Summary:

- The company is now an “AI-first” company after recently acquiring Silicon Valley-based Hyperplane.

- The company’s recently reported second-quarter 2024 earnings show the thesis for investing in Nu Holdings is still on track.

- The valuation of the stock is still reasonable.

Hispanolistic

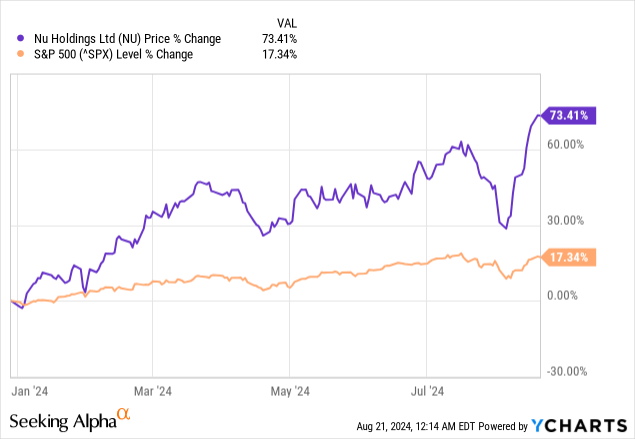

I recommended buying Nu Holdings (NU) four times, and all of those recommendations have beaten the market. The first time that I wrote about the company was a few weeks after its Initial Public Offering (“IPO”) at $9 a share. The company was already well-known as a CNBC Disruptor 50 and a Warren Buffett-backed stock. The stock is up 61.63% since that first article. The second time I recommended the stock was on February 28, 2022, during a Brazilian economic slowdown, when it sold below its IPO price. The stock is up 89.14% since that article was published, compared to the S&P 500’s (SPX) 28.55% rise. The stock is also up 98.76% and 39.50% from my October 08, 2023, and February 13, 2024 buy recommendations, respectively. The stock is on a tear in 2024, up 73.41%. In comparison, the S&P 500 grew 17.34% so far this year.

The company recently reported earnings on August 13, 2024. It beat analysts’ revenue estimates by 1.4% and their diluted EPS estimates by 10%. The stock rose 5% the day after management released the company’s earnings report. The thesis for investing in Nu Holdings remains the same as when I first recommended the stock. The first time that I wrote about this stock, I said:

Nu Holdings has also barely tapped a very large and attractive market for financial services in Latin America. The company is very disruptive to legacy financial institutions in Latin America and is currently taking market share in countries like Brazil, Mexico, and Colombia.

That statement remains true today. Although the company has become a dominant bank in Brazil, it has yet to fully monetize its members in the country compared to legacy Brazilian banks. The company also has yet to scale fully in Mexico and Colombia; those countries remain in investment mode. Nu Holdings has plenty of potential upside ahead.

This article will discuss how Nu Holdings is becoming an “AI-first” company. It will also examine its fundamentals after its recent second quarter 2024 earnings release, the risk the bank has taken by expanding its loan book into riskier loans, the stock’s valuation, and why it remains on my buy list.

Nu Holdings and the AI revolution

Nu Holdings is not a typical bank. The company has a solid technological background and an “AI-first” mentality. The company plans to invest heavily in AI solutions. On June 26, 2024, it purchased Hyperplane, a Silicon Valley company that designs large language models (“LLMs”) that financial institutions can train to perform various tasks, including personalizing their customers’ experiences. The press release announcing the deal stated:

Hyperplane, launched in 2022 and co-founded by Daniel Silva, Felipe Lamounier, Rohan Ramanath, and Felipe Meneses, has been instrumental in using proprietary foundation models [LLMs] to provide high-quality financial services to millions of individuals. The platform enables financial institutions to train, evaluate, and deploy self-supervised, deep-learning models on first-party data for decision-making. Their platform serves as a central hub, allowing customers to train hundreds of bespoke models across various business domains such as risk, collections, and marketing.

