indicates a greater risk. It is shown that Nu’s leverage ratio falls within the range of its peers. Also, the loan-to-deposit ratio is comparable to those of the bank’s peers.

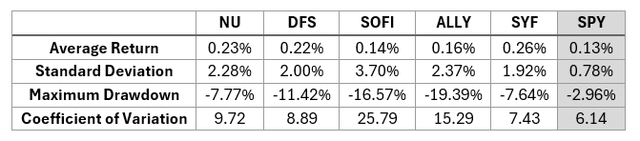

Stock Price Volatility

From October 24, 2023 to October 23, 2024, Nu Holdings stock earned an average daily return of 0.23%. The standard deviation of those returns was 2.28%, a figure that is close to those of its peers, but significantly higher than the 0.78% standard deviation of the (SPY) ETF. The maximum one-day drawdown of 7.77% is also comparable to the drawdowns of its peers.

When examining the coefficient of variation, which measures the amount of risk taken relative to the return earned, Nu Holdings investors are taking on 9.72 units of risk for every unit of return. This figure is within the range of its peer group but, as expected, higher than that of the SPY.

The data illustrates the level of volatility that investors must accept if they choose to invest in the stock.

Valuation

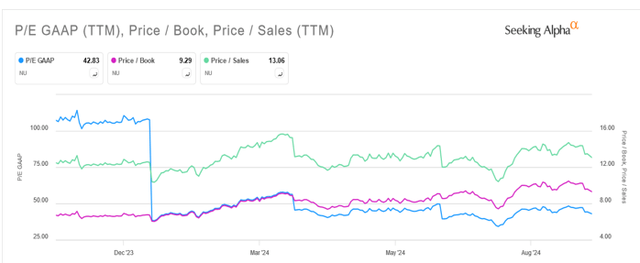

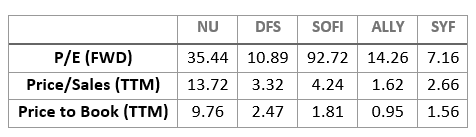

Nu Holdings’ valuation ratios, including Price to Earnings (P/E), Price to Sales (P/S), and Price to Book (P/B), are notably higher than those of its peers, suggesting an overvalued stock price.

Seeking Alpha

However, when examining these valuation ratios over the past year we find that the P/E ratio remained between 34 and 58, while the P/S ratio ranged from 10 to 16, and the P/B ratio varied between 6 and 11. Therefore, the current valuation ratios fall within their historical levels.

Investment Risk

Since it operates in emerging markets, NuBank faces more risks than companies operating in developed markets. These risks include exchange rate fluctuation, economic volatility, weak regulatory systems, and political instability.

In addition to emerging market risks, rising competition in the digital banking market could impact the company’s profitability, particularly from non-traditional players like MercadoLibre (MELI). Mercado Libre offers online financial services through Mercado Pago, Mercado Fondo, and Mercado Crédito. The products offered include deposit accounts, loans, online payments, and investments. Given Mercado Libre’s strong presence in Latin America and its high capabilities, I believe it may pose a major threat to NuBank’s business.

Bottom Line

The company’s potential for growth can offer an exceptional opportunity for investors seeking investments in emerging markets. In my view, NuBank’s successful operation in Brazil could be replicated in other emerging markets, giving the bank a long-term growth opportunity.

Nu Holdings is scheduled to report its Q3 earnings on November 13, and I anticipate further revenue and earnings growth. However, given the current valuation, I would avoid the risk of establishing a large position before the earnings. It is safe to wait for the earnings report or to initiate a small position and add to it later. Another way to establish a position could be by selling cash-secured puts with a strike price lower than the current market price. For instance, the $13 strike put expiring on November 15 is trading around $12, which could allow investors to purchase the stock at a net cost of approximately $12.88 in case the stock pulls back.

The stock’s forward P/E ratio of 35 may suggest that the stock is overvalued, however, when compared to its peers, Nu has shown superior performance on different metrics, which may justify its current high valuation. Given the promising growth opportunities, I believe the stock will keep outperforming the market, and therefore I give it a “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is not an advertisement or solicitation for any specific investment, investment strategy, or service. Forecasts, charts, and tables do not predict or project actual future investment performance or imply that any past performance will happen again. This report does not provide tax or legal advice. The results shown in this article are not guarantees of, or projections of future performance. Results shown are for illustrative purposes only. Historical data shown represents past performance and does not imply or guarantee comparable future results. Information and statistical data contained herein have been obtained from sources deemed to be reliable, but in no way are guaranteed as to precision or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.