Nu Holdings didn’t fully explain what it will do with its new acquisition except to say in the press release, “At Nubank, Hyperplane will power the core machine learning capabilities, building foundational models that the product and engineering teams consume to create the best customer experience at every step of their journey.” Management didn’t say whether Hyperplane would continue selling its AI solutions to other banks. There is a possibility that Nu Holdings could become an AI technology provider to different banks, similar to how SoFi Technologies purchased Galileo and became a platform-as-a-service provider for companies wanting to issue debit, credit, and prepaid cards.

Company Fundamentals

Nu Holding Second Quarter 2024 Earnings Presentation.

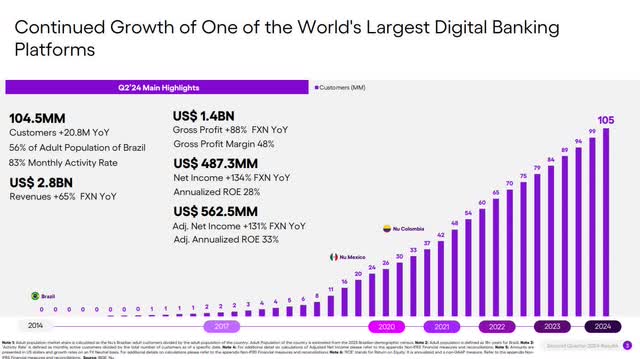

When I first recommended the stock, Nu Holdings had around 60 million members. Nu membership has increased 75% to around 105 million, with the most significant chunk of that membership coming from Brazil. The company says that as of the second quarter of 2024, 56% of Brazil’s adult population were members, up 2% sequentially. Mexico had 7.8 million Nu members, and Colombia had approximately 1.3 million members at the quarter’s end. The company stated in its second quarter 2024 earnings release that it is “the fourth largest financial institution in Latin America by number of customers.”

Active customers, who have generated revenue over the last 30 calendar days, were up 27% over the previous year’s comparable quarter. The monthly activity rate, an engagement metric that measures the number of customers who generated revenue during the month divided by the total number of customers, was up 120 basis points year over year to 83.4%. Chief Financial Officer (“CFO”) Guilherme Lago said, “This marks the 11th consecutive increase in this metric [monthly activity rate], demonstrating our proficiency and consistently offer of compelling value proposition to our customers in Brazil, Mexico, and Colombia.”

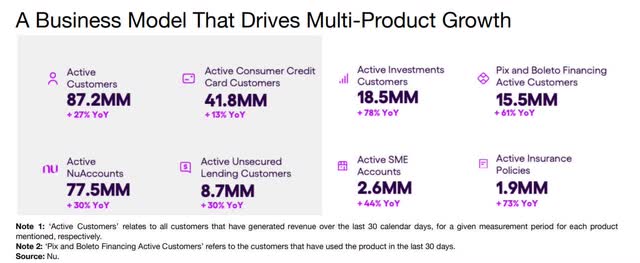

The image below shows the number of memberships and growth rates of several of its most important products. The company’s leading product is its consumer finance portfolio, which includes credit cards, Active NuAccounts (digital bank accounts), and unsecured lending. One product on the list that most U.S. investors are likely unfamiliar with is the Pix and Boleto financing accounts. Pix is a real-time payment system in Brazil similar to Zelle in the U.S. market. Boletos is another payment system backed by the Brazilian Central Bank that people commonly use in Brazil. Active SME accounts are Nu’s small and medium-sized business accounts. Nu Holdings also offers insurance and investment accounts, although the company talks less frequently about those products on earnings calls.

Nu Holdings Second Quarter 2024 Earnings Release.

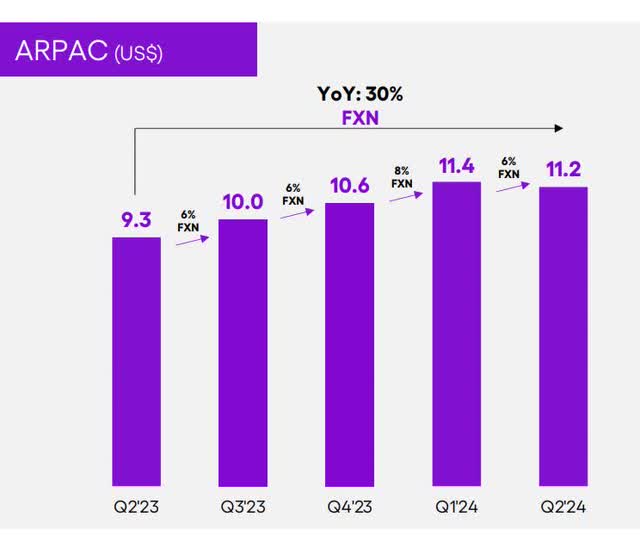

While rapidly gaining new customers is all well and good, it means little if Nu Holdings cannot monetize them. One metric that highlights how well the company is monetizing its members is ARPAC (Average Revenue Per Active Customer). Nu Holdings defines ARPAC as “the average monthly revenue divided by the average number of individual active customers during the period.” A significant part of the company’s strategy is to upsell and cross-sell an expanding set of financial products to its existing customer base. A rising ARPAC means Nu Holdings’ upselling and cross-selling strategy is succeeding in monetizing its users. Investors also tend to award the company a higher valuation as ARPAC rises because it bodes well for Nu Holdings’ profitability. It’s cheaper to sell products to existing customers than marketing to gain a new customer. The following image shows Nu grew ARPAC 30% year-over-year to $11.20 — an excellent number. However, some people claim that the average ARPAC for a traditional Brazilian bank ranges from $35 to $40. If true, Nu has a long way to go in monetizing its users. CFO Lago said on the second quarter earnings call, “We continue to see a clear path to further increase ARPAC towards its full potential.”

Nu Holding Second Quarter 2024 Earnings Presentation.

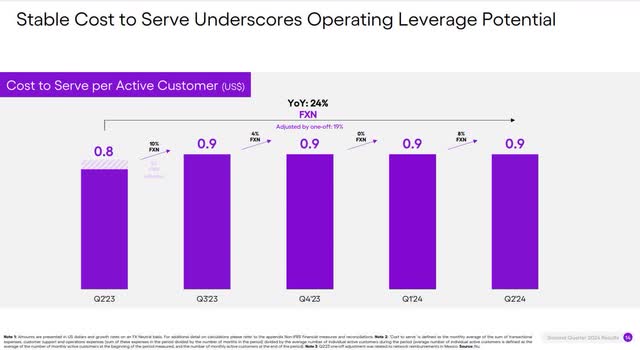

Another meaningful part of Nu Holdings’ strategy is maintaining a low cost to serve, and management thinks it holds one of the lowest costs to serve per active customer in the Latin American market. CFO Lago said on the earnings call, “Our platform remains one of the most cost-effective in our markets, with its low cost-to-serve providing a significant competitive advantage.” Maintaining a lower cost to serve than competitors means Nu Holdings has a better profit margin for each additional customer. It allows the company to offer similar financial services as other banks in Brazil, Mexico, and Colombia at lower prices or invest more in customer acquisition and retention. The combination of ARPAC expanding by 30% and a low cost to serve gives the company a solid operating leverage. Nu’s press release announcing second-quarter earnings stated (emphasis added), “Monthly Average Cost to Serve Per Active Customer remained stable and below the dollar level at $0.9, demonstrating the strong operating leverage of the business model.” Operating leverage means that profits grow even faster as the company grows revenue.

Nu Holding Second Quarter 2024 Earnings Presentation.

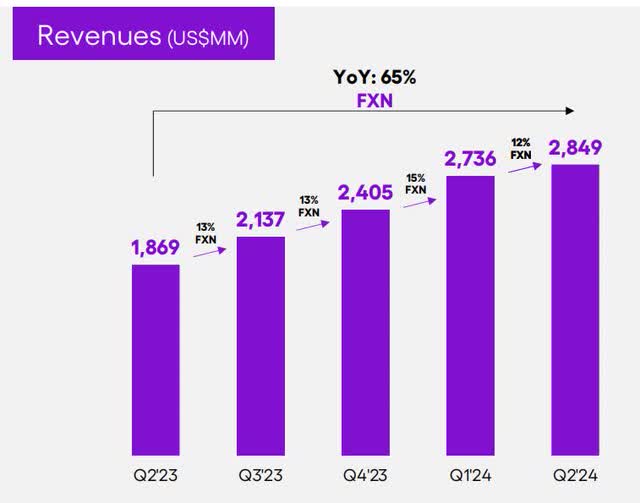

The company grew FX neutral (“FXN”) revenue by 65% year-over-year to $2.849 billion. Nu uses FXN to remove the effects of foreign exchange, which is essential since the company operates in several countries and reports earnings for its U.S.-based listing in dollars. Analysts expect revenue to grow at a compound annual growth rate (“CAGR”) of 46.3% over the next three fiscal years.

Nu Holding Second Quarter 2024 Earnings Presentation.

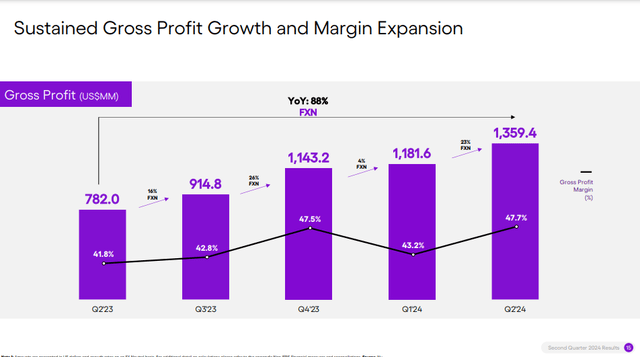

Nu Holdings’ second quarter 2024 gross profit grew 88% year-over-year to a record quarterly high of approximately $1.4 billion. In the second quarter of 2024, the gross margin increased by 450 basis points (“bps”) sequentially and by 590 bps year-over-year to 47.7%. The solid performance in Nu’s core market, Brazil, has offset the downward pressure on gross margins from increased investments to grow in Mexico and Colombia.

Nu Holding Second Quarter 2024 Earnings Presentation.

The above chart shows that gross margins and profit dipped in the first quarter. CFO Lago said the following about the first quarter gross margin dip on the first quarter earnings call:

The sequential drop in gross profit margins in the first quarter was driven by two main factors: number one, the seasonal drop in cards purchase volumes, which impacted interchange revenues when compared to the fourth quarter; and number two, the increase in growth, which drove credit loss allowance build in the quarter.

In plain English, credit card purchase volumes dropped in the first quarter compared to the fourth quarter because people will spend more during the holiday season. Interchange revenue is a fee a credit card network charges to a merchant for each credit card transaction processed. The credit card network splits this fee with the card issuing bank, Nu Holdings. A reduction in credit card purchases reduces Nu Holdings interchange fee revenue. The second reason for the gross margin decline is that the company’s expansion of its loan portfolio necessitated setting aside more money (credit loss allowance) to cover potential loan defaults, which reduced gross margins.

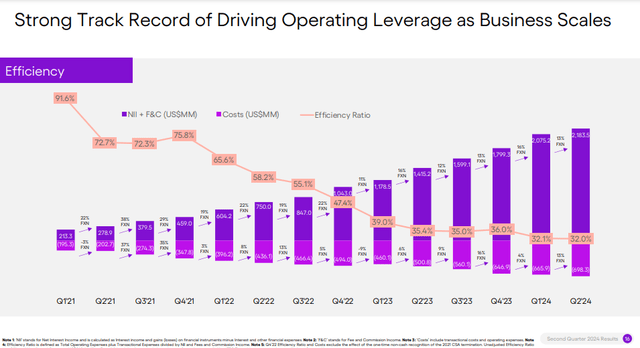

Next, let’s look at the efficiency ratio. A bank’s efficiency ratio equals its operating expenses (non-interest expenses) divided by its total income (Net Interest Income + fee and commission income). It measures how well management controls operating costs and impacts the company’s profitability.

Nu Holding Second Quarter 2024 Earnings Presentation.

The above chart shows that the company’s efficiency ratio dropped from 91.6% in the first quarter of 2021 to 32% in the second quarter of 2024—an astounding number. For comparison purposes, banking experts consider an efficiency ratio of 50% good. The lower the efficiency ratio, the better. A lower efficiency ratio means the company converts more revenue into profit.

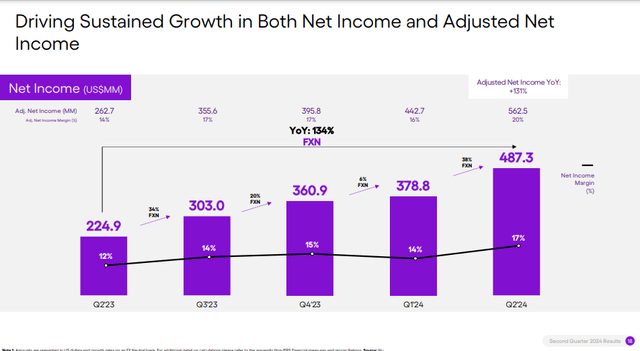

The following chart shows that the company’s second-quarter 2024 net income grew 134% over the previous year’s comparable quarter to $487 million. The net income margin grew five points year over year to 17%. Nu Holdings second quarter 2024 IFRS (International Financial Reporting Standards) earnings-per-share (“EPS”) was approximately $0.10.

Nu Holding Second Quarter 2024 Earnings Presentation.

Analysts expect EPS to grow at a 54.2% CAGR over the next three years.

The Brazilian economy and credit expansions

This section will mainly focus on Brazilian economic conditions and management’s decision to grow its loan portfolio in the country. One thing to understand about the lending business is that when a bank grows revenue faster by expanding its loan portfolio into riskier loans, the risks of investing in the bank rise. Additionally, if a bank increases its loan book too rapidly, it could strain its ability to meet short-term financial obligations, including depositors’ ability to withdraw their money.

Economic conditions are often a significant factor in bank failures. Investors need to monitor inflation, interest rates, the possibility of recession, asset value declines, and market volatility. Some of these factors are difficult to monitor in the U.S., much less in Brazil. For instance, a U.S. bank, SVB Financial, failed due partially to a decline in the value of its portfolio of U.S. Treasury securities and mortgage-backed securities. By the time some investors in that bank figured out what was happening, the bank had failed. No banking executive will come on an earnings call and say their company is in financial distress. So, when banks fail, it’s often surprising and quite sudden.

The current economic conditions in Brazil are mixed. Deloitte recently published an article about the Brazilian economy, highlighting the good and the bad. The good news is that the Brazilian economy is in solid condition right now, especially compared to when I recommended this company in the middle of a downturn several years ago. Today, Brazilian citizens are spending money, businesses are hiring, and wages are increasing.

The bad news is that the inflation rate remains above the Brazilian bank’s target, which makes the central bank reluctant to lower interest rates further. The labor market has more job openings than people looking for jobs, meaning employers must offer higher wages to attract job applicants, possibly stimulating higher inflation. Last, the Brazilian government’s fiscal policy is a significant concern, as the government has failed to achieve its goal of returning the budget to a surplus. The Deloitte article states:

The inability to get the primary deficit to surplus has concerned many investors. As a result, bond yields have moved higher. The yield on 10-year treasury bonds went from 10.3% in the last week of December to over 12.0% in July. The rise in bond yields will push debt levels higher as long as the primary deficit continues. In addition, the value of the currency against the dollar has depreciated sharply. At the end of last year, the currency was valued at 4.84 per US dollar. By the first week of July, it depreciated to 5.56 per dollar, though it has since strengthened slightly to 5.49. A weaker currency has the potential to raise the cost of imported goods, which could stoke inflation and raise interest rates further.

If the Brazilian government gets its fiscal house in order, there is a path to a longer sustained upcycle. If it fails to address the budgetary deficit adequately, the government risks higher inflation, rising interest rates, and a slowing economy, which would be bad for Nu Holding’s lending business. Nu Holdings’ current strategy is to take on more credit risk to increase profits. Chief Operating Officer (“COO”) Youssef Lahrech said on the company’s first quarter 2024 earnings call:

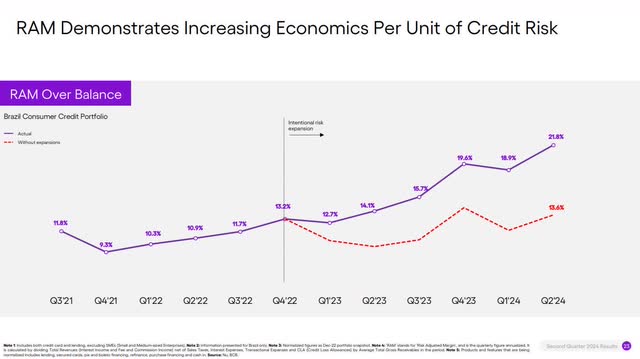

We continue to see meaningful opportunities to expand our credit portfolio, aiming for attractive returns and robust resilience. Part of that growth has been coming from expansions down the credit spectrum, which will continue to result in intentionally higher delinquency rates and will continue to be more than offset by additional revenues leading to increasing risk-adjusted margins over time.

In other words, the bank is lending to customers with lower credit scores, likely leading to more loan defaults. However, the company expects to raise revenue and profit margins by charging higher interest rates to these riskier borrowers. The following chart shows the risk-adjusted margins (“RAMs”) for the bank’s Brazil consumer credit portfolio with and without intentional risk expansions. The red line shows that the bank’s consumer credit portfolio would have only achieved 13.6% RAM without the risk expansions. The purple line represents Nu Holdings’ actual RAM of 21.8%. COO Lahrech said on the earnings call, “This clearly indicates that the additional revenues stemming from this [risk] expansion strategy have more than offset the additional credit risk and delivered substantially increased returns.”

Nu Holding Second Quarter 2024 Earnings Presentation.

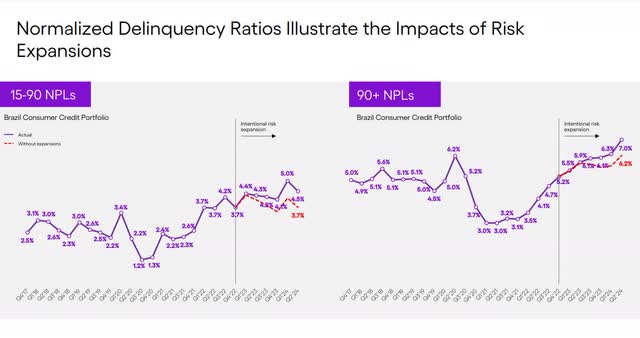

The following chart shows the number of bad loans through its delinquency ratios. The company highlights two delinquency ratios for investors: 15-90 NPLs (non-performing loans) and 90+ NPLs. Loans in the 90+ NPL category are loans the company will likely have to write off as a default. The company considers loans in the 15-90 NPL category as a leading indicator of loans that will likely default. As management intentionally raised the risk of the loans it was willing to take on, actual loan delinquency ratios (purple lines) rose above what they would have been without the risk expansion (red lines).

Nu Holding Second Quarter 2024 Earnings Presentation.

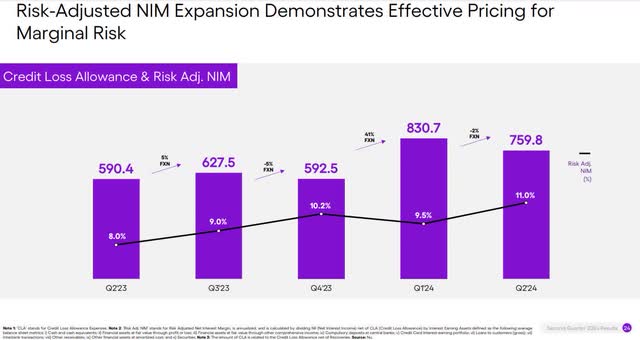

The following image shows Nu Holdings’ Credit Loss Allowance (“CLA”) and risk-adjusted net interest margin (“NIM”). A CLA (loan provision) is an accounting method banks use to estimate the amount of money they may lose due to uncollectible debts. Banks use this estimate to reduce the book value of loans to the cash they expect to collect. The purple bars represent the CLA. The solid line shows the risk-adjusted NIM. A bank’s loan portfolio’s NIM is similar to a standard company’s gross margin. As Nu Holdings took on more loan risk, the profitability of its loans represented by the NIM rose from 8% in the second quarter of 2023 to 11% in the second quarter of 2024. At the same time, the company’s loan provisions have trended up over the last year to guard against potential losses. However, note that the CLA has slightly contracted sequentially from the first quarter to the second quarter of 2024. COO Lahrech explained on the earnings call that Nu Holdings’ loan portfolio performed somewhat better than anticipated, leading to a lower CLA requirement in the latest quarter.

Nu Holding Second Quarter 2024 Earnings Presentation.

As long as the Brazilian economy doesn’t suddenly implode, investors will likely view the increased revenue growth as a risk worth taking, and the stock will likely continue to rise. However, suppose the Brazilian economy falters unexpectedly, and NPLs rise more than expected. In that case, analysts and investors will likely become very concerned about the loan risks that the company has taken on and could sell off the stock.

In my last article on this company, I said, “Before you eagerly decide to put your hard-earned money into the stock, understand that this digital bank primarily generates income from the loan business and has higher risks than similar U.S.-based investments.” Suppose you decide to invest in this company. In that case, following Brazil’s economic and political situation is in your best interest to avoid being blindsided by a sudden downdraft in stock price.

Valuation

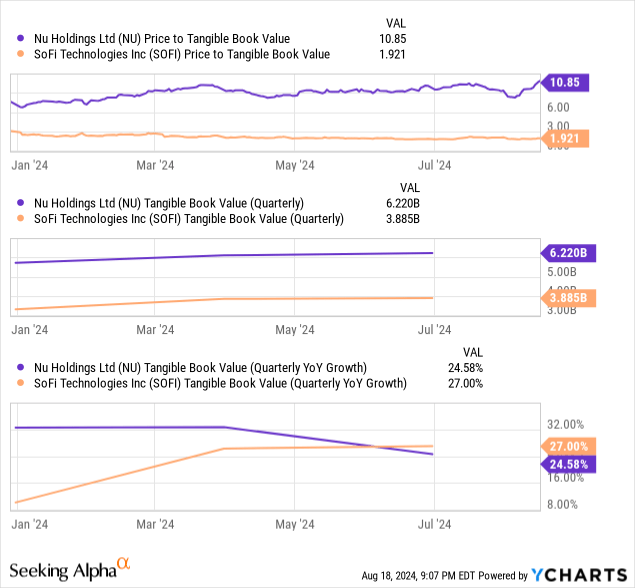

Tangible Book Value (“TBV”) measures the value of a company’s physical (tangible) assets. It excludes intangible assets such as goodwill, patents, copyrights, brand name, and trademarks. TBV is the liquidation value of a company. A bank with a solid physical asset base (high TBV) has a better chance of withstanding an economic downturn than a bank with too many intangible assets (low TBV). Some investors prefer using TBV to assess a bank because it has more stability and reliability than EPS, and the metric is easy to use to compare different lending institutions. Investors use price-to-TBV as one of the most conservative ways to value a bank.

Nu Holdings has a premium valuation over SoFi Technologies (SOFI) on a price-to-TBV basis, and it may deserve that premium valuation. Nu has a larger TBV than SoFi, and until the June quarter, Nu grew its TBV faster.

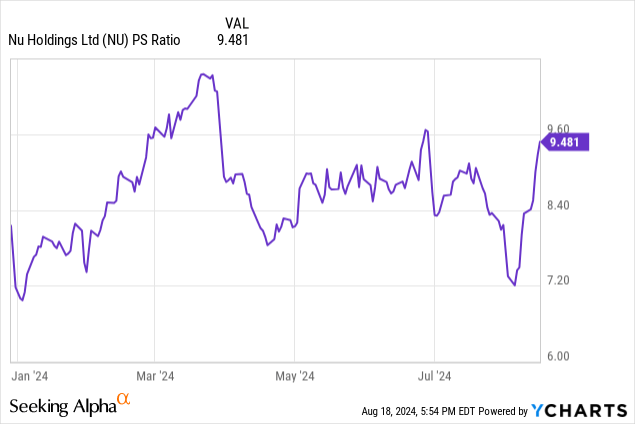

Next, let’s look at the company’s price-to-sales (P/S) ratio. Nu Holdings’ P/S ratio is 9.48, well above the banking industry P/S median of 2.41. So, the company has quite a premium over the banking sector.

The following table compares Nu Holdings to several online banks or fintechs. One potential reason Nu Holdings has a premium P/S ratio is its superior revenue and earnings growth compared to other fintechs and neobanks.

| Market Cap | Market Cap | Quarterly Revenue | Quarterly revenue Growth | P/S Ratio | EPS growth |

| Nu Holdings | $67.2 billion | $2.84 billion | 65% | 9.5 | 115% |

| Sofi Technologies | $7.5 billion | $0.59 billion | 20.2% | 7.0 | —- |

| StoneCo (STNE) | 4.5 billion | $0.55 billion | 8.5% | 1.9 | 64% |

| PagSeguro Digital (PAGS) | $4.5 billion | $0.83 billion | 19.1% | 2.4 | 32% |

| Block, Inc. (SQ) | $40.6 billion | $6.2 billion | 11.1% | 1.8 | —- |

Source: Company earnings reports and YCharts

StoneCo and PagSeguro report revenue in Brazilian Real (“BRL”). Some websites report revenue for the two Brazilian companies in BRL. Websites reporting StoneCo and PagSeguro’s revenue in dollars can sometimes have slight variations of the reported revenue depending on the exchange rate they use. All of the above numbers are from the June quarter of 2024. I derived StoneCo and PagSeguro revenue and EPS from each company’s June quarter earnings reports and converted them to dollars using the latest exchange rate.

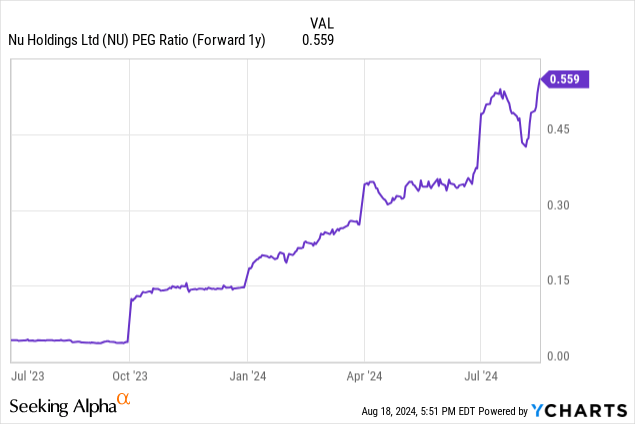

The following chart shows Nu Holdings’ one-year forward Price/Earnings to Growth (“PEG”) ratio of 0.56. Notice that when I gave my third buy recommendation of the stock on October 08, 2023, it traded at a forward PEG below 0.15, which some may consider extremely undervalued. Some investors believe that a fairly valued stock has a PEG ratio of one.

The following table shows that Nu Holding’s Fiscal Year (“FY”) 2025 (one year) forward price/earnings is 25.20, and its EPS estimate growth rate in the same FY is 45.19%. Dividing 25.20 by 45.19 equals a PEG ratio of 0.56.

Seeking Alpha

Suppose the stock trades at a one-year forward PEG ratio of one; its fair value price would be $25.30, a rise of 79.6% above the August 16 closing price of $14.09. So, even though the stock price is up significantly in 2024, the market may still undervalue Nu Holdings.

Nu Holdings remains a buy

The company’s fundamentals show that its financial inclusion strategy is working. By offering digital banking services to a large segment of the unbanked and underbanked Latin American population that the legacy banks have ignored, Nu Holdings has captured significant market share. The company has also shown evidence through its rising ARPAC that it can monetize its growing user base. If the company can eventually monetize its users near the level of legacy Brazilian banks and replicate that performance in Mexico and Colombia, it has meaningful potential upside. Nu Holdings also still sells at a reasonable valuation. Growth investors should consider adding a few shares to their portfolio. The stock remains on my buy list.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.